Student Expenses Templates

Are you a student struggling to keep track of your expenses? Are you overwhelmed by the cost of education and unsure of how to manage your finances effectively? Look no further than our comprehensive collection of student expense resources.

Our student expense documents are carefully curated to provide you with all the necessary tools and information to navigate the financial challenges that come with pursuing an education. Whether you are a student in California seeking help with Medi-Cal expenses or a student anywhere in the US looking for guidance on filing your IRS Form 1098-T, we have you covered.

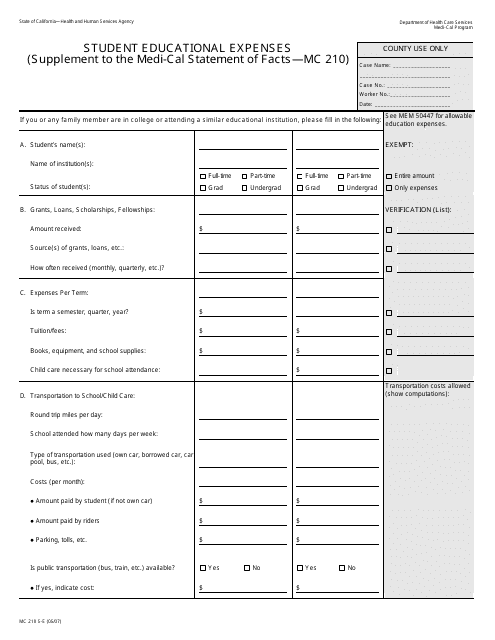

Our student expense collection offers a wide range of resources, including forms like the Form MC210 Supplement S-E Student Educational Expenses (Supplement to Medi-Cal Statement of Facts) exclusively for students in California. This form ensures that you receive the financial support you are entitled to for your education-related expenses.

For students across the country, our collection also includes the essential IRS Form 1098-T Tuition Statement. This form helps you report educational expenses and potentially claim tax credits or deductions, providing much-needed financial relief.

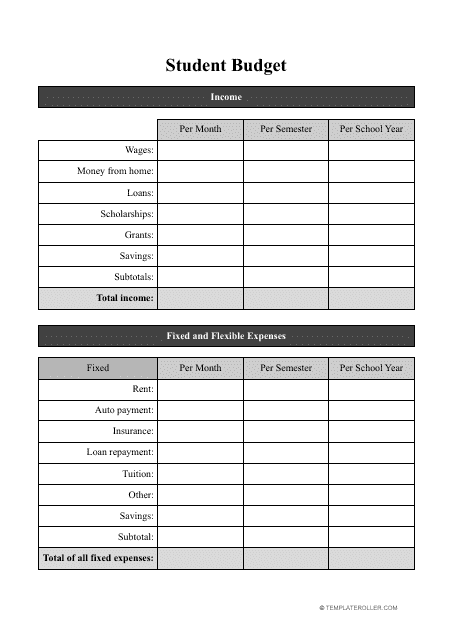

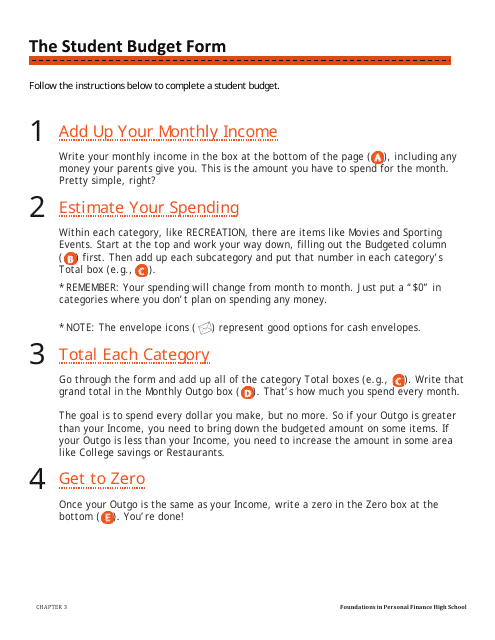

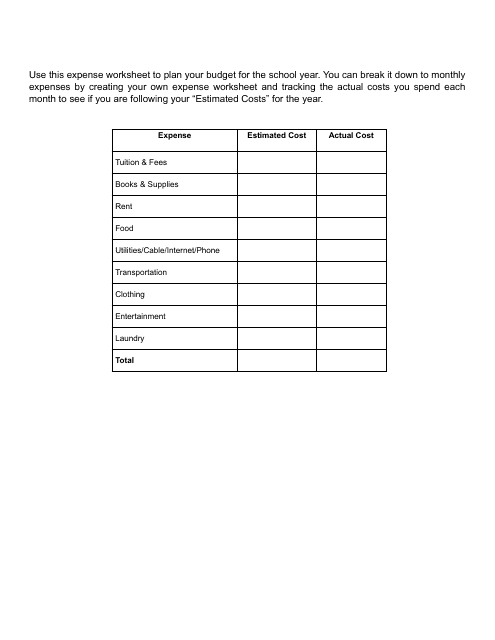

To make your financial planning and budgeting easier, we offer student budget templates and forms, such as the Student Budget Template and Student Budget Form. These resources enable you to track your income, expenses, and savings, empowering you to manage your finances more efficiently throughout the school year.

No matter where you are in your educational journey, our student expense documents will help you take control of your finances. With these resources at your disposal, you can better navigate the sometimes daunting costs associated with being a student.

Managing your student expenses has never been easier. Access our collection of student expense documents today and take charge of your financial future.

Documents:

5

This form is used for reporting student educational expenses as a supplement to the Medi-Cal Statement of Facts in the state of California.

Download this form if you are an educational institution and need information about qualified tuition and related fees paid during the tax year. The information can be used by the paying student to calculate their education-related tax deductions and credits.

Using this type of template will allow you to keep on top of finances and ensure that you are not left without any cash at any point during your student studies.