Foreign Earned Income Templates

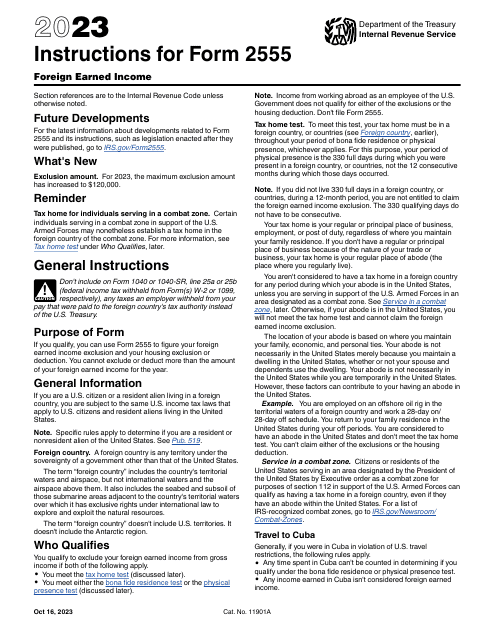

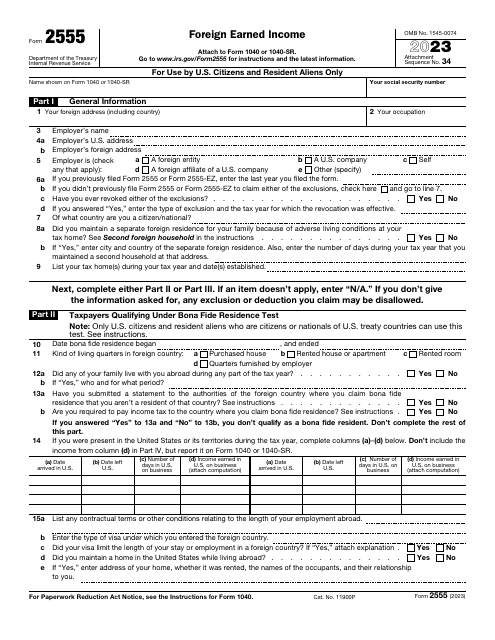

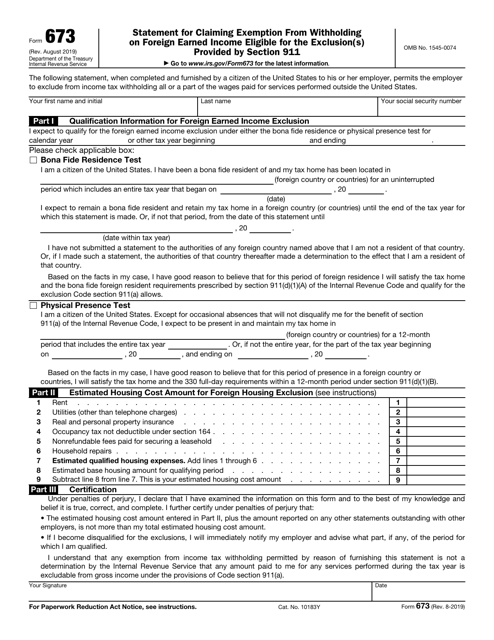

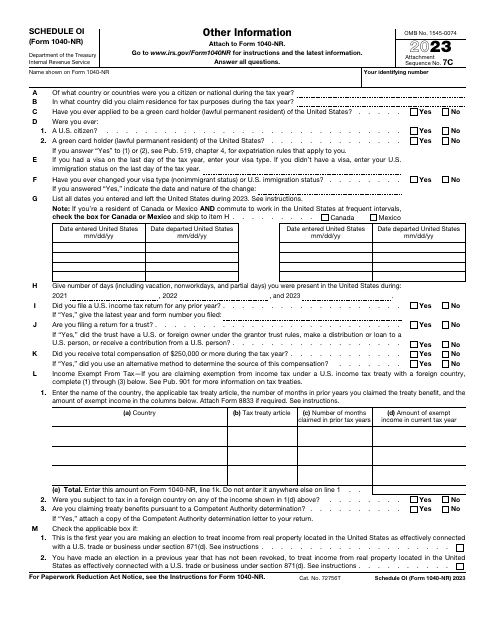

Are you an expatriate earning income abroad? Do you have questions about reporting your foreign earnings? Look no further than our comprehensive collection of documents on foreign earned income. This collection includes helpful resources such as IRS Form 2555, which is specifically designed for reporting foreign earned income. Our collection also features detailed instructions for completing this form, ensuring that you have all the information you need to accurately report your income.

Whether you're filing as an individual or as a non-resident, our collection has you covered. Our documents provide valuable insight into the reporting requirements for foreign earned income, allowing you to navigate the sometimes complex world of international taxation with ease.

Don't let the intricacies of reporting foreign earned income stress you out. Our documents provide clear and concise guidance, helping you stay compliant with tax regulations while optimizing your tax situation. With our comprehensive collection of resources, you can confidently tackle your foreign earned income obligations and make the most of your international income.

Choose our foreign earned income documents for accurate reporting, peace of mind, and a streamlined tax filing process. Don't let the confusion of international taxation hold you back – let our documents be your guide to successfully reporting your foreign earnings.

Documents:

17

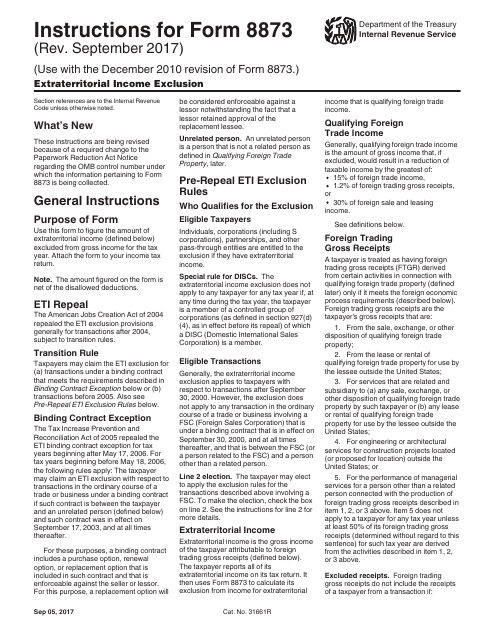

This form is used for reporting and claiming the extraterritorial income exclusion. It provides instructions on how to accurately complete IRS Form 8873.

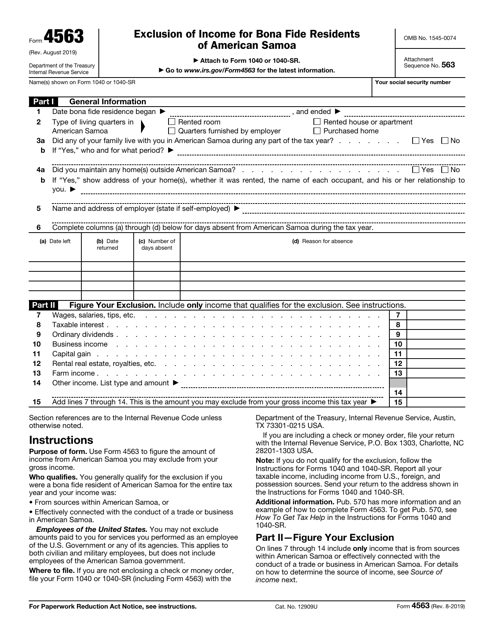

This is a tax form people permanently residing in American Samoa can use to exclude certain income from their gross income.