Wage Garnishment Laws Templates

Are you struggling with wage garnishment and need help understanding the laws surrounding it? Our website offers a comprehensive guide to wage garnishment laws, providing you with the information you need to protect your hard-earned income.

Wage garnishment laws, also known as wage deduction laws or wage attachment laws, determine the guidelines and procedures for deducting a portion of an employee's wages to satisfy a debt owed to a creditor. This collection of documents provides a wealth of resources to help you navigate the complexities of wage garnishment.

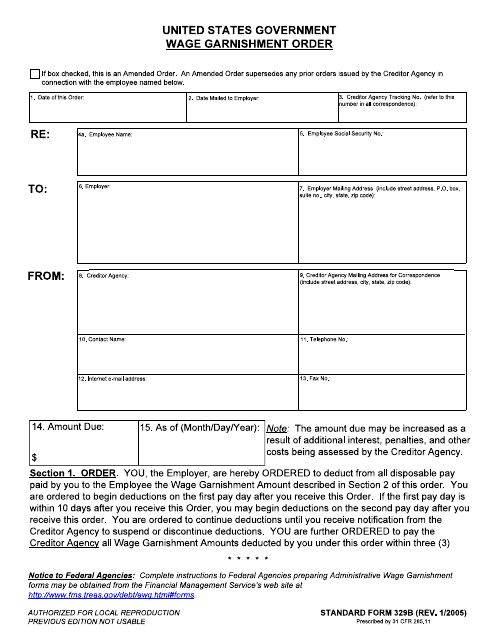

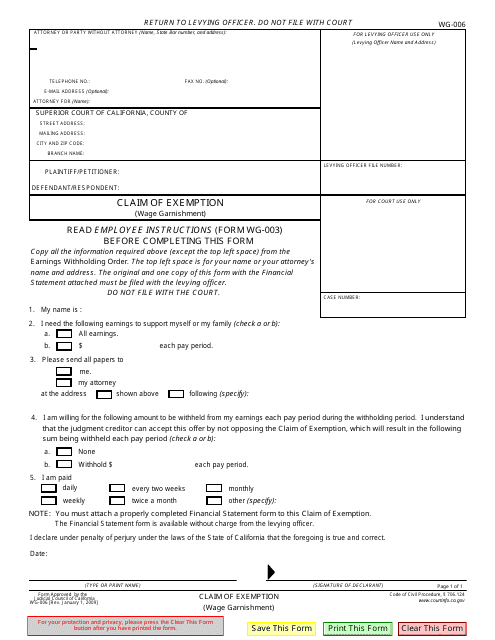

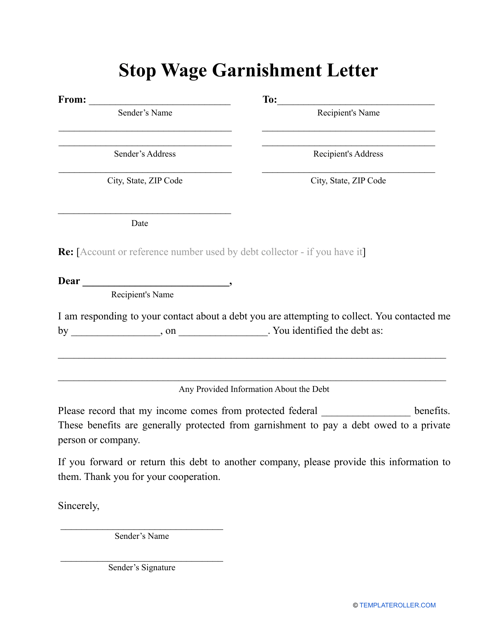

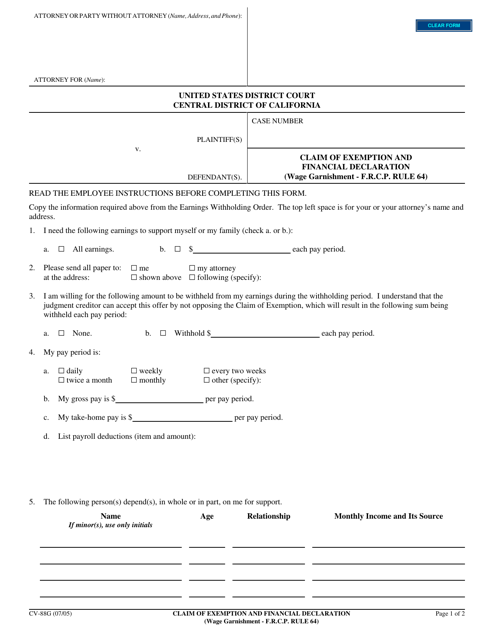

Whether you're looking for forms to initiate a wage garnishment order, such as the Form SF-329B or Form WG-006, or need assistance in filing a claim of exemption, like the Form CV-88G, we have you covered. Our website also offers helpful templates, such as the Stop Wage Garnishment Letter Template, to help you communicate with creditors and take action to protect your wages.

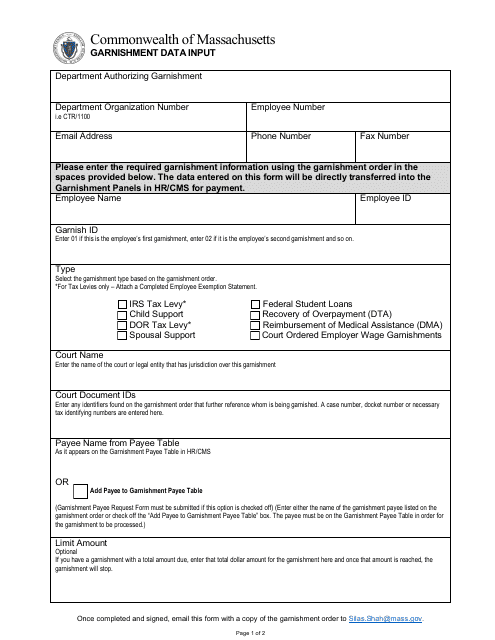

We understand that wage garnishment laws can vary from state to state, which is why we provide documents specific to certain regions. For example, if you are located in California, you can find resources like the Form WG-006 and Form CV-88G, designed to comply with California's wage garnishment laws. Similarly, if you reside in Massachusetts, our Garnishment Data Input form is tailored to the requirements of that state.

Don't let wage garnishment leave you feeling helpless. Arm yourself with the knowledge and resources you need to protect your wages and financial well-being. Explore our collection of wage garnishment law documents today and take control of your financial future.

Documents:

5

This Form is used for obtaining a wage garnishment order to collect a debt. It allows the creditor to legally collect a portion of the debtor's wages.

This form is used for claiming exemption from wage garnishment in California. It allows individuals to protect a certain amount of their wages from being taken to satisfy a debt.

The purpose of this type of document is to convince your creditor to stop taking garnishments from an individual's salary.

This document is for individuals claiming exemption from wage garnishment in California. The form allows the individual to declare their financial situation to support their claim.

This type of document is used for inputting data related to garnishment in the state of Massachusetts.