Single Payment Templates

A single payment, also known as a single payment form, refers to a standardized document used for the processing of a one-time payment. This type of document is commonly used in various contexts, including financial transactions, tax filing, and legal proceedings.

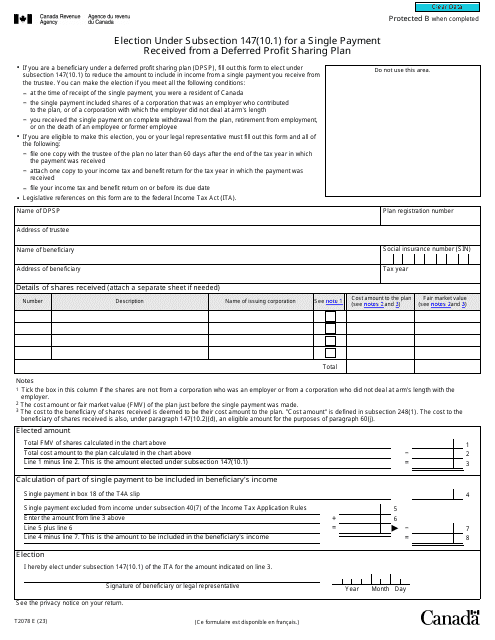

For individuals living in Canada, the Canada Revenue Agency requires the completion of Form T2078 Election Under Subsection 147(10.1) for a Single Payment Received From a Deferred Profit Sharing Plan. This form ensures compliance with tax regulations when a single payment is received from such a plan.

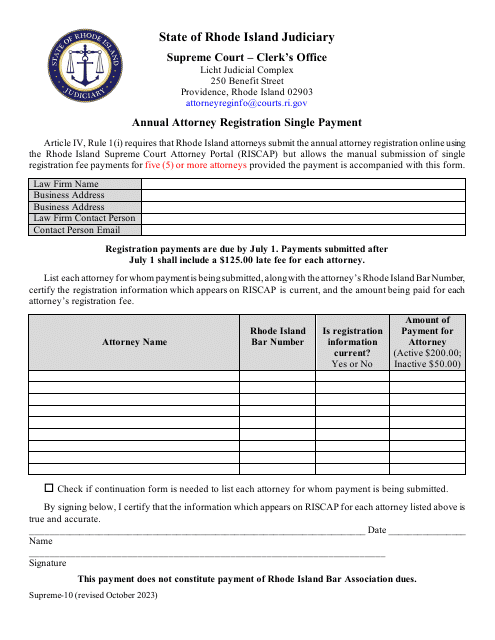

Similarly, in the state of Rhode Island, attorneys are required to complete the Form Supreme-10 Annual Attorney Registration Single Payment Form. This document serves as a means of registering and making a single payment for attorneys' annual registration.

Whether you are dealing with a financial institution, government agency, or legal entity, the completion of a single payment form is crucial to facilitate accurate and efficient processing. These forms ensure that all necessary information is provided, such as payment amount, recipient details, and any additional documentation required.

Completing a single payment form accurately helps streamline the payment process, ensuring that the payment is received and applied promptly. It also provides a clear record of the transaction for both the payer and the payee, offering transparency and accountability.

In summary, a single payment, or single payment form, is an essential document that simplifies the processing of one-time payments. It is commonly used in a variety of contexts, ensuring compliance with regulations and facilitating efficient financial transactions.