Nol Deduction Templates

Are you looking to learn more about NOL deductions? Look no further! Our comprehensive collection of documents related to NOL deductions provides all the information you need to understand and take advantage of this tax-saving opportunity.

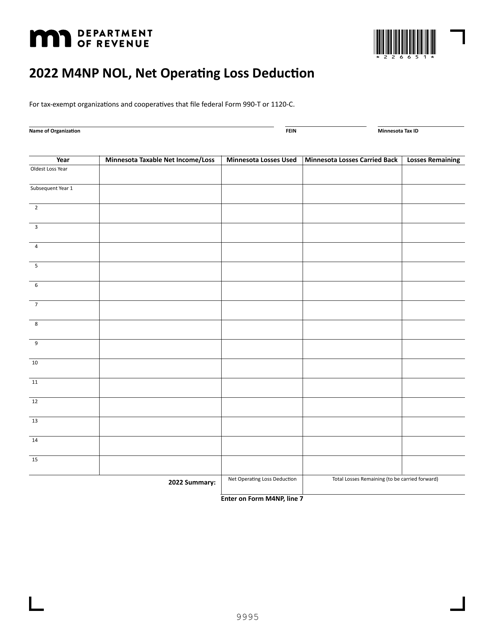

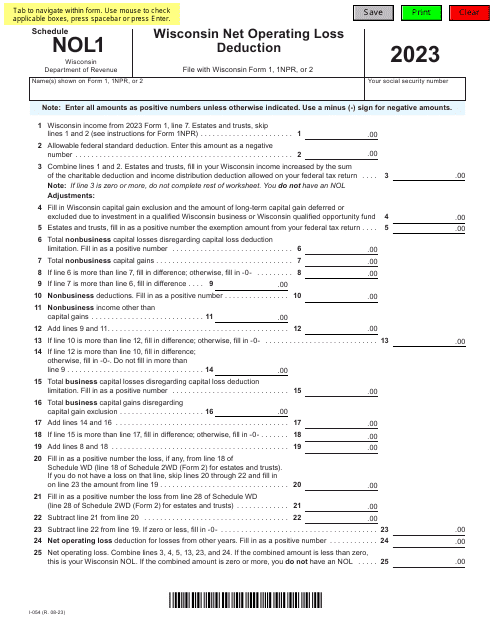

Also known as Net Operating Loss deductions, NOL deductions allow businesses to offset their taxable income by deducting any net operating losses incurred in previous years. This can result in significant tax savings and help businesses recover from financial downturns.

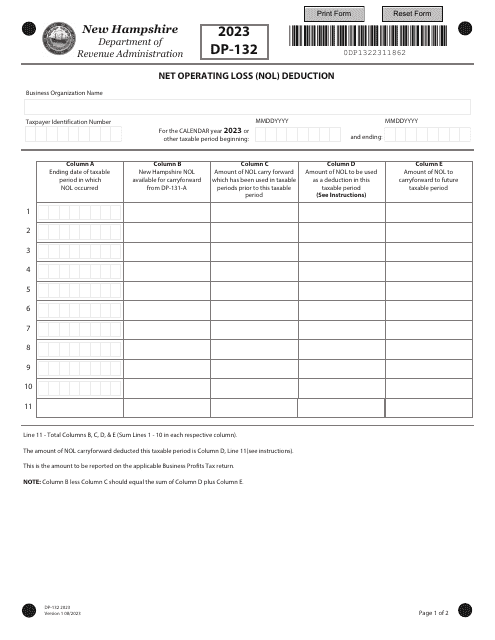

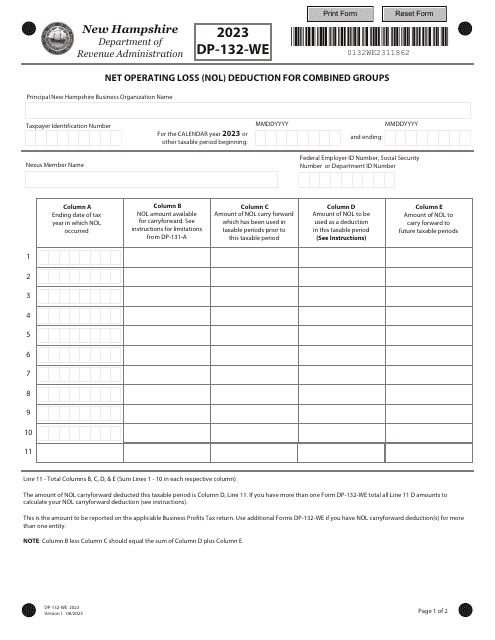

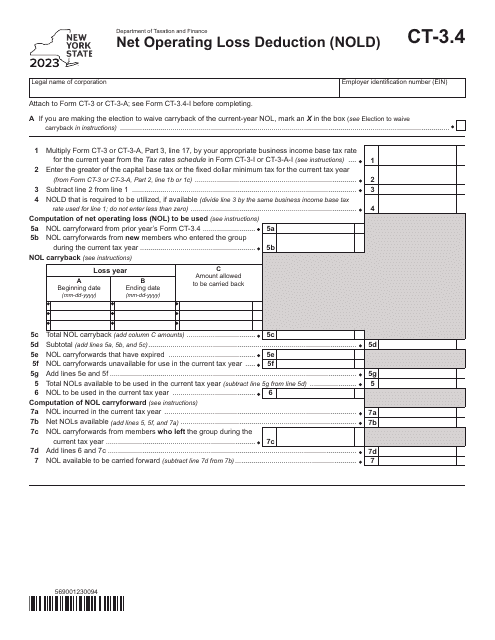

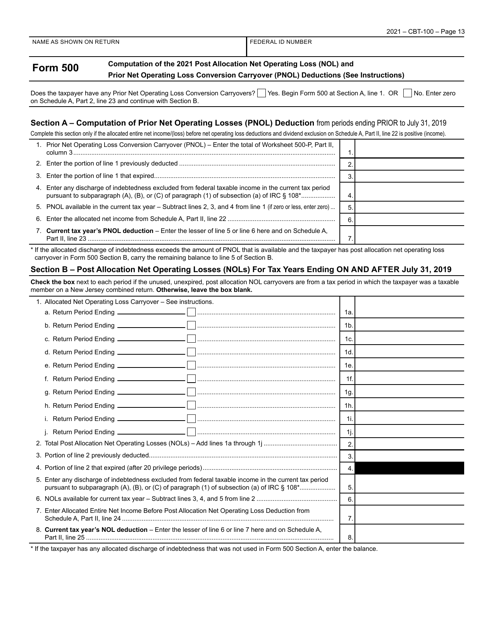

Our collection includes a variety of resources, such as forms and schedules specific to different states, including New Hampshire, New York, and Wisconsin. These documents outline the requirements and procedures for claiming NOL deductions in each state, ensuring you have the right information to navigate the process successfully.

Whether you're a business owner looking for ways to minimize your tax liability or a tax professional assisting clients with their tax planning, our NOL deduction documents can be an invaluable resource. Stay up to date with the latest regulations and ensure you're maximizing your NOL deduction benefits.

Don't miss out on potential tax savings! Explore our collection of NOL deduction documents today and take advantage of this valuable tax planning opportunity.

Documents:

10

This Form is used for claiming a net operating loss deduction in Minnesota.