Tax Due Date Templates

Are you aware of your upcoming tax obligations? Stay informed and avoid penalties by keeping track of tax due dates. Understanding when your tax payments and filings are due is essential for individuals and businesses alike. Our comprehensive collection of tax due date documents will guide you through the deadlines and help you manage your tax responsibilities effectively.

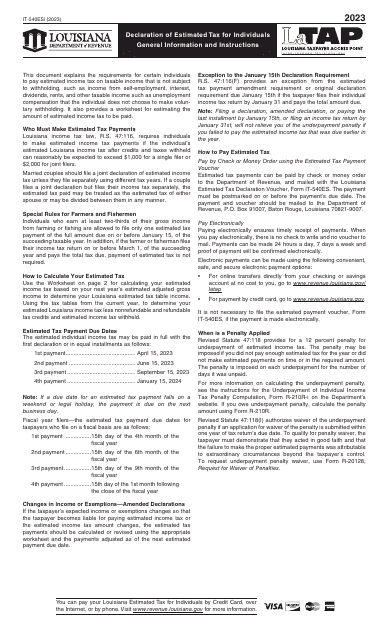

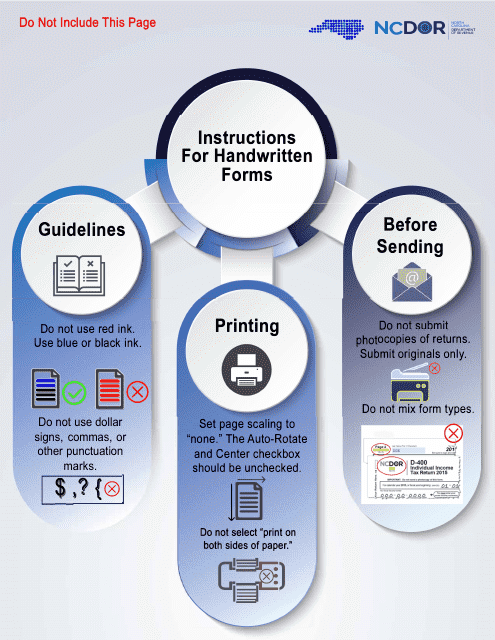

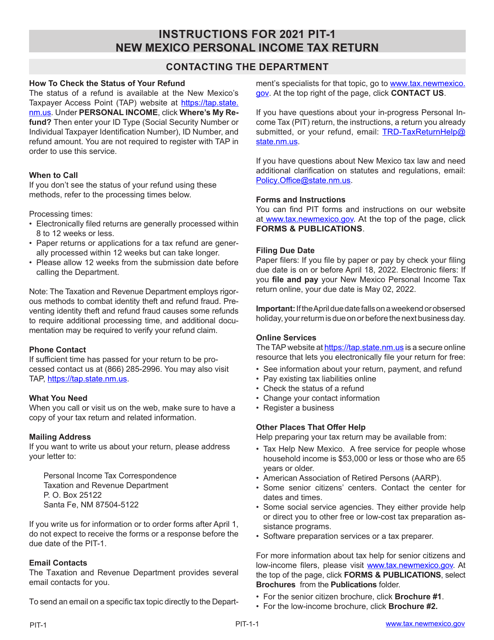

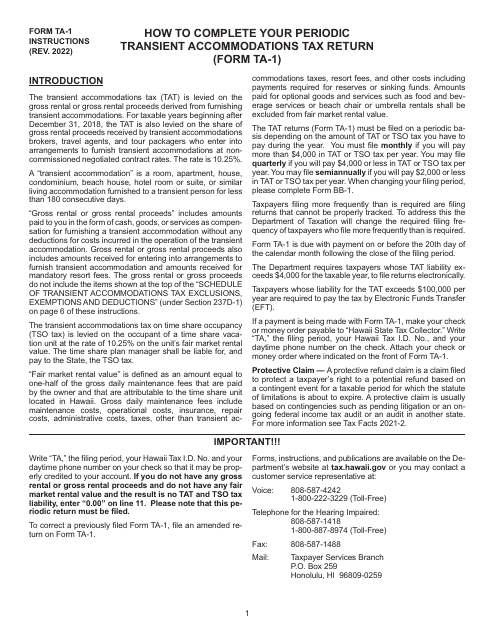

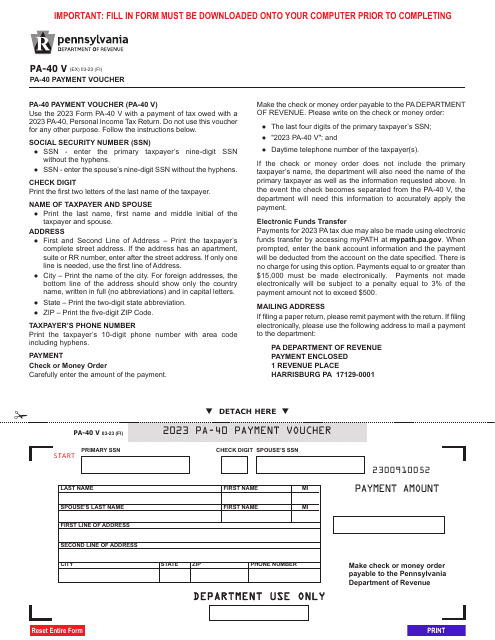

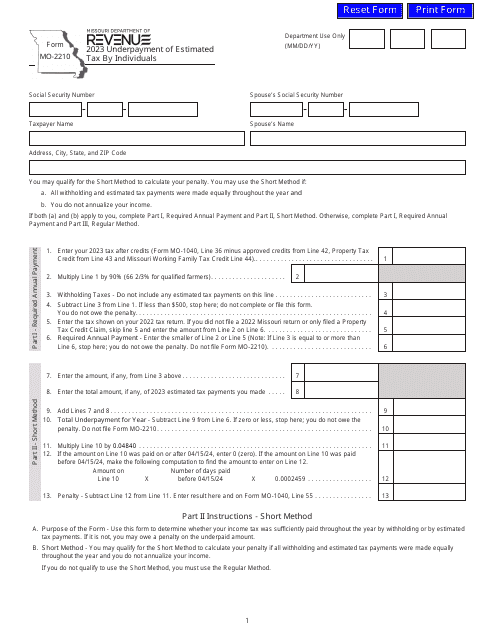

Explore our range of tax due date resources, including instructions for various tax forms and vouchers. Whether you need assistance with the Declaration of Estimated Tax for Individuals in Louisiana or the Underpayment of Estimated Tax by Individuals in North Carolina, we have you covered. We also provide guidance on completing the Transient Accommodations Tax Return in Hawaii or the Payment Voucher in Pennsylvania. Don't forget about the Underpayment of Estimated Tax by Individuals in Missouri – we have instructions for that too.

With our informative documents, you'll have access to the information you need to ensure timely tax compliance. Stay on top of your tax obligations, avoid unnecessary stress, and enjoy peace of mind knowing that you are meeting your tax due dates. Don't miss out on any important deadlines; let our tax due date resources be your go-to guide for timely and accurate tax filings.

Documents:

9

This Form is used for filing your income tax return in the City of Stow, Ohio.

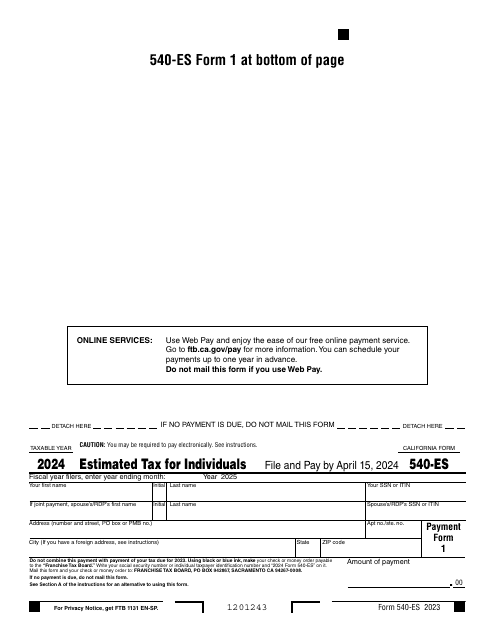

Fill out this form over the course of a year to pay your taxes in the state of California.

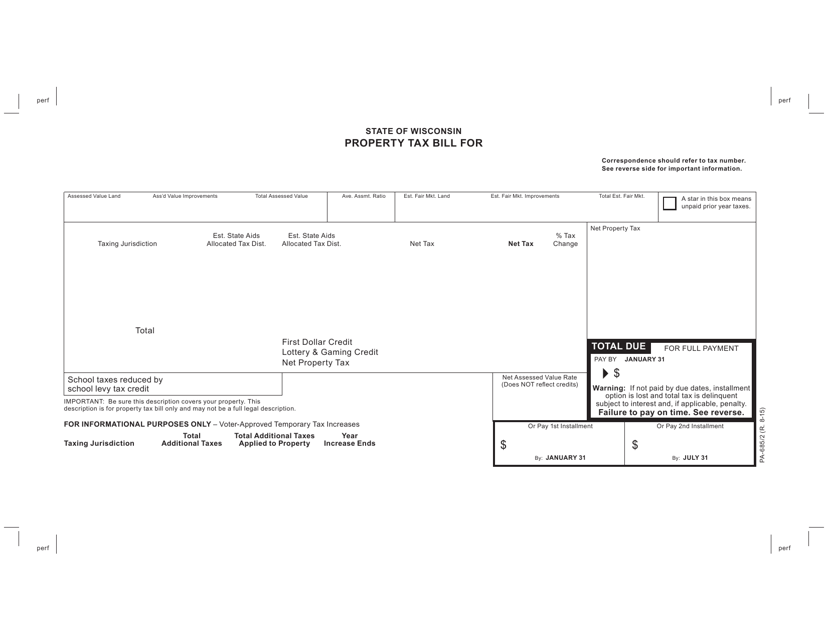

This document is used for paying property taxes in the state of Wisconsin. It provides a detailed bill of the amount owed for the property tax and instructions for payment.

This Form is used for filing the New Mexico Personal Income Tax Return in the state of New Mexico. It provides instructions on how to accurately complete and submit the PIT-1 form for income taxes.