Clean Vehicle Templates

Looking to learn more about clean vehicles? Look no further! Our website is the ultimate resource for all things related to clean vehicles. From information on tax credits and incentives to forms and reports, we've got you covered.

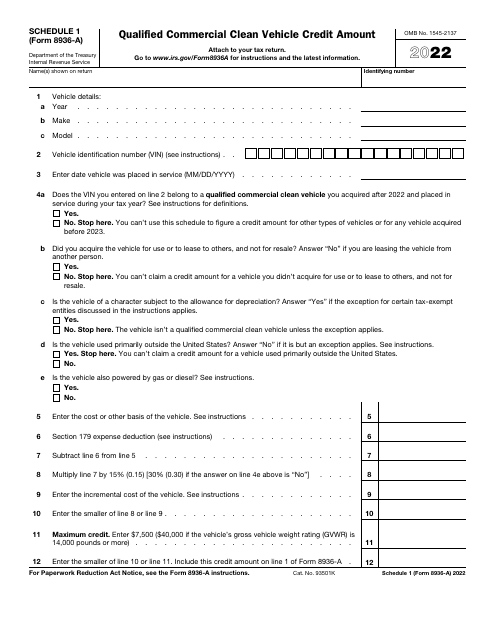

Are you an eligible commercial vehicle owner looking to claim the Qualified Commercial Clean Vehicle Credit Amount? Check out our comprehensive guide on IRS Form 8936-A Schedule 1. This form provides the necessary details for claiming your tax credit and maximizing your benefits. We also offer step-by-step instructions to make the process easier for you.

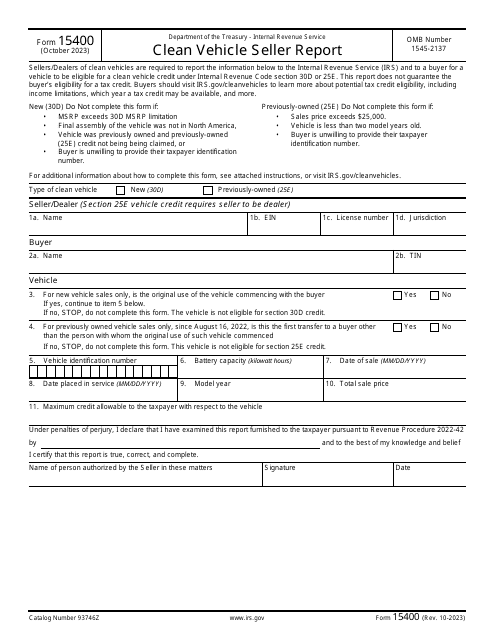

If you're involved in selling clean vehicles, you'll want to familiarize yourself with IRS Form 15400, also known as the Clean Vehicle Seller Report. This form is essential for sellers to report the sale of clean vehicles and ensure compliance with regulations. Our website provides detailed information and tips on how to complete this form accurately.

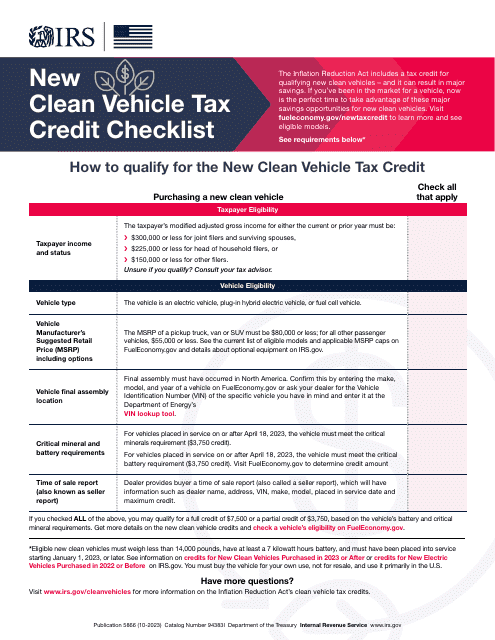

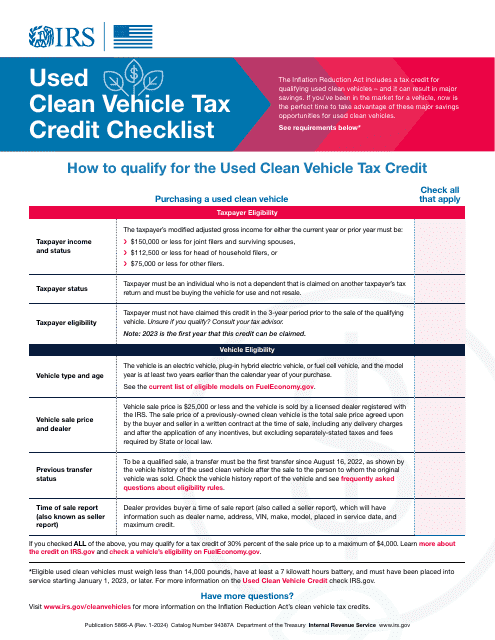

To simplify the process, we have created a New Clean Vehicle Tax Credit Checklist, which guides you through the necessary steps to claim your tax credit for purchasing a new clean vehicle. Similarly, if you have purchased a used clean vehicle, our Used Clean Vehicle Tax Credit Checklist will help you navigate the requirements and maximize your tax benefits.

Our website serves as a comprehensive knowledge hub for all things related to clean vehicles. Whether you're a commercial vehicle owner or involved in the clean vehicle industry, our resources and guides will provide you with the information you need to make informed decisions and take advantage of available tax credits and incentives.

Join us today and unlock the potential of clean vehicles for a greener, more sustainable future!

Documents:

5

This form is used for calculating and claiming the Qualified Commercial Clean Vehicle Credit Amount on your taxes. It is used for individuals or businesses that have purchased qualified clean vehicles for commercial purposes.