Railroad Retirement Templates

The Railroad Retirement system is a vital program designed to provide financial security for railroad employees and their families. This dedicated retirement plan ensures that railway workers receive the benefits they deserve after years of service. With our comprehensive collection of documents related to railroad retirement, you can easily navigate the complex regulations and requirements. Our selection includes instructional guides for completing IRS forms, such as the Employer's Annual Railroad Retirement Tax Return and the Adjusted Employer's Annual Railroad Retirement Tax Return or Claim for Refund. We also offer verification forms, like the H1026-FTI Verification of Railroad Retirement Benefits - Texas, to help streamline the process. Whether you are an employer, employee, or beneficiary, our library of railroad retirement documents will guide you through the necessary steps to ensure proper coverage and enjoyment of this essential program. Trust us to provide the information you need to secure your financial future.

Documents:

9

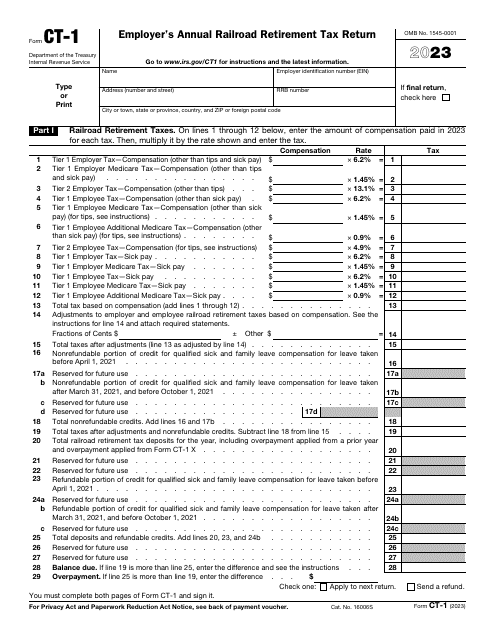

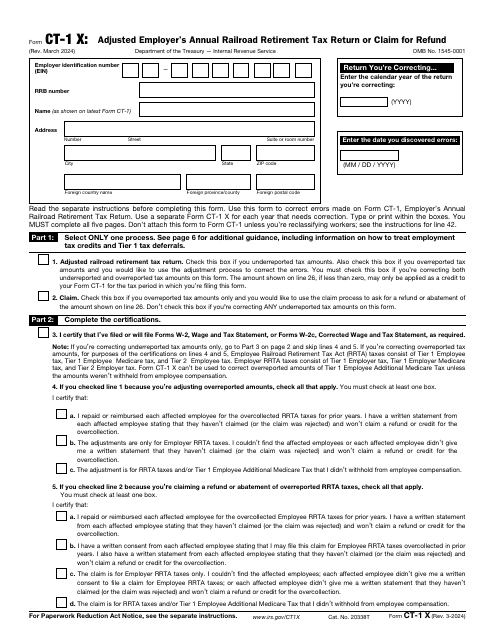

This is a fiscal form railroad industry employers are supposed to fill out in order to report the compensation they paid to their employees if that compensation is taxed in accordance with the Railroad Retirement Tax Act.

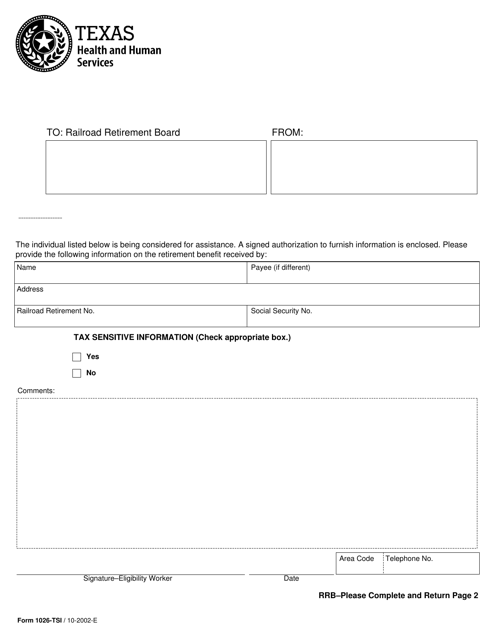

This form is used for verifying the retirement benefits of railroad workers in Texas.

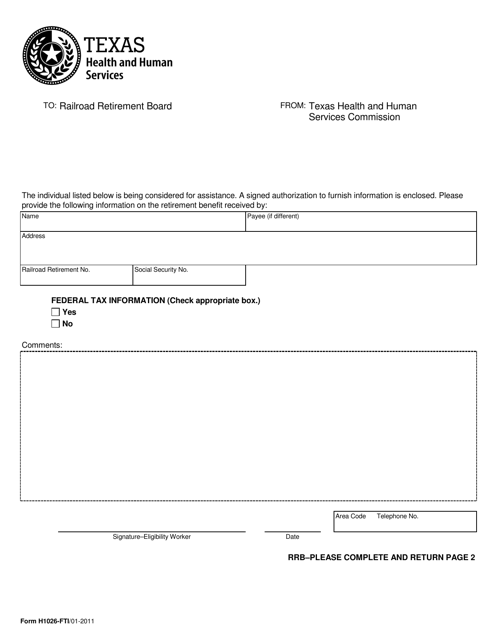

This form is used for verifying railroad retirement benefits in Texas. It helps to ensure that individuals are accurately reporting their income for eligibility in benefit programs.

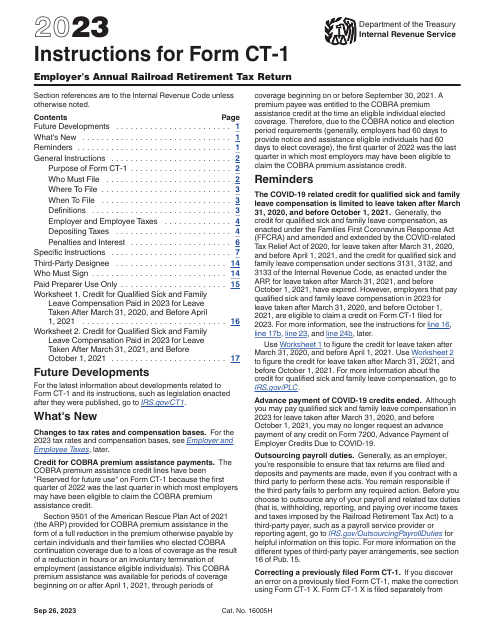

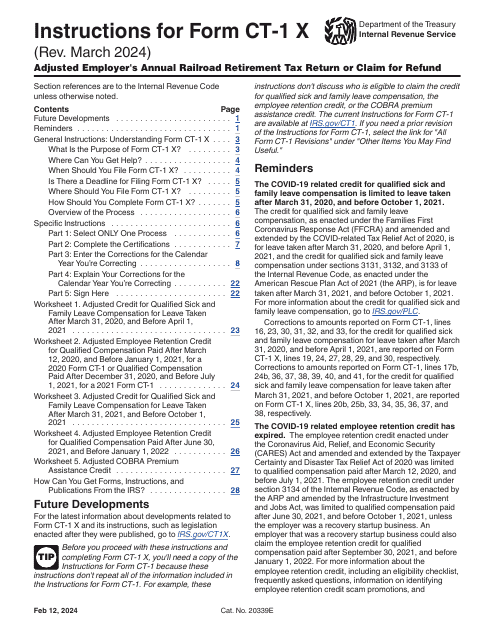

This is a formal document used by railroad industry employers to correct errors they have noticed upon filing IRS Form CT-1, Employer's Annual Railroad Retirement Tax Return.