International Transaction Templates

Are you involved in international business transactions? Do you need to stay up-to-date with the latest regulations and requirements? Our International Transaction documents collection is the ultimate resource for individuals and businesses engaged in cross-border transactions.

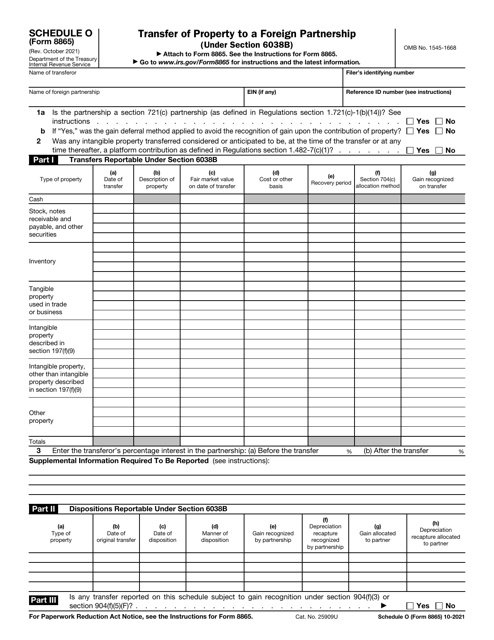

Also known as international transactions, this comprehensive collection of documents covers a wide range of topics and requirements from various countries. Whether you're dealing with payments to non-residents, foreign trusts, or partnerships with international partners, our collection has you covered.

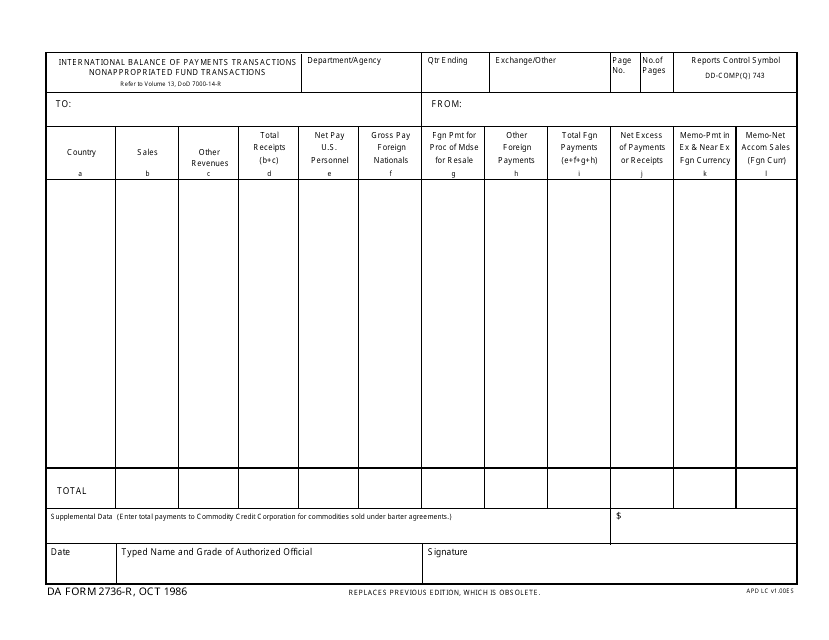

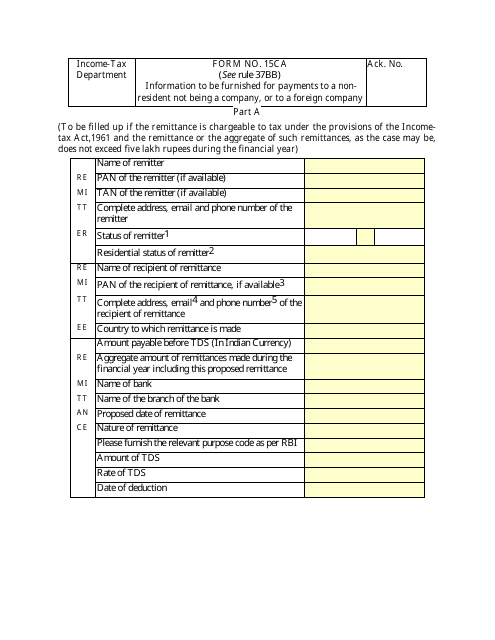

For example, our documents include forms such as DA Form 2736-R International Balance of Payments Transactions, which provides a systematic report on international transactions related to nonappropriated funds. If you're conducting transactions in India, you'll find the Form 15CA, which contains vital information to be furnished for payments to non-residents or foreign companies.

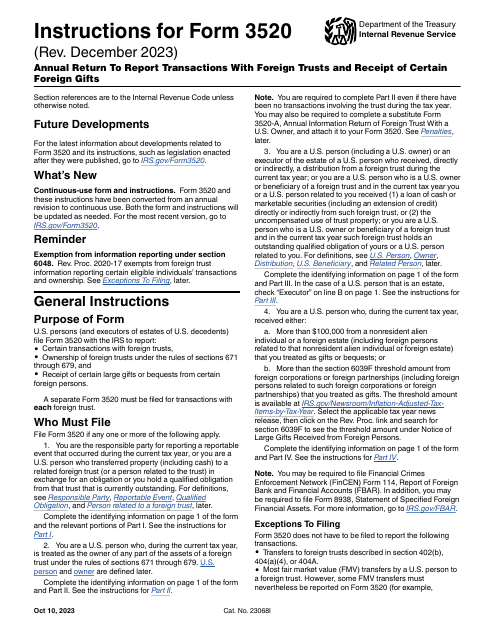

If you're dealing with foreign trusts or receiving foreign gifts, our collection includes instructions for IRS Form 3520 Annual Return to Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts. This invaluable resource will help you navigate the complex reporting requirements and ensure compliance.

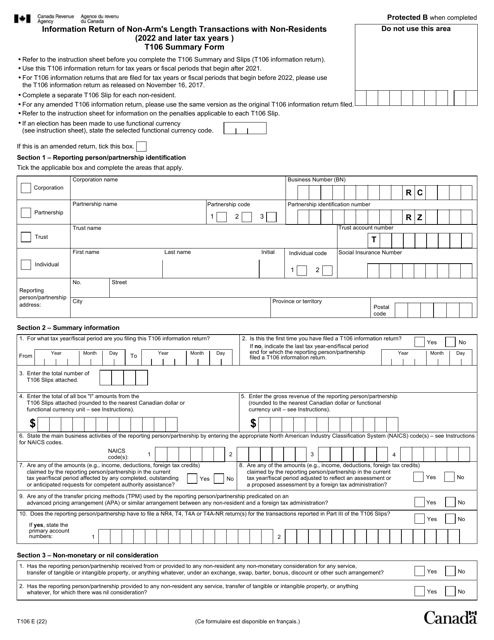

For our Canadian users, we have the Form T106 Information Return of Non-arm's Length Transactions With Non-residents. This form is essential for reporting non-arm's length transactions with international partners and is a key component of Canadian tax compliance.

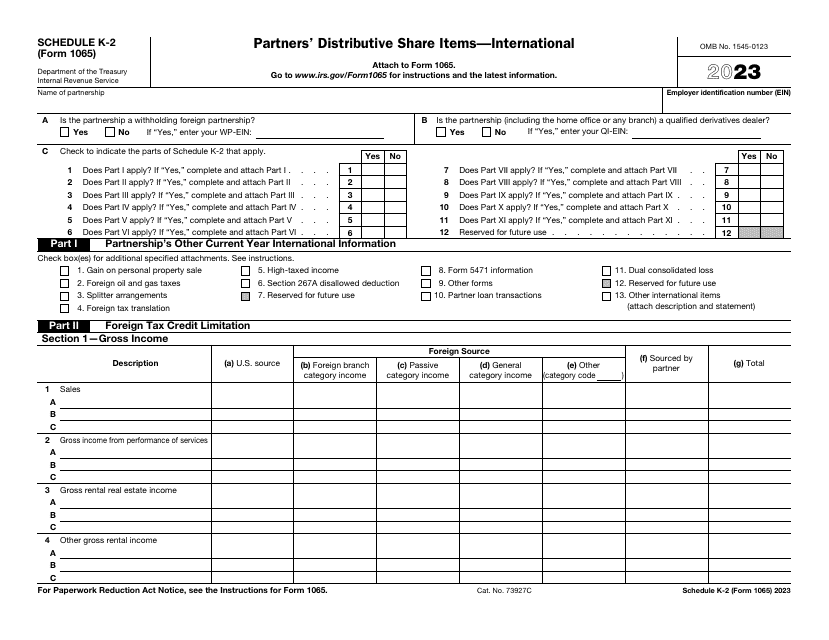

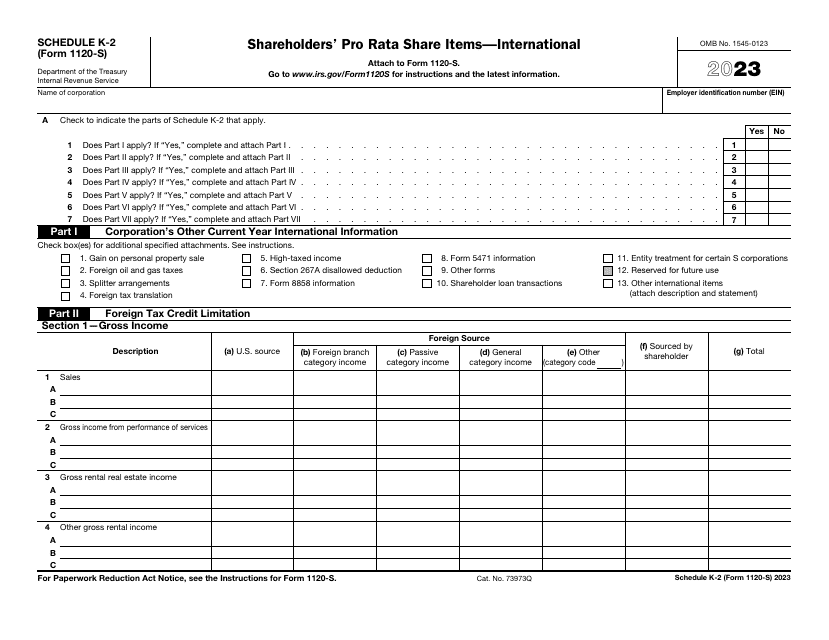

Partnership distributions and items related to international transactions are also covered in our collection. By using IRS Form 1065 Schedule K-2, you can report partners' distributive share items accurately, facilitating smooth communication and ensuring compliance.

Stay ahead of the game and make international transactions a breeze with our International Transaction documents collection. It's your one-stop-shop for all the information you need to navigate the complexities of global business.

Documents:

10

This form is used for providing information about payments made to non-residents or foreign companies in India. It is necessary for tax purposes and ensuring compliance with Indian regulations.

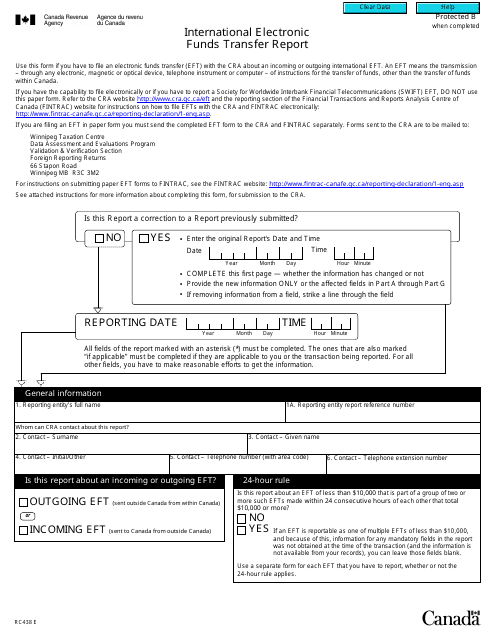

This form is used for reporting international electronic funds transfers in Canada.

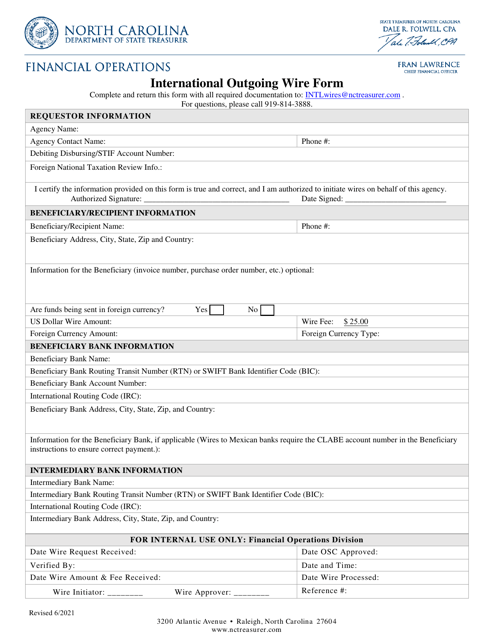

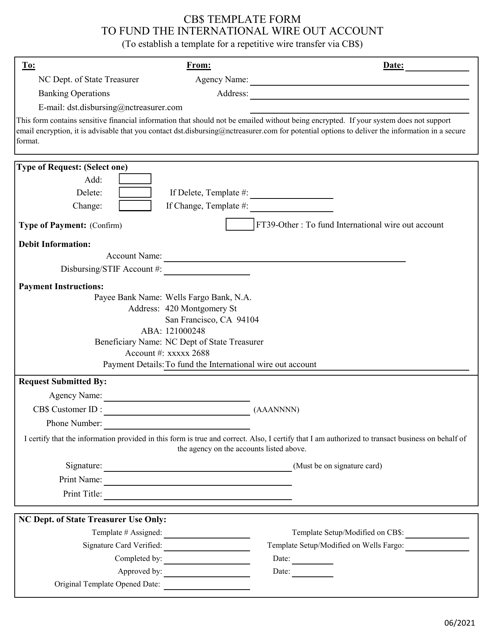

This document template can be used for international wire transfers in North Carolina. It provides a standardized format for supplying the necessary information for an international wire transfer.