Business Liabilities Templates

Are you a business owner seeking to understand your legal obligations and potential risks? Look no further - our comprehensive collection of documents on business liabilities is here to help you. Whether you refer to it as "business liabilities" or "business liability," this curated selection of legal documents will provide you with the information you need to safeguard your operations.

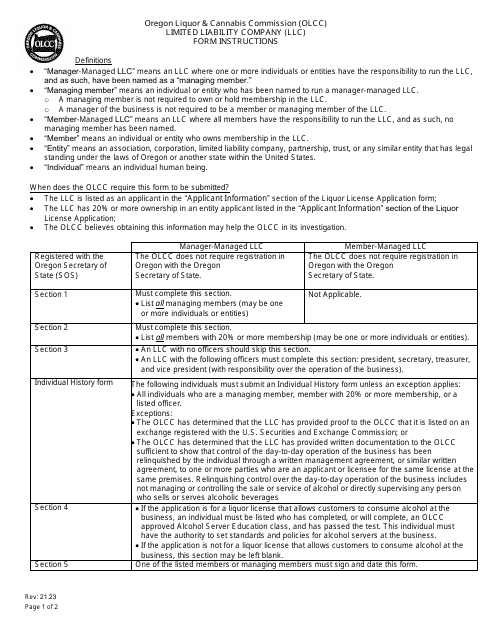

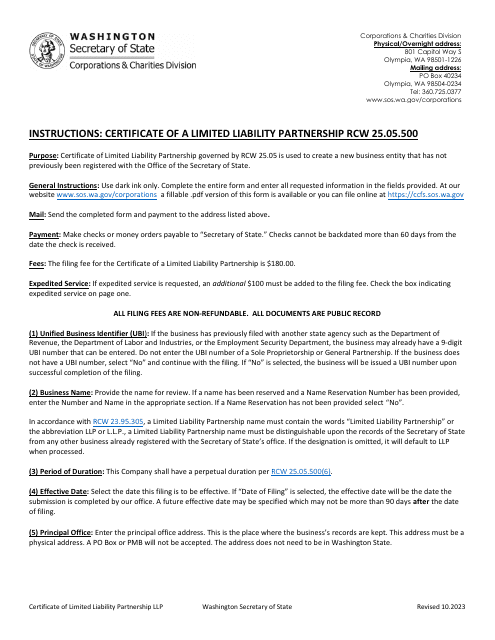

Our collection includes a diverse range of documents specifically tailored for various business structures such as Limited Liability Companies (LLCs), Limited Liability Partnerships (LLPs), and Limited Partnerships. For instance, if you are considering forming an LLC in Oregon, our Limited Liability Company (LLC) Questionnaire - Oregon document will guide you through the necessary requirements and help you establish your company with ease.

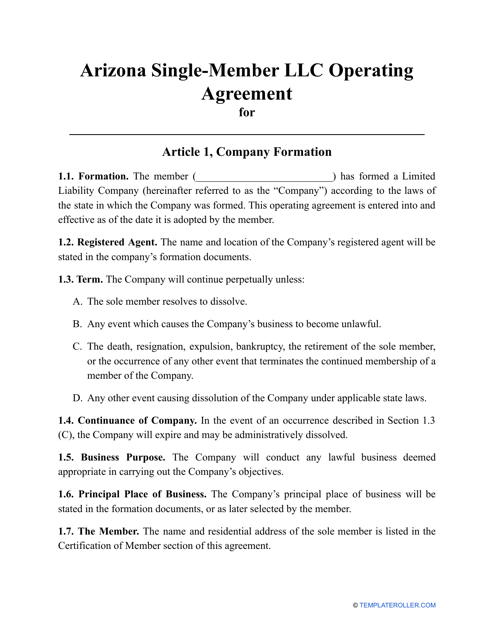

If you are looking to form a partnership and need documentation to protect your interests, our Limited Partnership Questionnaire - Oregon can assist in ensuring that all relevant legal aspects are covered. Similarly, for those operating as a single-member LLC in Arizona, we offer a Single-Member LLC Operating Agreement Template - Arizona to help you formalize the structure of your business.

Furthermore, if you find yourself in a situation where you need to negotiate with the IRS or resolve tax issues, our IRS Form 433-B (OIC) Collection Information Statement for Businesses document is an invaluable resource. It will guide you through the process and ensure that you provide the necessary information to reach a satisfactory resolution.

We understand that navigating business liabilities can be a daunting task, but our collection of documents aims to simplify the process. With our carefully curated selection of legal resources, you can gain peace of mind, knowing that you are taking the necessary steps to protect yourself and your business. Don't let liabilities hinder your success - explore our collection today.

Documents:

6

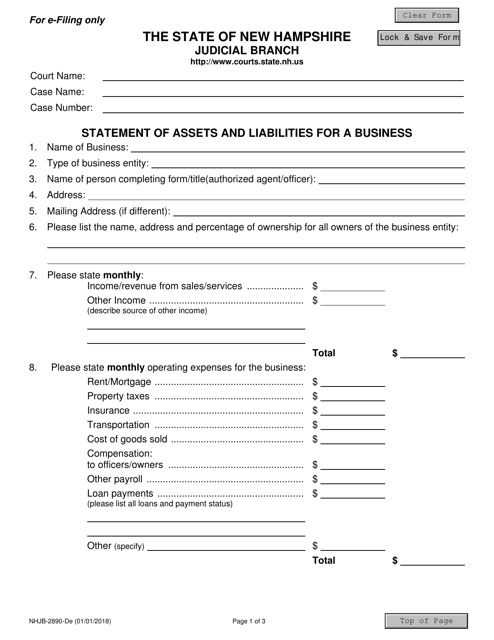

This document is used for disclosing the assets and liabilities of a business located in New Hampshire.

This is a formal IRS document that outlines the financial health of a business entity that owes a tax debt to the government.

This agreement is used in Arizona and should clearly lay out all of the information regarding the structure of a business and the daily business operations that occur.