Cargo Insurance Templates

Cargo insurance, also known as transport insurance or freight insurance, is a crucial type of coverage that protects businesses and individuals involved in the transportation of goods. This insurance provides financial protection against loss or damage to cargo while it is being transported by land, sea, or air.

Cargo insurance is particularly important for businesses that rely on the safe and timely delivery of goods, such as importers, exporters, manufacturers, and freight forwarders. Without proper insurance, these businesses are at risk of significant financial loss if their cargo is lost, stolen, damaged, or destroyed during transit.

There are various types of cargo insurance policies available, depending on the specific needs of the insured. Some policies cover all risks, providing comprehensive coverage for goods in transit, while others offer more limited coverage for specific perils or circumstances. It is essential for businesses to carefully read and understand the terms and conditions of their cargo insurance policy to ensure that it meets their unique requirements.

In addition to protecting the value of the cargo itself, cargo insurance can also cover related costs such as freight charges, customs duties, and other expenses associated with the transportation of goods. This helps to minimize the financial impact on businesses in the event of a covered loss.

Cargo insurance is typically provided by insurance companies or brokers specializing in transportation and logistics insurance. These professionals have in-depth knowledge of the industry and can help businesses navigate the complex world of cargo insurance, ensuring that they have the right coverage in place based on their specific needs.

Whether you are a small business owner shipping goods internationally or a large corporation transporting goods across the country, cargo insurance is a critical component of your risk management strategy. By protecting your cargo against unforeseen events, you can have peace of mind knowing that your goods are covered and your business is safeguarded from significant financial losses. Ensure the safe and secure transportation of your goods with cargo insurance.

Documents:

8

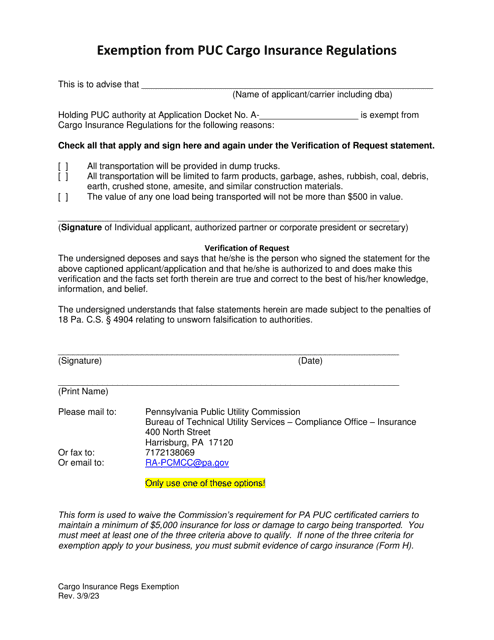

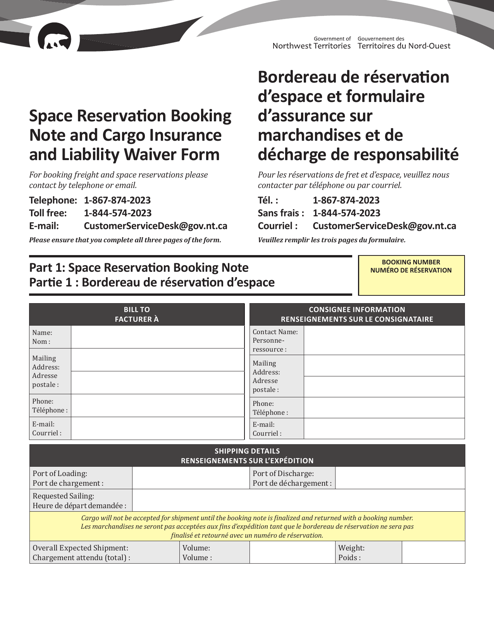

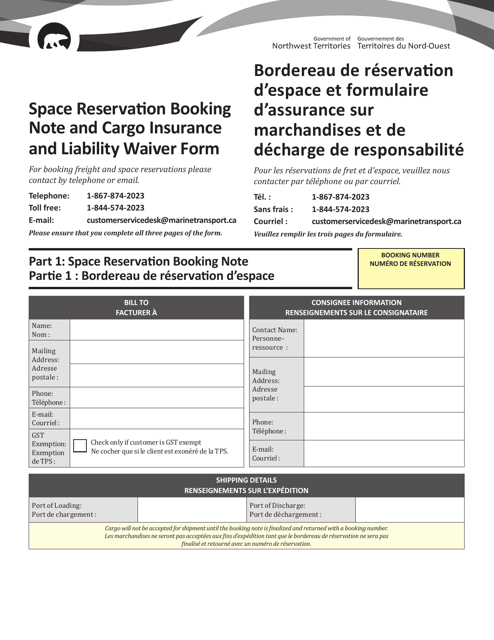

This type of document is used for making space reservations, booking notes, and obtaining cargo insurance and liability waivers in the Northwest Territories of Canada. It is available in both English and French.

This document is used to reserve space and book cargo insurance in the Northwest Territories, Canada. It also includes a liability waiver to protect against any potential damages.

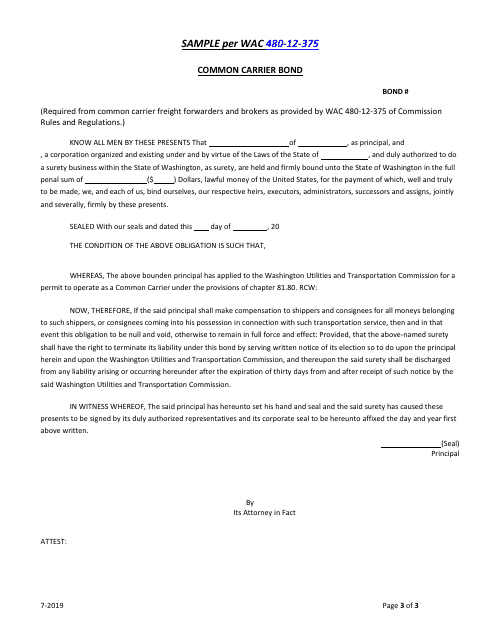

This type of document is a bond that is required for businesses operating as common carriers in the state of Washington. It ensures that the carrier meets their financial obligations and provides compensation if any damages or losses occur during transportation.