Property Tax Deferral Templates

Are you struggling to pay your property taxes on time? Property tax deferral programs can provide the relief you need by allowing you to delay payment until a later date. These programs, also known as property tax deferral, can be a lifesaver for homeowners who are facing financial difficulties or have limited income.

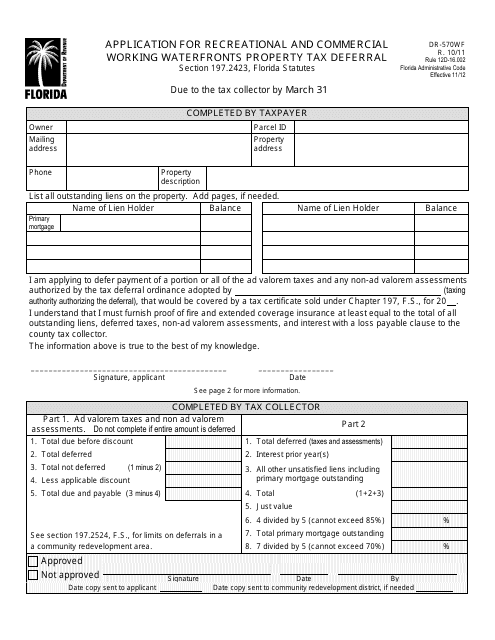

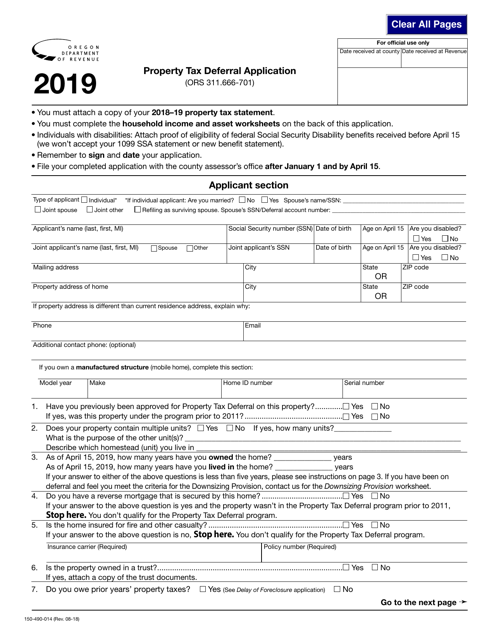

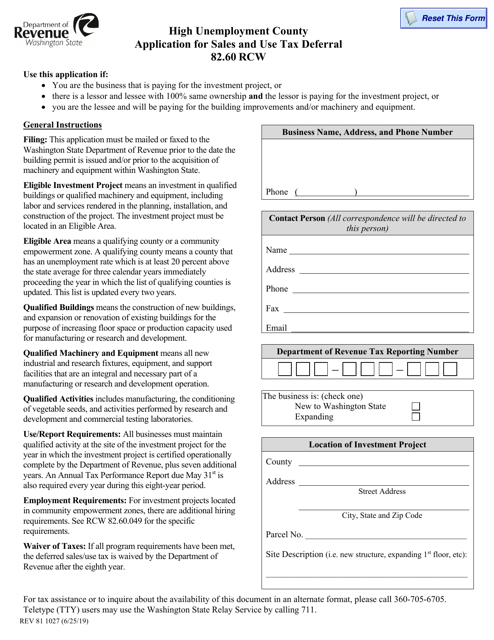

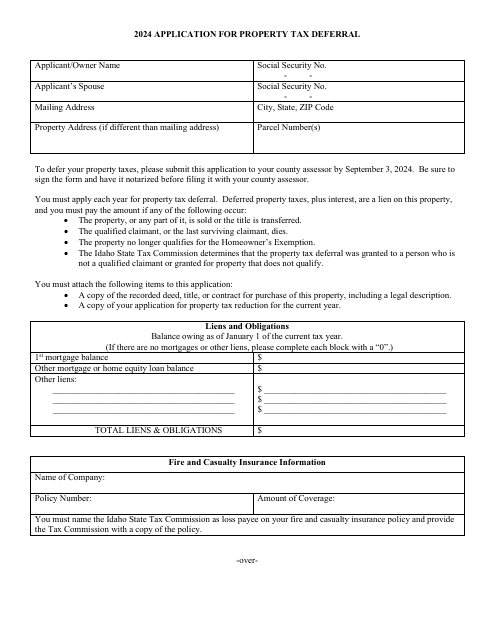

The property tax deferral program offers assistance to eligible individuals in various states, such as Oregon, Washington, and Idaho. These states have recognized the challenges faced by homeowners and have established programs to help them defer their property tax payments.

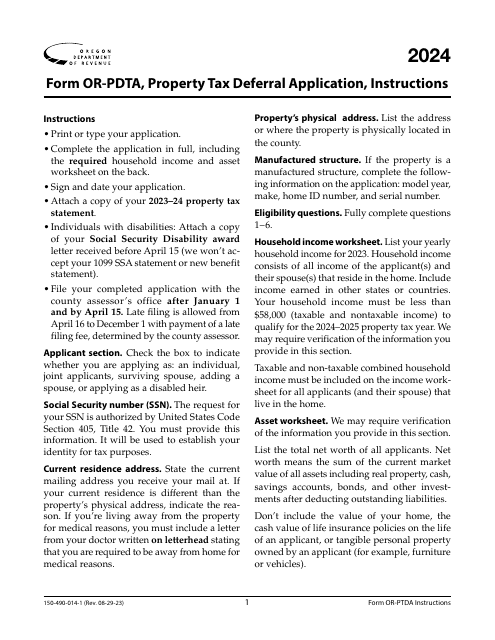

In Oregon, for instance, the Property for Ors Tax Deferral Application (Form 150-490-014) is available to homeowners who meet specific income requirements. This form allows qualified individuals to postpone their property tax payments, giving them much-needed breathing room during difficult times. Similar programs, such as the High Unemployment County Application for Sales and Use Tax Deferral (Form REV81 1027) in Washington and the Property Tax Deferral Application (Form EFO00023) in Idaho, provide relief for eligible residents as well.

If you're unsure about how to apply for property tax deferral, don't worry. Each state provides detailed instructions on how to submit your application. In Oregon, for example, you can find the Instructions for Form OR-PDTA, which will guide you through the process. By following these step-by-step instructions, you can ensure that your application is filled out correctly and increase your chances of approval.

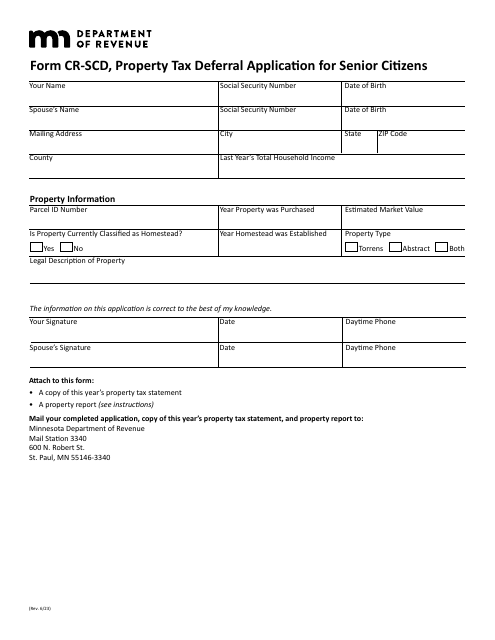

Moreover, senior citizens in Minnesota can take advantage of the Property Tax Deferral Application for Senior Citizens (Form CR-SCD). This specific form caters to the needs of seniors who may be struggling to meet their property tax obligations.

If you find yourself in a challenging financial situation and need assistance with your property taxes, the property tax deferral program may be the solution you've been searching for. By delaying your tax payments, you can have peace of mind knowing that you have more time to manage your finances effectively.

To learn more about the property tax deferral process in your state, explore the relevant forms and instructions provided. Don't let the burden of property taxes weigh you down – take advantage of the property tax deferral program today.

Documents:

6

This form is used for applying for a property tax deferral for recreational and commercial working waterfronts in Florida.

This form is used for applying for property tax deferral in Oregon for properties owned by qualified individuals or certain organizations.

This Form is used for applying for a sales and use tax deferral in Washington for counties with high unemployment.

This form is used for senior citizens in Minnesota to apply for property tax deferral. It allows eligible seniors to delay payment of their property taxes.