Transient Accommodations Tax Templates

The Transient Accommodations Tax, also known as TAT, is a tax imposed on short-term rentals and accommodations in various locations. This tax applies to a wide range of accommodations, including hotels, motels, vacation rentals, and bed and breakfast establishments.

The Transient Accommodations Tax is an important source of revenue for the state or region where it is implemented. It helps fund various initiatives and services that benefit both tourists and residents. This tax is collected by the relevant authorities and is typically reported and paid on a regular basis.

If you own or operate a transient accommodation business, it is crucial to understand the rules and regulations surrounding the Transient Accommodations Tax. Compliance with these tax requirements is essential to avoid penalties and maintain a good standing with the tax authorities.

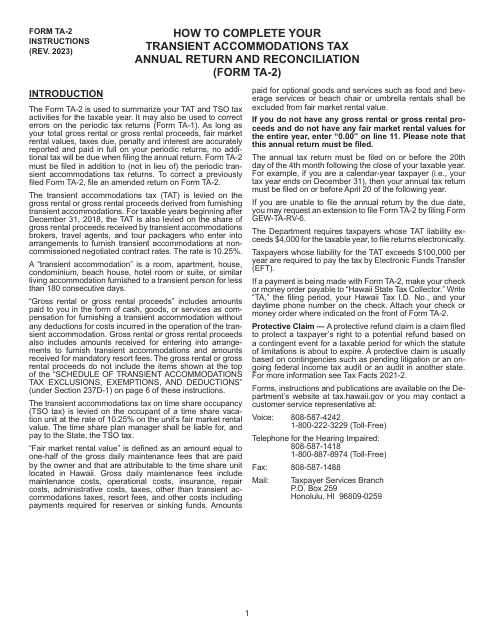

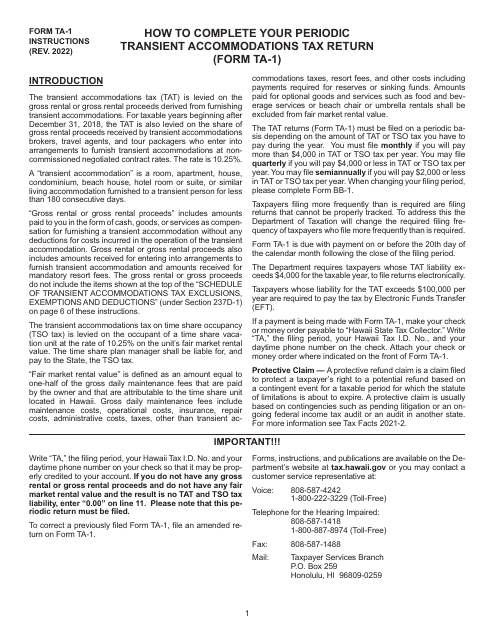

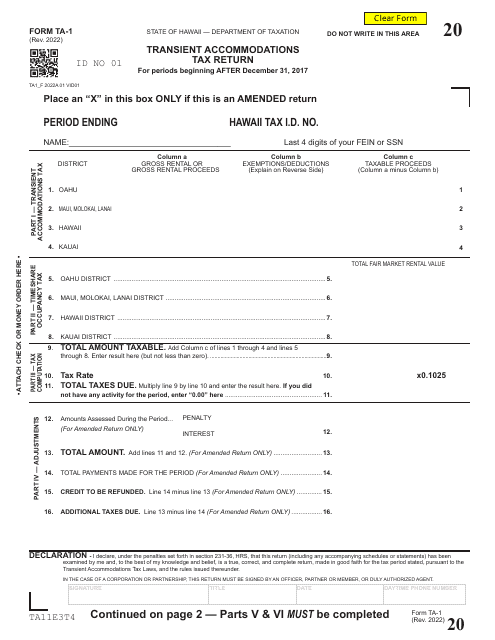

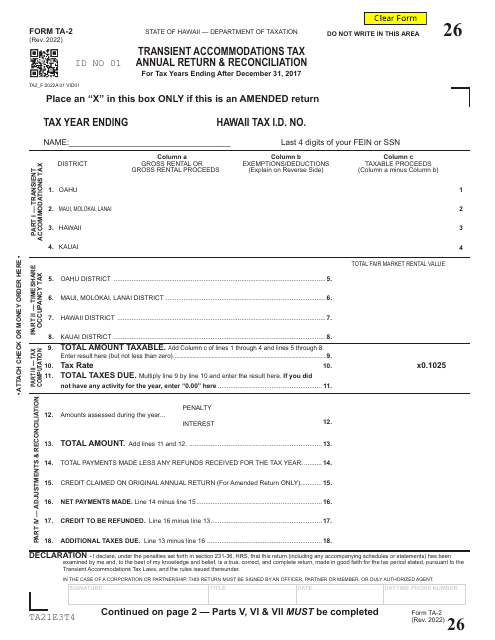

To assist taxpayers in meeting their obligations, various documents and forms are available. These include the Instructions for Form TA-1 Transient Accommodations Tax Return, Instructions for Form TA-2 Transient Accommodations Tax Annual Return and Reconciliation, Form TA-1 Transient Accommodations Tax Return for Periods Beginning After December 31, 2017, and Form TA-2 Transient Accommodations Tax Annual Return & Reconciliation for Tax Years Ending After December 31, 2017.

These documents provide detailed guidance on how to file the tax returns, report the required information, and calculate the appropriate tax amount. By following the instructions provided, taxpayers can ensure accuracy and compliance with the Transient Accommodations Tax regulations.

Whether you are a business owner or a tax professional, accessing these documents is crucial in navigating the complexities of the Transient Accommodations Tax. Stay informed and up-to-date with the latest guidelines to fulfill your tax obligations effectively and efficiently.

Note: No given alternate names provided.