First Time Home Buyer Templates

Are you a first-time home buyer? Congratulations on taking this important step towards homeownership! As a first-time home buyer, there are certain documents and information that you need to be aware of. Whether you're looking to claim a refund of realty transfer taxes, opening a first-time home buyer savings account, or seeking deductions, this is an exciting journey.

Navigating the paperwork and understanding the requirements can be overwhelming, but we're here to help. Our comprehensive collection of documents for first-time home buyers provides all the necessary information you need to get started on your path to owning a home.

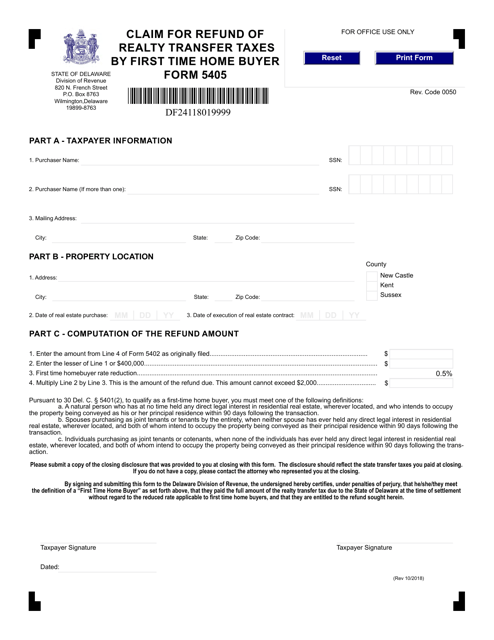

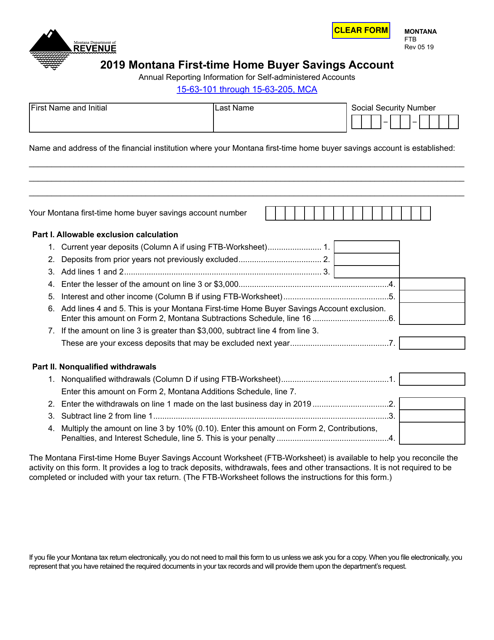

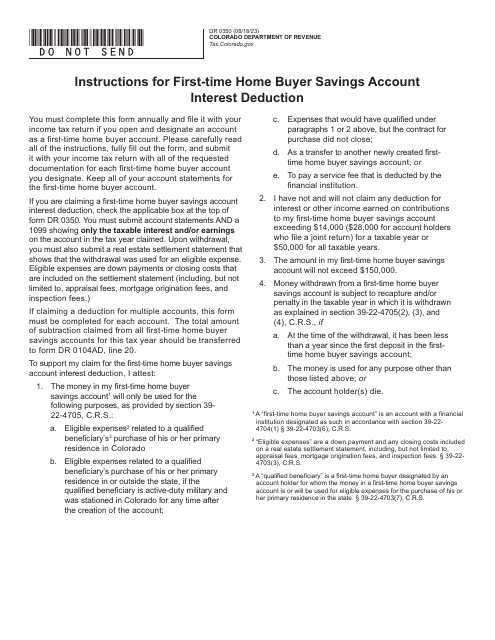

Our documents cover a wide range of topics and include important forms such as Form 5405 Claim for Refund of Realty Transfer Taxes, ensuring that you're aware of any potential refund opportunities. In addition, we offer resources like the Montana First-Time Home Buyer Savings Account Form FTB and the Colorado Form DR0350 First-Time Home Buyer Savings Account Interest Deduction, which can help you maximize your savings.

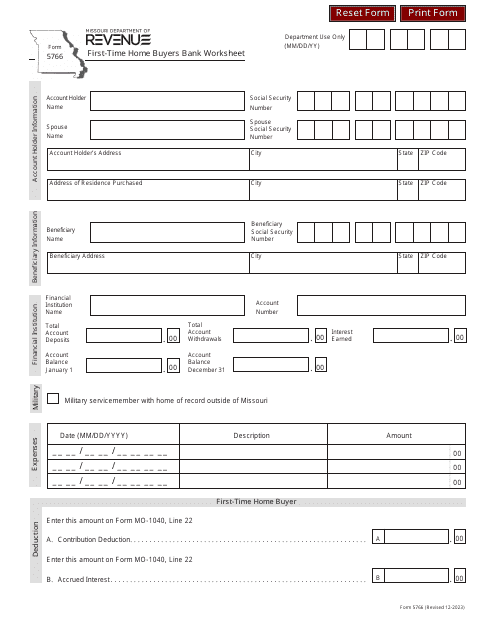

Furthermore, our collection includes Form 5766 First-Time Home Buyers Bank Worksheet, a valuable tool for organizing your finances and ensuring a smooth home buying process. With its help, you can better understand your financial situation and make informed decisions.

Buying a home for the first time is an exciting milestone, but it's important to have all the necessary documents and information at your fingertips. Our collection of first-time home buyer documents ensures that you have everything you need to navigate this journey with ease.

So, whether you're a first-time home buyer in Delaware, Montana, or any other state, don't wait any longer. Explore our extensive collection of documents and get on track to becoming a proud homeowner.

Documents:

12

This document is a certificate template for first-time home buyers. It can be used to recognize and celebrate the achievement of purchasing a home for the first time.

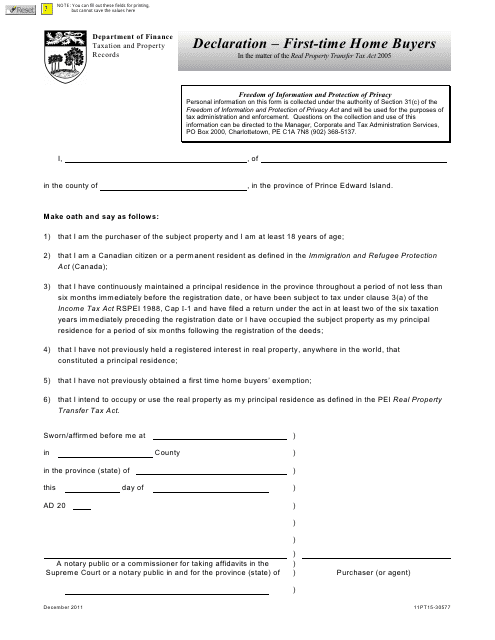

This document is for first-time homebuyers in Prince Edward Island, Canada. It provides information related to the declaration process for individuals purchasing a home for the first time in PEI.

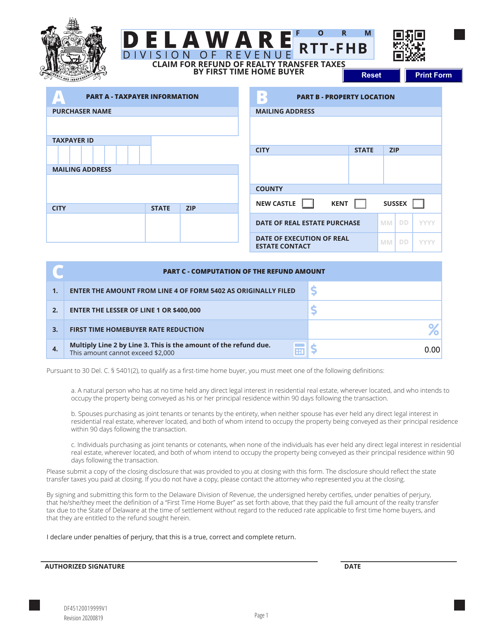

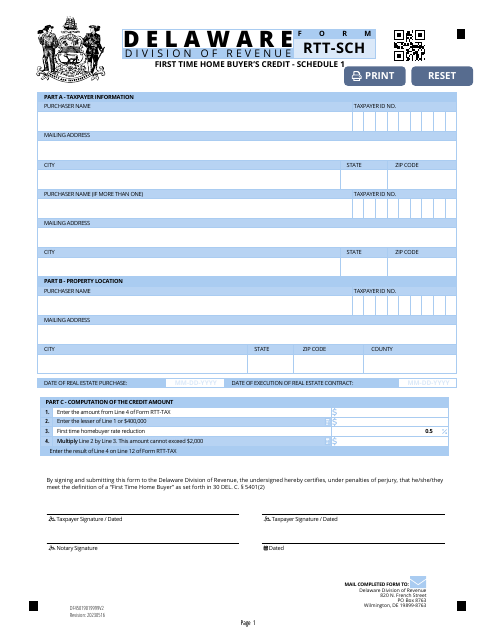

This Form is used for claiming a refund of realty transfer taxes by first-time home buyers in Delaware.

This Form is used for opening a First-Time Home Buyer Savings Account in the state of Montana. It allows individuals to save money towards the purchase of their first home and provides potential tax benefits.

This form is used for first-time home buyers in Delaware who want to claim a refund for realty transfer taxes paid during the purchase of a property.

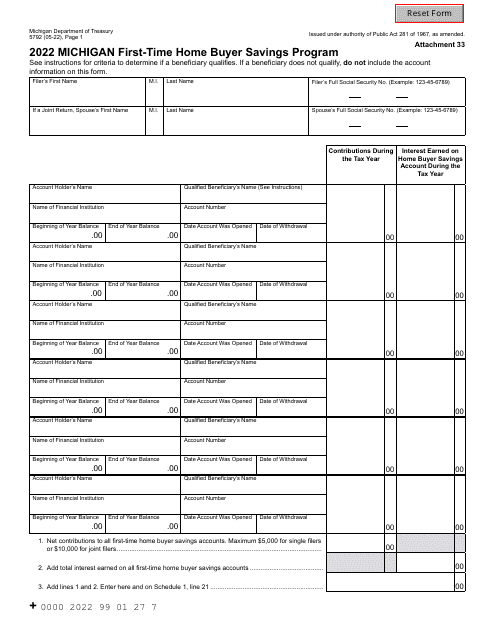

This form is used for the Michigan First-Time Home Buyer Savings Program in Michigan. It is a program that allows first-time homebuyers in Michigan to save money for their future home purchase.