Dependent Care Expenses Templates

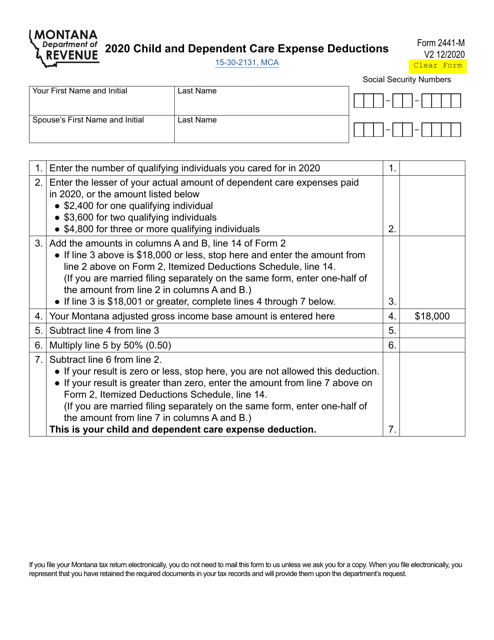

Dependent Care Expenses, also known as child and dependent care expenses, refer to the costs associated with caring for a child or dependent individual. These expenses are important to take note of as they may qualify for tax deductions or credits.

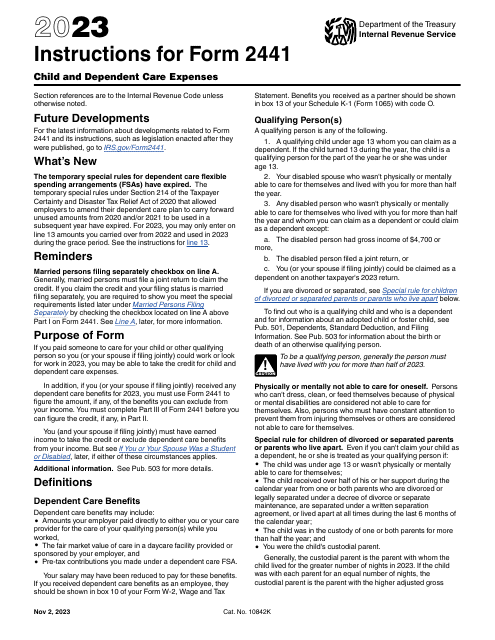

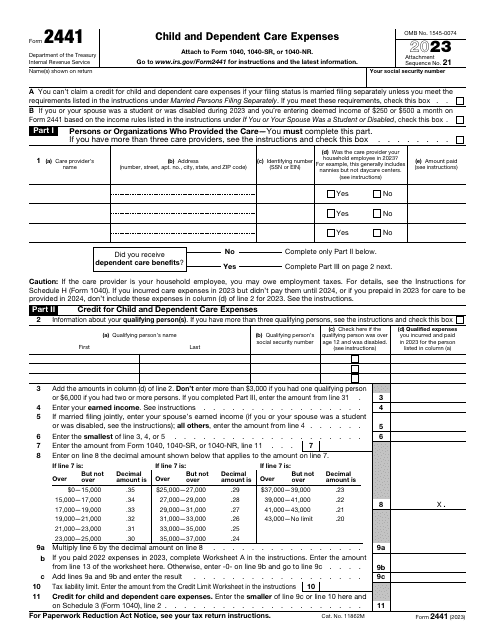

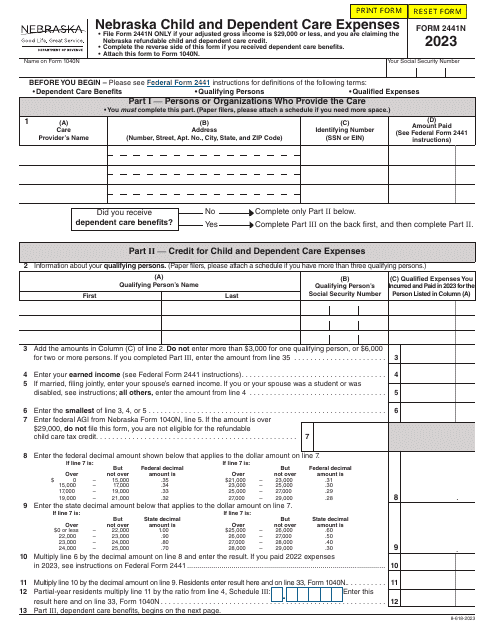

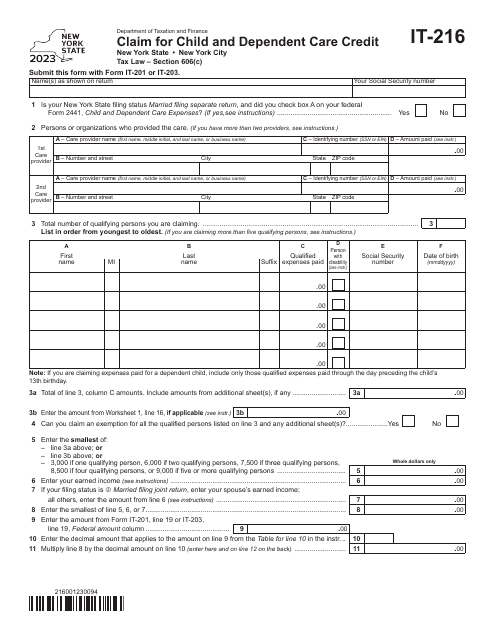

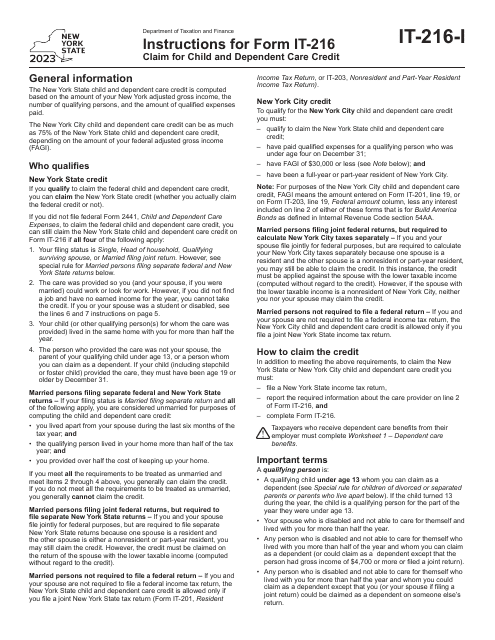

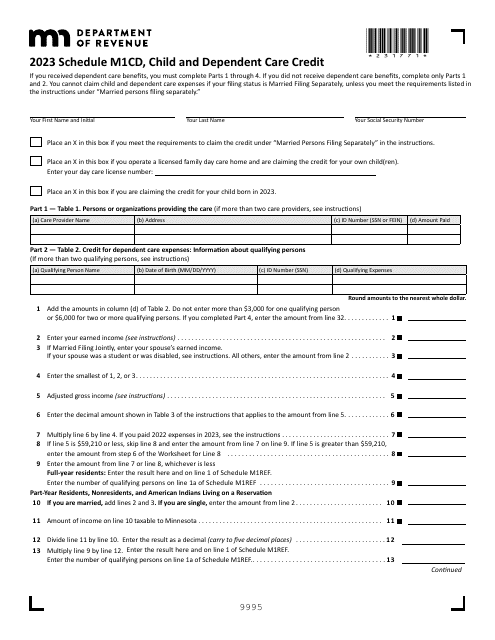

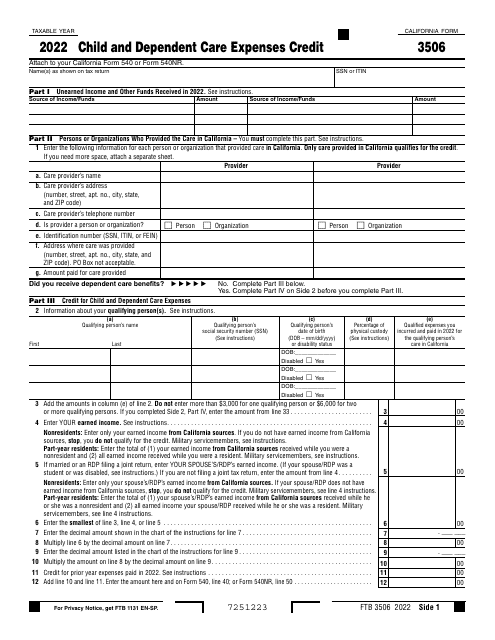

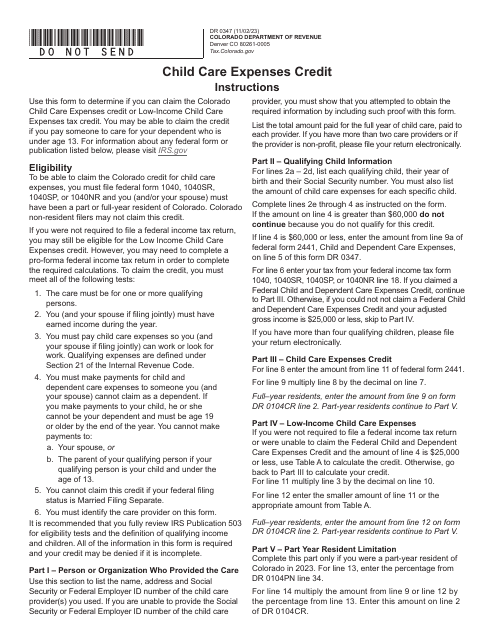

Understanding the complexities of navigating dependent care expenses can be overwhelming, which is why it is crucial to familiarize yourself with the necessary documents and instructions to ensure accurate reporting. The Instructions for IRS Form 2441 provide a comprehensive guide for individuals looking to claim the Child and Dependent Care Expenses credit on their federal taxes. Similarly, the Instructions for Form IT-216 serve the same purpose for residents of New York who are seeking to claim the Child and Dependent Care Credit.

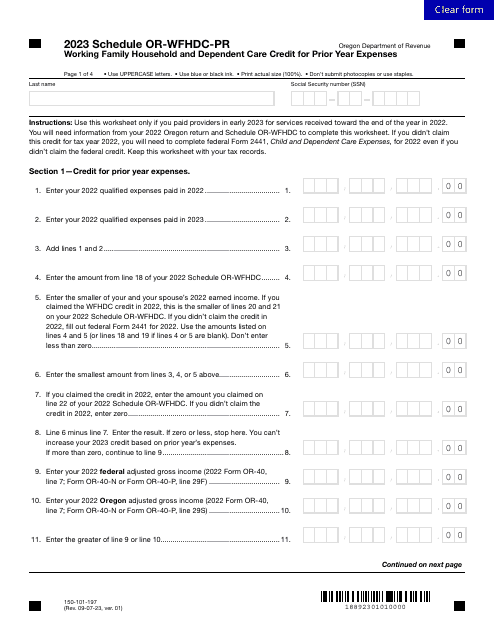

In addition to these specific forms, there may be other state-specific forms that individuals need to complete. For example, the Form 150-101-197 Schedule OR-WFHDC-PR is used by residents of Oregon to claim the Working Family Household and Dependent Care Credit for Prior Year Expenses.

It is essential to gather all relevant information and documentation when claiming dependent care expenses to ensure that you receive any entitled tax benefits. By using the correct forms and following the provided instructions, you can maximize your potential deductions or credits, ultimately reducing your overall tax liability.

Documents:

25

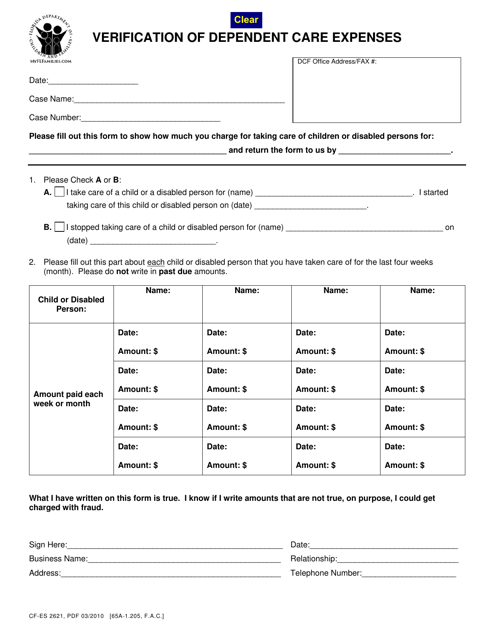

This Form is used for verifying dependent care expenses in the state of Florida.

This form was developed for taxpayers who have paid someone to care for their child or another qualifying person so they could work or look for work.

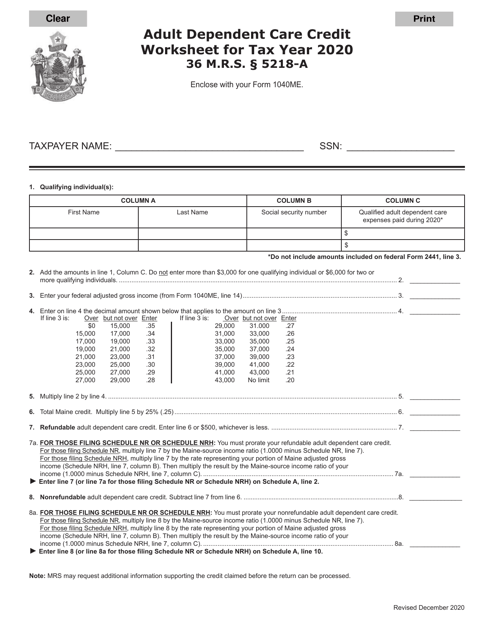

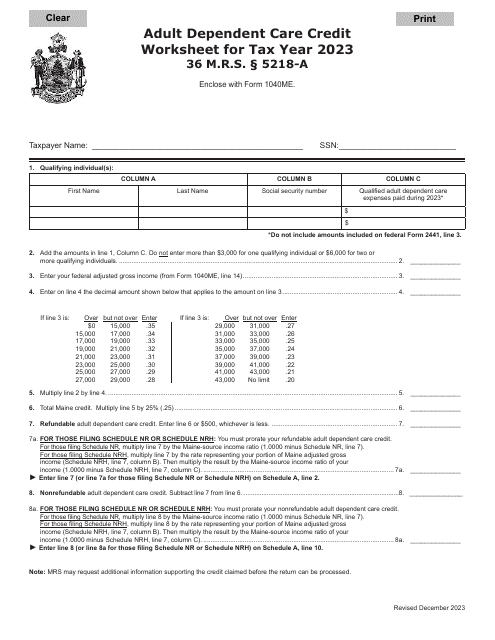

This document is used for calculating the Adult Dependent Care Credit in the state of Maine.

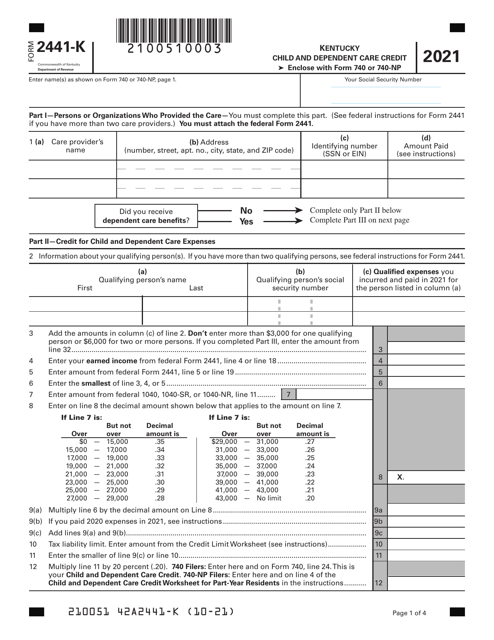

This form is used for claiming the Kentucky Child and Dependent Care Credit in Kentucky. It helps taxpayers to report their qualifying expenses for child and dependent care and determine the amount of credit they are eligible for.

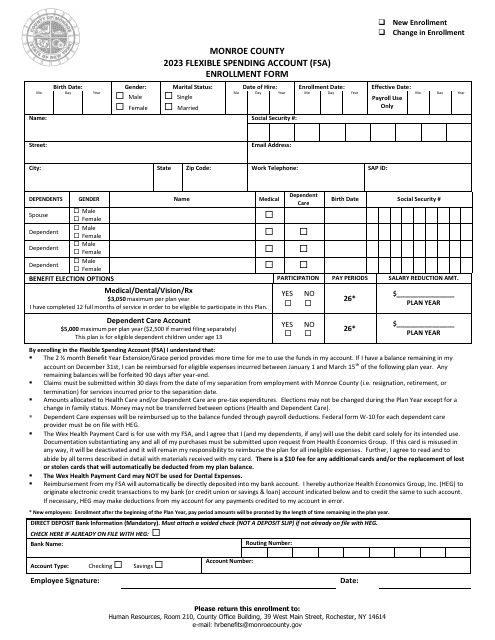

This document is for enrolling in a Flexible Spending Account (FSA) in Monroe County, New York. It allows individuals to set aside pre-tax funds to pay for eligible medical expenses.