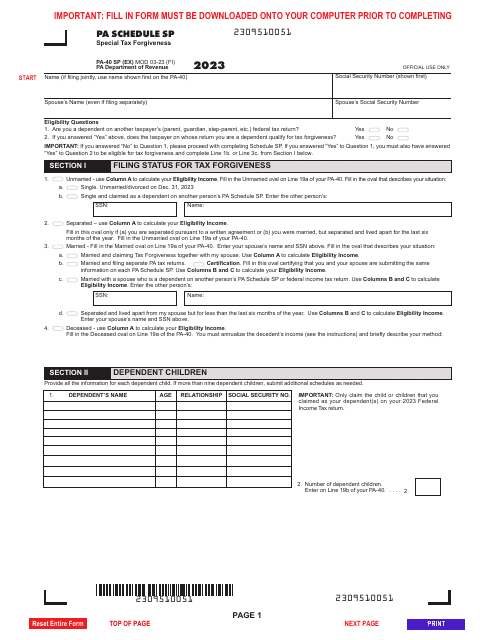

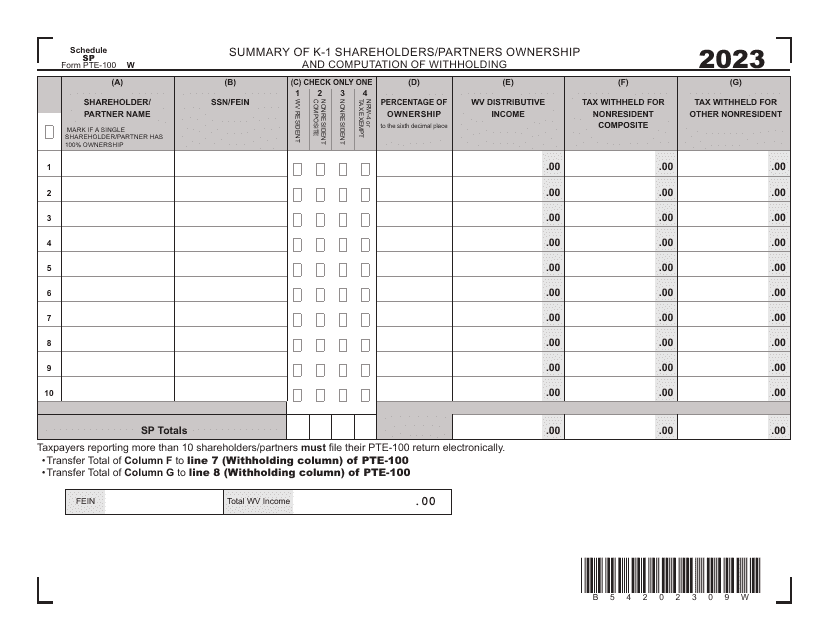

Schedule Sp Templates

The Schedule SP documents, also known as the special tax forgiveness forms, are an essential resource for individuals and businesses in various states, including Pennsylvania and West Virginia. These documents provide valuable information and calculations related to special tax forgiveness, ensuring accurate and compliant tax filings.

Whether you're an individual taxpayer or a business owner with shareholders or partners, the Schedule SP forms offer detailed instructions and a summary of ownership and withholding tax computations. By utilizing these documents, you can effectively navigate the complex tax regulations, ensuring that you don't miss out on any potential tax forgiveness opportunities.

The Schedule SP documents are designed to streamline the tax filing process and provide clarity on specific tax liabilities that may qualify for forgiveness. They are an invaluable tool for understanding eligibility requirements, calculating forgiveness amounts, and ensuring accurate reporting of any special tax credits or exemptions.

By utilizing the Schedule SP documents, you can ensure that you are taking full advantage of the special tax forgiveness programs available in your state. These forms provide a clear and concise framework for reporting and documenting your tax liabilities, ultimately helping you save money and minimize any potential penalties or interest charges.

In summary, the Schedule SP documents, also referred to as special tax forgiveness forms, provide individuals and businesses with a comprehensive resource for accurately reporting and calculating tax liabilities. These forms are an essential tool for maximizing tax forgiveness opportunities and ensuring compliance with state tax regulations.