Corporate Control Templates

Are you looking for information about corporate control and the regulations surrounding it? Look no further! Our comprehensive collection of documents provides all the guidance and instruction you need to navigate the complex landscape of corporate control.

Also known as controlled corporations, this collection of documents covers various aspects of corporate control and capital structure changes. If you are involved in a corporate transaction that triggers changes in control or capital structure, it is crucial to understand the IRS requirements and reporting obligations.

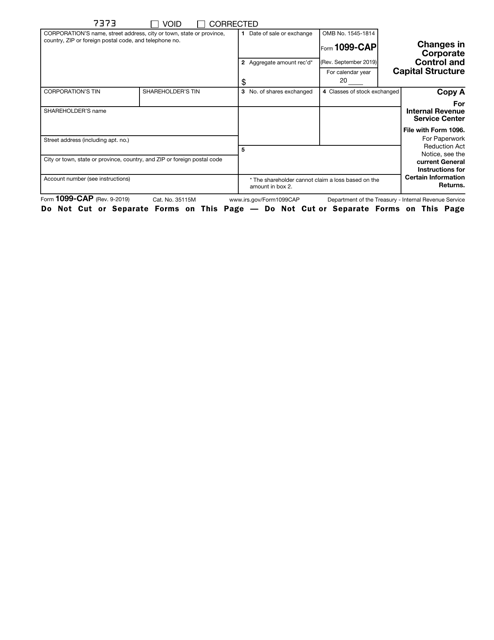

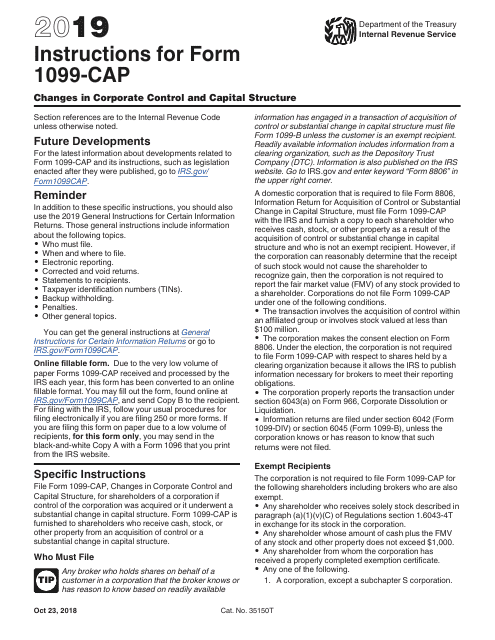

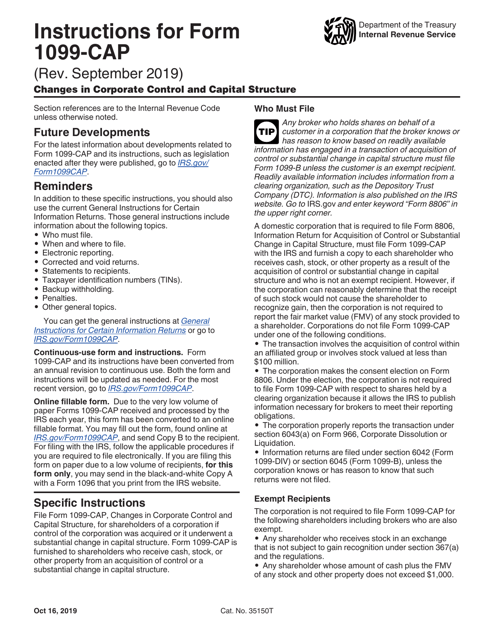

One of the key documents in this collection is the IRS Form 1099-CAP Changes in Corporate Control and Capital Structure. This form must be filed by corporations to report any significant changes in ownership or control. The accompanying instructions for this form provide detailed guidance on how to complete it accurately.

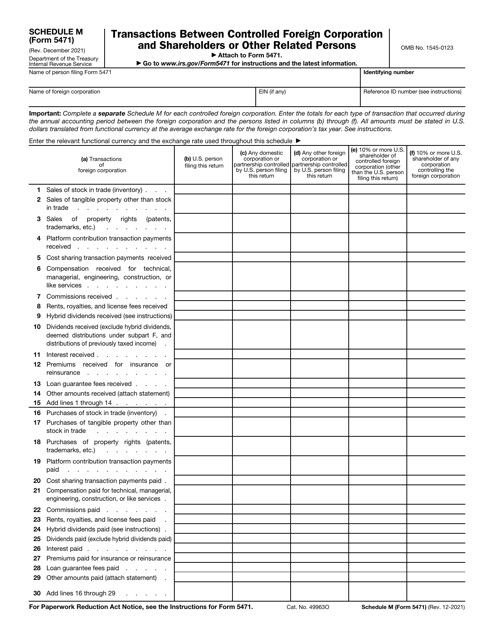

In addition to Form 1099-CAP, we also have IRS Form 5471 Schedule M, which covers transactions between controlled foreign corporations and shareholders or other related persons. This form is essential for corporations with foreign subsidiaries or entities under their control, as it helps to ensure compliance with tax regulations.

We understand that corporate control can be a complex subject, which is why we have compiled a range of documents to simplify the process for you. Whether you are a business owner, an accountant, or a legal professional, our documents are designed to provide clear and concise information to help you navigate the intricate world of corporate control.

Don't let corporate control and capital structure changes be a headache for you. Access our collection of documents today and get the guidance you need to ensure compliance and success in your corporate endeavors.

Documents:

6

This type of document provides instructions for filling out IRS Form 1099-CAP, which is used to report changes in corporate control and capital structure.

This form is used for reporting changes in corporate control and capital structure to the IRS. It is important for businesses to accurately complete this form to comply with tax regulations.

Fill in this document if you are a U.S. citizen that had control of a foreign corporation during the yearly accounting period of a foreign corporation

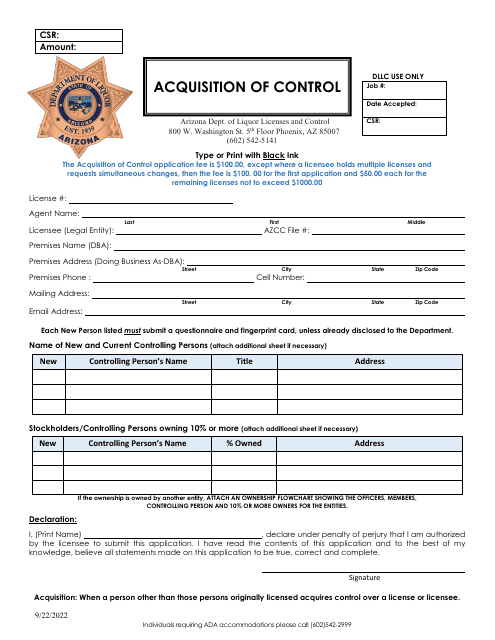

This Form is used for initiating the process of acquiring control over a company or business entity in the state of Arizona.