Real Property Templates

Documents:

382

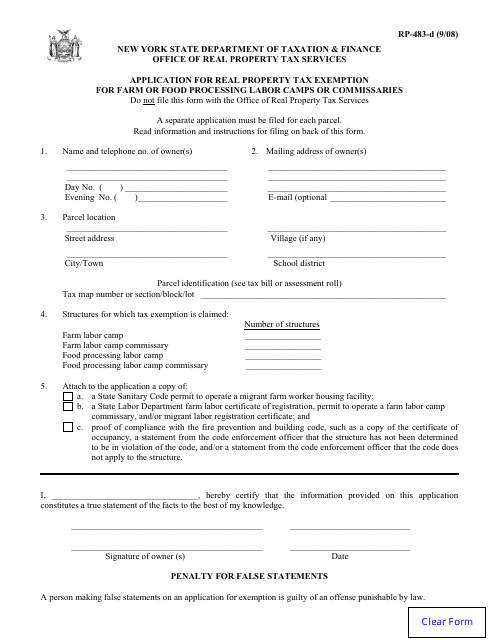

This form is used for applying for a real property tax exemption specifically for farm or food processing labor camps or commissaries in the state of New York.

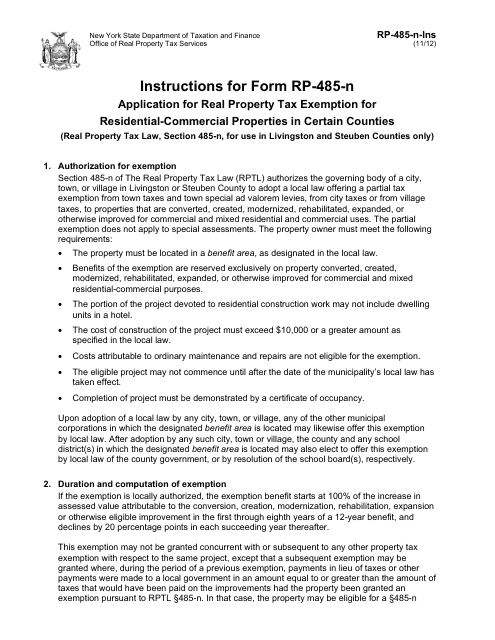

This Form is used for applying for a tax exemption on residential-commercial properties in certain counties in New York. It provides instructions for completing the application process.

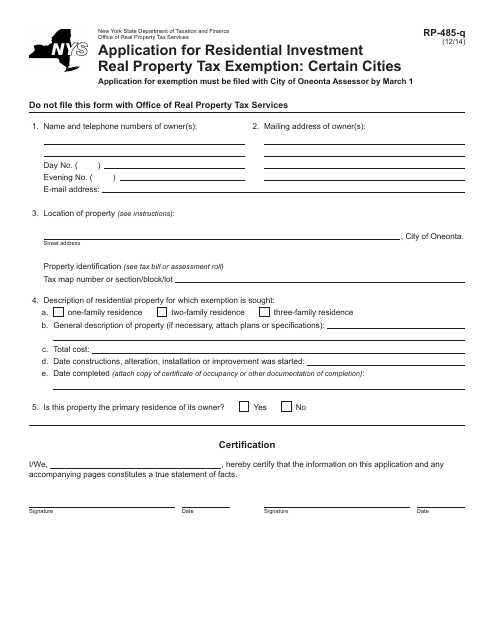

This Form is used for applying for a residential investment real property tax exemption in certain cities in New York.

This form is used for applying for a residential investment real property tax exemption in certain school districts in New York.

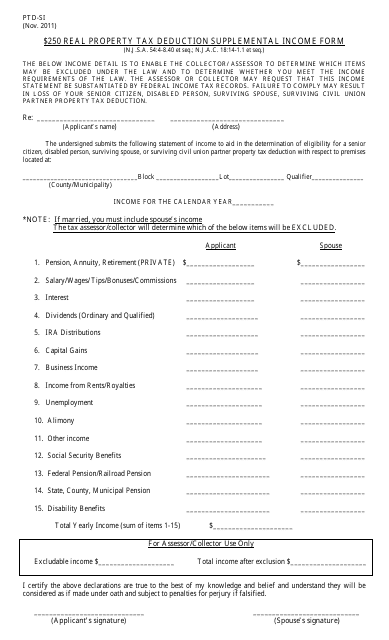

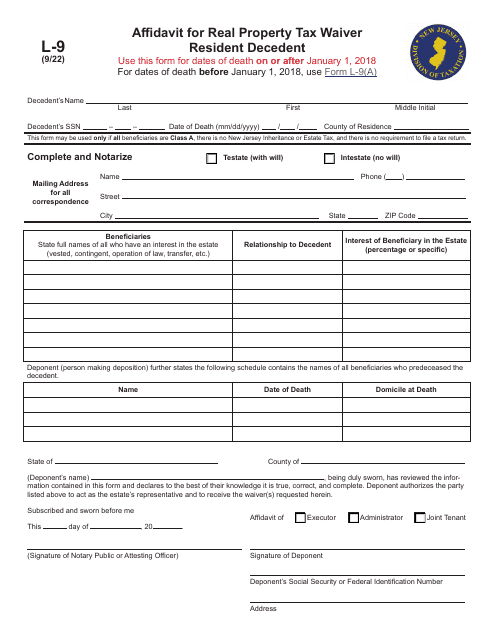

This form is used for reporting supplemental income for the Real Property Tax Deduction in New Jersey.

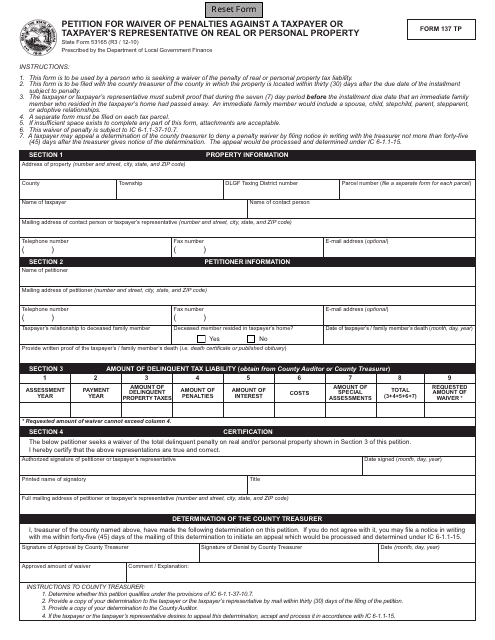

This form is used for filing a petition to request a waiver of penalties for a taxpayer or taxpayer's representative on real or personal property in the state of Indiana.

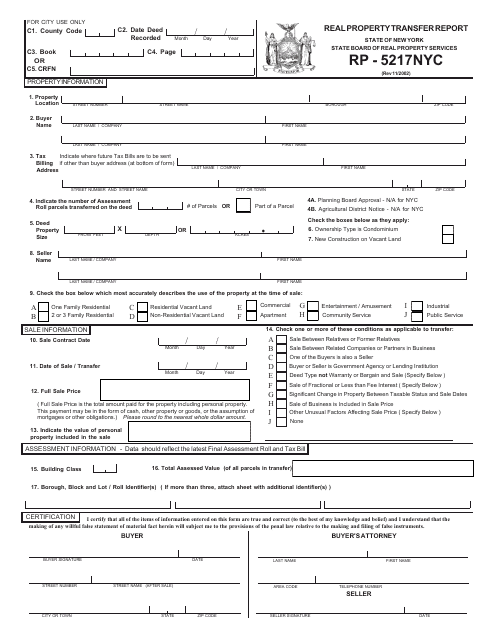

This form is used for reporting transfers of real property in New York City.

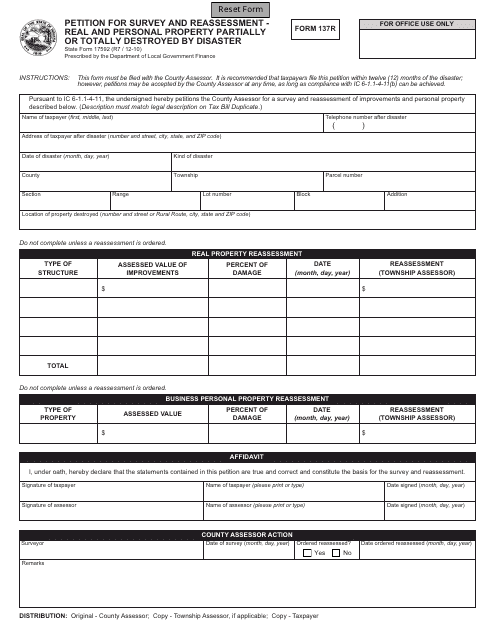

This Form is used for filing a petition for survey and reassessment for real and personal property that has been partially or totally destroyed by a disaster in Indiana.

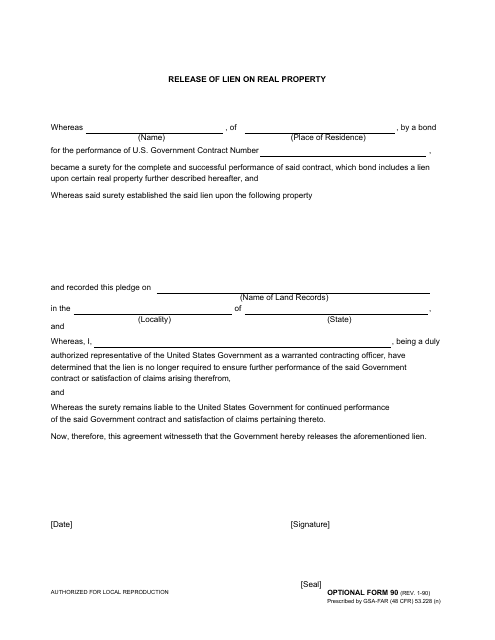

This document is used to release a lien on a piece of real property.

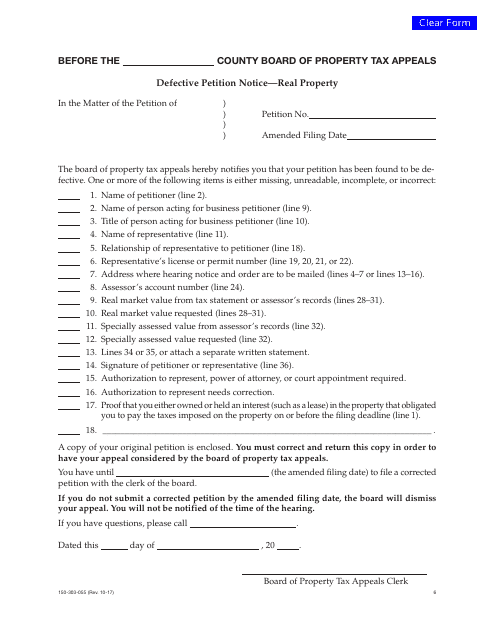

This form is used for notifying a property owner in Oregon about a defective petition related to their real property.

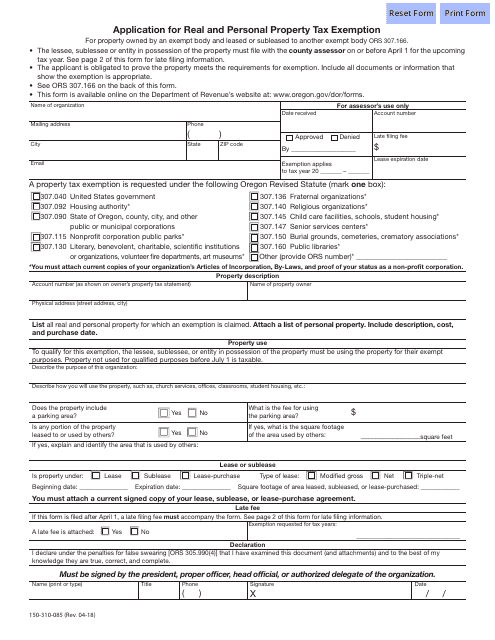

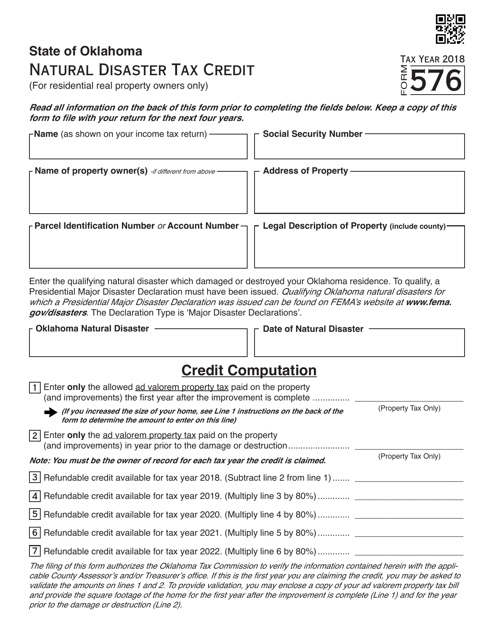

This form is used for applying for a tax exemption on real and personal property in Oklahoma.

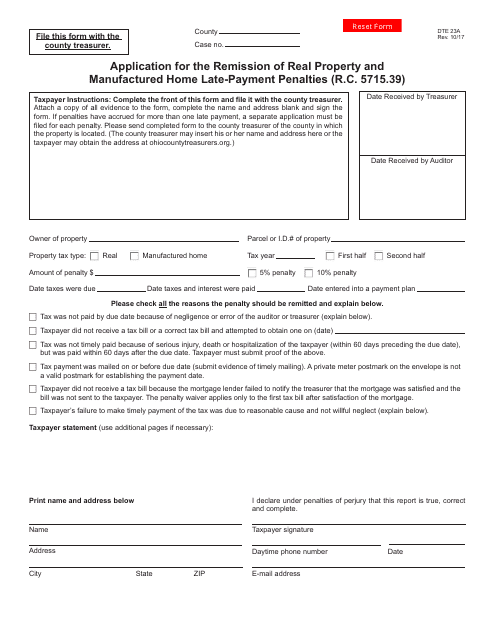

This form is used for applying for the remission of late-payment penalties for real property and manufactured homes in Ohio.

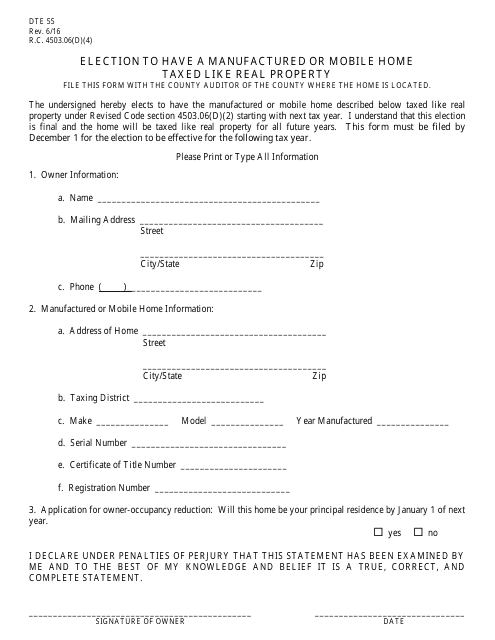

This form is used for electing to have a manufactured or mobile home taxed like real property in the state of Ohio.

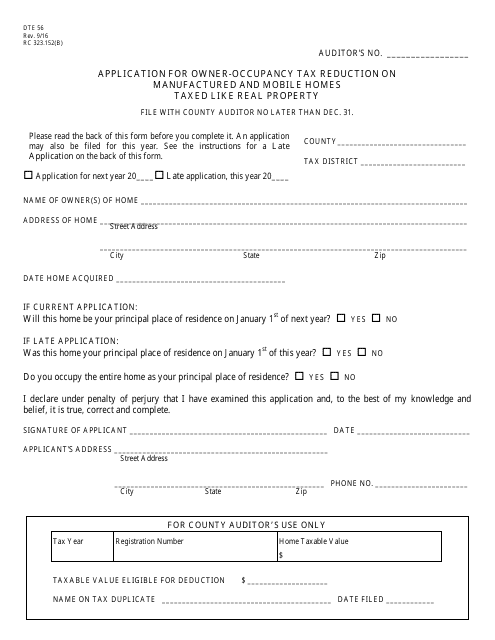

This form is used for applying for an owner-occupancy tax reduction on manufactured and mobile homes taxed like real property in the state of Ohio.

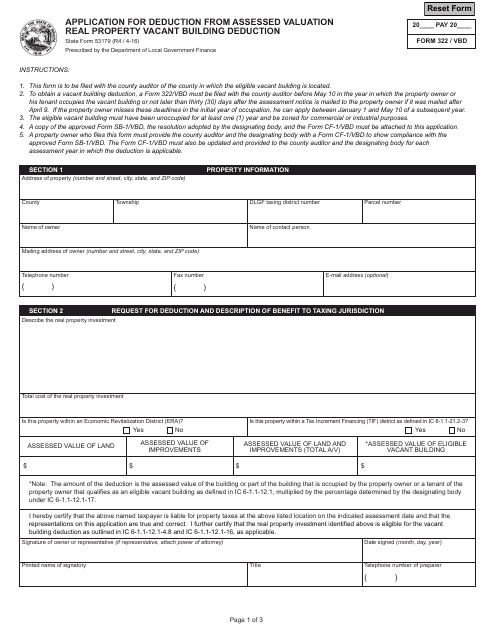

This Form is used for applying for the deduction from assessed valuation for vacant buildings in Indiana.

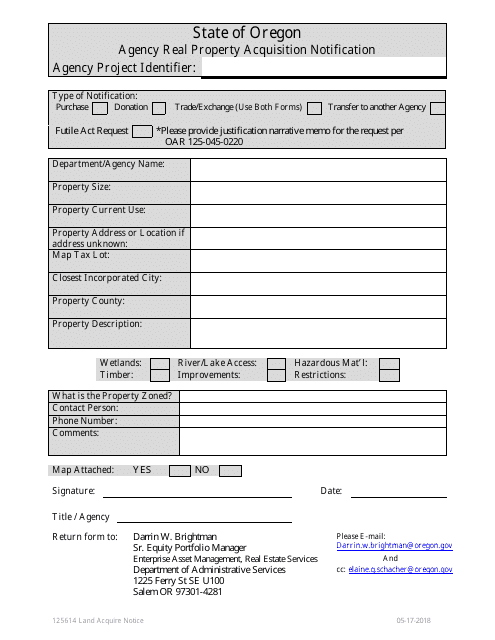

This Form is used for notifying the agency about real property acquisition in Oregon.

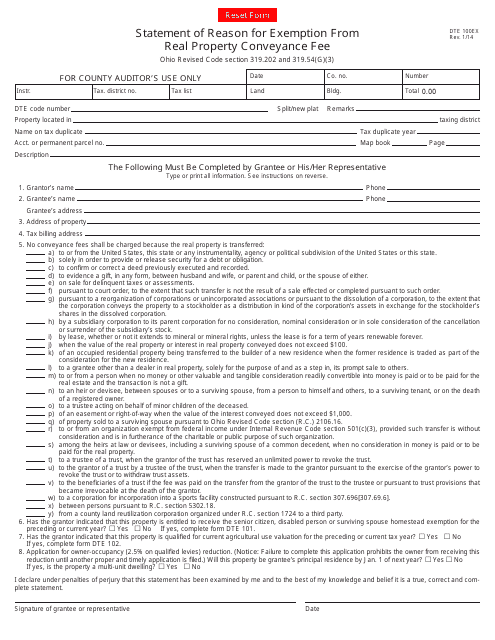

This Form is used to provide a statement of reason for exemption from the real property conveyance fee in Ohio.

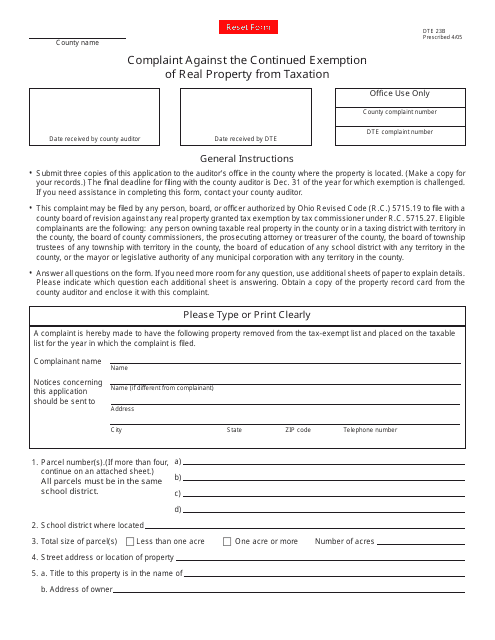

This form is used for filing a complaint against the continued exemption of real property from taxation in Ohio.

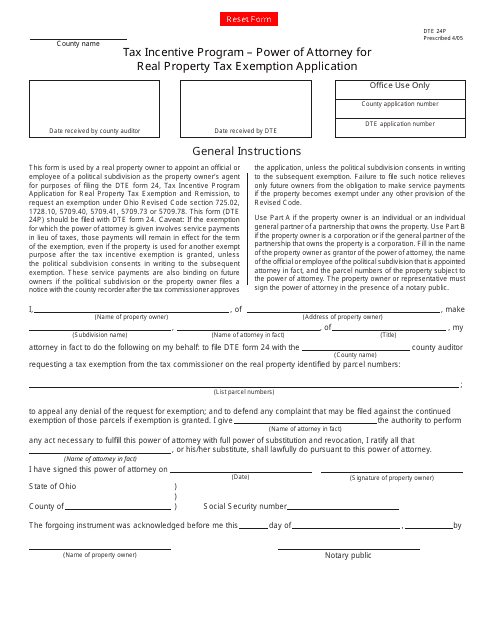

This form is used for applying for a power of attorney for real property tax exemption in Ohio's tax incentive program. It allows someone to act on your behalf in the application process.

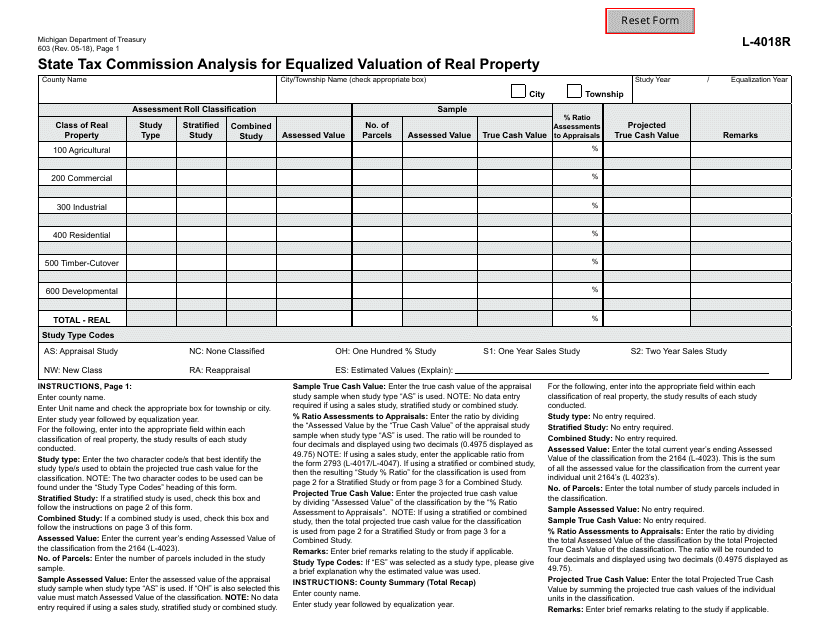

This document is used for analyzing the equalized valuation of real property in Michigan for the State Tax Commission.

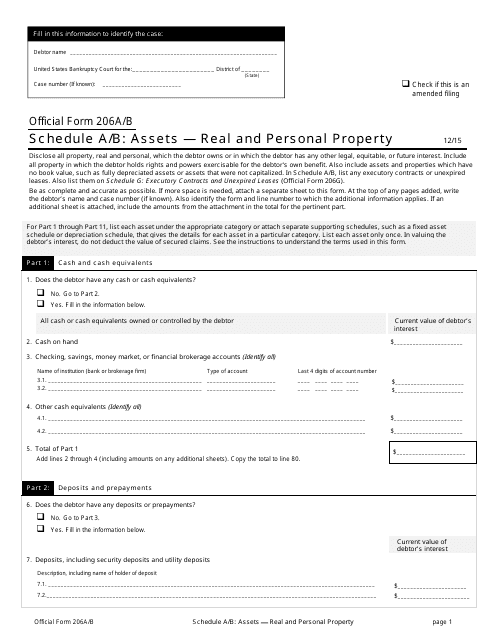

This Form is used for reporting real and personal property assets.

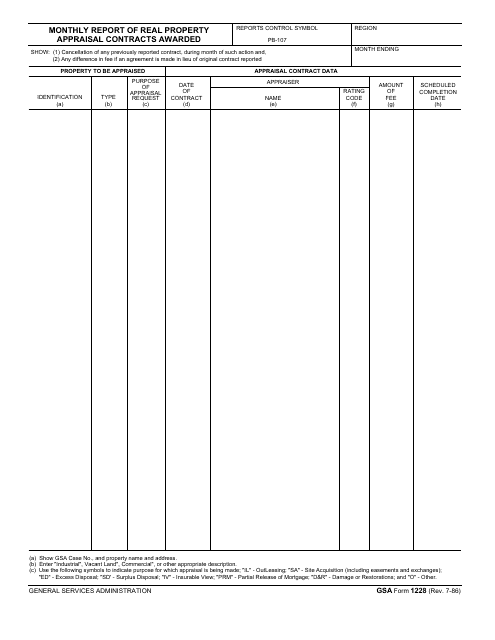

This form is used for reporting monthly real property appraisal contracts awarded by the General Services Administration (GSA). It helps track and document the contracts awarded for property appraisal services.

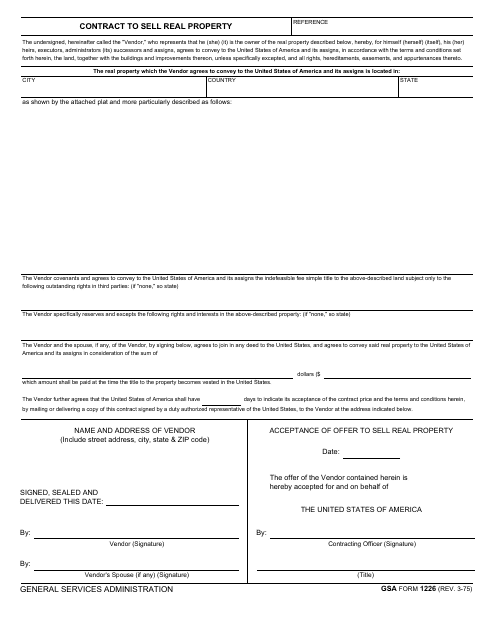

This Form is used for entering into a contract to sell real property.

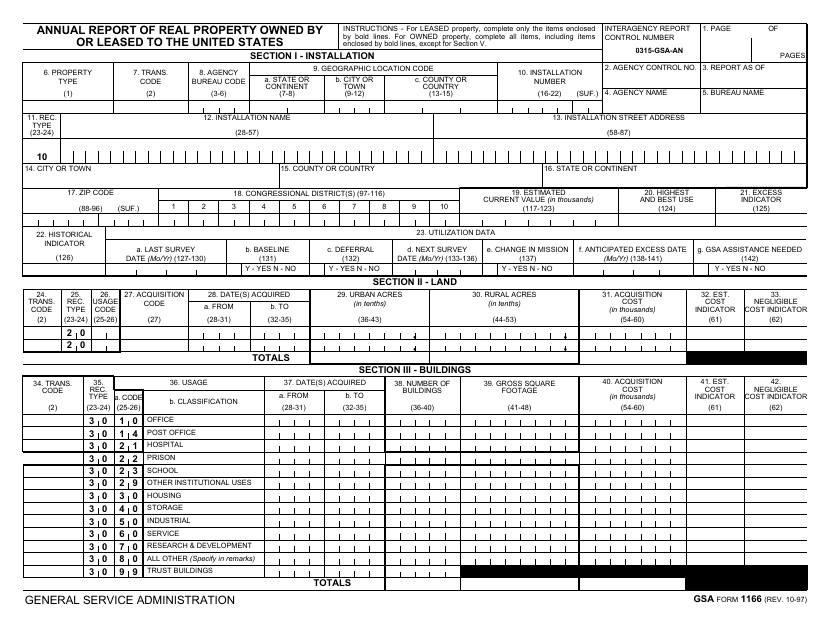

This form is used for reporting the annual inventory of real property owned or leased by the United States. It helps track and manage the government's real estate assets.

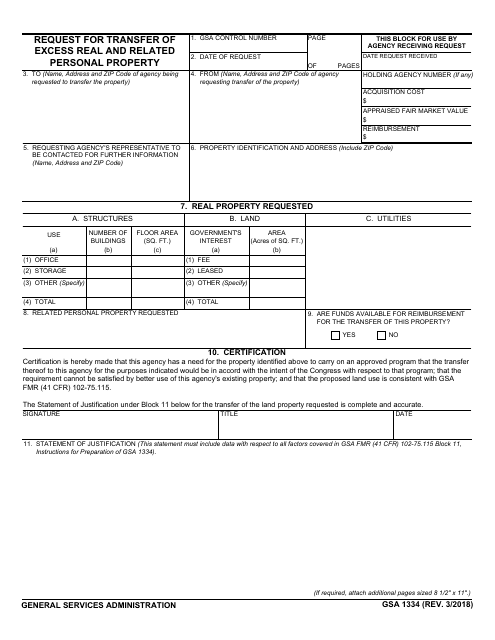

This Form is used for requesting the transfer of excess real and related personal property. It is used by government agencies to facilitate the redistribution of surplus items.

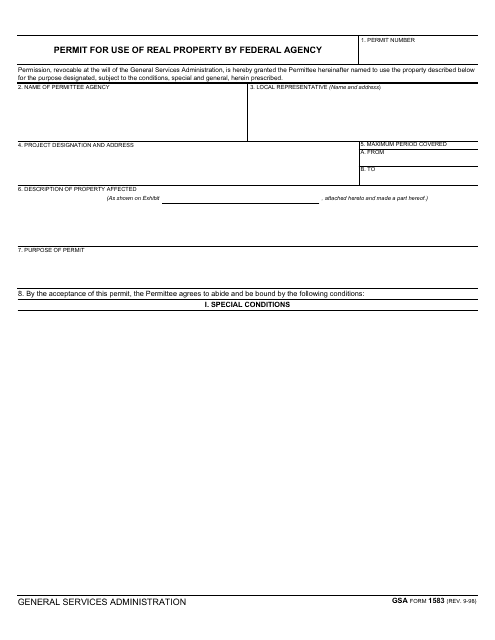

This document is used to obtain a permit for a federal agency to use real property.

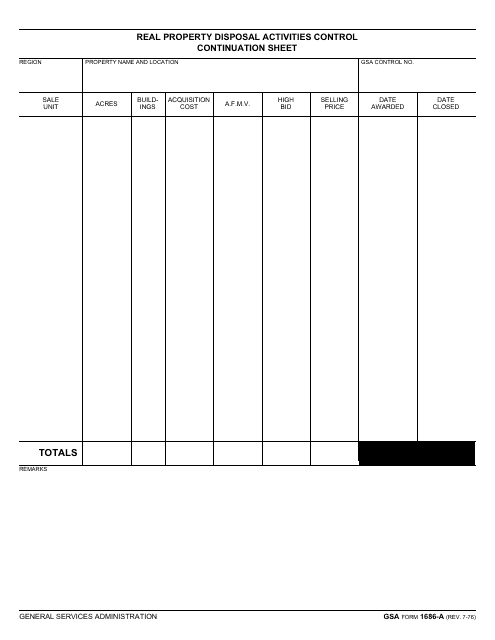

This document is a continuation sheet for GSA Form 1686-A, which is used to control and track real property disposal activities.

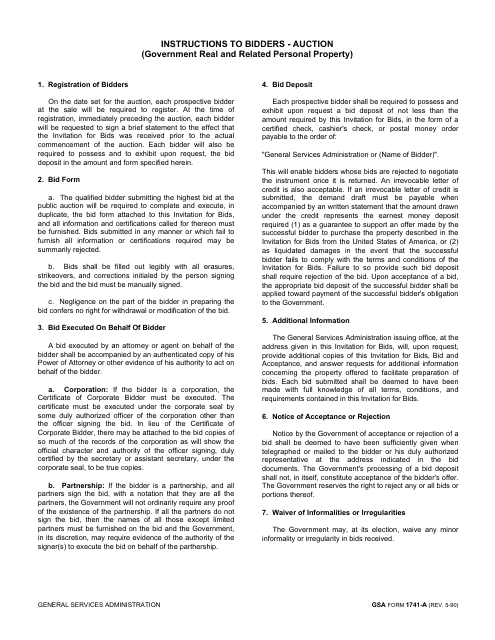

This document provides instructions to bidders participating in government auctions for real estate and personal property. It explains the process and requirements for bidding on items being auctioned by the government.

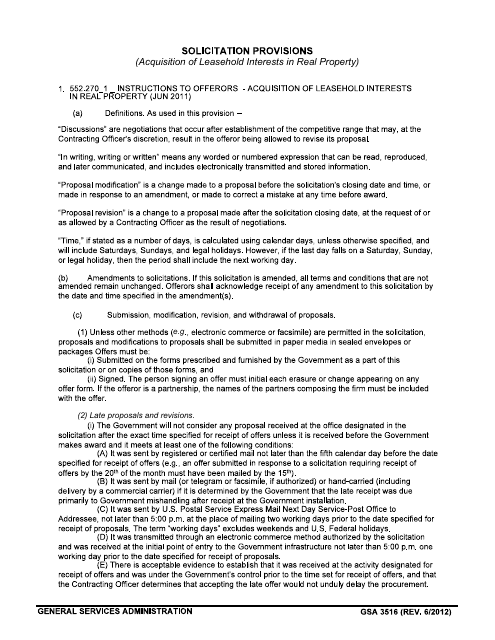

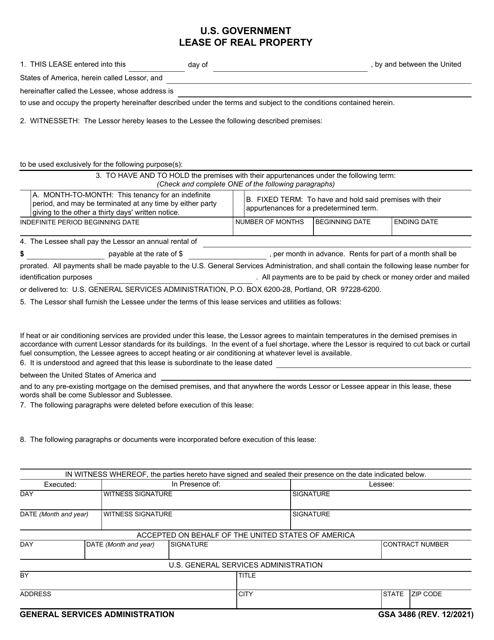

This document is used for requesting and acquiring leasehold interests in real property through the GSA (General Services Administration). It contains the solicitation provisions required for this type of acquisition.

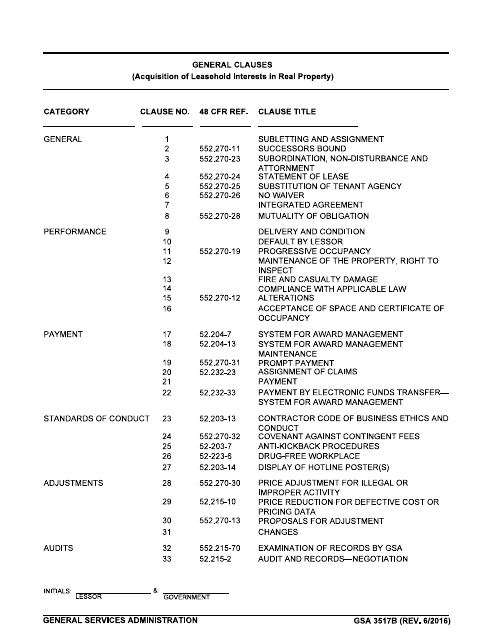

This document is for the General Services Administration (GSA) Form 3517B. It includes general clauses that apply to the acquisition of leasehold interests in real property.

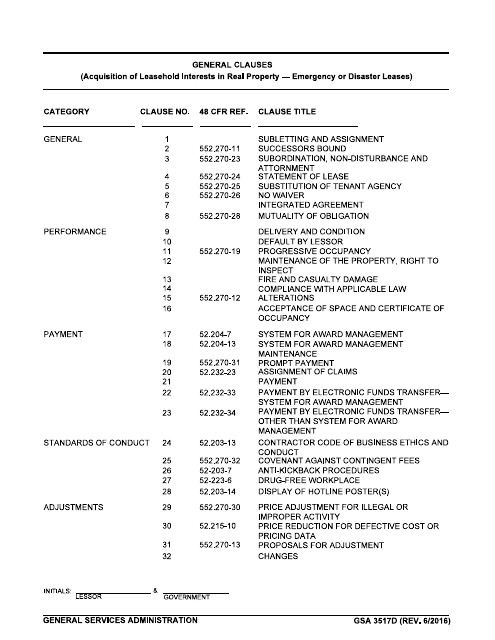

This Form is used for acquiring leasehold interests in real property during emergency or disaster situations.

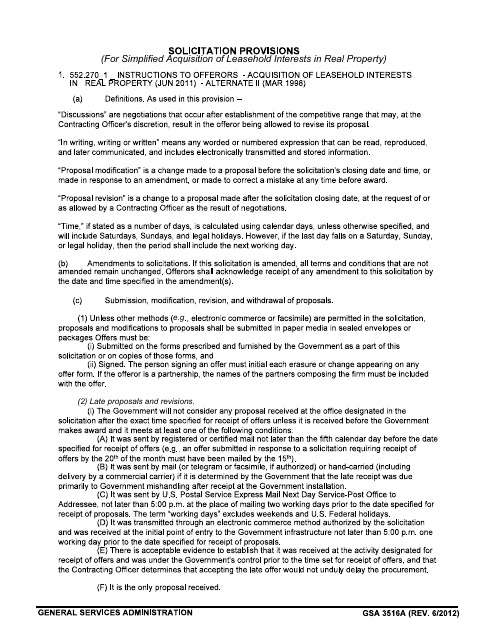

This document is used for including solicitation provisions for simplified acquisition of leasehold interests in real property.

![Form RP-485-I [AMSTERDAM SD] Application for Residential Investment Real Property Tax Exemption; Certain School Districts - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733928/form-rp-485-i-amsterdam-sd-application-residential-investment-real-property-tax-exemption-certain-school-districts-new-york_big.png)