Agricultural Employees Templates

Are you an agricultural employer or do you have agricultural employees working for you? If so, it's important to stay informed about the various forms and regulations that pertain specifically to agricultural employees.

Our comprehensive collection of documents provides valuable resources and instructions to help agricultural employers navigate their tax responsibilities and ensure compliance with federal regulations. Whether you need guidance on filing your annual federal tax return or want to learn more about adjustments or refunds, our documents cover it all.

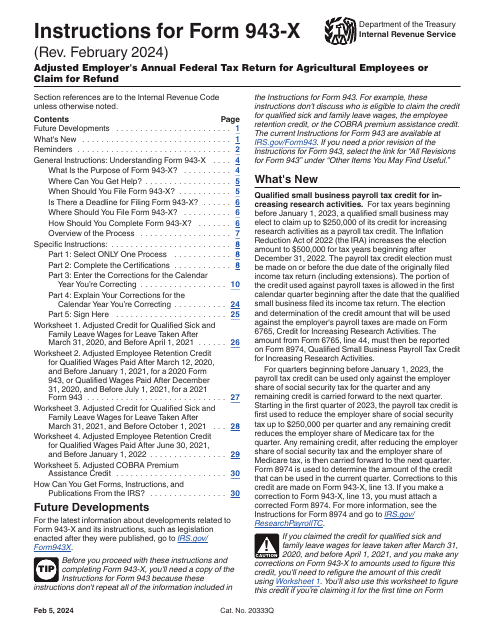

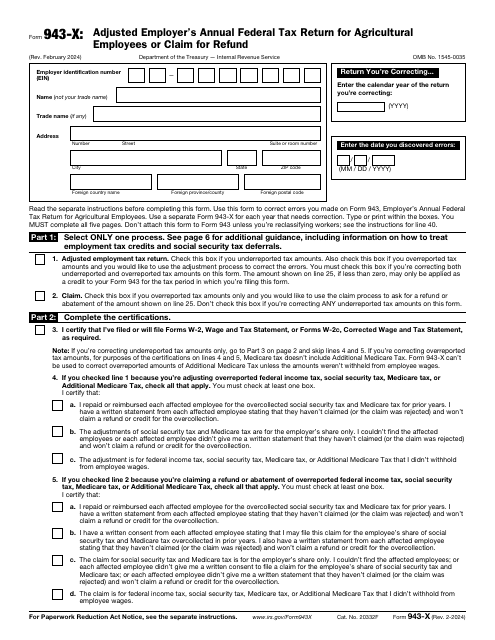

Included in our collection is the IRS Form 943-X Adjusted Employer's Annual Federal Tax Return for Agricultural Employees or Claim for Refund. This form allows agricultural employers to make necessary adjustments to their previously filed tax return and seek refunds if eligible. Our detailed instructions for this form will walk you through the process step-by-step, ensuring accuracy and compliance.

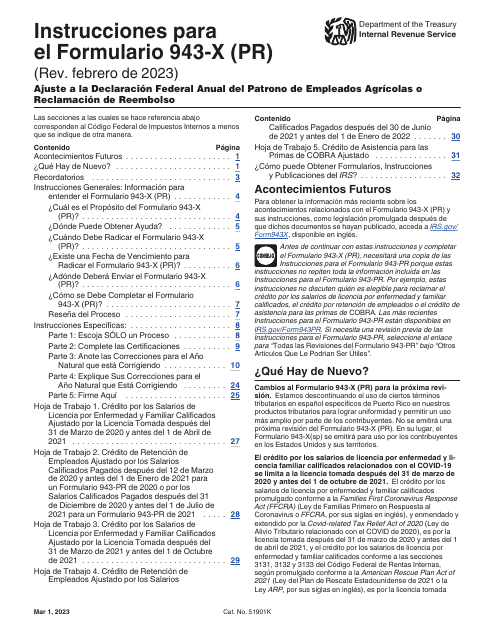

For those operating in Puerto Rico, we also offer instructions in Puerto Rican Spanish for the IRS Formulario 943-X (PR) Ajuste a La Declaracion Federal Anual Del Patrono De Empleados Agricolas O Reclamacion De Reembolso. This document is specifically tailored to meet the needs of agricultural employers in Puerto Rico.

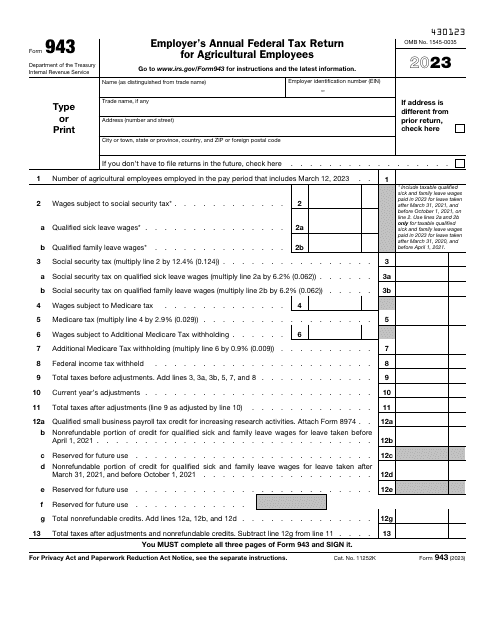

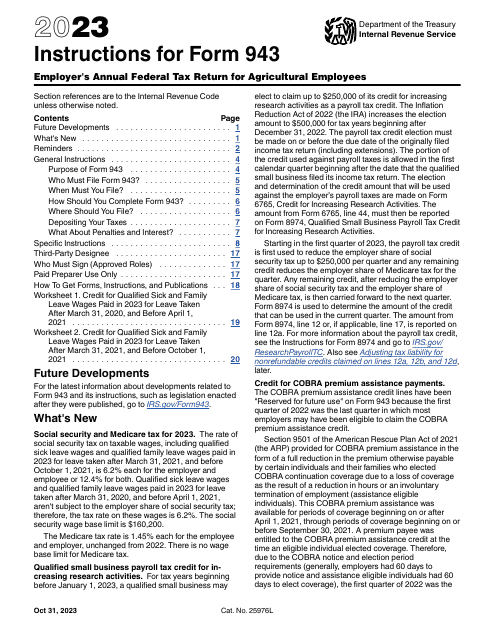

Additionally, our collection includes the IRS Form 943 Employer's Annual Federal Tax Return for Agricultural Employees. This form is the standard annual tax return that agricultural employers need to submit, and our documents provide detailed instructions on how to complete it accurately.

With our comprehensive agricultural employees document collection, you can confidently navigate the complexities of agricultural employee tax requirements. Stay compliant, streamline your tax filing processes, and ensure you are taking advantage of any eligible adjustments or refunds. Explore our collection today and empower yourself with the knowledge to effectively manage the taxation aspects of your agricultural workforce.

Documents:

17

This is an IRS form designed to allow taxpayers to amend the information they previously filed reporting tax deducted from an employee's wages.

If you paid wages in the reported tax year to one or more farm workers, file this form for your annual federal tax return in case the wages you paid to your farmworkers were subject to the federal income, Medicare, or social security tax withholdings.