Ginnie Mae Templates

Ginnie Mae, also known as the Government National Mortgage Association, is a government-owned corporation that plays an essential role in the mortgage market. Ginnie Mae provides assistance to lenders by guaranteeing mortgage-backed securities (MBS) that are backed by federally insured or guaranteed loans. These MBS are then sold to investors, ensuring a steady flow of capital into the mortgage market.

By guaranteeing the timely payment of principal and interest on the MBS, Ginnie Mae provides stability and liquidity to the housing market. This allows lenders to offer competitive interest rates to homebuyers and ensures that the mortgage market remains accessible to borrowers across the country.

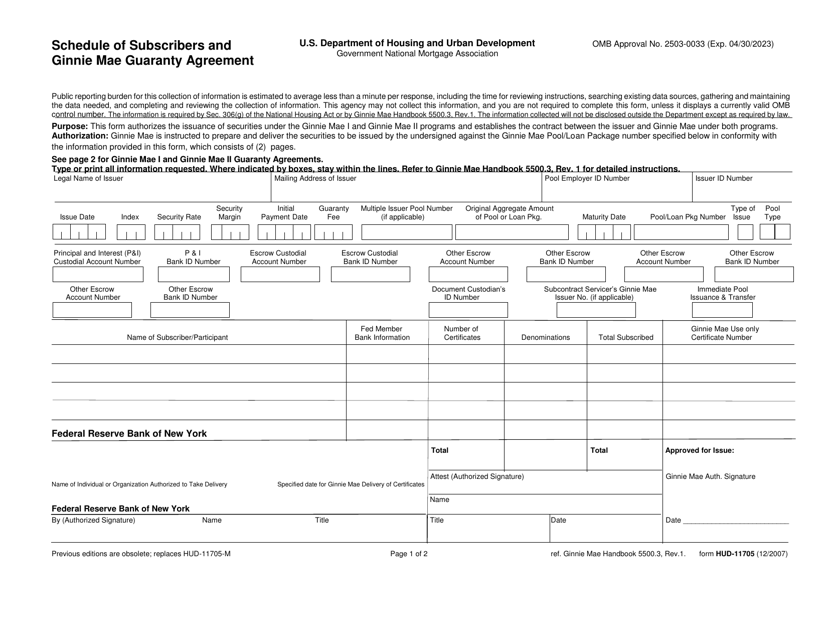

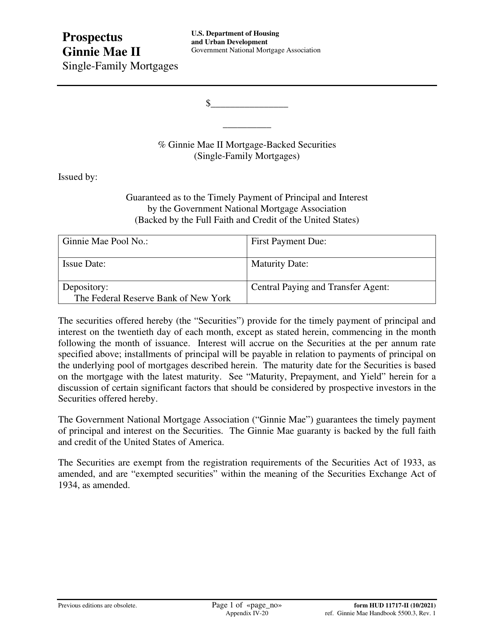

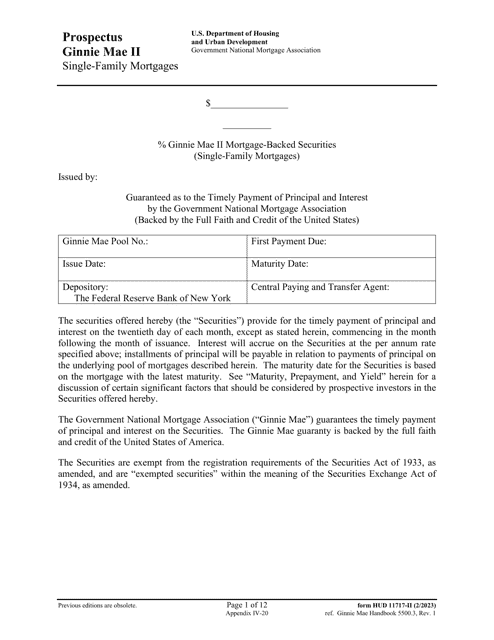

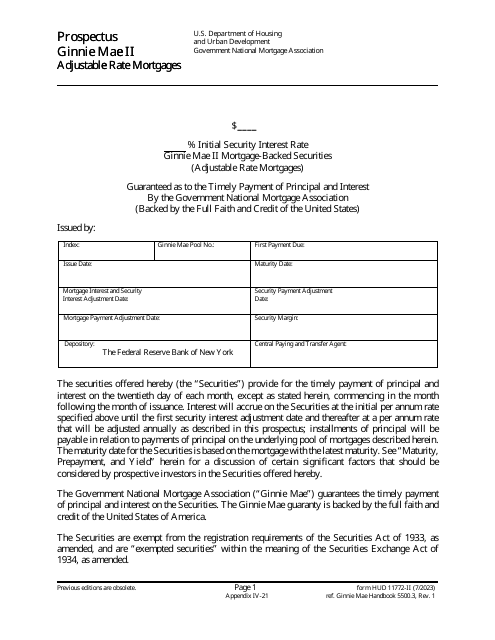

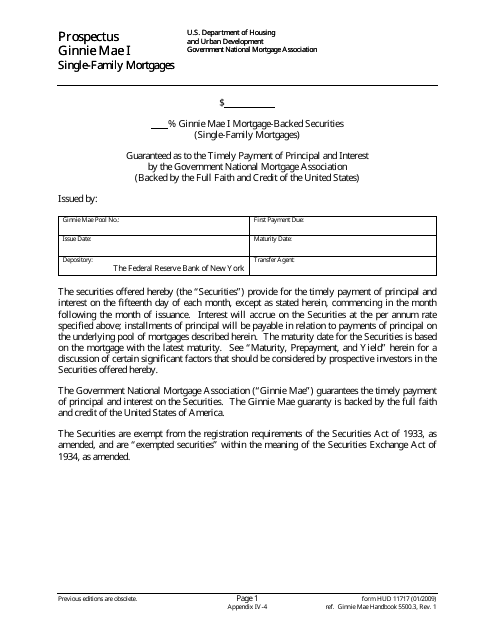

Ginnie Mae offers a range of documents and forms that are crucial for lenders and investors participating in the mortgage market. These documents include the Schedule of Subscribers and Ginnie Mae Guaranty Agreement, which outlines the responsibilities and requirements for lenders participating in the Ginnie Mae program. Additionally, the Prospectus Ginnie Mae II - Single-Family Mortgages provides detailed information about the mortgage-backed securities offered by Ginnie Mae.

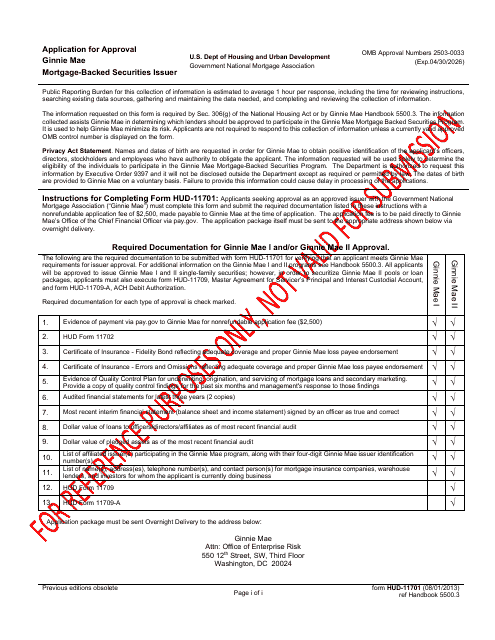

Whether you are a lender seeking approval to participate in the FHA or Ginnie Mae programs, or an investor looking for opportunities in the mortgage market, Ginnie Mae's documents are essential for navigating the mortgage-backed securities industry. These documents ensure compliance with regulations, provide transparency to market participants, and contribute to the overall stability of the housing finance system.

With Ginnie Mae's commitment to facilitating access to affordable mortgage financing and promoting homeownership, these documents serve as vital resources for industry professionals. Explore Ginnie Mae's collection of documents to gain a comprehensive understanding of their programs and initiatives.

Documents:

6

This form is used for the prospectus of Ginnie Mae II - Single-Family Mortgages.

This document provides the appendix IV-20 prospectus for Ginnie Mae II single-family mortgages.

This document is used for applying to become an approved lender for the Federal Housing Administration (FHA) and/or Ginnie Mae.