Real Property Templates

Documents:

382

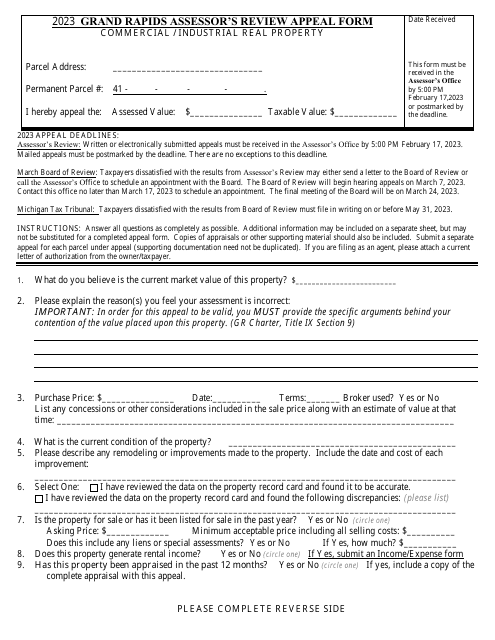

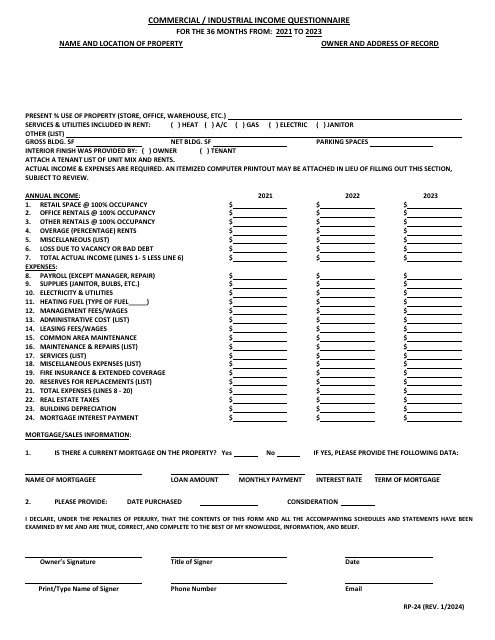

This form is used for appealing the assessment of commercial or industrial real property in the City of Grand Rapids, Michigan.

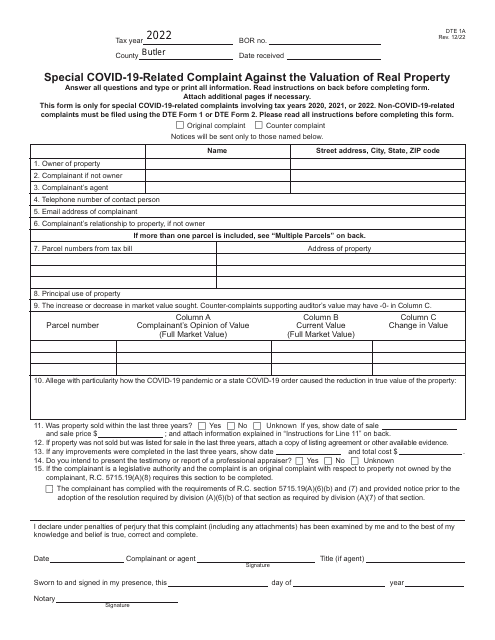

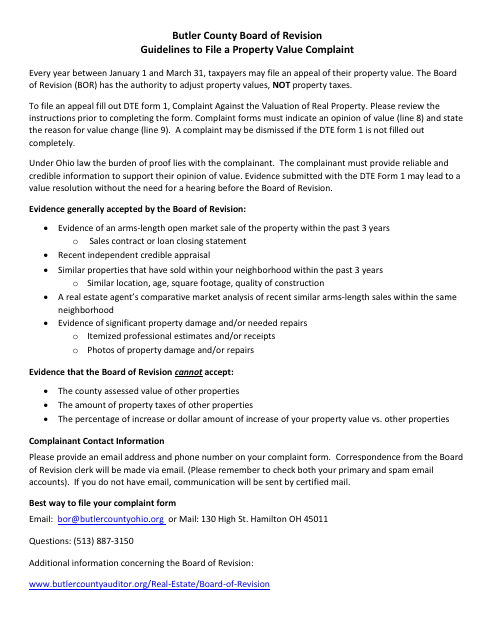

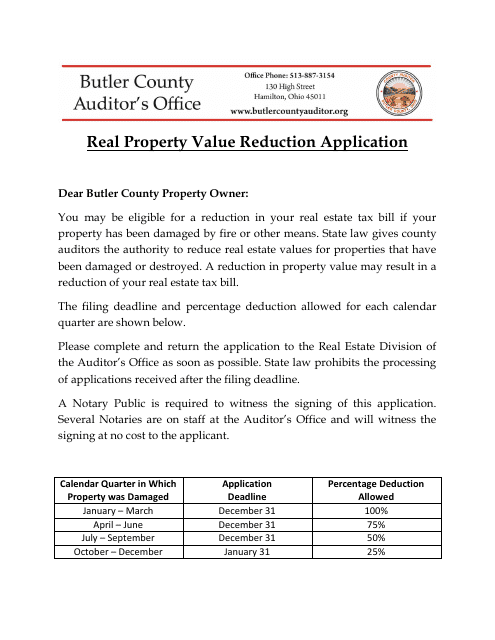

This form is used for filing a special complaint related to the valuation of real property in Butler County, Ohio, that is specifically related to the Covid-19 pandemic. It allows individuals to raise concerns and seek a revision of their property's assessed value during these extraordinary circumstances.

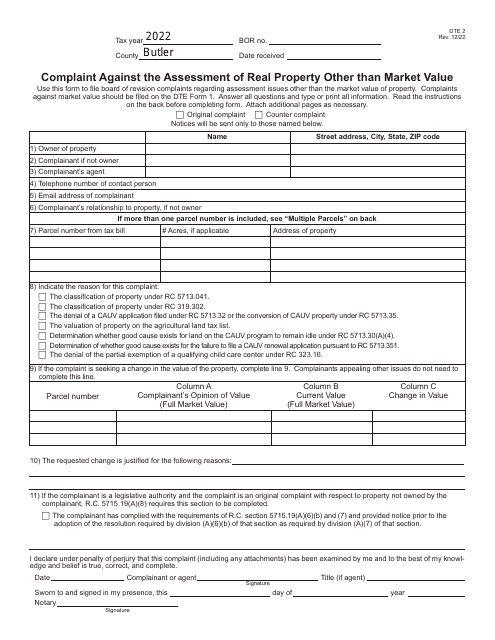

This form is used for filing a complaint against the assessment of real property in Butler County, Ohio, that is not based on the market value.

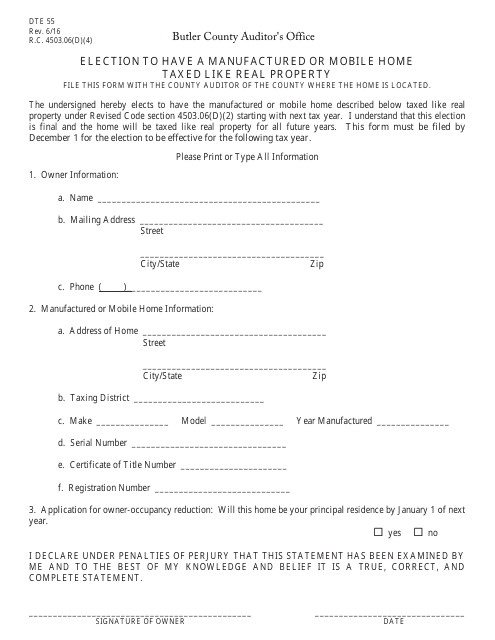

This form is used for residents of Butler County, Ohio to elect to have their manufactured or mobile home taxed as real property.

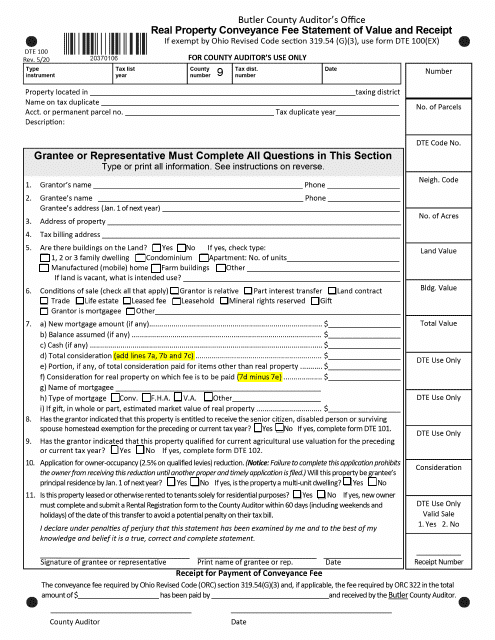

This form is used for reporting the value of real property and paying conveyance fees in Butler County, Ohio.

This form is used for applying to the Real Property Tax Deferral Program for Senior Citizens in Prince Edward Island, Canada.

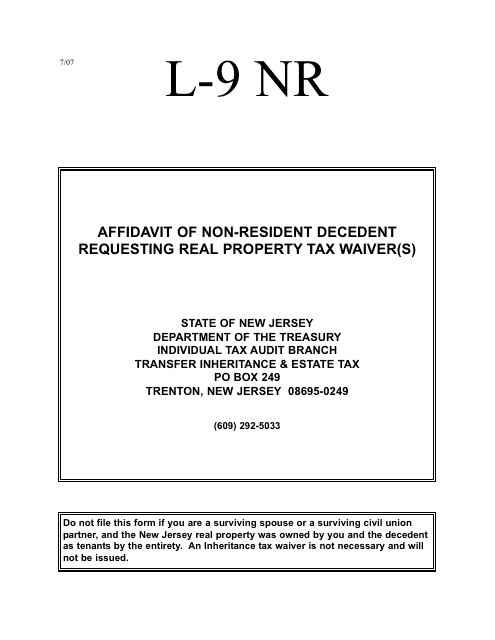

This Form is used for non-resident decedents in New Jersey to request a waiver of real property tax.

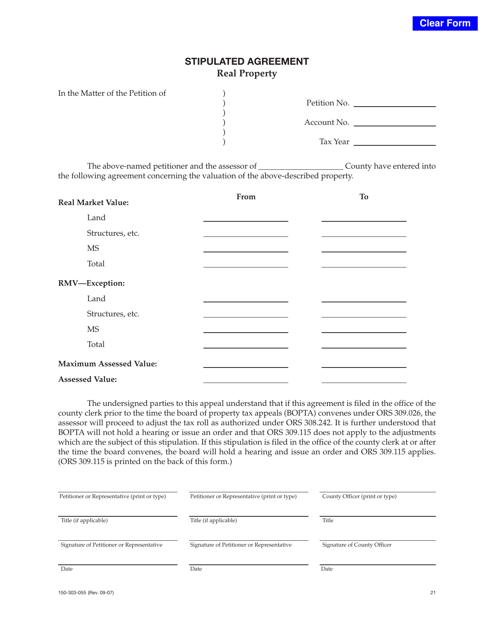

This form is used for entering into a stipulated agreement regarding real property in Oregon.

This document details the tax exemptions applicable for domestic partners on inheritance of real property in Howard County, Maryland. It is crucial for domestic partners to understand their estate planning rights and obligations in that region.

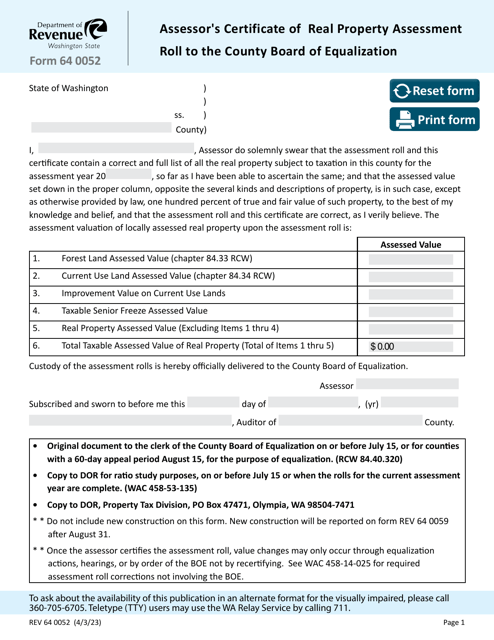

This Form is used for Assessor's Certificate of Real Property Assessment Roll to the County Board of Equalization in Washington.

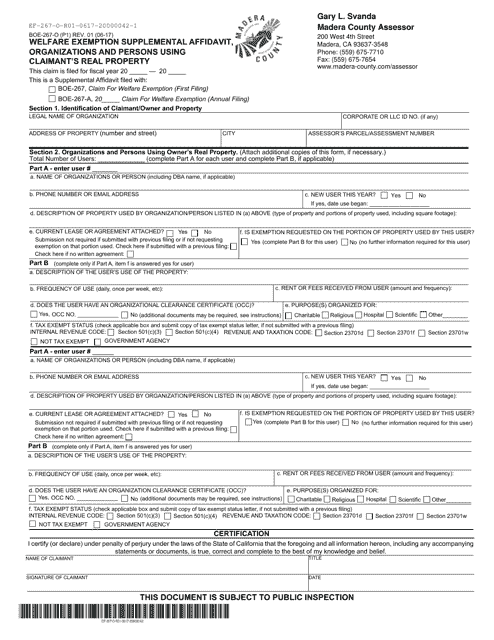

This document is used for submitting a welfare exemption supplemental affidavit for organizations and individuals using a claimant's real property in Madera County, California.

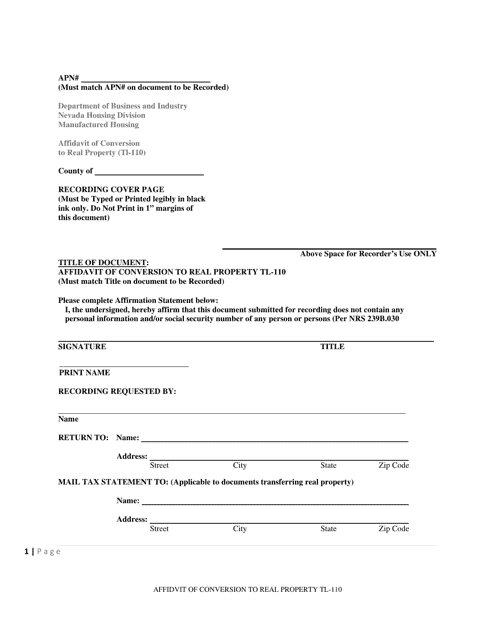

This Form is used for converting personal property in Nevada to real property through an affidavit. It helps legalize the conversion process and provides a legal record of the conversion.

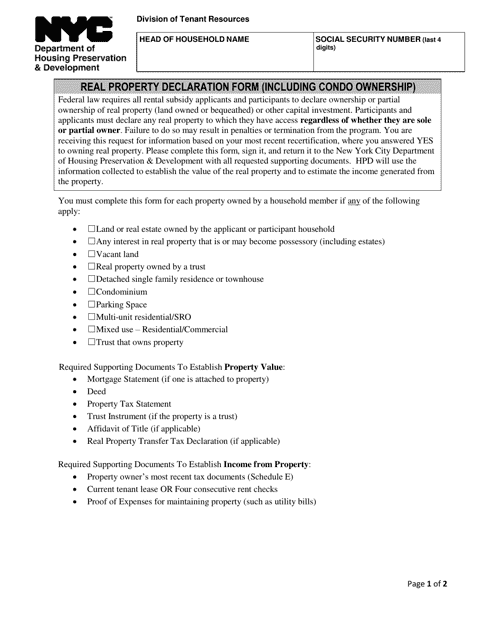

This Form is used for declaring real property ownership in New York City, including condos.