Tax Forgiveness Templates

Are you struggling with your taxes and looking for a way to find relief? Look no further than our tax forgiveness program. Whether you refer to it as tax forgiveness or tax forgiveness form, this program is designed to provide individuals and businesses with the opportunity to settle their tax burdens and start fresh.

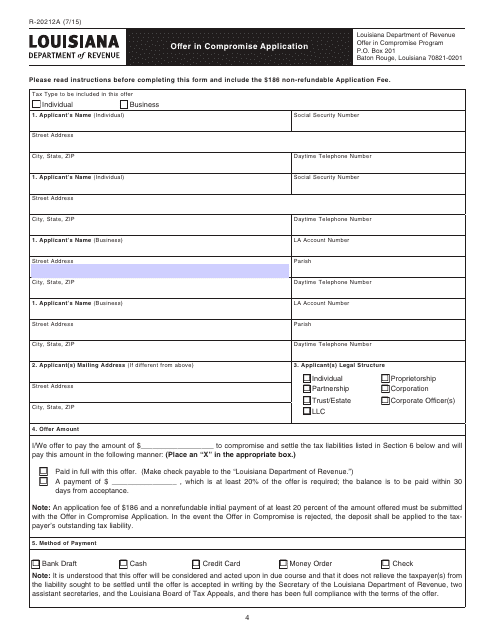

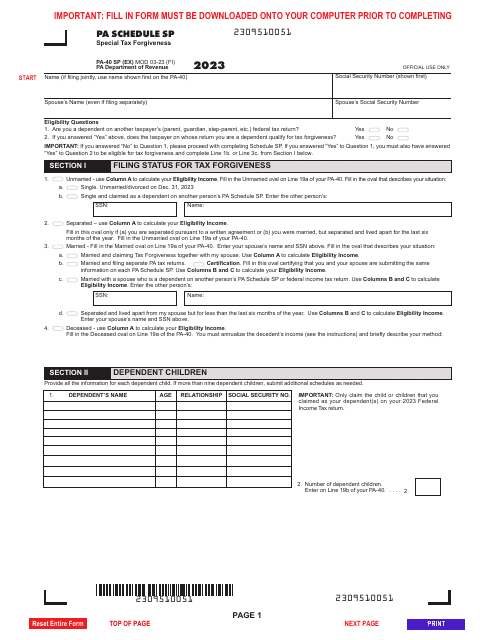

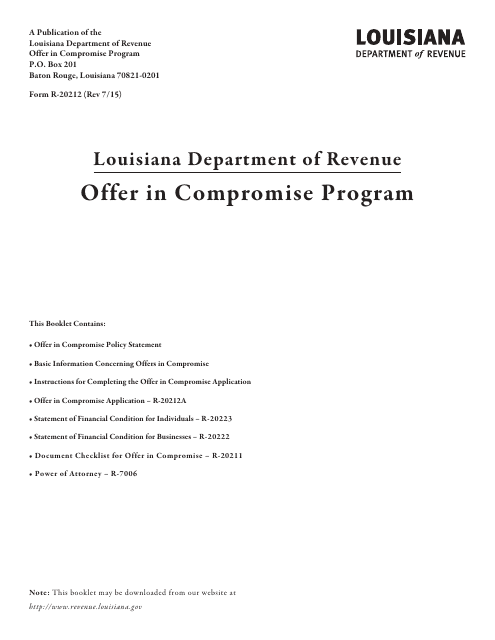

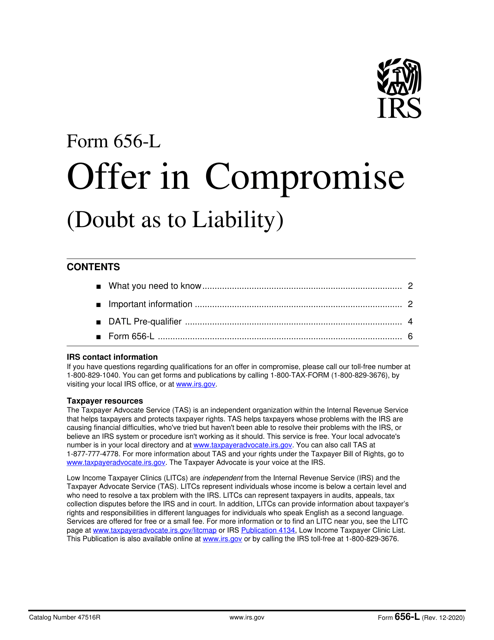

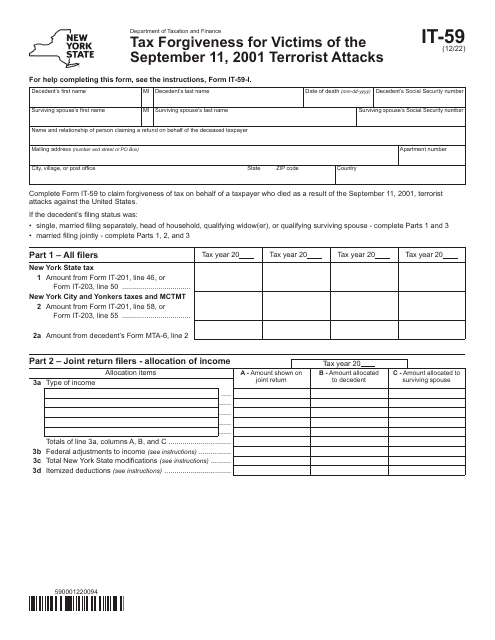

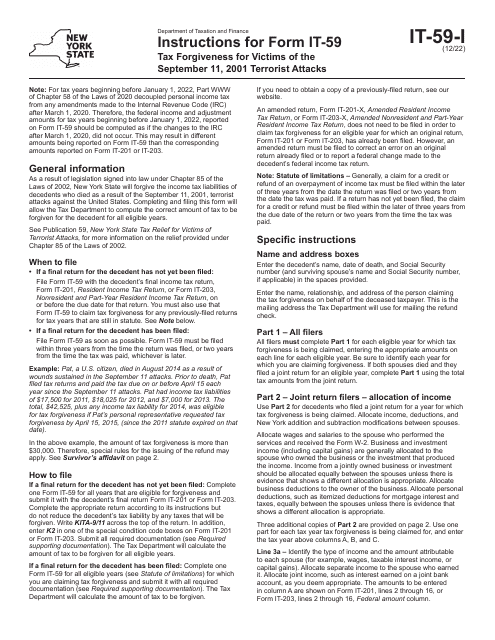

Our tax forgiveness program offers various options to eligible taxpayers, including the Form R-20212A Offer in Compromise Application in Louisiana, the IRS Form 656-L Offer in Compromise (Doubt as to Liability), the Form A-213 Offer in Compromise for Business in Wisconsin, and the Form PA-40 Schedule SP Special Tax Forgiveness in Pennsylvania, among others. These documents are all part of our extensive collection of tax forgiveness resources.

By taking advantage of our tax forgiveness program, you can potentially reduce the amount you owe, resolve any disputes, and find a path towards financial stability. Whether you are an individual or a business owner, our tax forgiveness options can help alleviate the stress and burden of outstanding tax debts.

Don't let tax issues hold you back any longer. Explore our tax forgiveness program today and discover the relief you deserve. It's time to take control of your finances and move forward with confidence.

Documents:

29

This Form is used for filing an Offer in Compromise Application in the state of Louisiana.

This form is used for the Offer in Compromise Program in the state of Louisiana. It allows taxpayers to settle their tax debts with the state for a reduced amount.

This form is used for submitting an offer-in-compromise to the Arizona Department of Revenue. It allows taxpayers to propose a settlement for their outstanding tax liabilities with the state of Arizona.

This form is used for submitting an offer in compromise application to the California Department of Tax and Fee Administration.

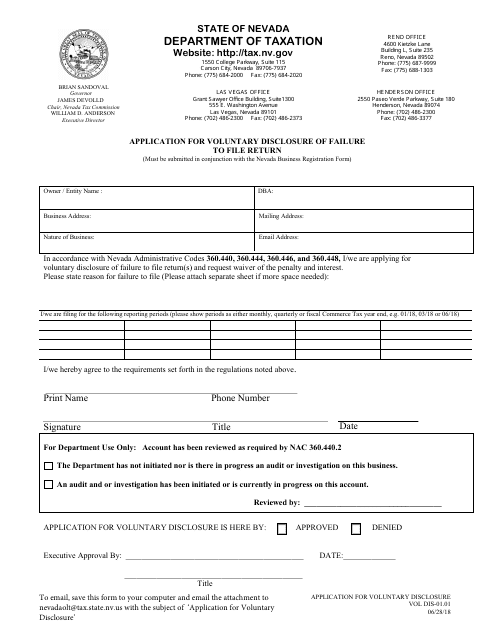

This form is used for individuals or businesses in Nevada who have failed to file a tax return and want to voluntarily disclose their mistake to the state. By filling out this application, you can avoid penalties and potential legal consequences.

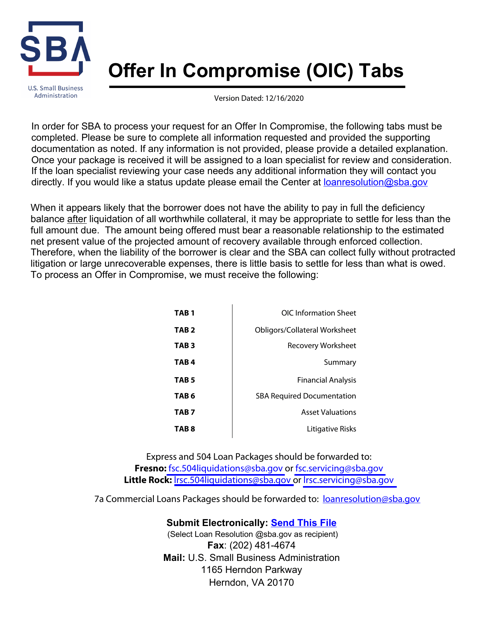

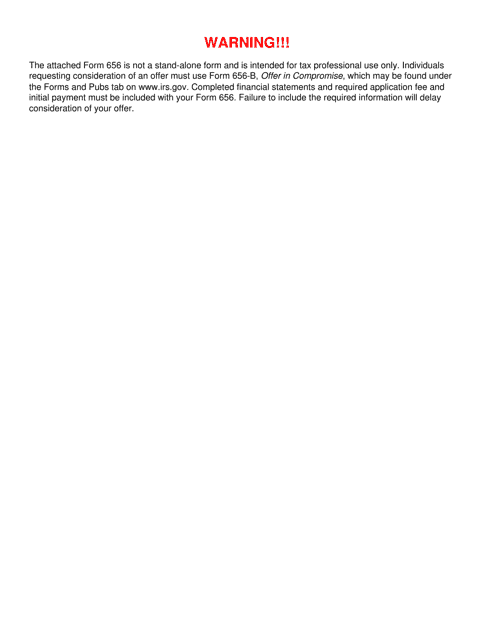

This is a formal document prepared and filed by a taxpayer to clarify the terms of the agreement they wish to enter to settle their tax debt.

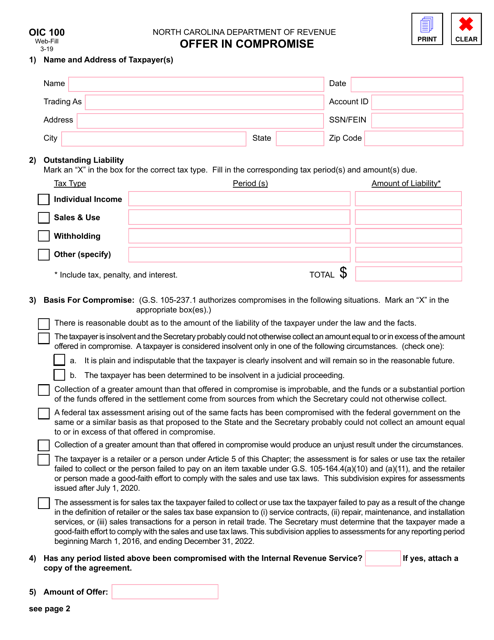

This document is used for submitting an Offer in Compromise to the state of North Carolina. It is a request to settle a tax liability for less than the full amount owed.

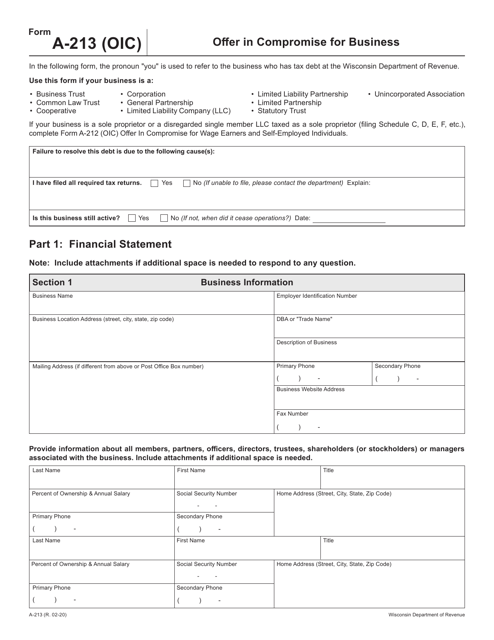

This form is used for making an offer in compromise for a business located in Wisconsin.

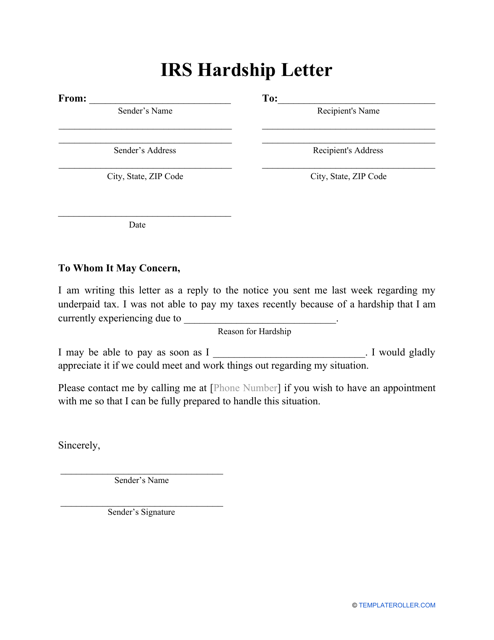

Complete this template and send it to the Internal Revenue Service (IRS) in order to describe a difficult financial situation you're experiencing, ask the IRS for leniency, or request a new payment deadline.

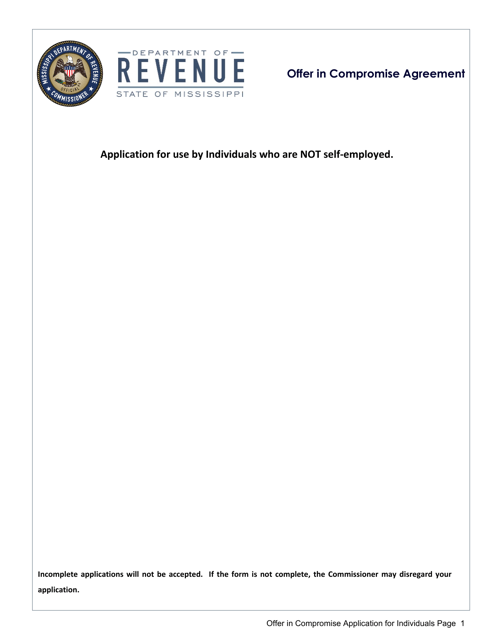

This Form is used for individuals in Mississippi to apply for an Offer in Compromise, which is a potential solution for taxpayers who are unable to pay their tax debt in full.

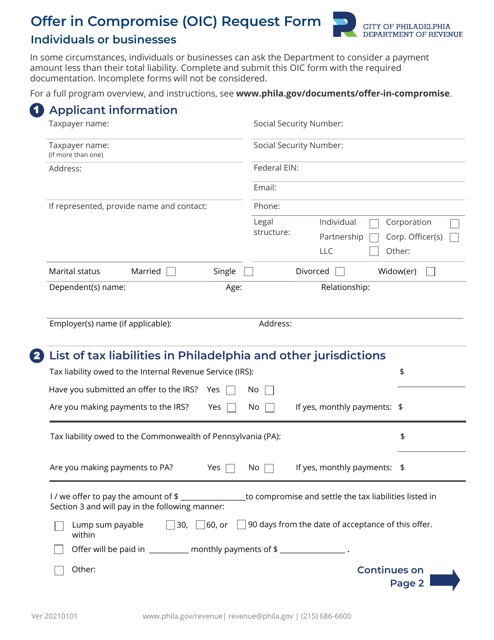

This form is used for requesting an Offer in Compromise (OIC) from the City of Philadelphia, Pennsylvania. An OIC is a way for taxpayers to settle their tax debt for less than the full amount owed.

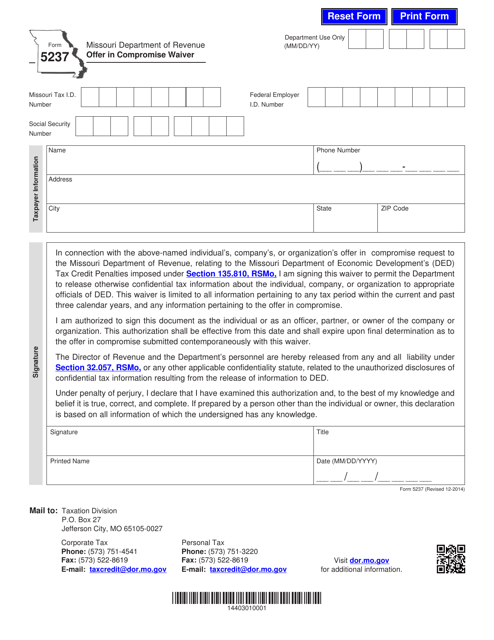

This form is used for applying for an offer in compromise waiver in the state of Missouri.