Oil and Gas Tax Templates

Are you in the oil and gas industry and need to stay compliant with tax regulations? Our oil and gas tax services are designed to help companies like yours navigate the complex world of taxation in this industry. Our team of tax experts is highly knowledgeable and experienced in all aspects of oil and gas tax compliance, ensuring that you stay in line with the law and avoid any penalties or fines.

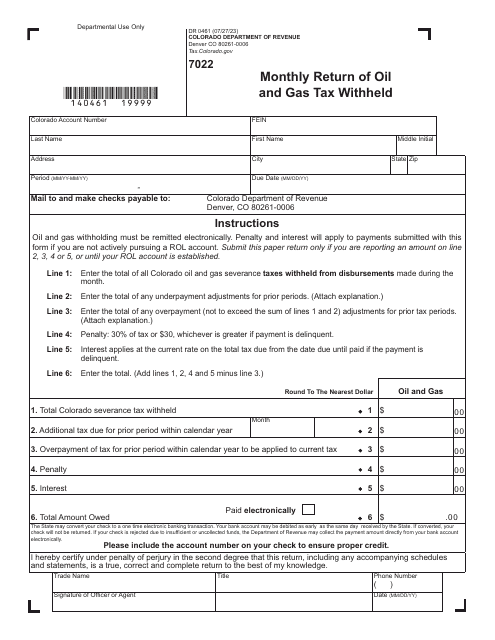

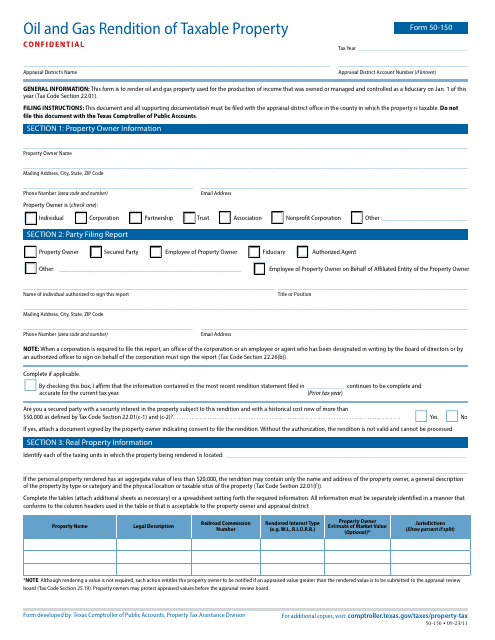

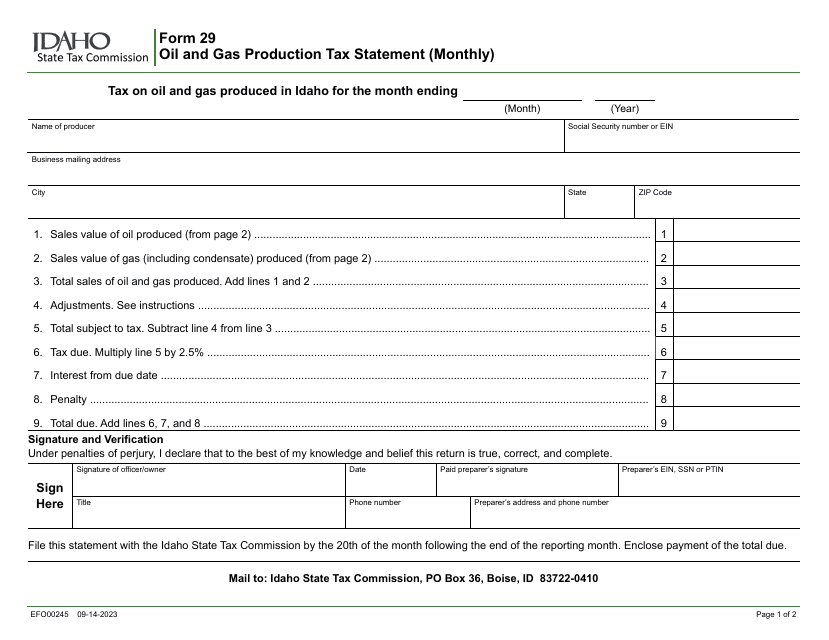

Our oil and gas tax services cover a wide range of taxes related to this industry, including the monthly return of oil and gas tax withheld, oil and gas rendition of taxable property, oil and gas productiontax statements, and more. We understand that different states may have different requirements, which is why our services are tailored to meet the specific needs of each state.

With our oil and gas tax services, you can be confident that your tax obligations are being handled accurately and efficiently. Our team will assist you in preparing and filing the necessary forms, keeping track of important deadlines, and ensuring that you are making the right tax payments. We will also provide you with detailed reports summarizing your oil and gas tax obligations, giving you a clear understanding of your financial responsibilities.

Stay compliant with oil and gas tax regulations and focus on growing your business. Choose our oil and gas tax services today and let us take care of all your tax needs. Contact us now to learn more about how we can assist you in managing your tax obligations effectively.

Documents:

5

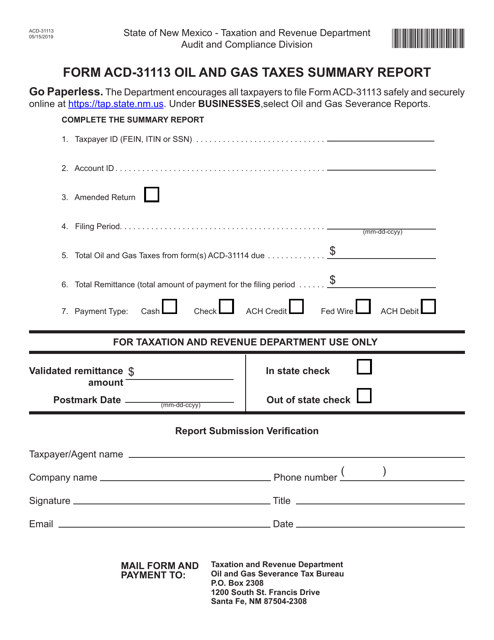

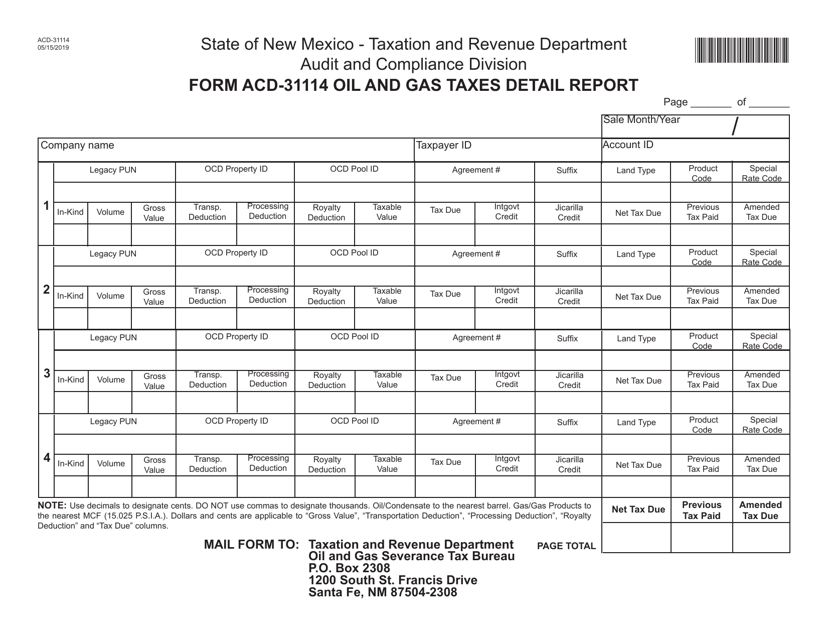

This form is used for reporting and summarizing oil and gas taxes in New Mexico. It provides a summary of taxes paid by companies operating in the oil and gas industry in the state.

This form is used for reporting details of oil and gas taxes in the state of New Mexico.