Trust Taxation Templates

Trust Taxation: Maximizing Your Wealth with Effective Trust Tax Strategies

Are you looking to optimize the tax efficiency of your trust? Trust taxation is a complex and ever-evolving area of tax law that requires careful planning and expert guidance to ensure you're maximizing your wealth.

Our trust taxation services offer comprehensive guidance on managing the intricacies of trust taxation. With our expertise, you can navigate the complex world of trust taxation, ensuring compliance with federal and state tax laws while minimizing your tax burden.

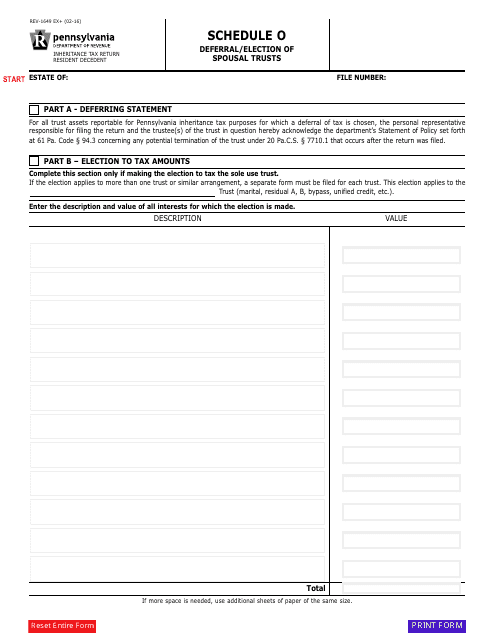

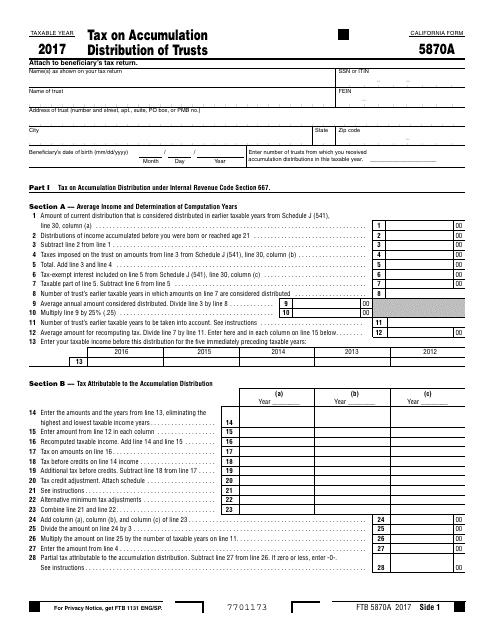

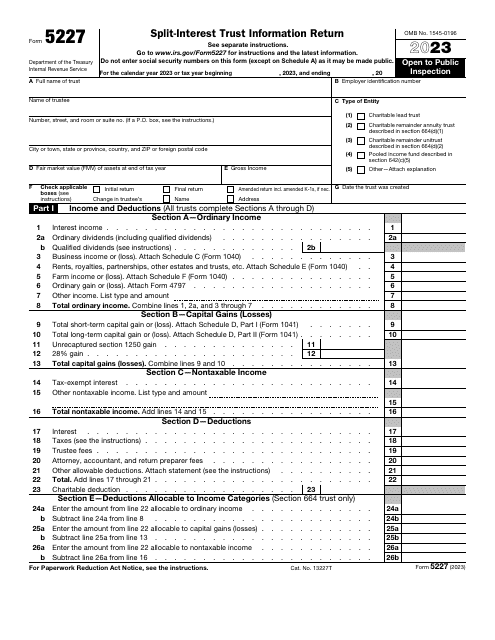

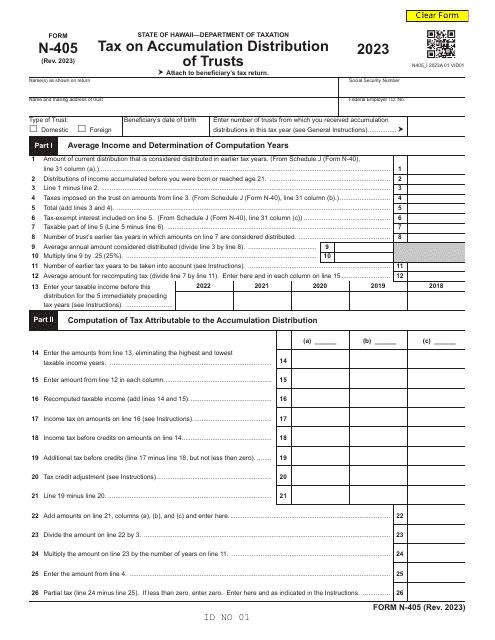

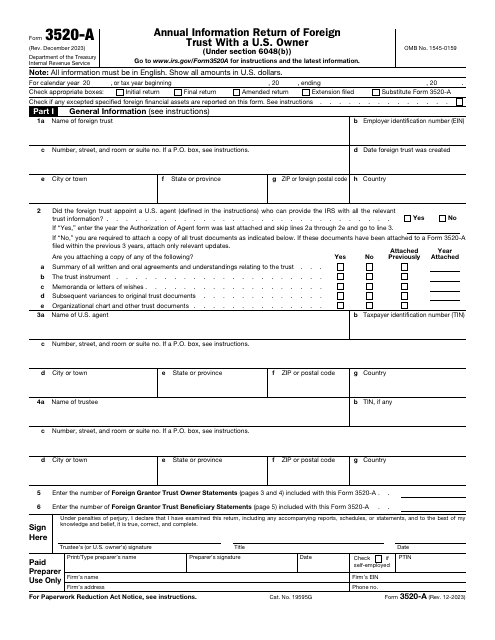

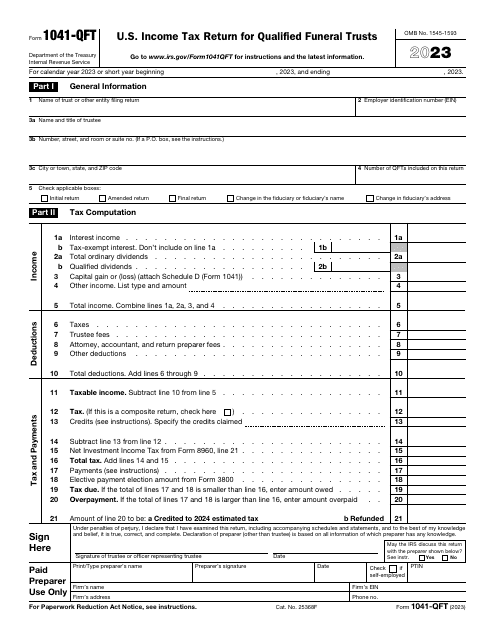

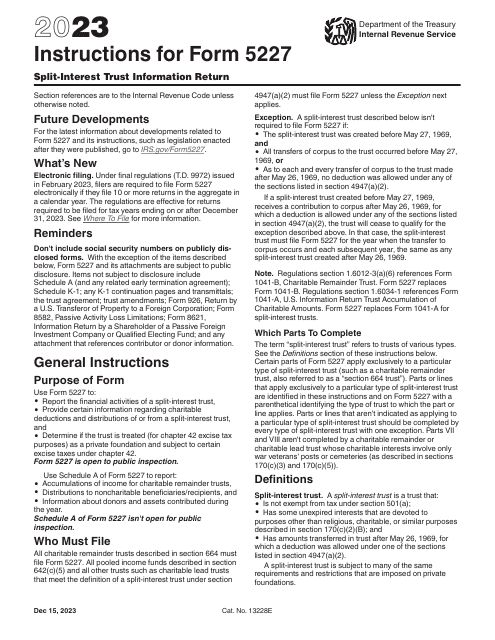

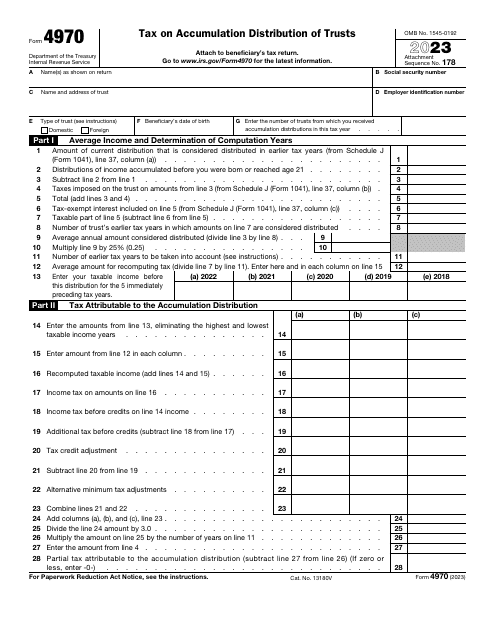

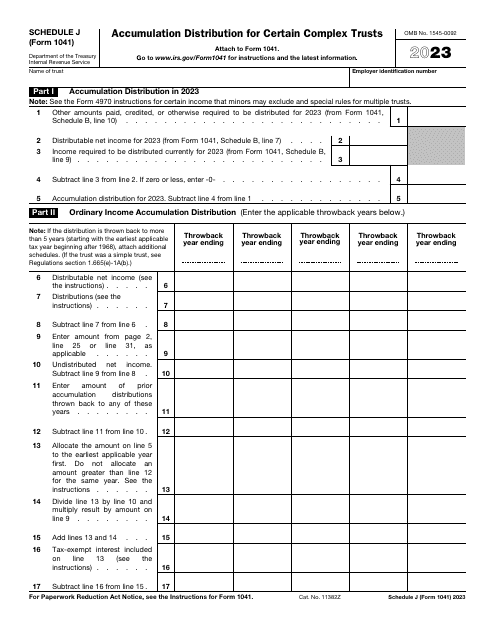

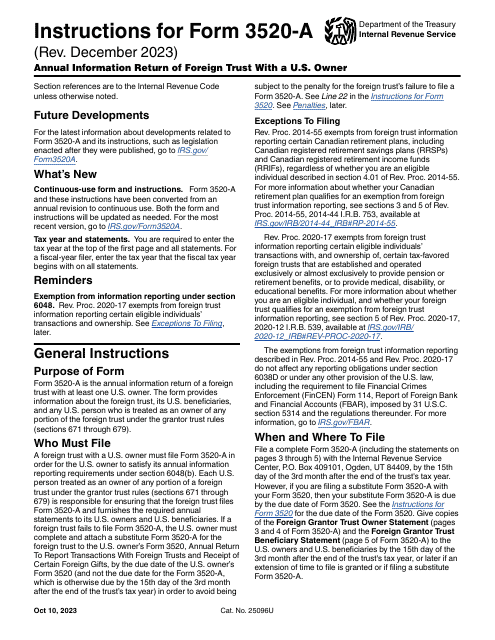

From deferral and election of spousal trusts to accumulation distribution taxes, our team of experienced professionals can help you understand the intricacies of trust taxation and identify opportunities to reduce your tax liability. We specialize in handling various trust tax forms, such as Form REV-1649 Schedule O, Form FTB5870A, IRS Form 3520-A, IRS Form 1041-QFT, and Form N-405, among others.

Whether you're a trust beneficiary, trustee, or estate planner, our trust taxation services provide you with the tools and knowledge needed to make informed decisions about your trust's tax planning. We stay up-to-date with the latest tax laws and regulations to ensure that you are fully compliant while taking advantage of any available tax-saving opportunities.

Don't let trust taxation become a burden. Let our experts guide you through the complexities of trust tax planning, allowing you to focus on maximizing your wealth and preserving your legacy.

Documents:

16

This form is used for deferral or election of spousal trusts in Pennsylvania.

This form is used for reporting and calculating the tax on accumulation distribution of trusts in the state of California.

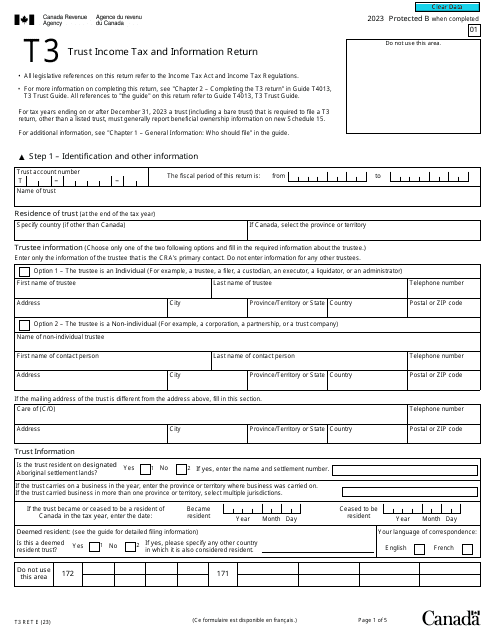

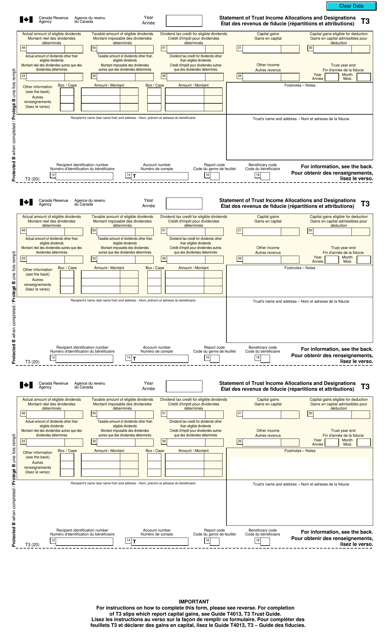

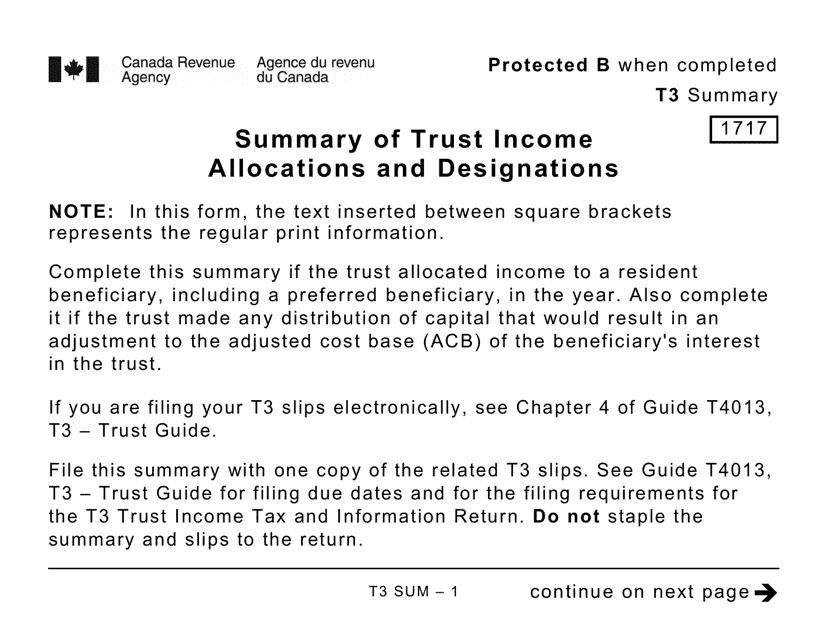

Canadian taxpayers may use this form when they would like to report the investment income they have received during the year.

This document is submitted to the Internal Revenue Service (IRS) annually by foreign trusts with a U.S. owner to inform the IRS about the trust, its American beneficiaries, and any U.S. trust owner.

This type of document, Form T3 SUM Summary of Trust Income Allocations and Designations (Large Print), is used in Canada for summarizing the income allocations and designations for trusts.