Loan Fees Templates

Are you looking for a way to understand and navigate the costs associated with loans? Look no further! Our comprehensive collection of documents and resources on loan fees, also known as fee loans, is here to help you make informed decisions.

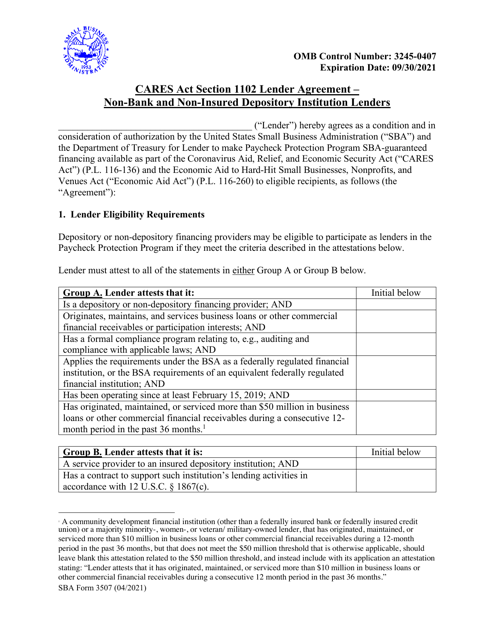

Our loan fees document group, alternatively known as fee loans, brings together a wide range of resources that cover various aspects of loan fees. Whether you are applying for a loan in the United States, Canada, or other countries, our collection has got you covered.

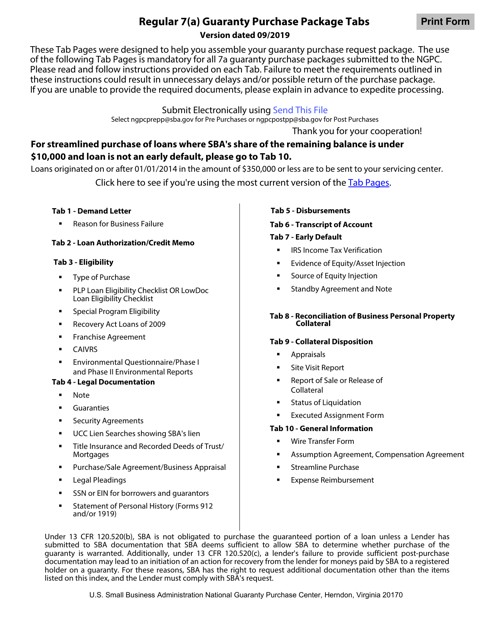

Within this document group, you will find various examples of loan fee documents, such as the Regular 7(A) Guaranty Purchase Package Tabs. This document provides a detailed breakdown of the fees associated with obtaining a loan and helps you understand the costs involved.

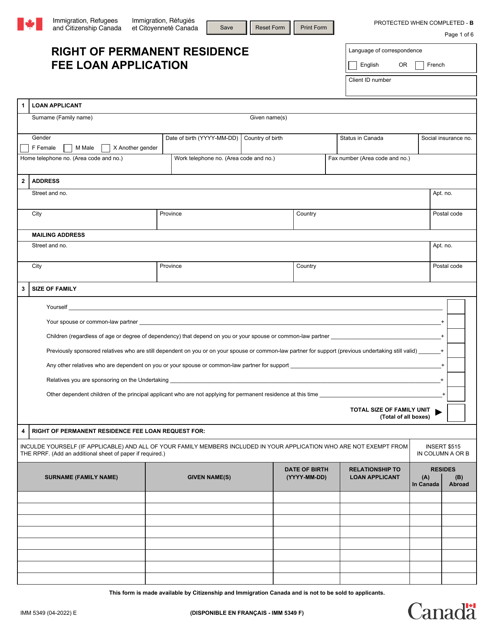

If you are applying for a loan in Canada, you may come across the Form IMM5349 Right of Permanent Residence Fee Loan Application. This document specifically focuses on the fees associated with obtaining permanent residence and assists you in navigating the complex application process.

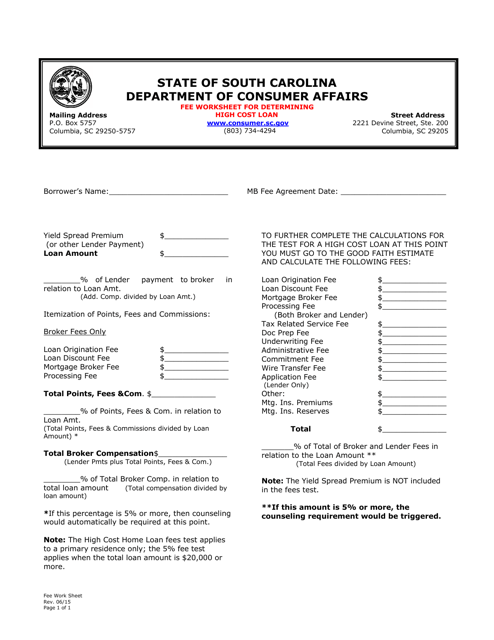

Need assistance in determining if a loan is a high-cost loan in South Carolina? Our Fee Worksheet for Determining High Cost Loan provides a step-by-step guide to help you assess the fees and costs associated with the loan.

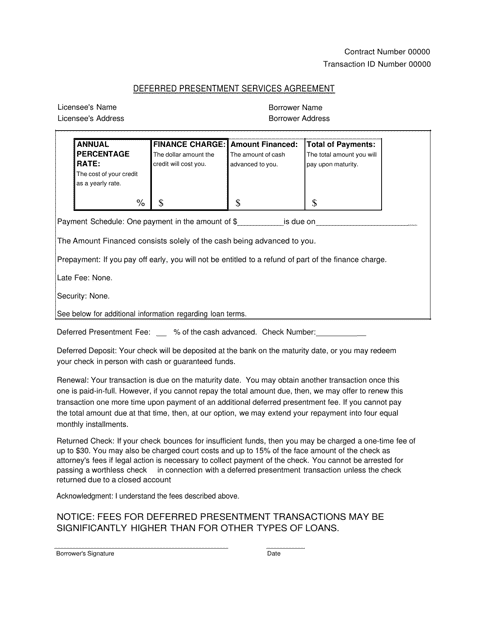

For those residing in Alabama, our Deferred Presentment Services Agreement is a must-read. This document outlines the fees and terms of deferred presentment services, ensuring transparency and clarity for both parties involved.

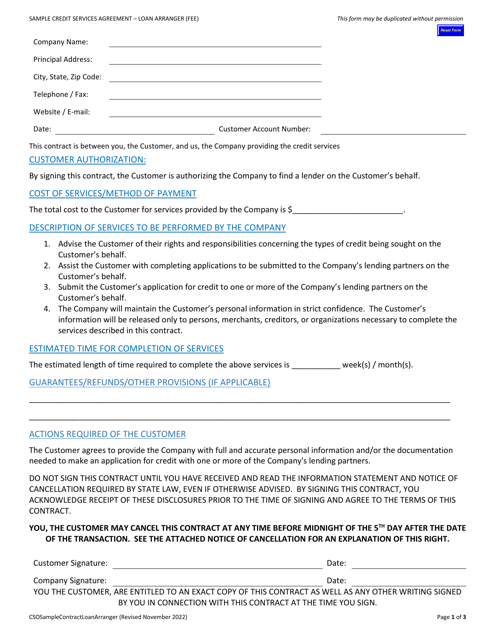

If you are a loan arranger in Wisconsin, our Credit Services Agreement for Loan Arrangers document is a valuable resource. It provides a comprehensive overview of the fees, responsibilities, and obligations involved in arranging loans.

With our wide range of documents and resources on loan fees, you can navigate the complex world of loan costs with confidence. Stay informed, make educated decisions, and ensure transparency in your loan agreements with our loan fees document group.

Documents:

12

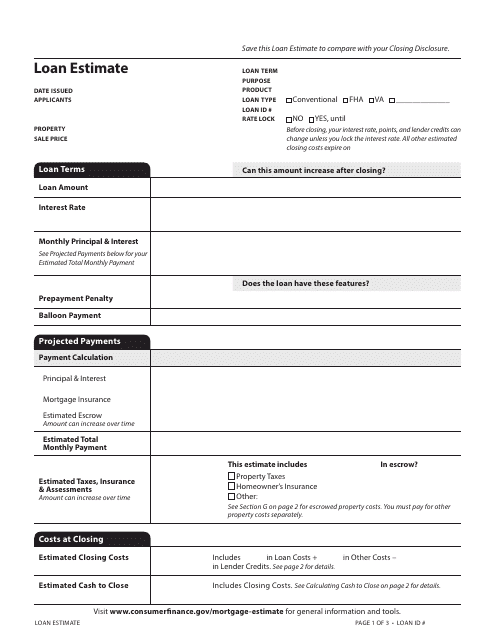

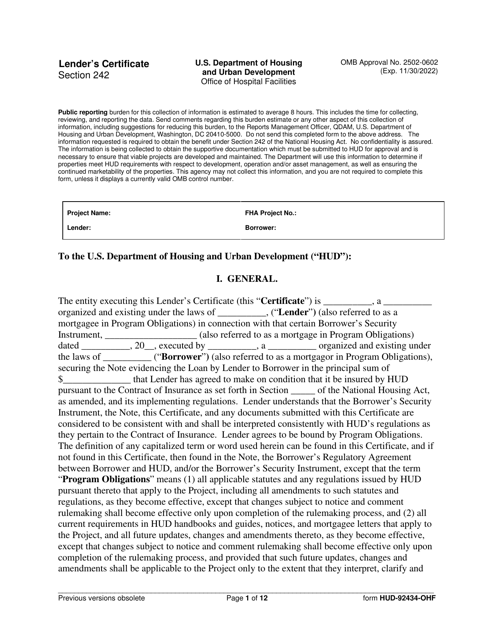

This document is used for providing borrowers with an estimate of the costs and terms associated with a mortgage loan. It includes details on interest rate, closing costs, and monthly payments.

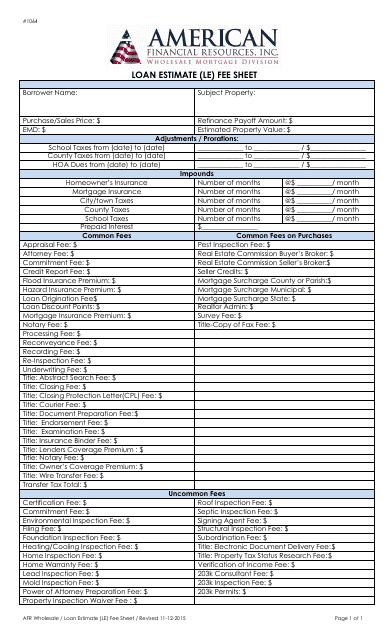

This document provides a breakdown of the fees associated with obtaining a loan from American Financial Resources, Inc.

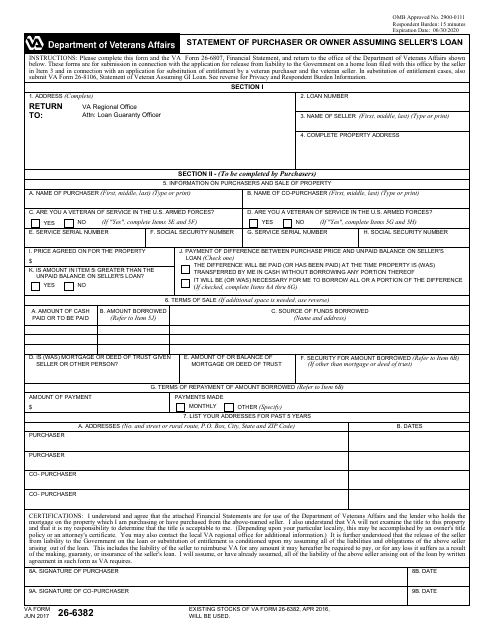

This Form is used for buyers or owners who are assuming the seller's loan.

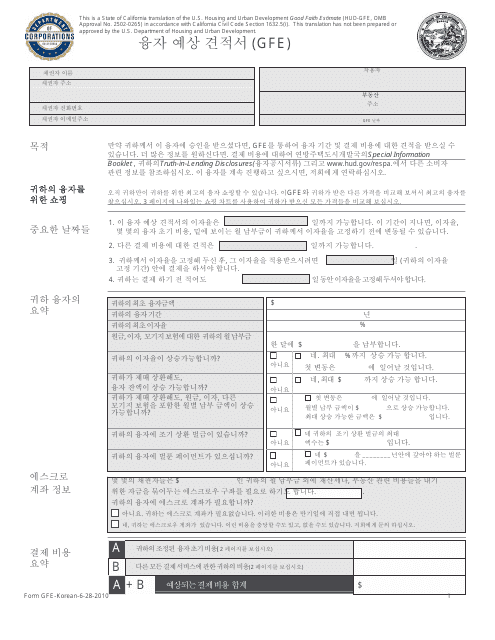

This type of document is used for providing an estimate of the closing costs for a mortgage loan in California. The form is available in Korean.

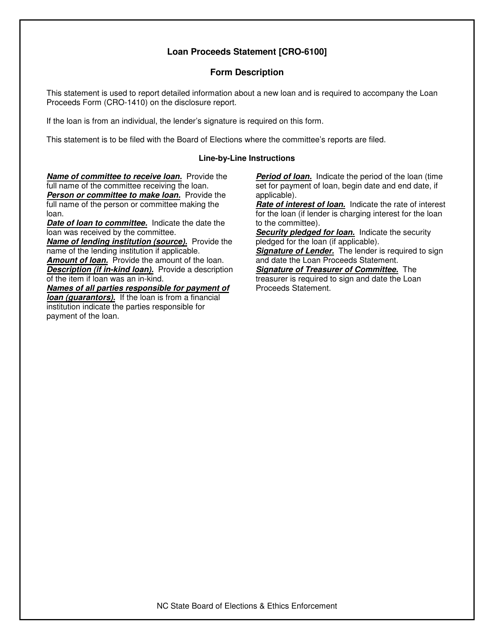

This form is used to provide instructions for completing Form CRO-6100 Loan Proceeds Statement in North Carolina. It provides guidance on how to accurately report loan proceeds for various purposes.

This document is a fee worksheet for determining if a loan is considered a high-cost loan in South Carolina. It helps lenders and borrowers calculate the fees involved in the loan and determine if it exceeds the legal limits set by the state.

This form is used for lenders to certify compliance with specific requirements for the OneHome Program.

This document is a contract used in Alabama for a type of short-term loan called deferred presentment services. It outlines the terms and conditions of borrowing money and the repayment terms.

This agreement is used when loan arrangers in Wisconsin provide credit services for borrowers. It outlines the terms and conditions of the credit arrangement.