Production Credit Templates

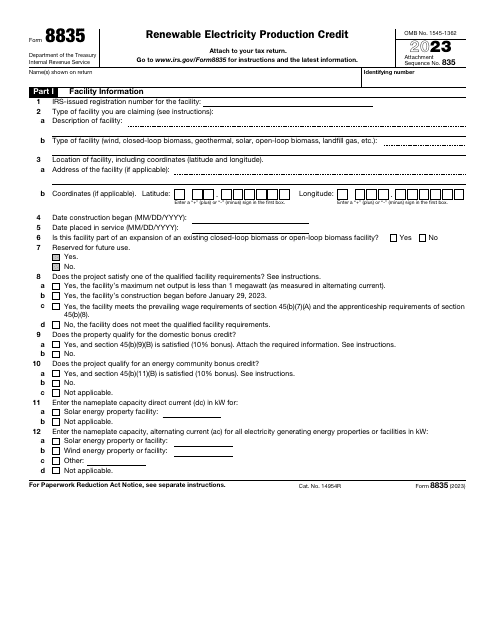

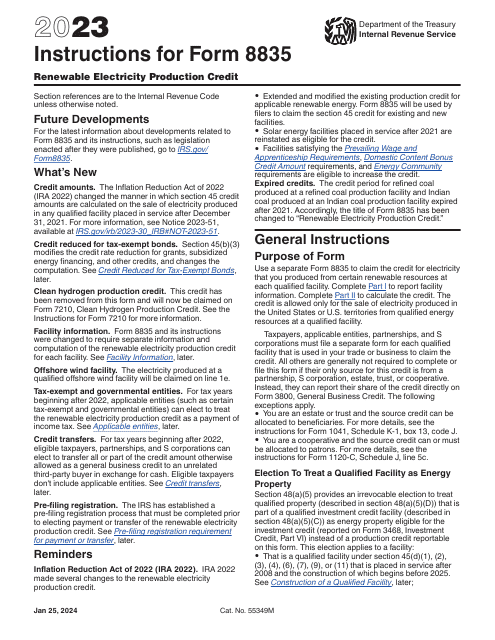

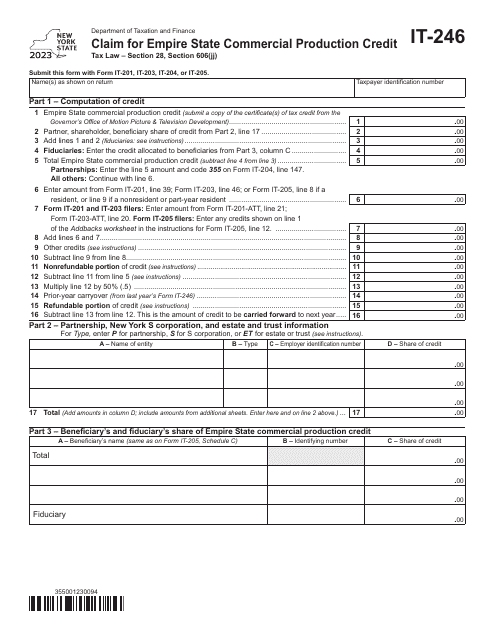

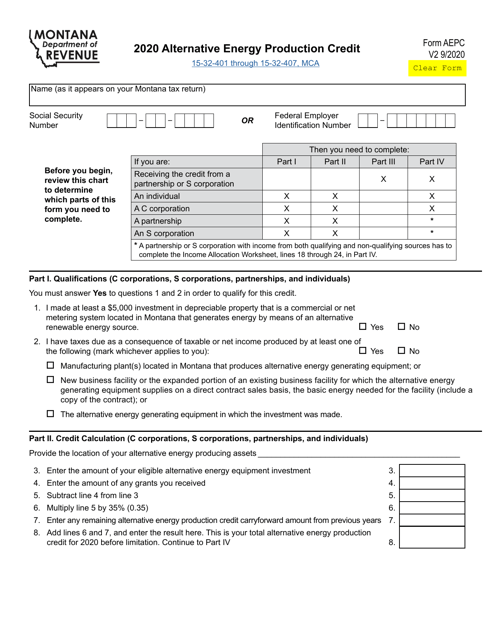

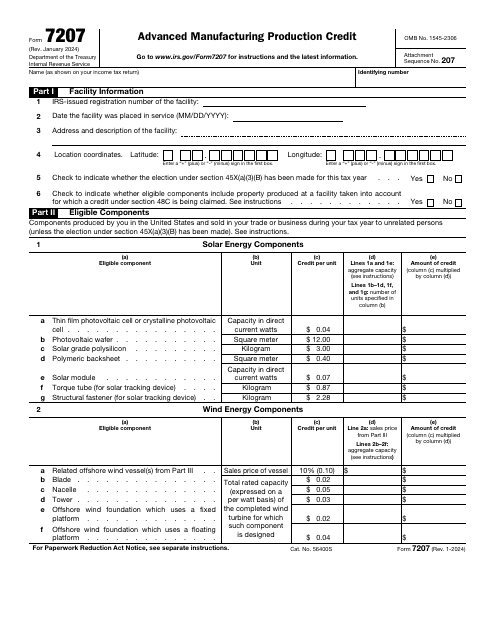

Are you a business or individual involved in the production of renewable electricity, refined coal, or Indian coal? If so, you may be eligible for a production credit, also referred to as a production tax credit. These credits are designed to incentivize and reward activities that contribute to energy production and are offered by governments at federal and state levels.

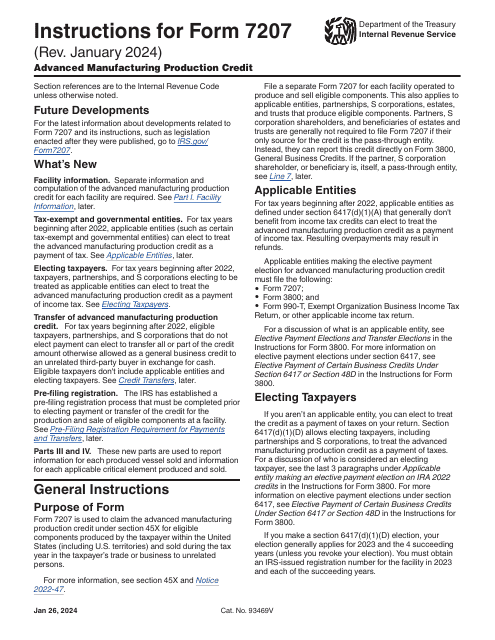

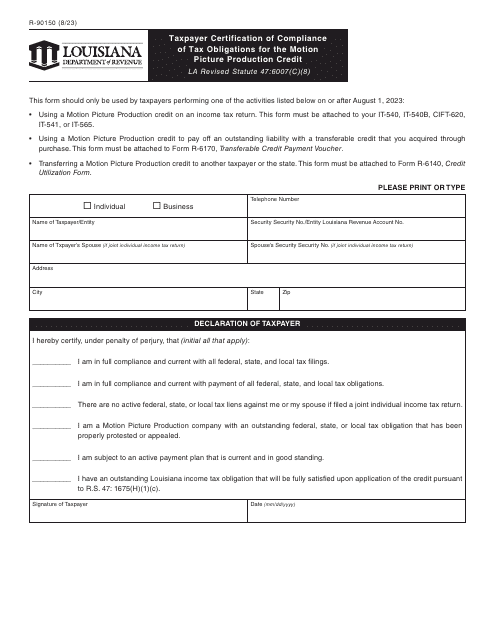

To help you navigate through the process of claiming these credits, we have gathered a collection of documents that include instructions and forms specific to different types of production credits. These documents provide detailed guidance on how to properly complete the required forms and maximize your eligible credit.

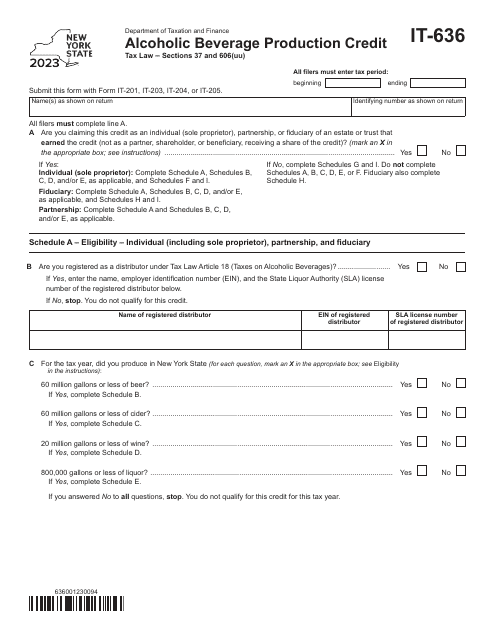

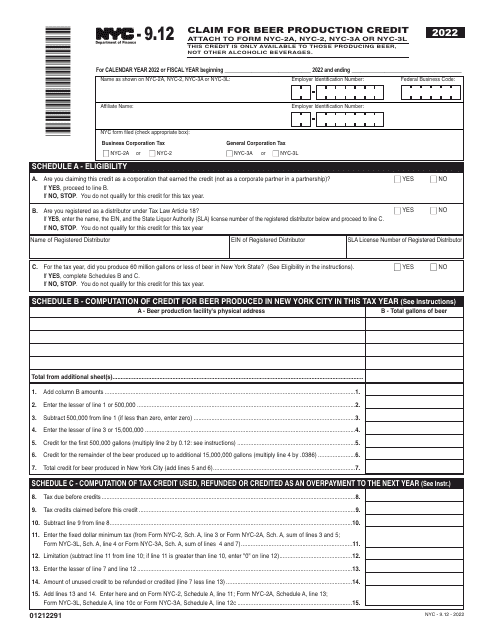

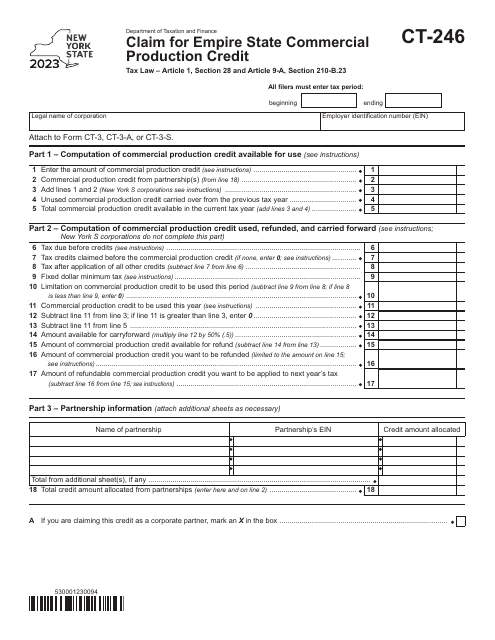

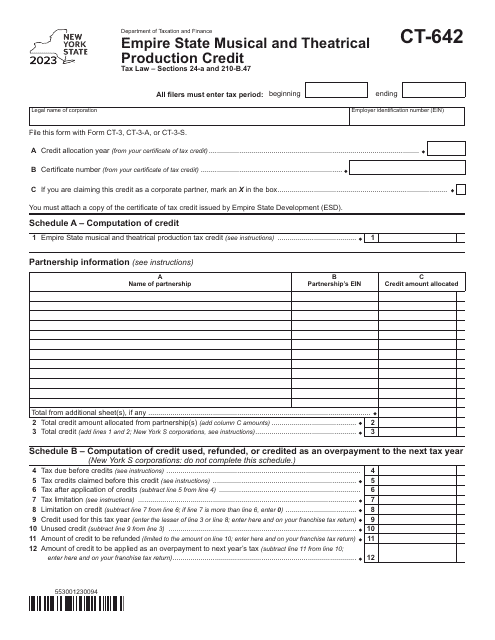

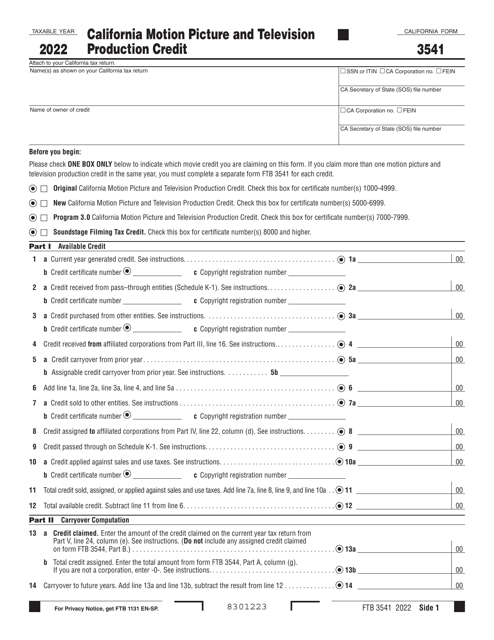

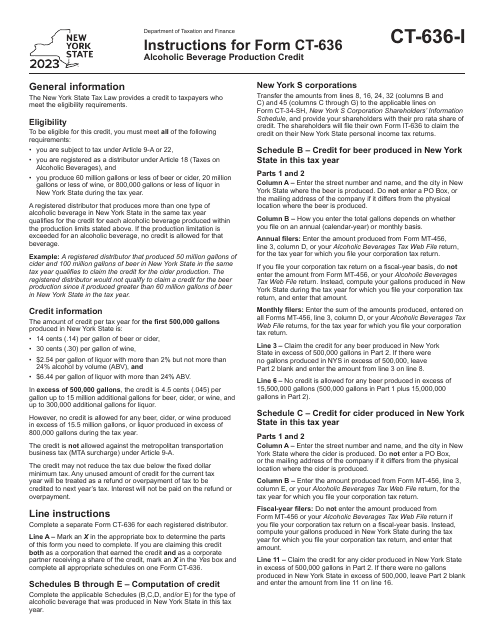

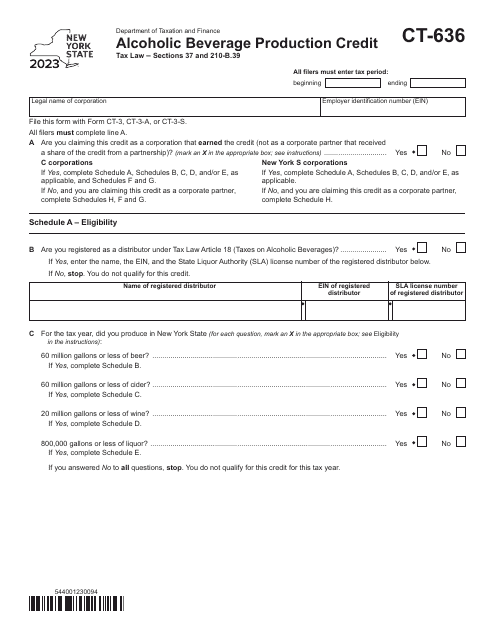

Whether you are operating in New York, Montana, or any other state, our collection of documents includes variations of the forms catered to specific states, such as Form IT-636 for Alcoholic Beverage Production Credit in New York, and Form AEPC for Alternative Energy Production Credit in Montana. We have also included the comprehensive IRS Form 8835 for those engaged in Renewable Electricity, Refined Coal, and Indian Coal Production Credit.

Navigating the world of production credits can be overwhelming, but our collection of documents aims to simplify the process and ensure that you don't miss out on the opportunity to claim the credits you are entitled to.

Please note that while we strive to provide the most up-to-date and accurate information, it is essential to consult with a tax professional or advisor to ensure that you fully understand the requirements and eligibility criteria for claiming these production credits.

Documents:

21