Unused Credit Templates

Are you a taxpayer who has leftover credits from a previous tax year that you haven't been able to use? Well, you're not alone. Many individuals and businesses find themselves with unused credits that can potentially save them money. That's where the "unused credit" document collection comes in.

Also referred to as "unused credits," this document group consists of a variety of instructions and worksheets related to carrying forward unused credits on your tax return. These documents provide guidance on how to properly report and utilize these credits, ensuring that you don't miss out on any potential tax savings.

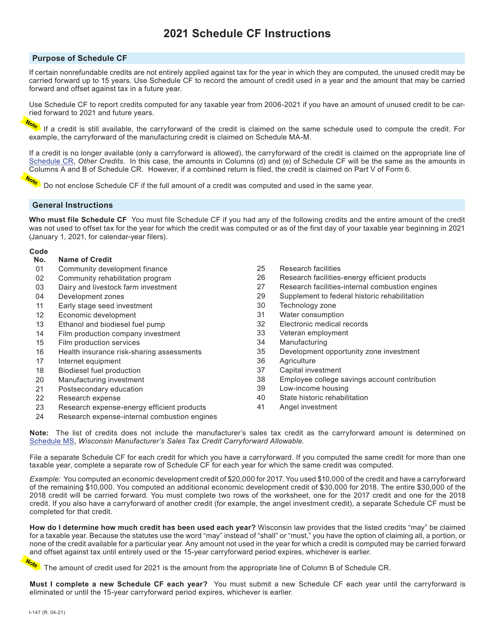

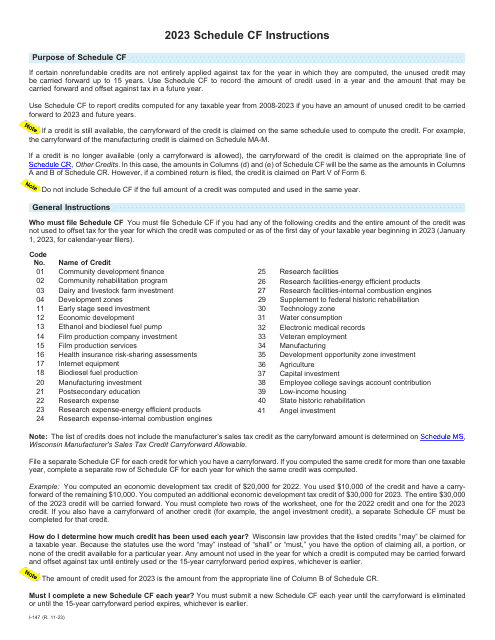

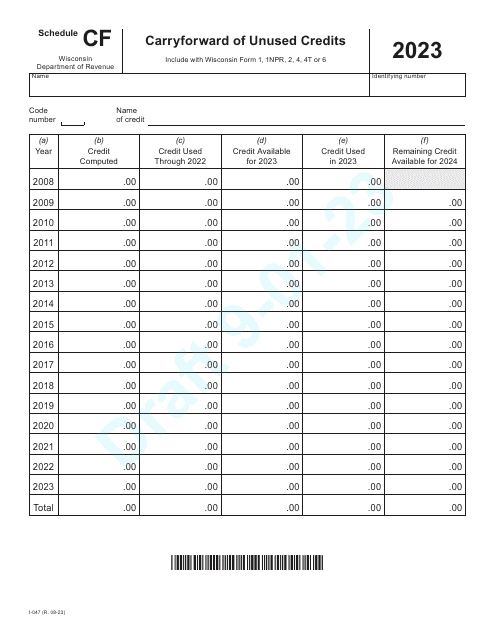

For example, you may come across the "Instructions for Form I-147 Schedule CF Carryforward of Unused Credits - Wisconsin" document. This document specifically pertains to taxpayers in Wisconsin who have unused credits that they want to carry forward to a future tax year. It provides step-by-step instructions on how to complete the necessary forms and properly report these credits.

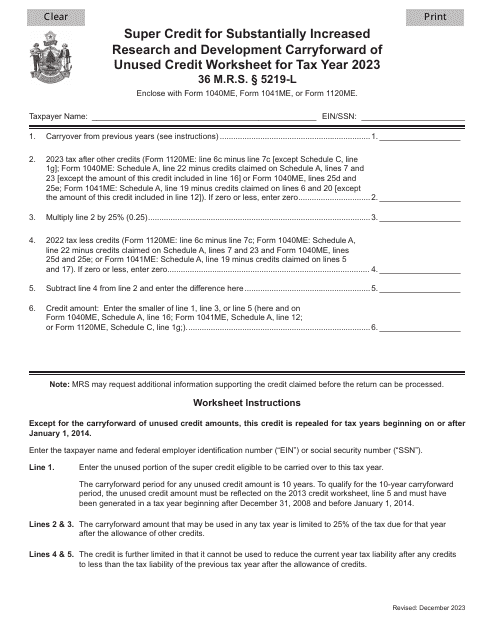

Another document you might find helpful is the "Super Credit for Substantially Increased Research and Development Carryforward of Unused Credit Worksheet - Maine." This worksheet is designed for businesses in Maine who have unused research and development credits and wish to carry them forward. It provides a clear outline and instructions on how to calculate and report these credits on their tax return.

Whether you're an individual or a business, properly utilizing unused credits can result in significant tax savings. That's why it's crucial to have access to accurate and up-to-date information. The "unused credit" document collection aims to provide you with the necessary resources to navigate this sometimes complex process effectively.

So, if you have unused credits from a previous tax year, don't let them go to waste. Explore the "unused credit" document collection to find the guidance you need to ensure that your unused credits are properly reported and utilized, potentially saving you money on your tax bill.

Documents:

6

This Form is used for carrying forward unused tax credits in the state of Wisconsin. It provides instructions on how to report and claim these credits from previous years.