Motor Vehicle Insurance Templates

Motor Vehicle Insurance is essential for all motor vehicle owners and drivers, providing protection in case of accidents, theft, or damage to your vehicle. This important document group ensures that you are legally covered and financially protected.

Also known as Auto Insurance or Car Insurance, Motor Vehicle Insurance is a legal requirement in most states and provinces. It provides coverage for bodily injury liability, property damage liability, medical payments, collision, comprehensive, and uninsured/underinsured motorist protection.

Motor Vehicle Insurance not only provides financial protection, but it also offers peace of mind while on the road. In the event of an accident, your insurance policy will cover the costs of repairs, medical expenses, and legal fees, depending on your coverage limits.

It is important to carefully review and compare different Motor Vehicle Insurance policies to find the one that best suits your needs and budget. You can customize your coverage options and deductible amounts to ensure the right level of protection for your vehicle.

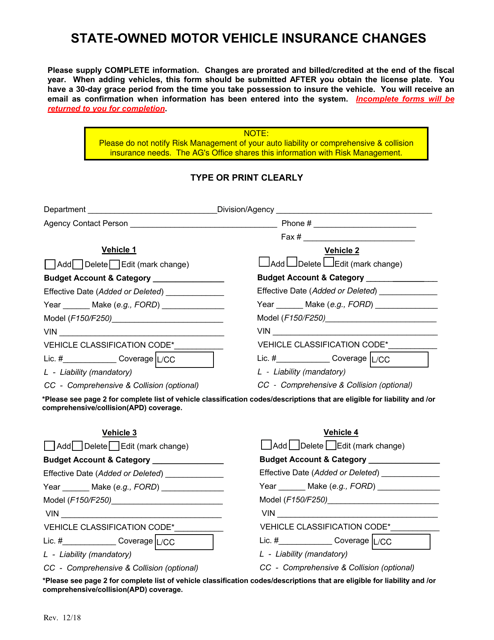

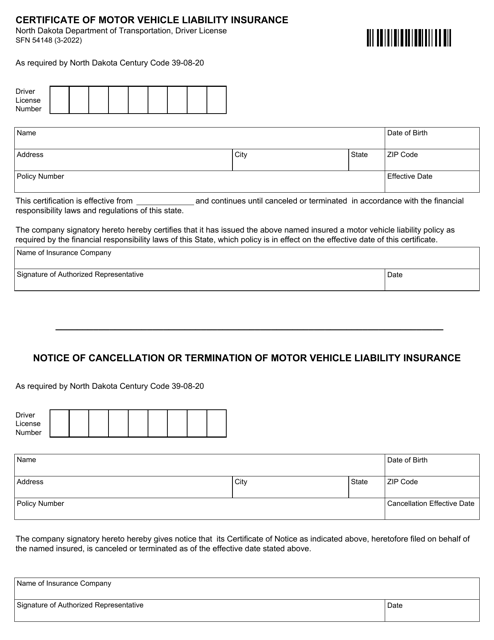

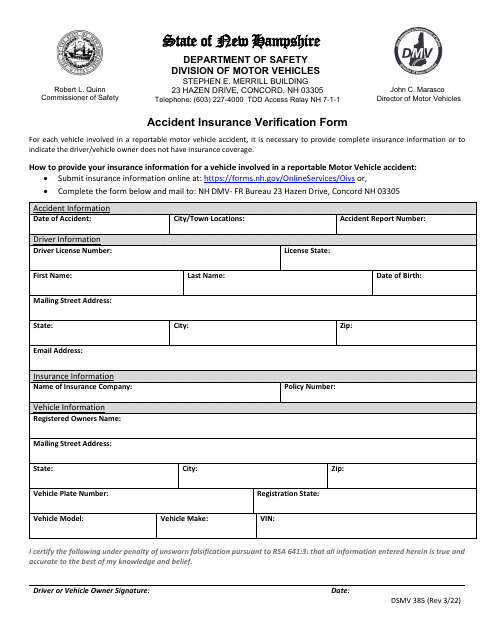

To obtain Motor Vehicle Insurance, you need to fill out various forms and documents. These include the Certificate of Motor Vehicle Liability Insurance, Insurance Verification Forms like the Blue Card, and applications for Self-Insurance. These documents ensure that you meet the legal requirements and have the necessary coverage in place.

Whether you own a car, truck, motorcycle, or any other motor vehicle, having proper Motor Vehicle Insurance is crucial. It not only protects you financially but also provides legal compliance and peace of mind on the road.

Documents:

8

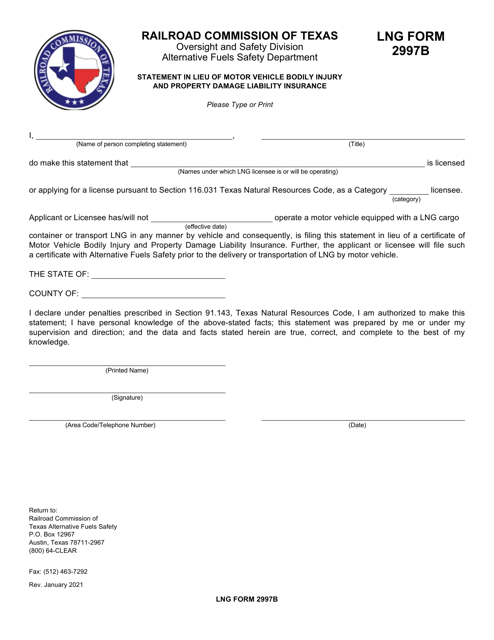

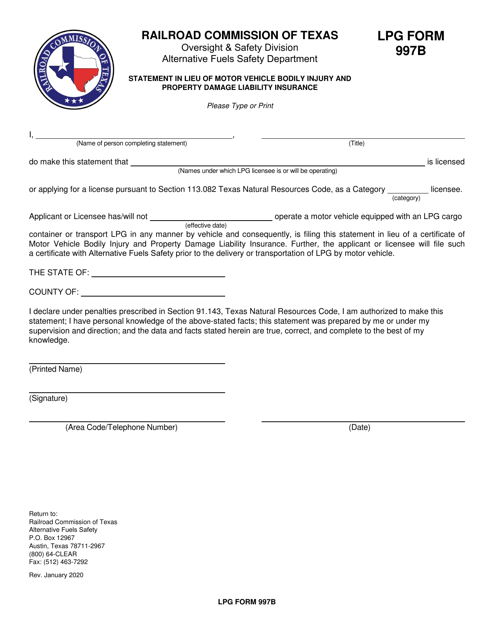

This form is used for providing a statement in lieu of motor vehicle bodily injury and property damage liability insurance in Texas.

This form is used for providing a statement in lieu of motor vehicle insurance in Texas for bodily injury and property damage liability.

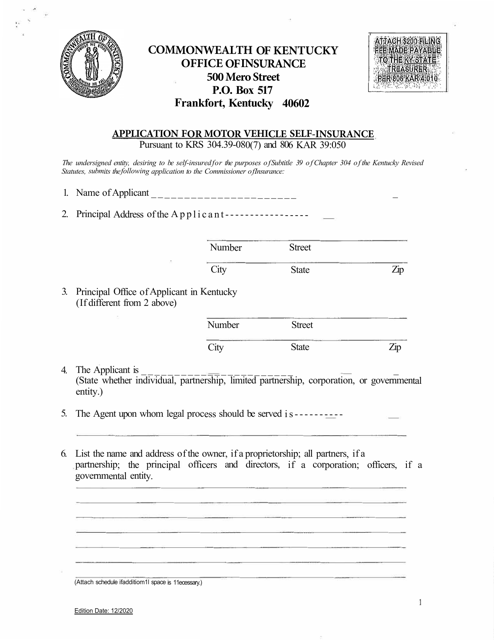

This form is used for applying for self-insurance for a motor vehicle in the state of Kentucky. Self-insurance allows individuals to provide proof of financial responsibility for the vehicle instead of purchasing traditional auto insurance coverage.