Hardship Exemption Templates

Are you facing significant financial challenges that make it difficult for you to meet your obligations? If so, you may be eligible for a hardship exemption. A hardship exemption provides temporary relief from certain financial responsibilities, allowing individuals and families to navigate through difficult circumstances.

At times, unforeseen events and circumstances can impact our ability to fulfill our commitments. Whether it's due to a job loss, medical condition, or other financial hardship, a hardship exemption can provide much-needed support during these challenging times.

Our hardship exemption program is designed to assist individuals throughout the United States, including Ohio, Arkansas, Texas, New York, and more. We understand that each state has its own unique requirements and forms, which is why we provide comprehensive information and resources to guide you through the application process specific to your location.

The availability of hardship exemptions is not limited to one particular category or situation. Whether you need relief from healthcare-related expenses, housing costs, utility bills, or other financial burdens, our hardship exemption program is here to help.

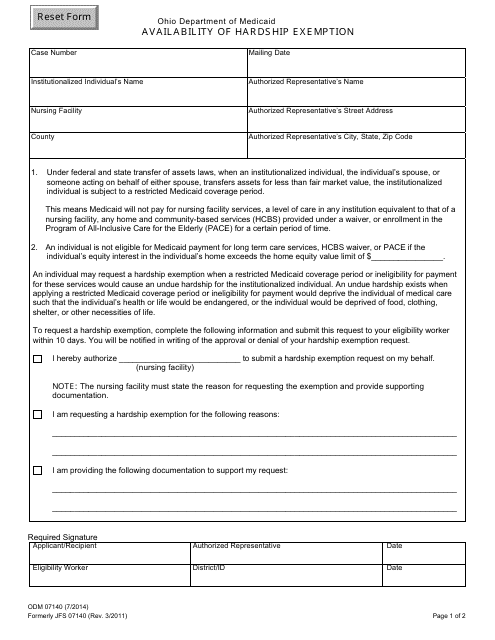

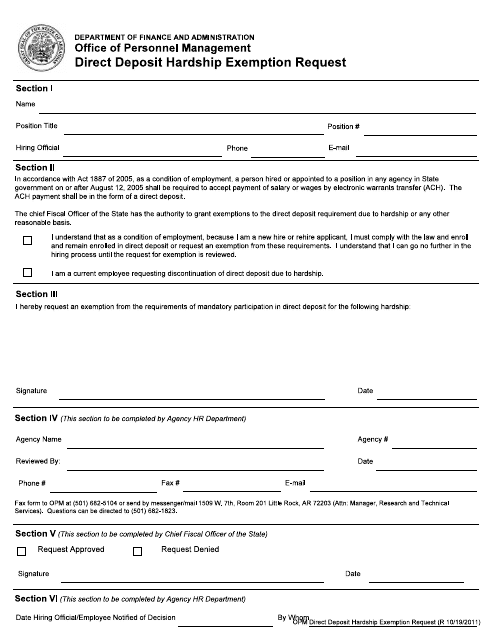

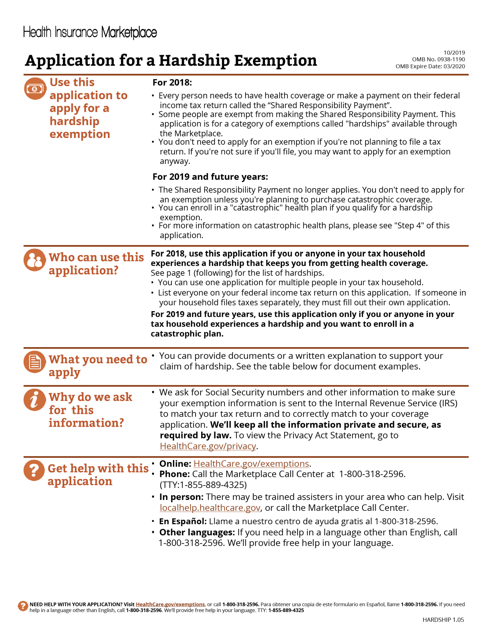

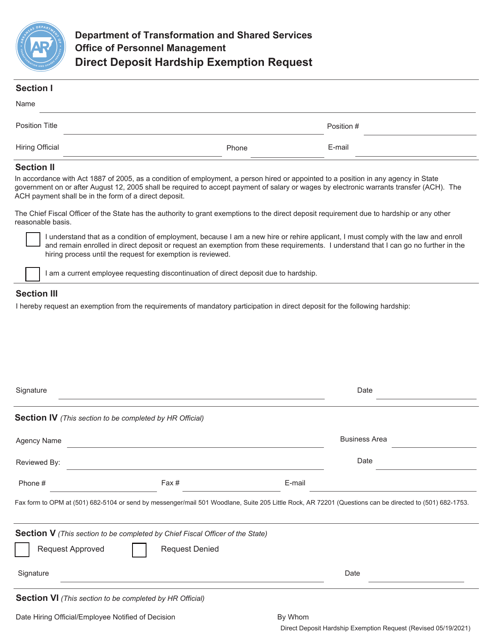

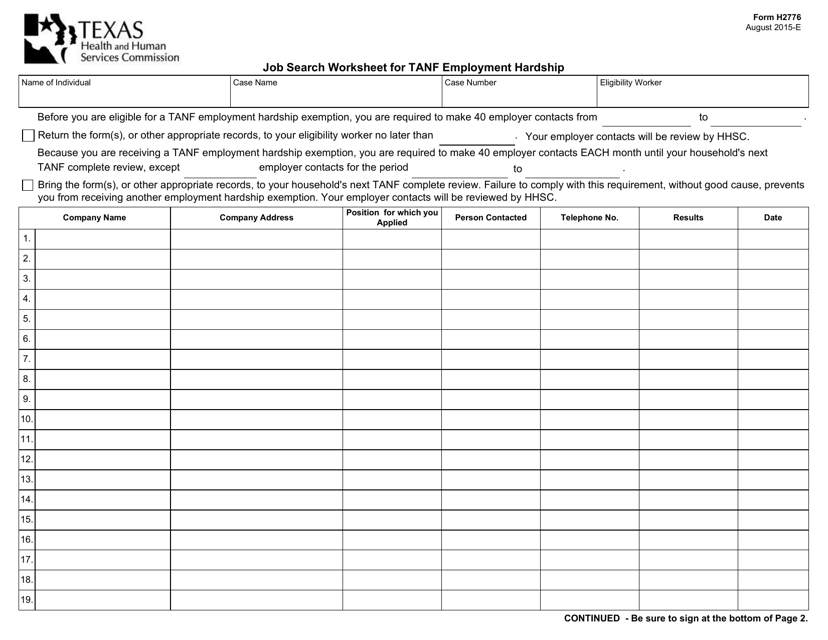

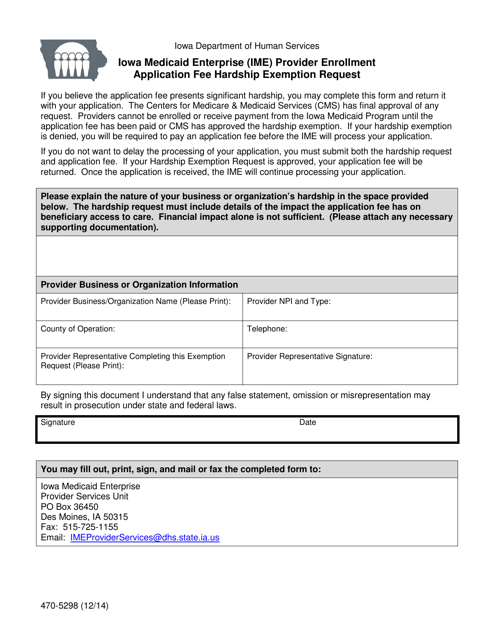

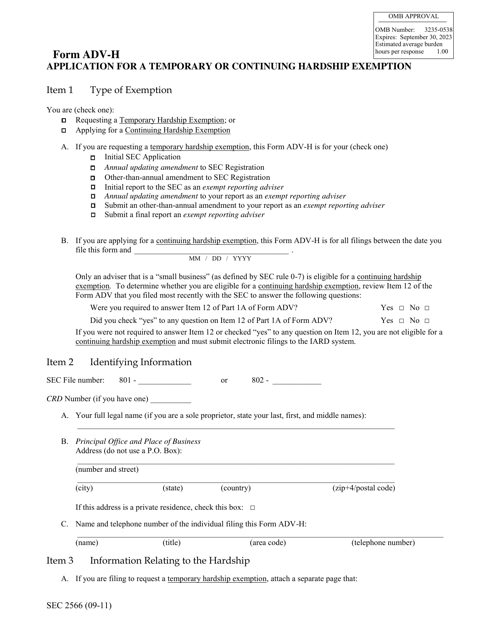

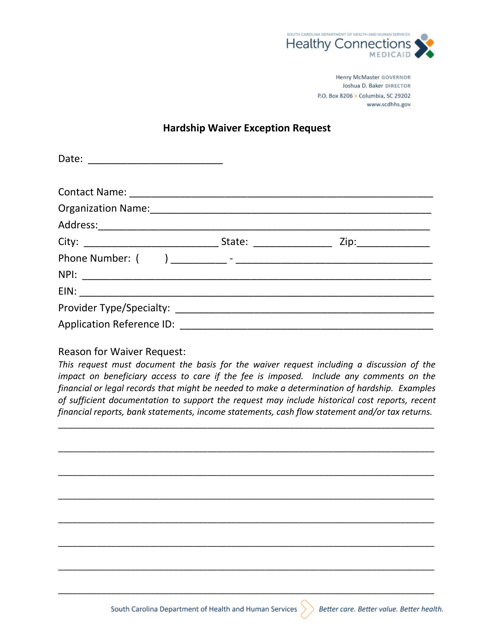

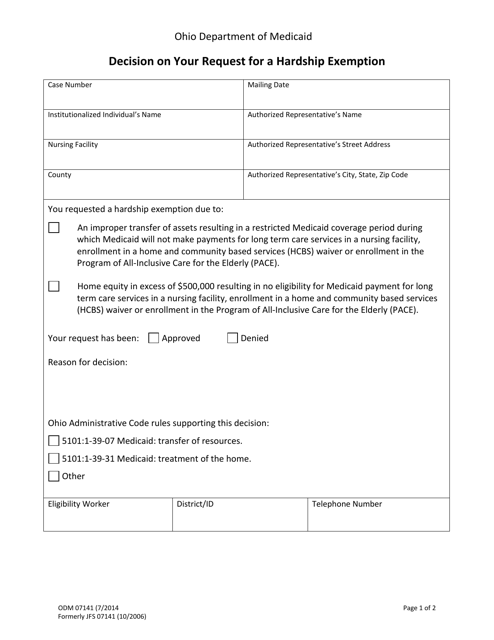

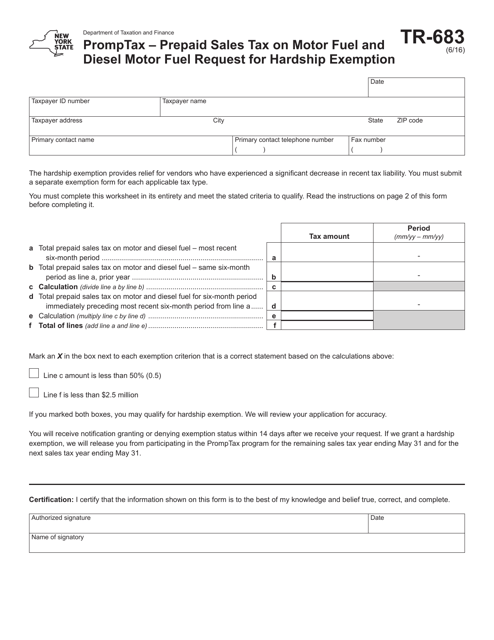

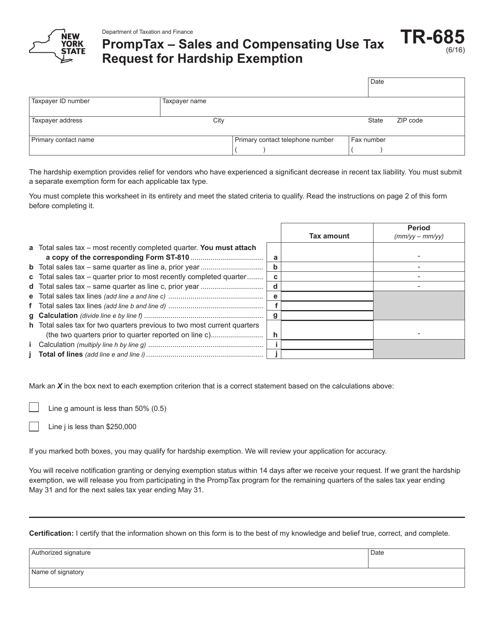

To apply for a hardship exemption, you may need to complete a specific form that is relevant to your circumstances. These forms may vary, but commonly include the Form ODM07140 Availability of Hardship Exemption, the Direct Deposit Hardship Exemption Request form, the Form H2776 Job Search Worksheet for TANF Employment Hardship Exemption, the Form ODM07141 Decision on Your Request for a Hardship Exemption, and the Form TR-685 Promptax - Sales and Compensating Use Tax Request for Hardship Exemption.

By providing accurate and detailed information on these forms, you increase your chances of obtaining a hardship exemption and receiving the necessary support during your financial hardship. Our website provides step-by-step guidance on how to complete these forms, ensuring that you submit a comprehensive application that meets the necessary criteria.

Remember, a hardship exemption is not a long-term solution but rather a temporary reprieve during times of financial distress. It is crucial to explore other avenues of support and financial management to navigate through these challenges successfully.

If you are facing financial difficulties and believe you may be eligible for a hardship exemption, explore our website to learn more about the specific requirements and processes in your state. Our resources and information can assist you in completing the necessary forms and navigating through this challenging period.

Documents:

14

This Form is used for requesting a hardship exemption in the state of Ohio.

This document is a request form for individuals in Arkansas who are facing financial hardship and need an exemption from the requirement to receive wages via direct deposit.

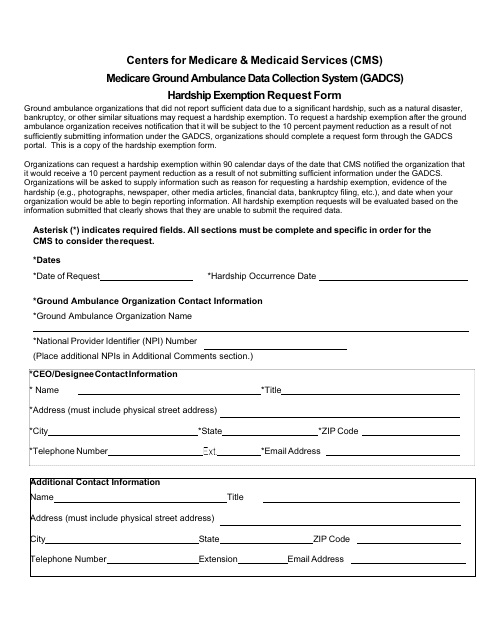

This document is used to apply for a hardship exemption, which could provide relief from certain financial or health-related burdens. It allows individuals to request an exemption from certain requirements, such as a tax penalty or healthcare coverage, due to difficult circumstances they are facing.

This form is used for TANF recipients in Texas who are applying for an employment hardship exemption. It is a job search worksheet that helps individuals document their efforts to find a job while experiencing certain hardships.

This Form is used for requesting a hardship exemption from the application fee for the Iowa Medicaid Enterprise (IME) provider enrollment application.

This Form is used for applying for a temporary or continuing hardship exemption from certain SEC regulations.

This Form is used for requesting a hardship waiver exception in South Carolina.

This form is used for making a decision on your request for a hardship exemption in the state of Ohio.

This form is used for requesting a hardship exemption for prepaid sales tax on motor fuel and diesel motor fuel in New York.

This form is used for requesting a hardship exemption from the sales and compensating use tax in the state of New York. It is specifically designated as Form TR-685 Promptax.

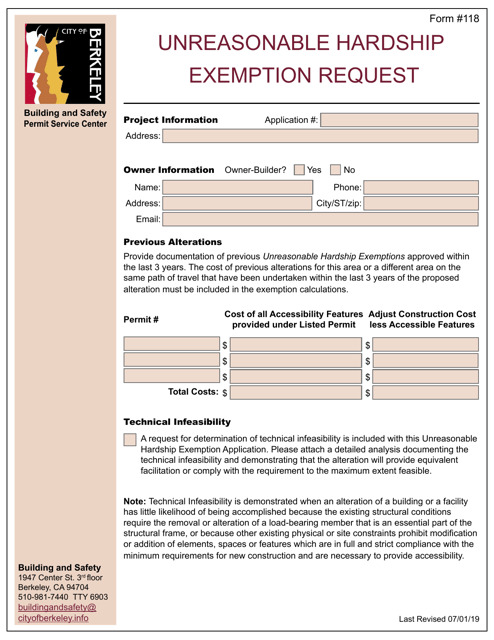

This form is used for submitting a request for an unreasonable hardship exemption in the City of Berkeley, California.

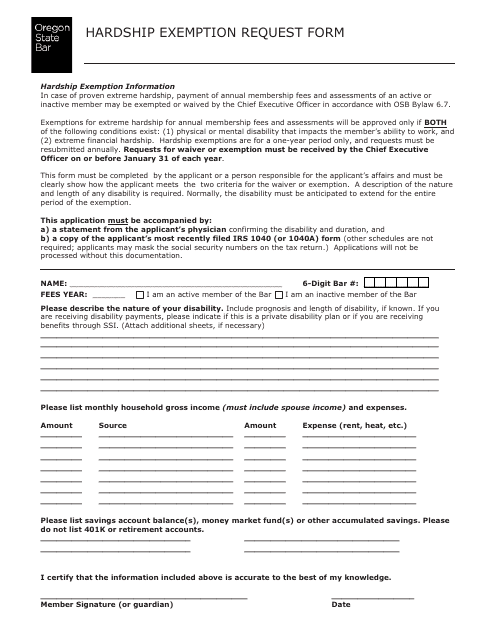

This Form is used for requesting a hardship exemption in the state of Oregon.