Credit for Prior Year Minimum Tax Templates

Are you looking to claim a credit for the prior year minimum tax? This credit allows individuals, estates, and trusts, as well as corporations, to offset taxes paid in a previous year against their current tax liability. Without this credit, taxpayers might be subject to double taxation.

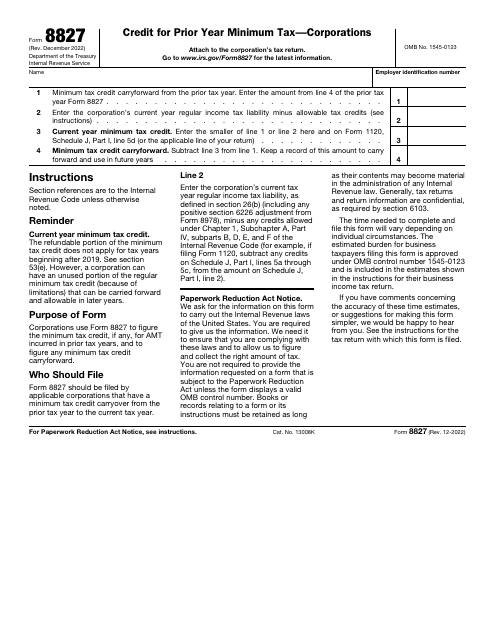

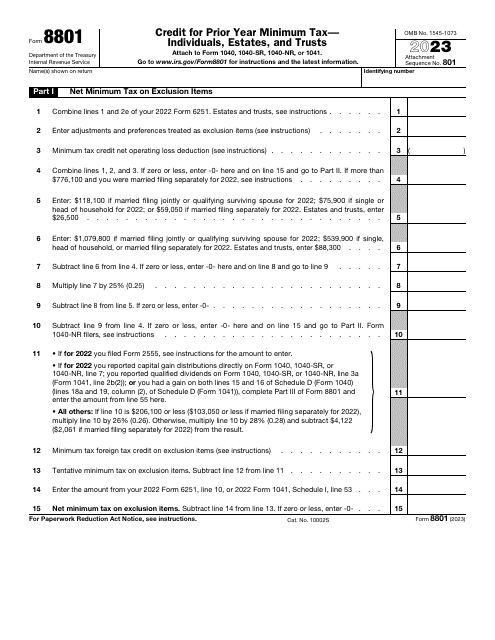

To successfully claim the credit for prior year minimum tax, you will need to fill out the appropriate IRS forms. For corporations, you will need IRS Form 8827, while individuals, estates, and trusts will need IRS Form 8801. Both forms come with detailed instructions to guide you through the process.

The credit for prior year minimum tax is a valuable opportunity to reduce your overall tax burden. By looking back to a previous year's tax liability, you can take advantage of credits that may have gone unused, ultimately saving you money. Even if you've already paid the minimum tax in a prior year, this credit can help you avoid paying it again in the current year.

Whether you're a corporation or an individual, understanding the requirements and eligibility criteria for the credit for prior year minimum tax is crucial. The IRS forms and instructions provide all the necessary information to ensure you accurately calculate and claim the credit. By familiarizing yourself with the process and seeking assistance if needed, you can take advantage of this credit and potentially reduce your tax liability.

So, don't miss out on claiming the credit for prior year minimum tax. Explore the forms and instructions provided by the IRS to see if you qualify and start saving money today. Remember, every dollar saved through tax credits is a dollar that can be put towards your financial goals.