Farm Income Templates

Are you a farmer looking for information on how to calculate your income? Look no further! Our website provides a comprehensive collection of documents relating to farm income. Whether you're based in the USA, Canada or other countries, these resources will help you make sense of your farming income and ensure that you're meeting all your tax obligations.

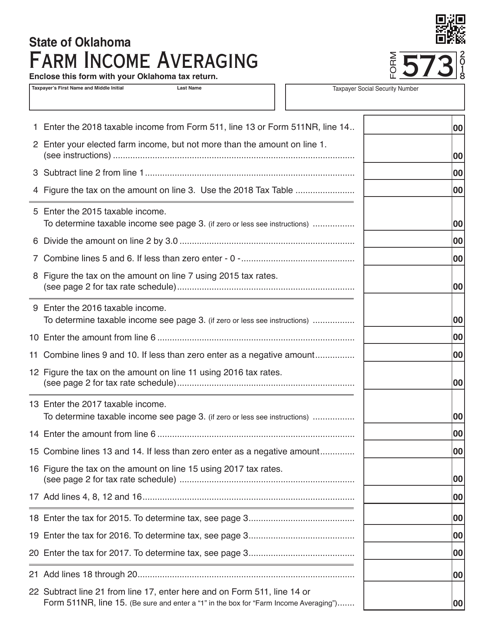

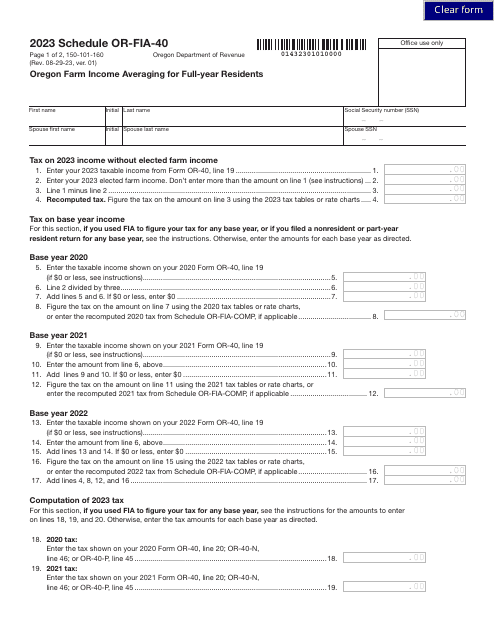

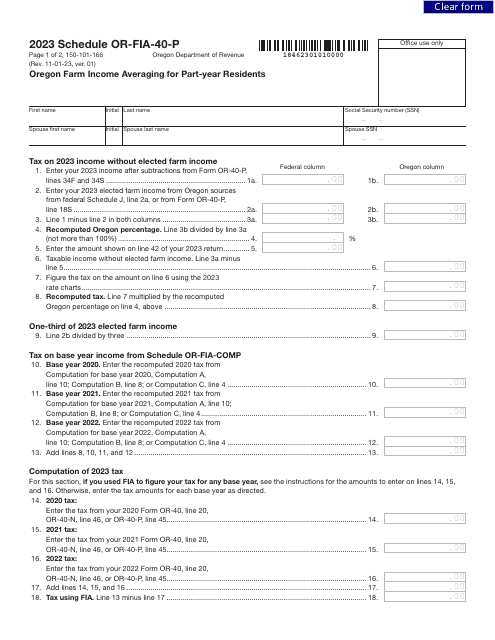

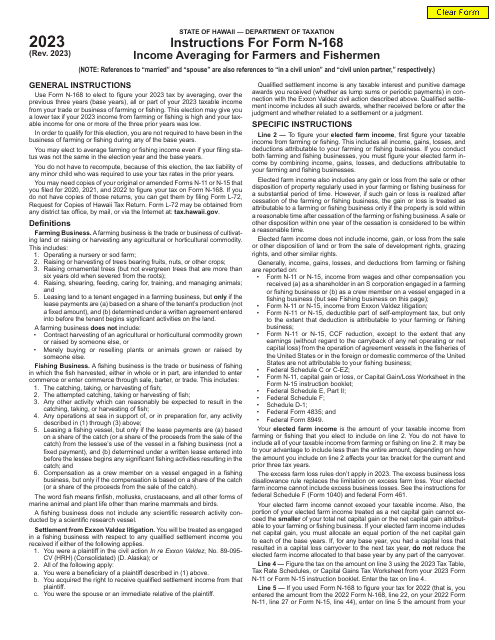

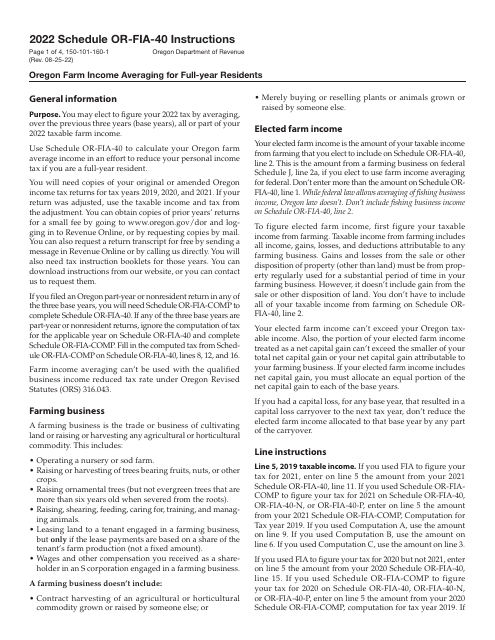

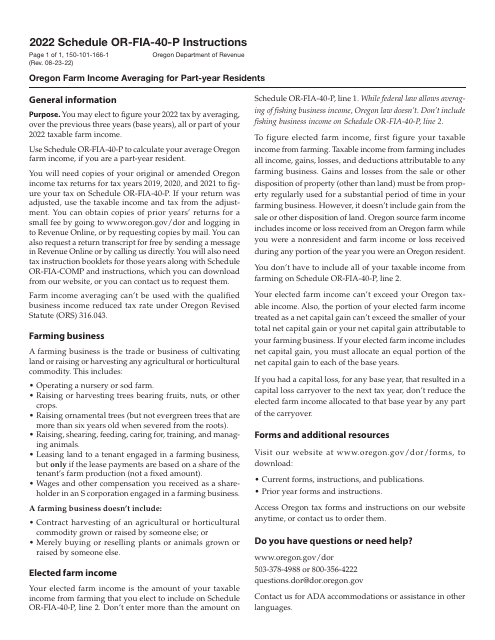

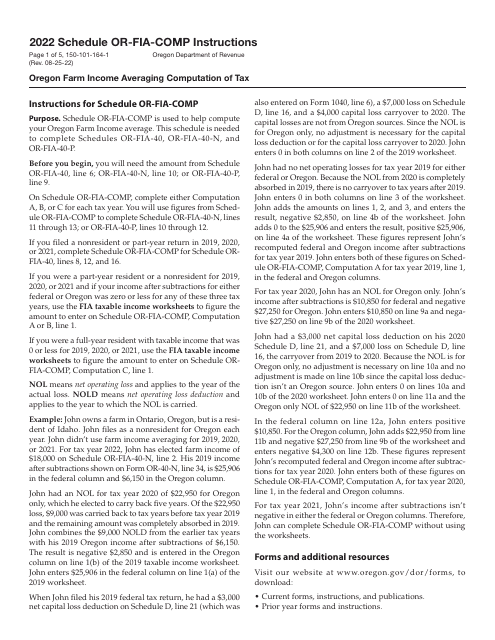

Our collection includes various forms, such as the Form 573 Farm Income Averaging in Oklahoma and the Form 150-101-164 Schedule OR-FIA-COMP for Oregon. These forms are designed to help you calculate your farm income accurately and take advantage of certain tax benefits. Additionally, we provide detailed instructions for completing these forms, such as the Instructions for Form 150-101-166 Schedule OR-FIA-40-P for part-year residents in Oregon.

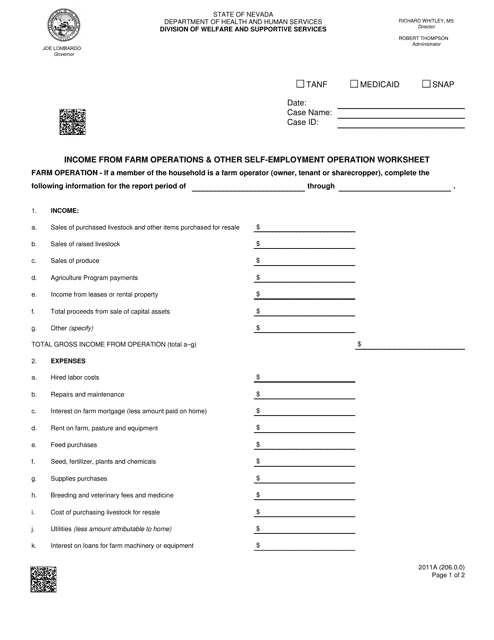

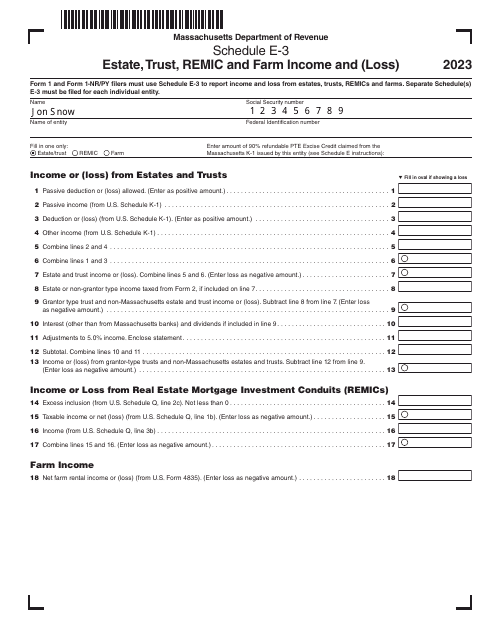

If you're located in Nevada, we have the Form 2011A Income From Farm Operations & Other Self-employment Operation Worksheet, which will guide you through the process of calculating your income from both farm operations and other self-employment activities. We also offer resources for estate planning and trust management, such as the Schedule E-3 Estate, Trust, REMIC and Farm Income and (Loss) in Massachusetts.

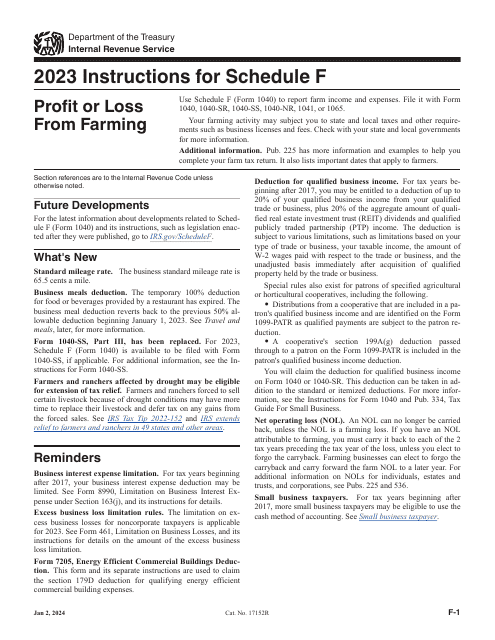

Don't let the complexities of farm income calculations overwhelm you. Our website provides a comprehensive collection of resources to help you navigate the process and ensure that you're reporting your income accurately. Whether you're looking to benefit from farm income averaging or simply need assistance with your tax obligations, our documents are here to support you every step of the way. Explore our collection now and take control of your farm income.

Documents:

38

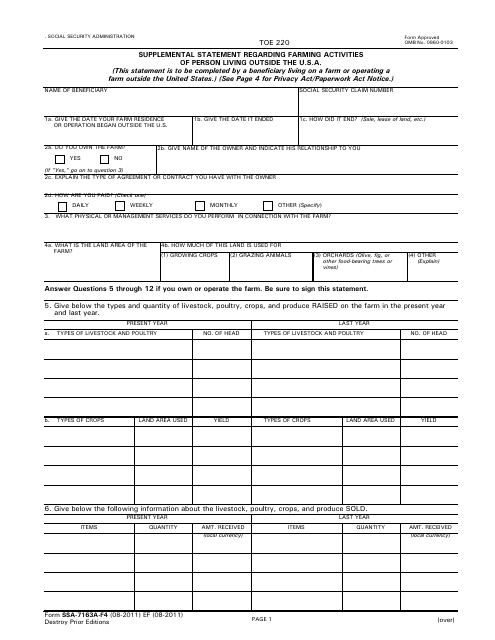

This Form is used for reporting farming activities of individuals living outside the U.S.A.

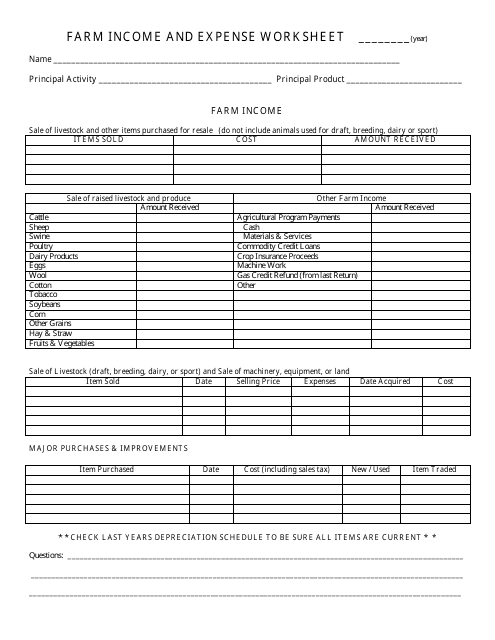

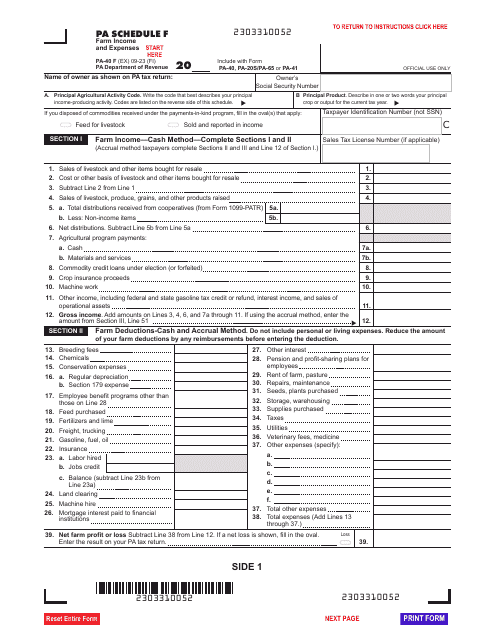

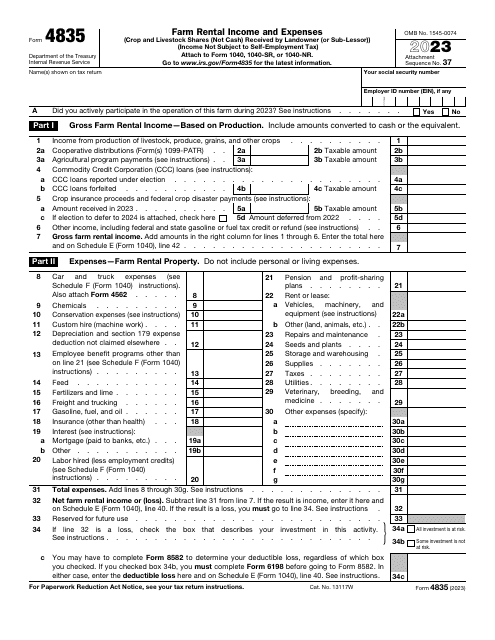

This document is used for keeping track of the income and expenses related to a farm operation. It helps farmers calculate their net income and make informed financial decisions.

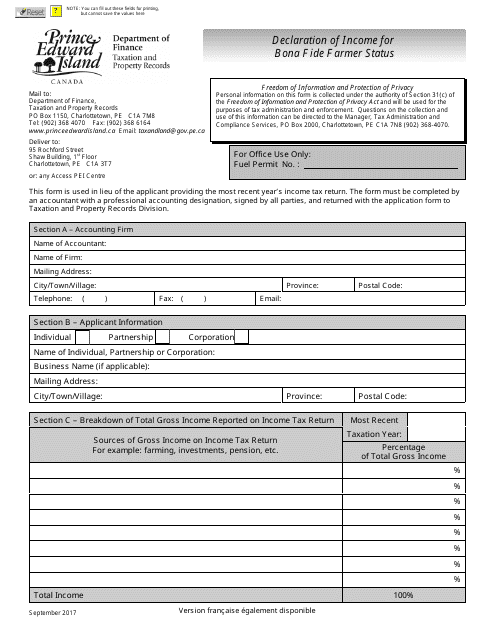

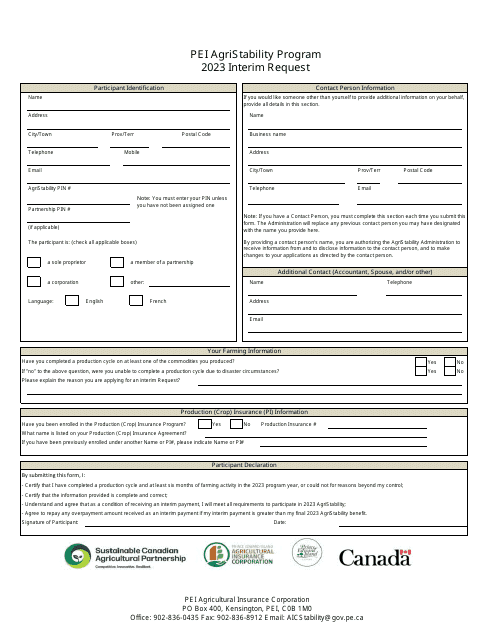

This document is used for declaring income and proving bona fide farmer status in Prince Edward Island, Canada. It is necessary for farmers to qualify for certain benefits and exemptions.

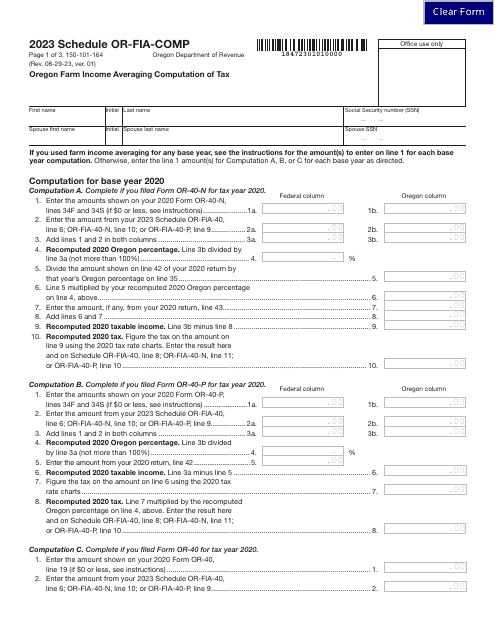

Form 150-101-164 Schedule OR-FIA-COMP Oregon Farm Income Averaging Computation of Tax - Oregon, 2023

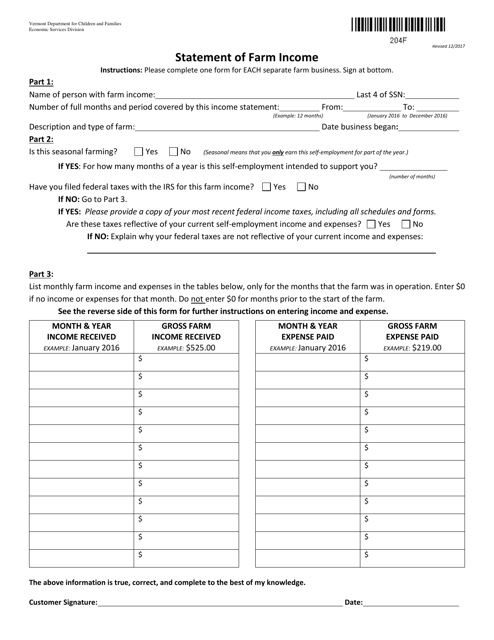

This form is used for reporting farm income in the state of Vermont. It is used by farmers to accurately report their income from agricultural activities.

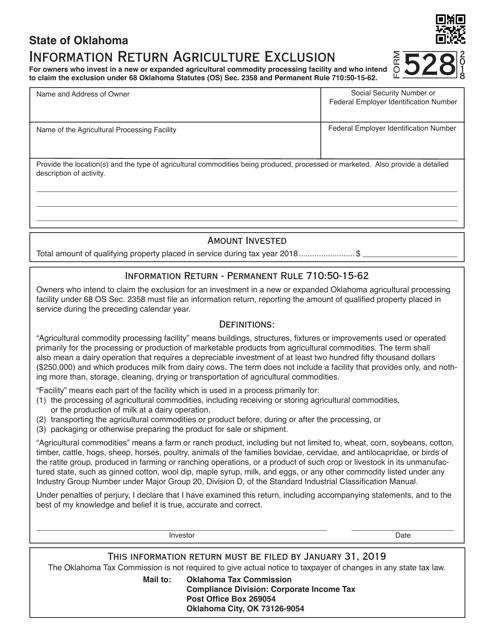

This form is used for reporting information related to the agriculture exclusion in the state of Oklahoma. It helps to determine which agriculture activities are exempt from certain taxes.

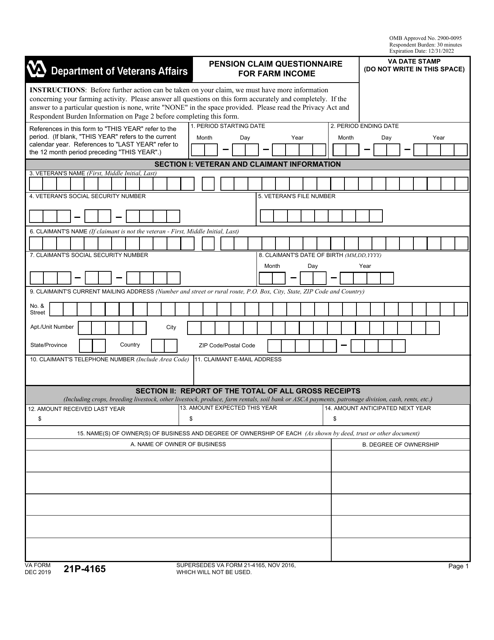

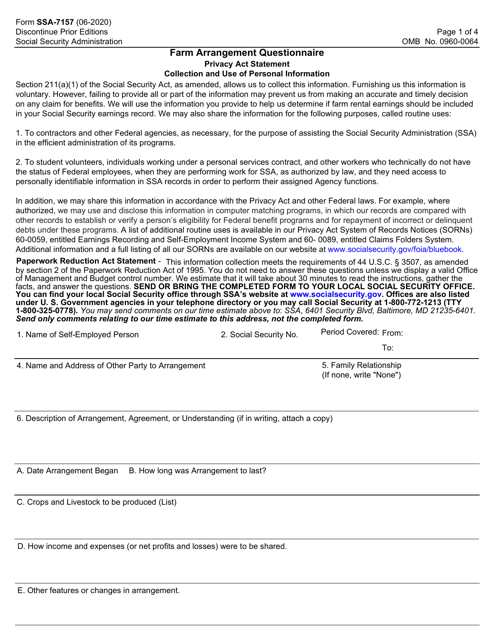

This form is used for gathering information about farm arrangements. It collects details about the ownership, operation, and management practices of a farm.

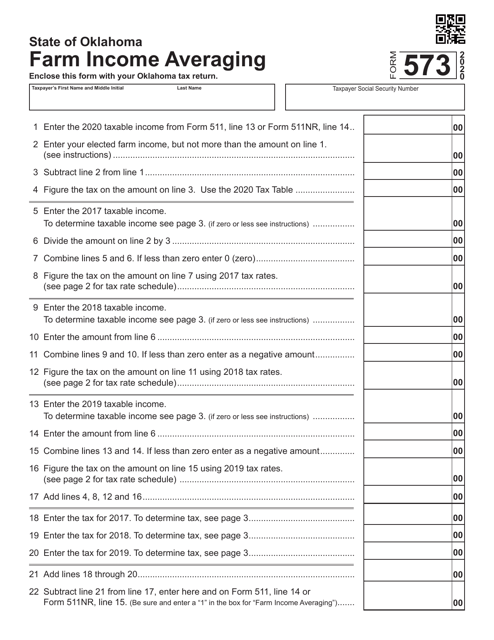

This form is used for farm income averaging in Oklahoma. It helps farmers in calculating their average income over a period of time to reduce tax liability.

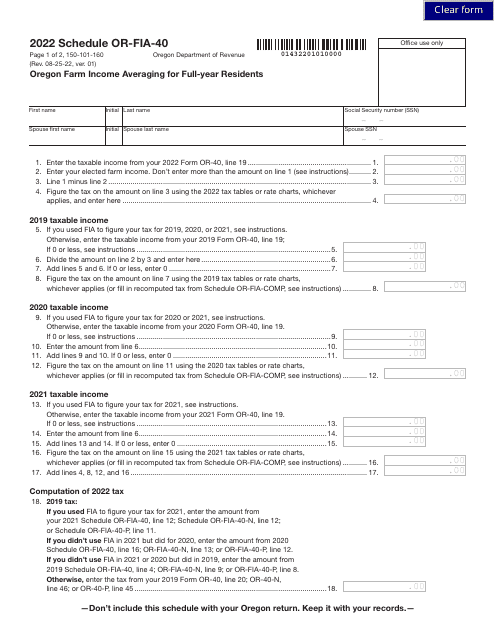

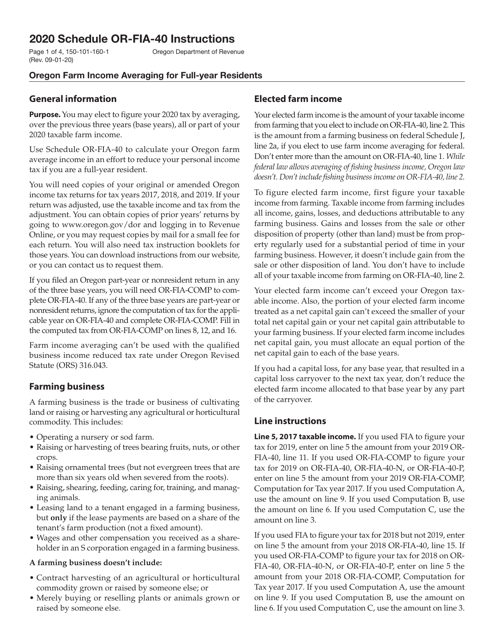

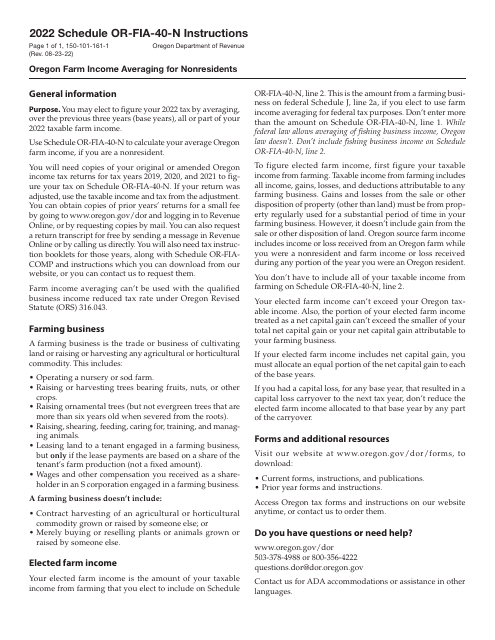

This Form is used for Oregon residents who are farmers to calculate their average income for tax purposes. It helps them determine if they qualify for income averaging and how to report their farm income.

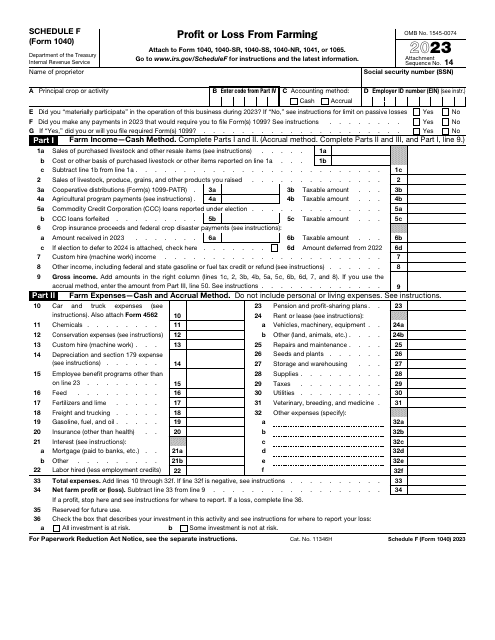

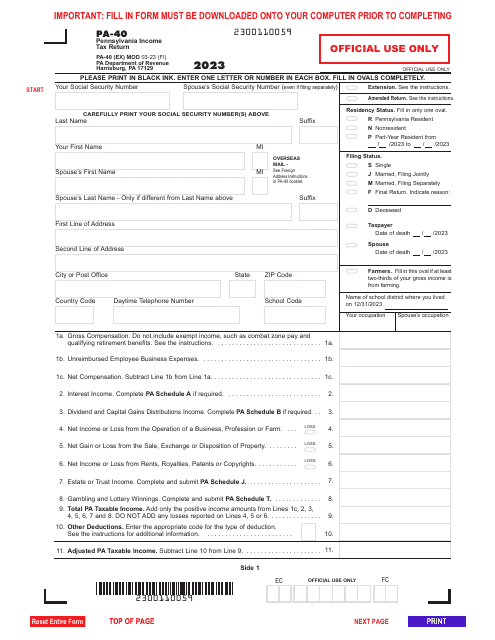

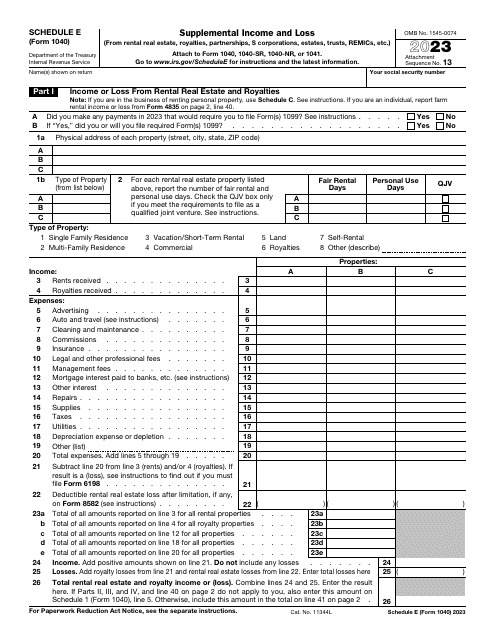

This form is part of the IRS 1040 series, which is used to calculate and submit different types of federal individual income tax returns. File this form to inform the Internal Revenue Service (IRS) about your income and loss from royalties, rental real estate, trusts, and S corporations among others.

This form is used for calculating income from farm operations and other self-employment activities in Nevada. It is a worksheet that helps individuals keep track of their earnings and expenses related to these types of activities.

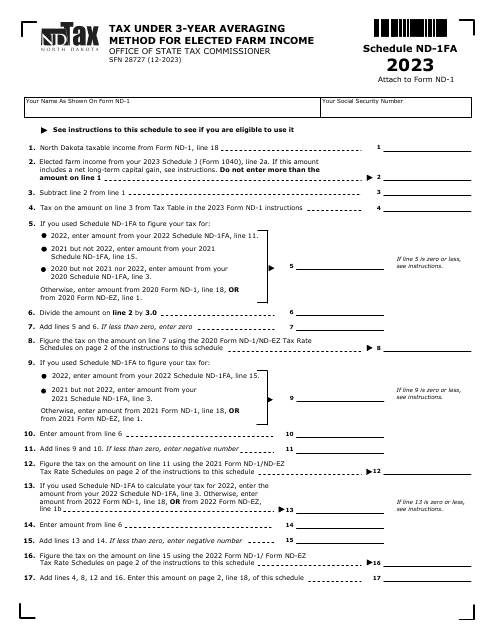

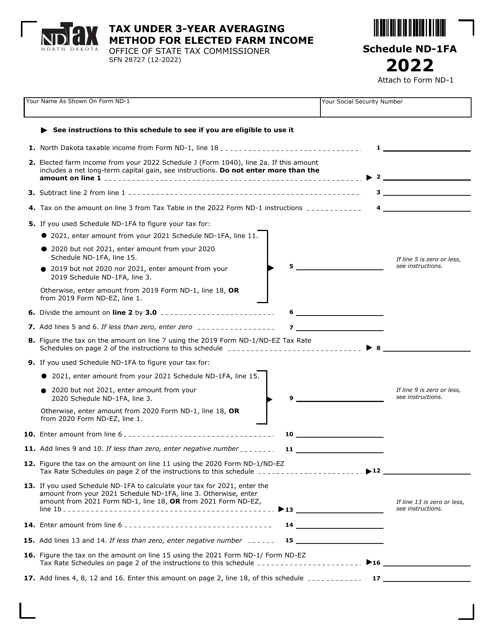

This form is used for calculating and reporting taxes under the 3-year averaging method for elected farm income in North Dakota.