Trabajador Independiente Templates

If you are a self-employed worker or freelancer, you may need to access various documents related to your work. These documents may be required by government agencies, financial institutions, or even potential clients. As a trabajador independiente, it is important to have a comprehensive collection of these documents to ensure your business and financial affairs are in order.

At times, these documents may have different names depending on the region or language. For example, some of these documents may be referred to as trabajadores independientes. Whether you call them trabajador independiente or trabajadores independientes, the importance of these documents remains the same.

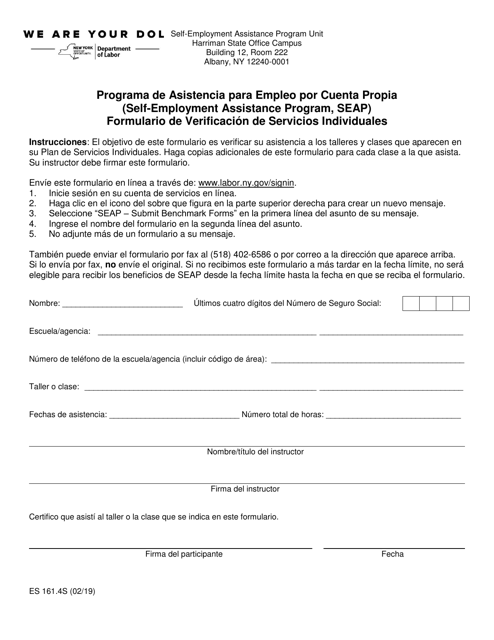

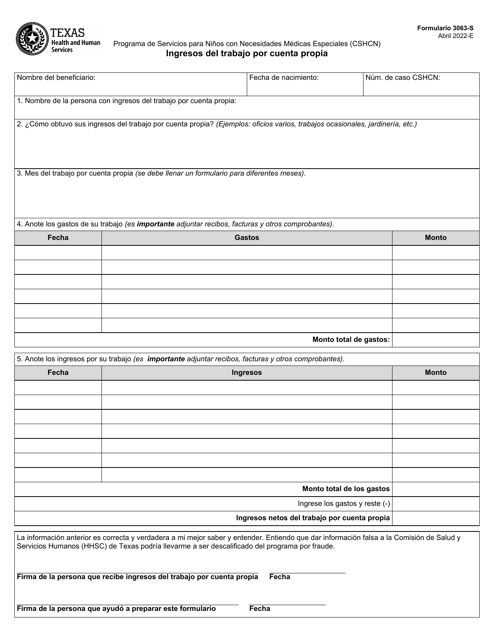

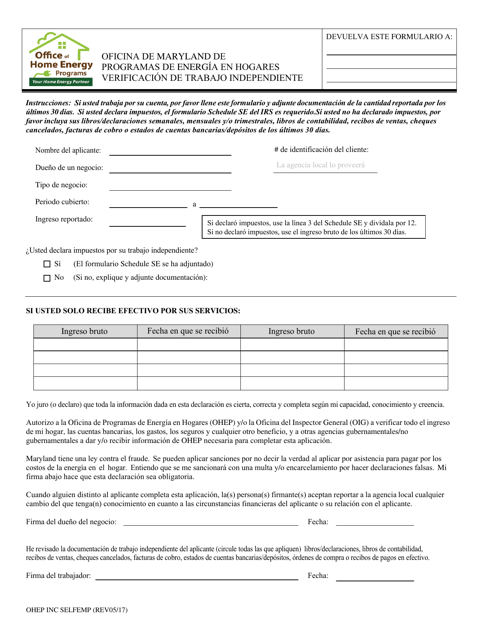

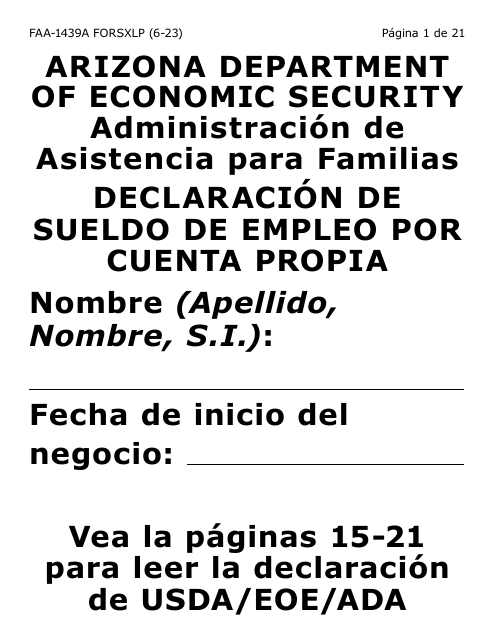

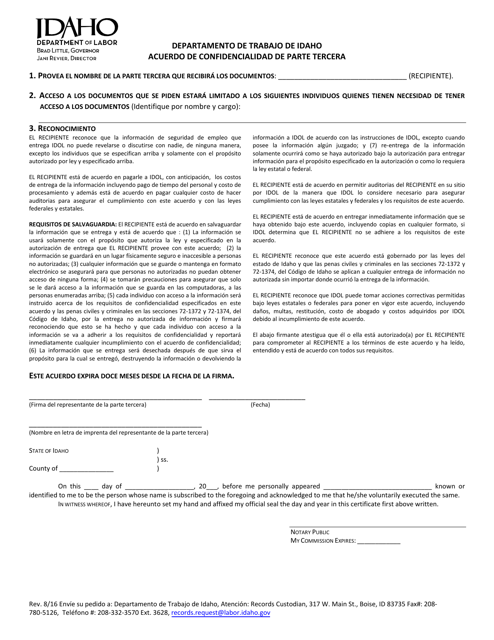

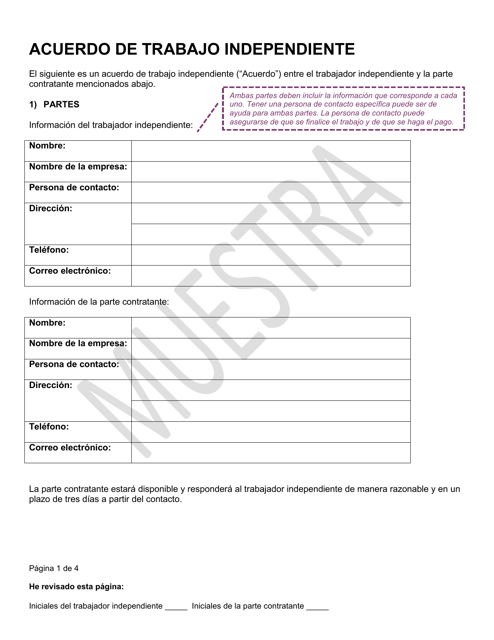

Some of the common documents that fall under this trabajador independiente category include the Formulario ES161.4S Programa De Asistencia Para Empleo Por Cuenta Propia, Verificacion De Trabajo Independiente, Formulario FAA-1439A-SXLP Declaracion De Sueldo De Empleo Por Cuenta Propia (Letra Extra Grande), Acuerdo De Trabajo Independiente, and Formulario 3063-S Ingresos Del Trabajo Por Cuenta Propia. These documents serve various purposes, such as verifying your self-employment income, declaring your earnings, or even establishing agreements with clients or partners.

As a trabajador independiente, having a clear understanding of these documents and their requirements can help you navigate the complexities of self-employment and maintain compliance with relevant regulations and laws. It is important to keep these documents organized and readily accessible to ensure a smooth workflow and avoid any potential issues or delays.

If you're a trabajador independiente, or trabajadores independientes, make sure you have all the necessary documents in place to demonstrate your self-employment status and income. Having these documents readily available can help you in various situations, such as applying for government assistance programs, securing financing, or simply providing proof of your income to interested parties.

Make sure to keep your trabajador independiente documents updated and in order, so you can focus on growing your business and succeeding as a self-employed professional.

Documents:

7

This form is used for verifying individual services for the Self-Employment Assistance Program in New York.

This document for verifying self-employment in Maryland for Spanish speakers.

This document is an Independent Contractor Agreement specific to New York City. It outlines the terms and conditions between a company and an individual contractor who will be working independently.