Oklahoma Tax Forms and Templates

Documents:

321

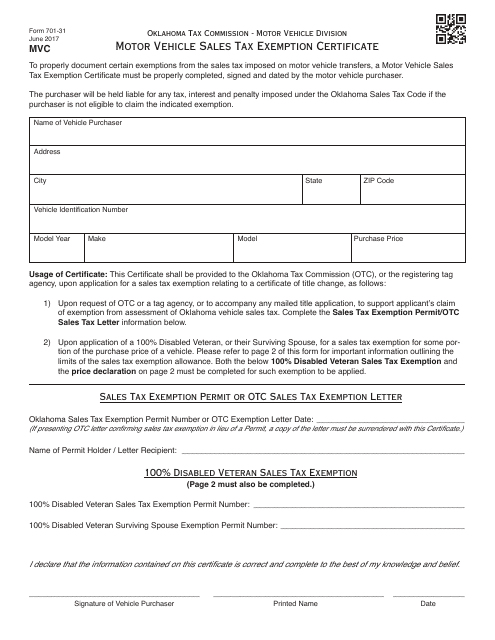

This document is used for claiming a sales tax exemption on motor vehicle purchases in Oklahoma. It is an OTC Form 701-31.

This form is used for registering businesses that manufacture products in Oklahoma. It is part of the OTC Form M Oklahoma Business Registration Packet.

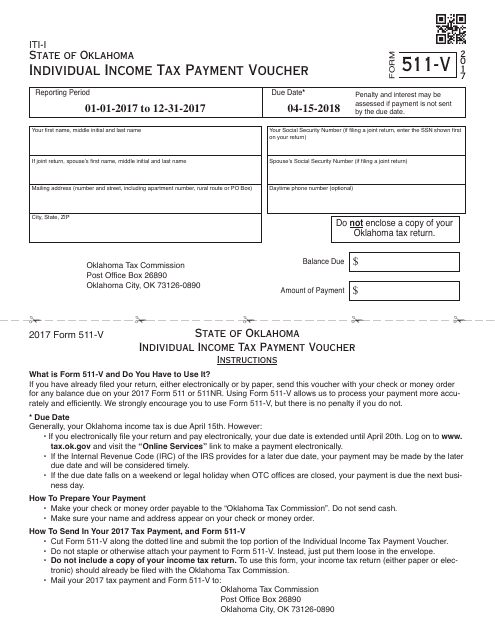

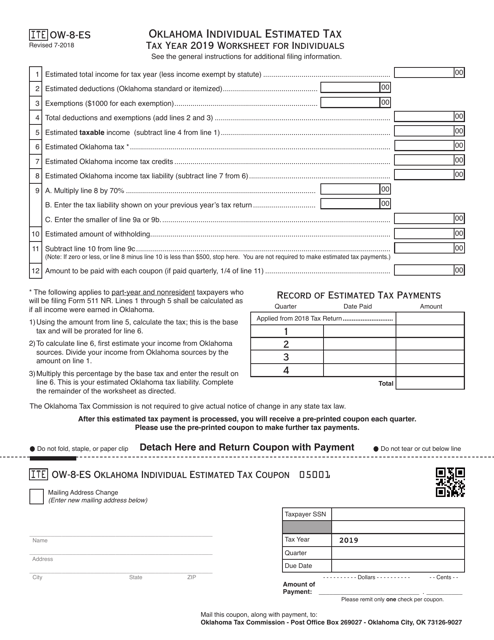

This form is used for making individual income tax payments in the state of Oklahoma. It is used by residents to submit their tax payments to the Oklahoma Tax Commission.

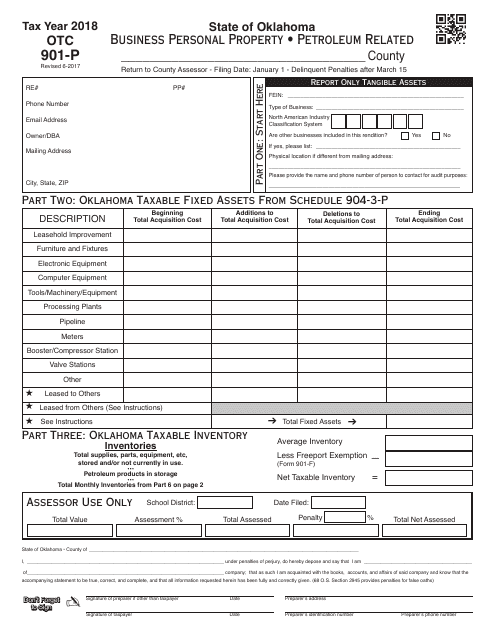

This Form is used for reporting business personal property related to petroleum in the state of Oklahoma.

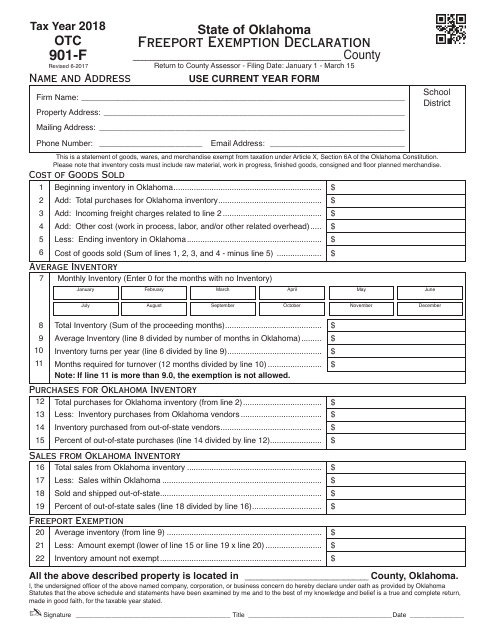

This document is used for declaring a Freeport exemption in the state of Oklahoma.

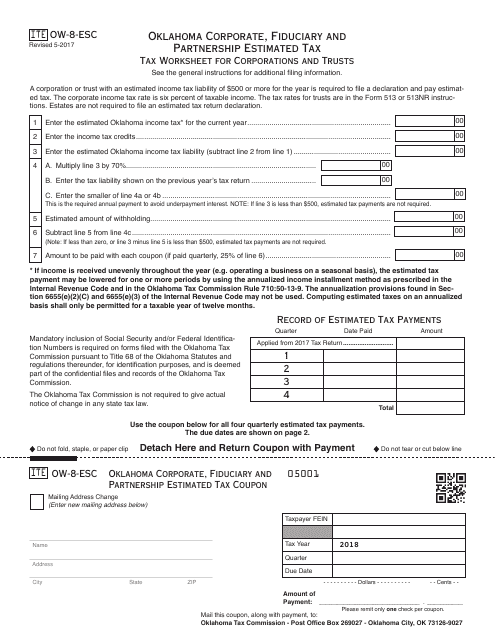

This form is used for corporations and trusts in Oklahoma to declare their estimated tax payments.

This document provides the necessary forms and instructions for filing partnership income taxes in the state of Oklahoma.

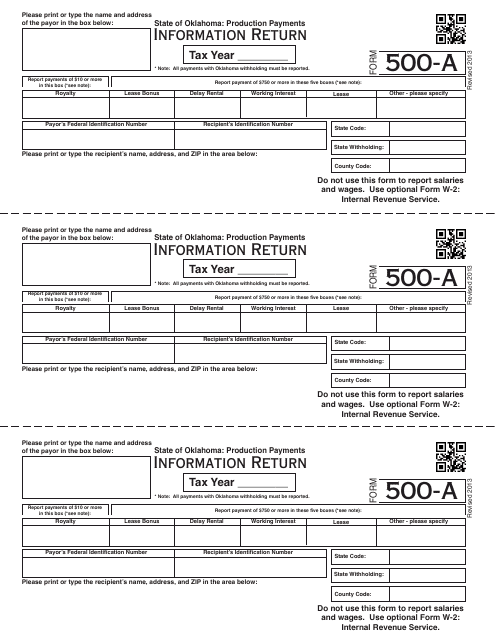

This Form is used for reporting production payments in Oklahoma.

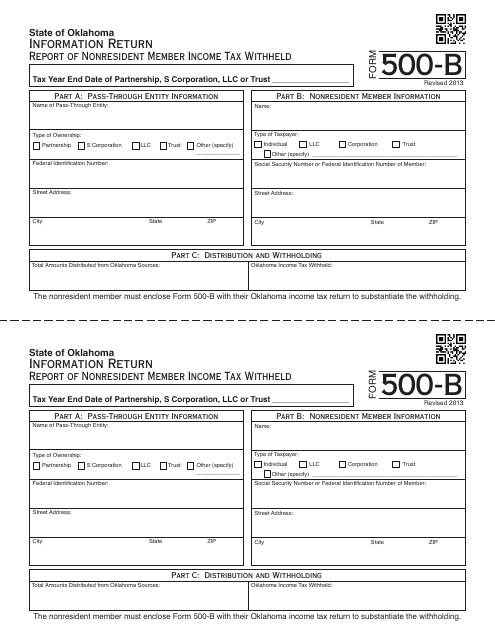

This form is used to report and withhold income tax for nonresident members in Oklahoma.

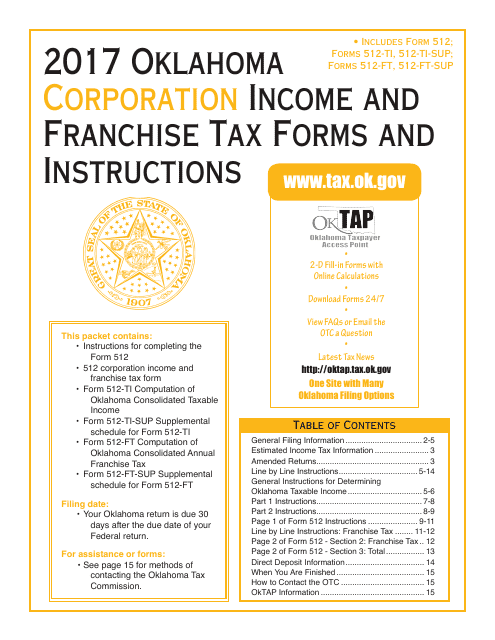

This document provides the necessary forms and instructions for filing corporation income and franchise taxes in the state of Oklahoma.

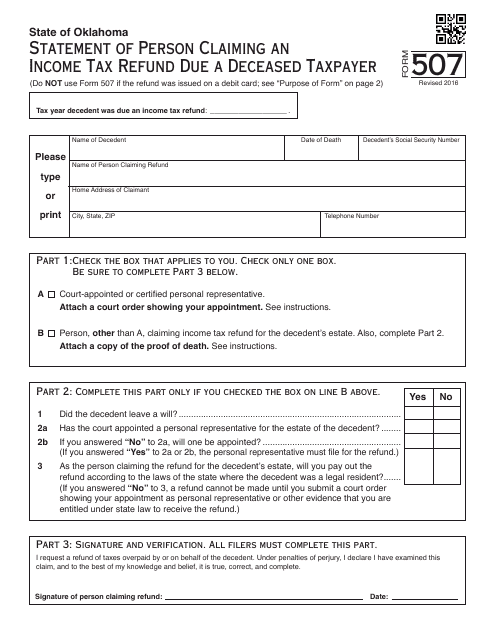

This form is used for claiming a refund on behalf of a deceased taxpayer in the state of Oklahoma.

This type of document is used for applying to settle tax liability in the state of Oklahoma.

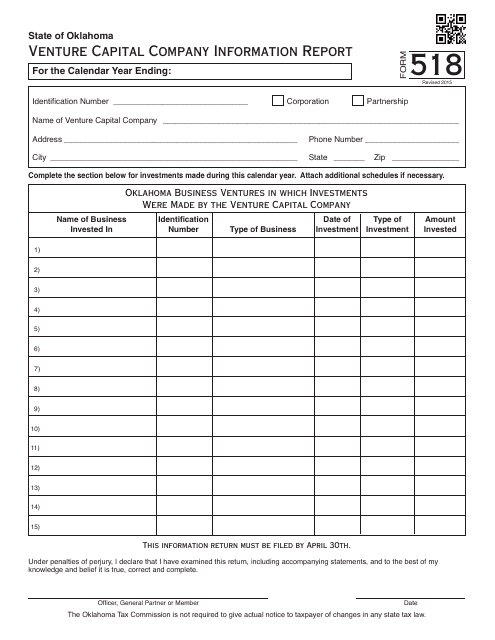

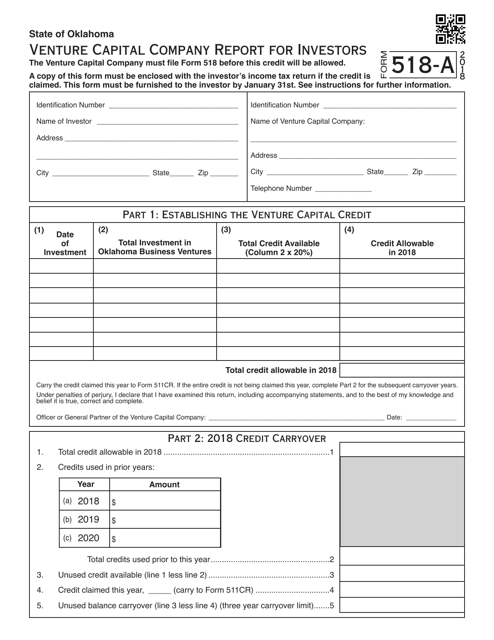

This document is used for reporting information about venture capital companies in Oklahoma.

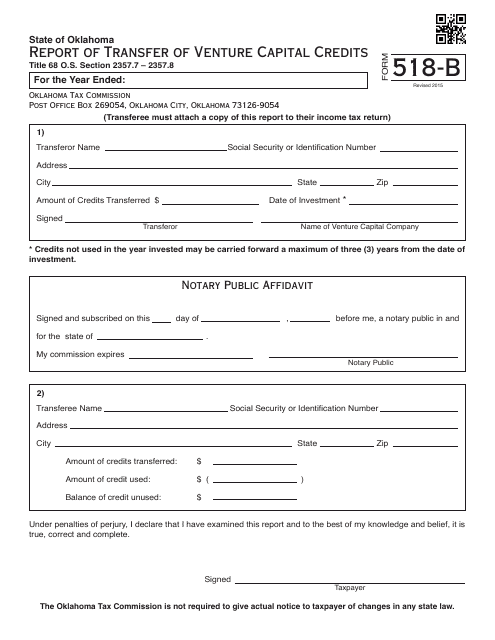

This Form is used for reporting the transfer of venture capital credits in Oklahoma.

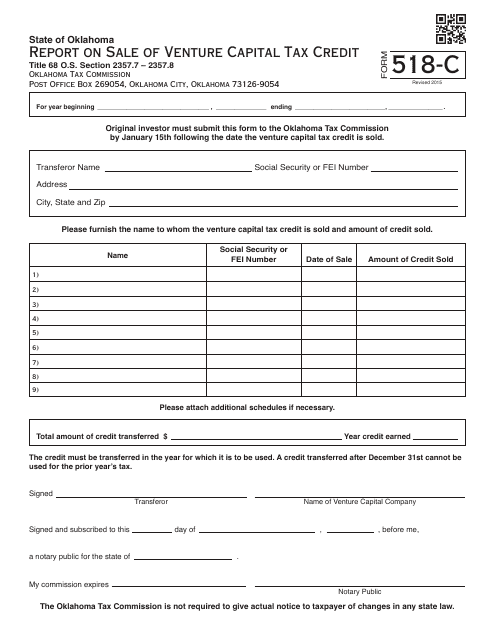

This form is used for reporting the sale of Venture Capital Tax Credit in Oklahoma.

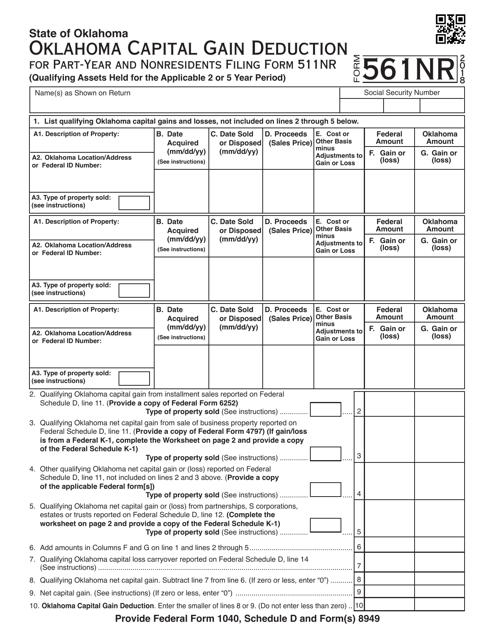

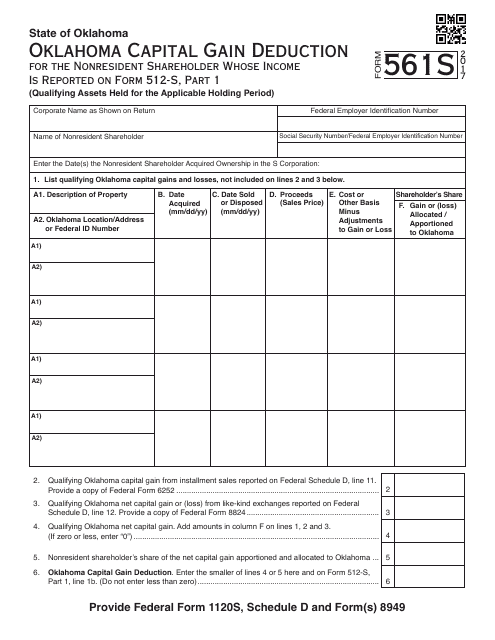

This OTC Form 561S is used for capital gain deduction for nonresident shareholders whose income is reported on Form 512-s, Part 1 in the state of Oklahoma.