Property Insurance Templates

Property Insurance, also known as property insurers, is a type of insurance coverage that protects individuals and businesses from financial loss arising from damage or loss to their property. Whether you own a home, a commercial building, or any other type of property, ensuring that it is adequately protected against unexpected events is essential.

Property insurance provides coverage for a wide range of perils, including but not limited to fire, theft, vandalism, and natural disasters such as hurricanes or earthquakes. Without proper insurance coverage, property owners may be left vulnerable to significant financial burdens in the event of an unforeseen incident.

For businesses, property insurance is particularly crucial, as it safeguards not only the physical structure but also the valuable assets contained within. From equipment and inventory to furnishings and fixtures, property insurance offers financial protection that can help businesses recover and rebuild in the aftermath of a covered loss.

In addition to providing financial protection, property insurance also offers peace of mind. Knowing that your property and assets are secure allows you to focus on what matters most – running your business or enjoying your personal life – without the constant worry of what might happen if disaster strikes.

At property insurers, we understand the unique needs and risks associated with property ownership. We work closely with our clients to assess their individual requirements and provide customized insurance solutions that offer comprehensive coverage at affordable rates. With our expertise and industry knowledge, we can help you navigate the complex world of property insurance and ensure that you have the right policy in place to protect what matters most to you.

Whether you are a homeowner, a landlord, or a business owner, don't leave the fate of your property to chance. Contact property insurers today and let us help you find the perfect property insurance policy to safeguard your investment and provide you with the peace of mind you deserve.

Documents:

34

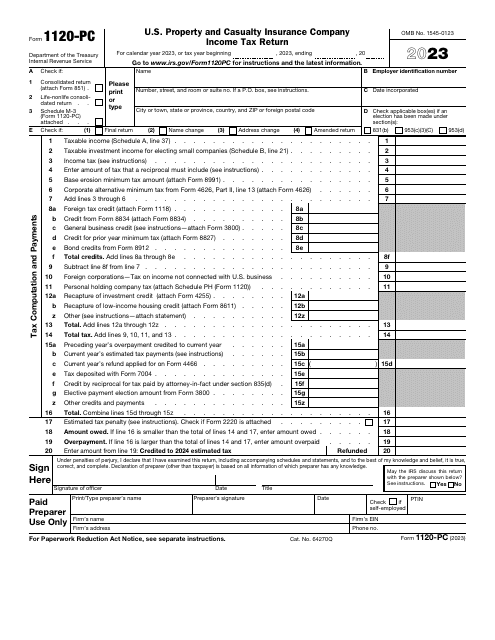

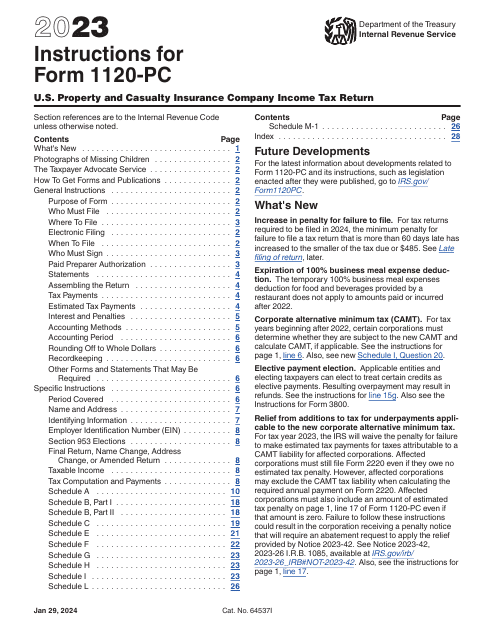

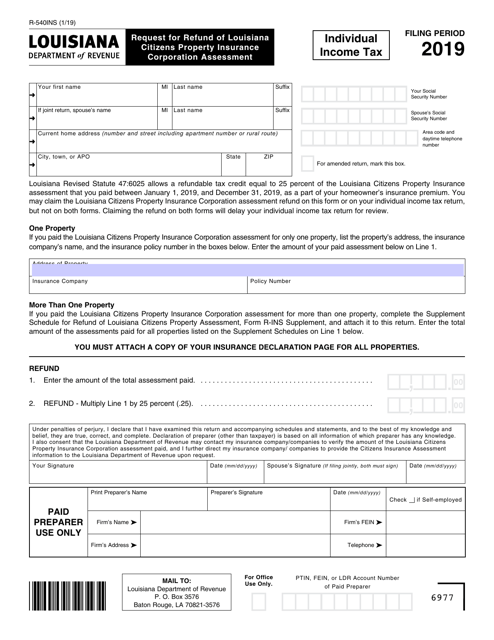

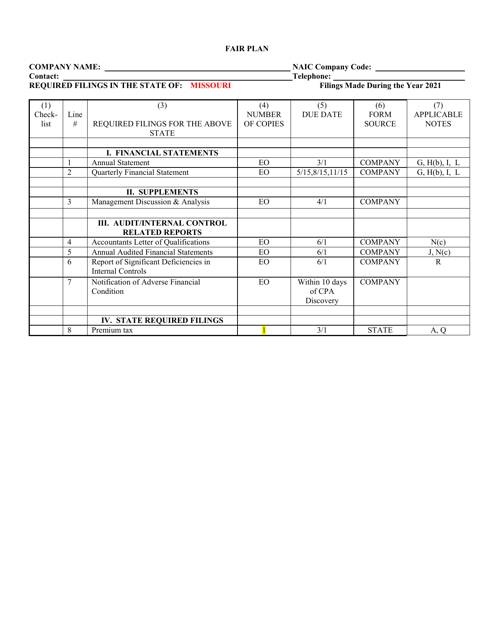

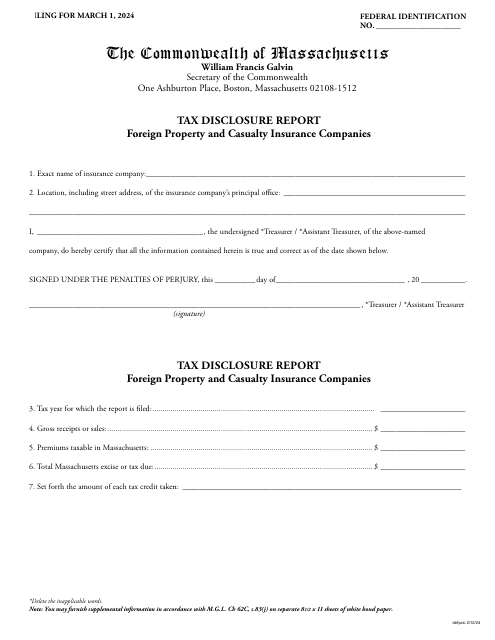

This form is filed by non-life insurance companies wishing to inform the Internal Revenue Service (IRS) of their income, deductions, and credits, as well as to figure their income tax liability.

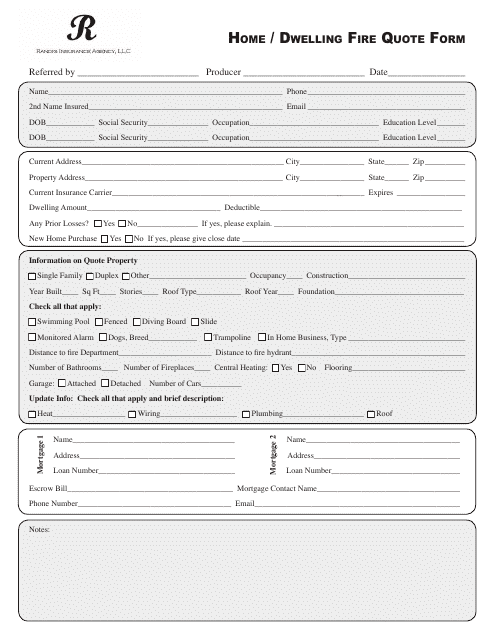

This form is used to request a quote for insurance coverage on a home or dwelling. Fill out the form with your information and submit it to Randig Insurance Agency to get an estimate.

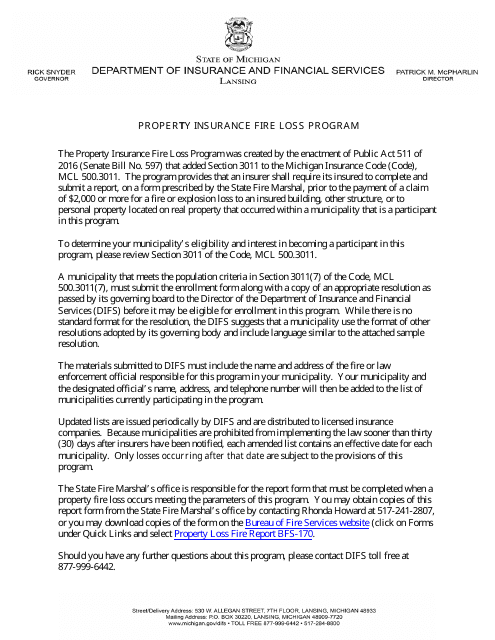

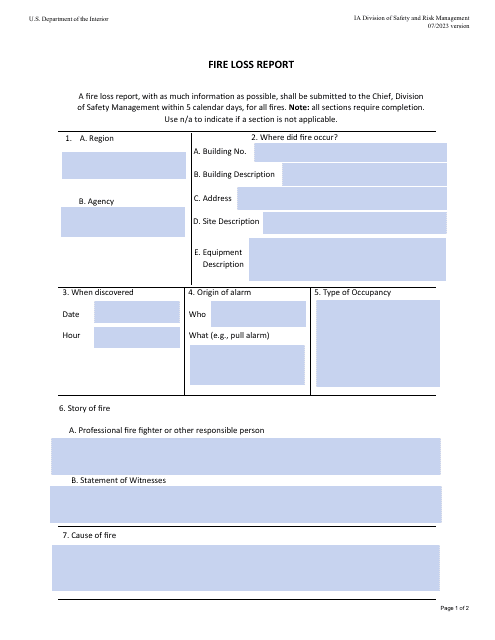

This form is used for enrolling in the Property Insurance Fire Loss Program and notifying the authorities in Michigan.

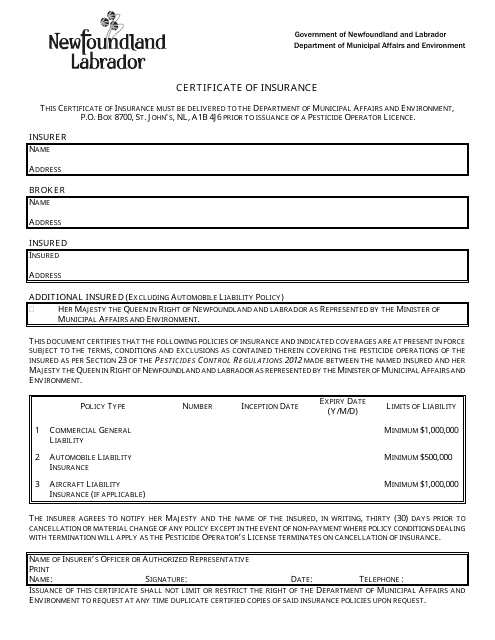

This document verifies that an individual or company has insurance coverage in the province of Newfoundland and Labrador, Canada.

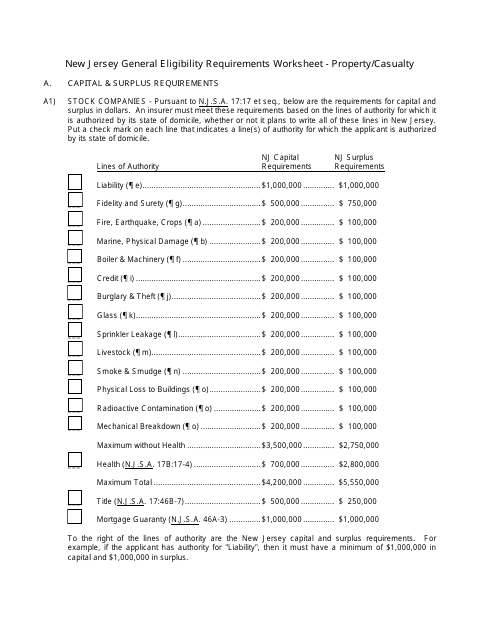

This document is a worksheet used in New Jersey to determine the general eligibility requirements for property/casualty insurance.

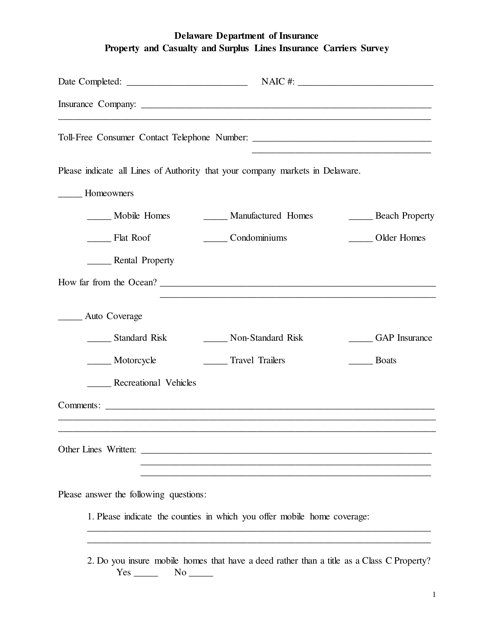

This survey is used to gather information about property and casualty insurance carriers in Delaware, including those that handle surplus lines.

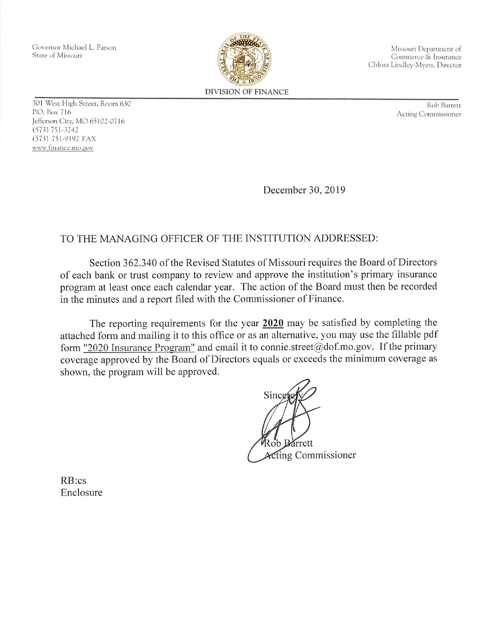

This form is used for applying for an insurance program in the state of Missouri.

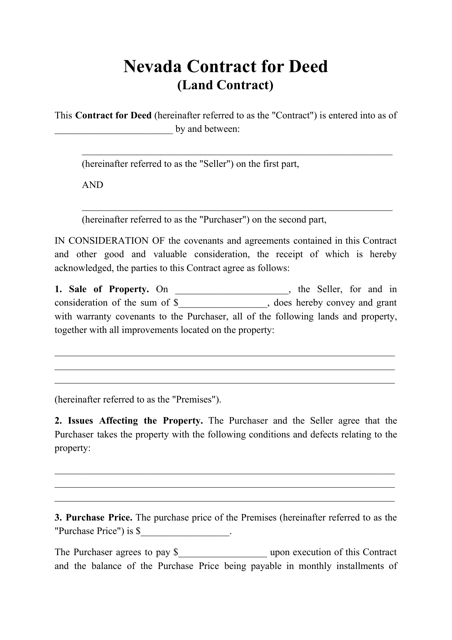

This document is a legally binding contract used in Nevada for the sale of land. It allows the buyer to make installment payments and take possession of the property while the seller retains legal ownership until the full purchase price is paid.

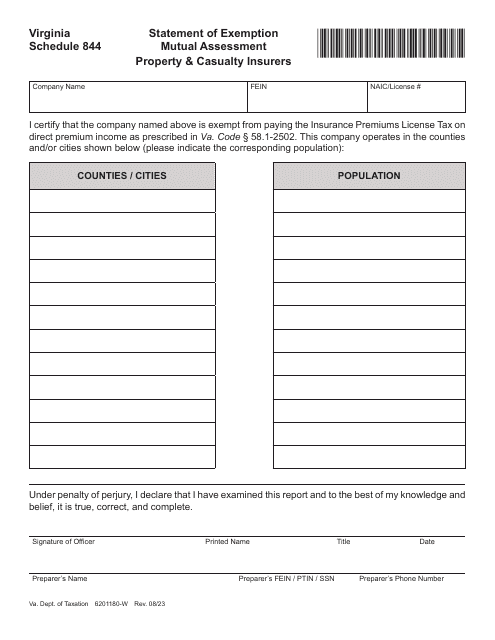

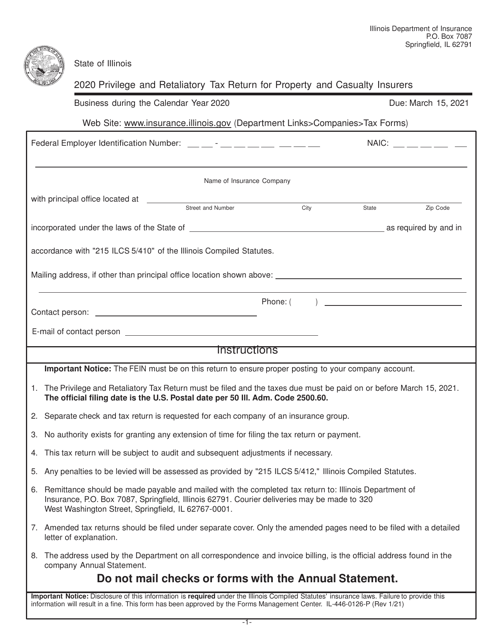

This Form is used for filing the Privilege and Retaliatory Tax Return for Property and Casualty Insurers in Illinois. It must be completed by property and casualty insurers to report and pay their taxes.

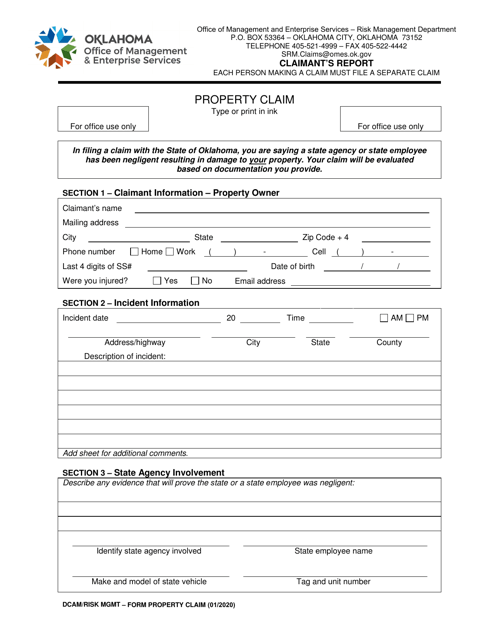

This document is used for filing a property claim in the state of Oklahoma. It helps individuals report damages or losses to their property and seek compensation or repairs.

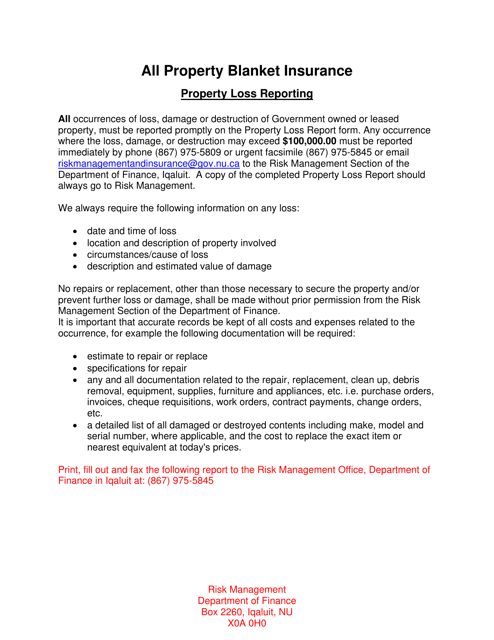

This document is used for reporting property losses in the Nunavut region of Canada.

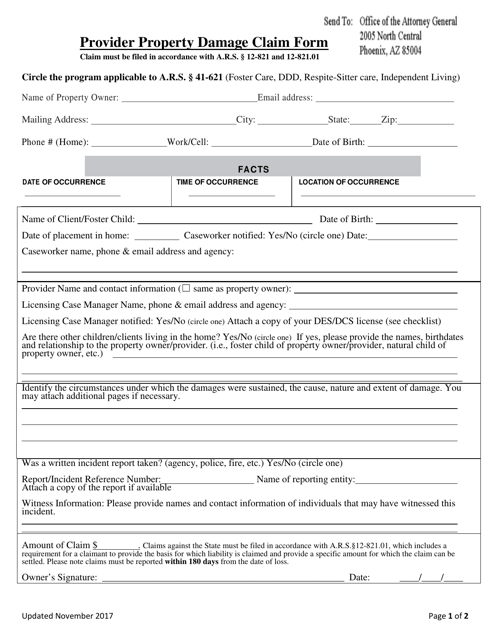

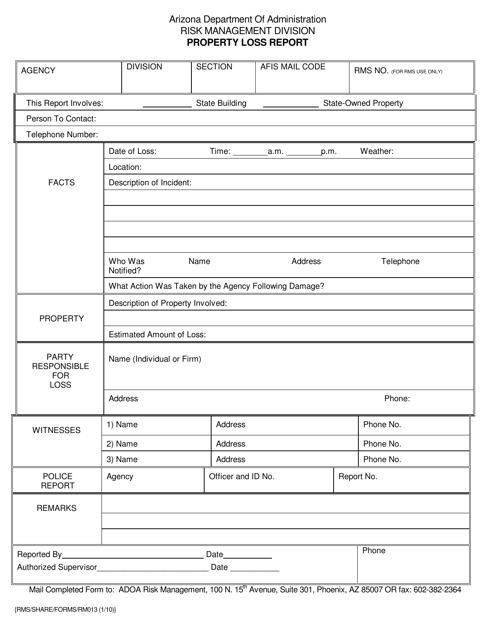

This document is used for filing a property damage claim in Arizona. It is used by insurance providers to gather information about the claim and assess the damage.

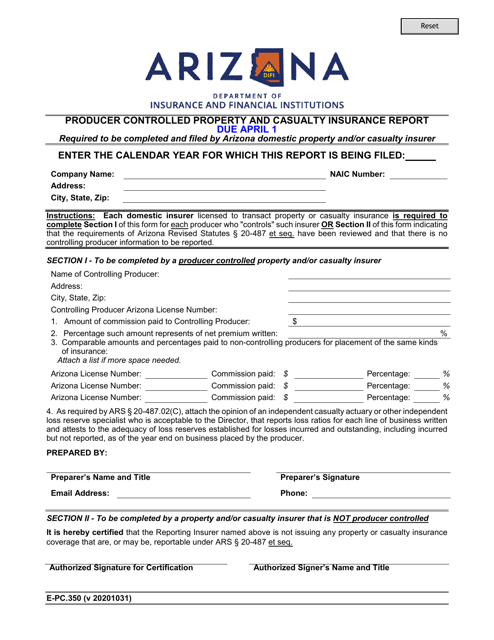

This form is used for reporting producer controlled property and casualty insurance in Arizona.

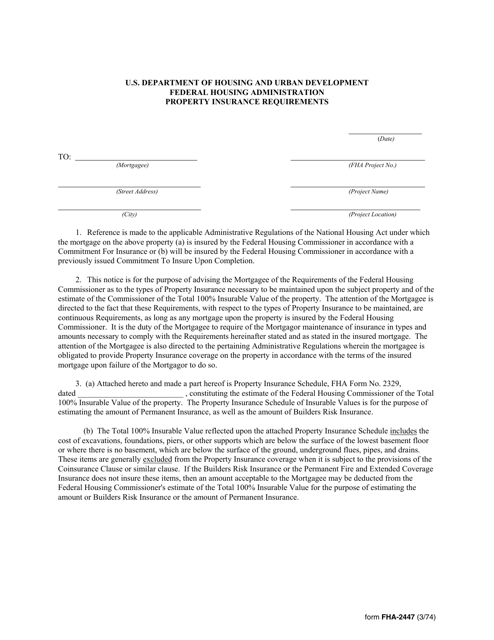

This form is used for documenting the property insurance requirements for FHA loans. It outlines the necessary insurance coverage for the property being financed.

This document is used for reporting property losses that occurred in Arizona. It helps collect necessary information for insurance claims and legal purposes.

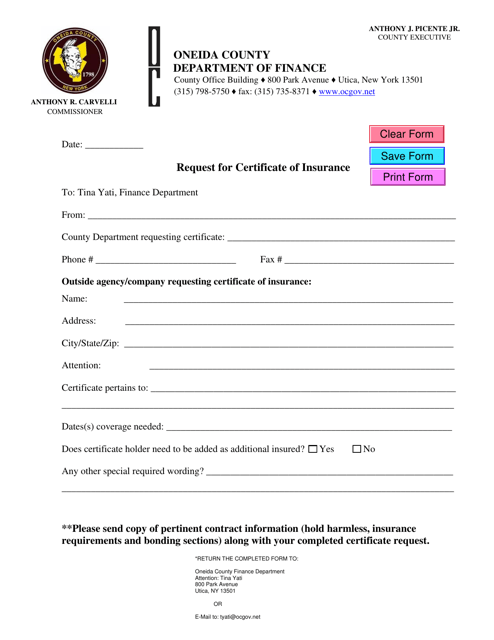

This type of document is a request for a certificate of insurance specific to Oneida County, New York. It is used to formally ask for proof of insurance coverage.

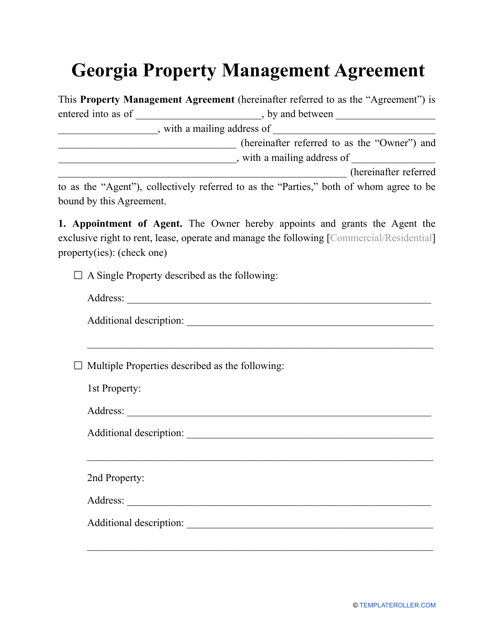

This template is used in Florida and signed by a business or individual agreeing to manage a property and the owner of the property.

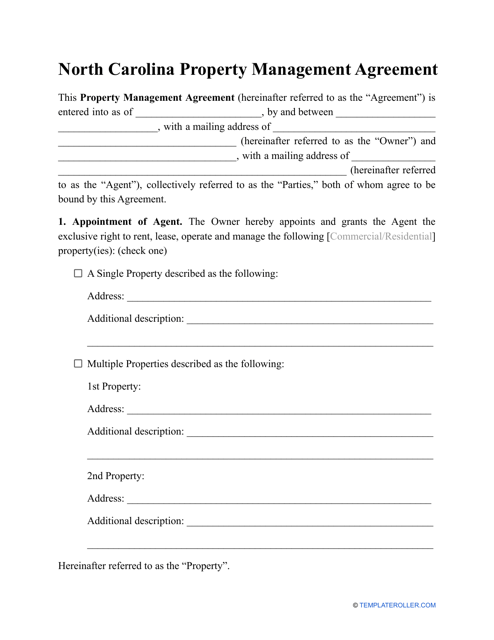

This is a legally binding template used in North Carolina and signed between the property owner and the company or individual they have hired to maintain their property.

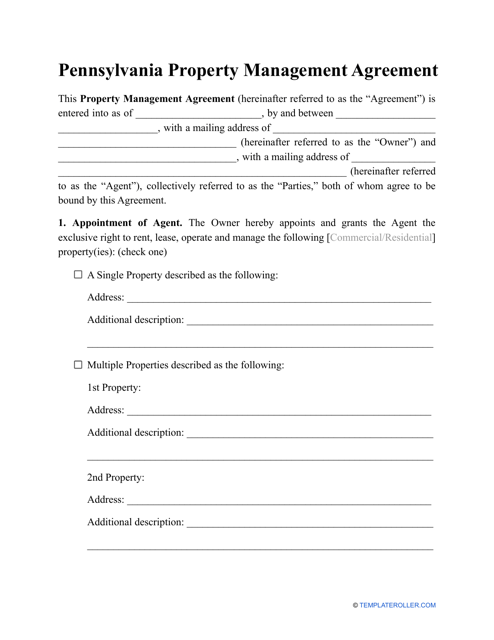

This template permits another party to legally manage a property with full permission from the owner of the property in the state of Pennsylvania.

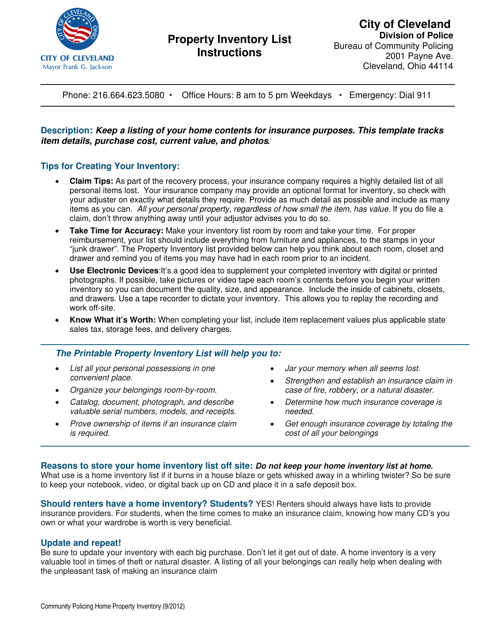

This Form is used for creating a record of the items in your home for insurance purposes in the City of Cleveland, Ohio.

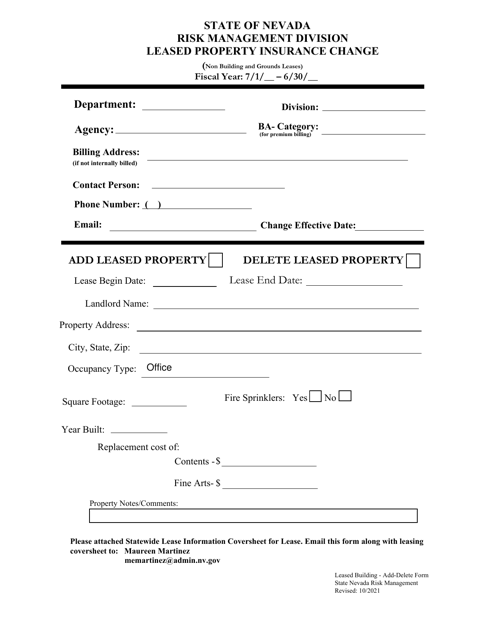

This document is used for making changes to the insurance coverage for a leased property in the state of Nevada.

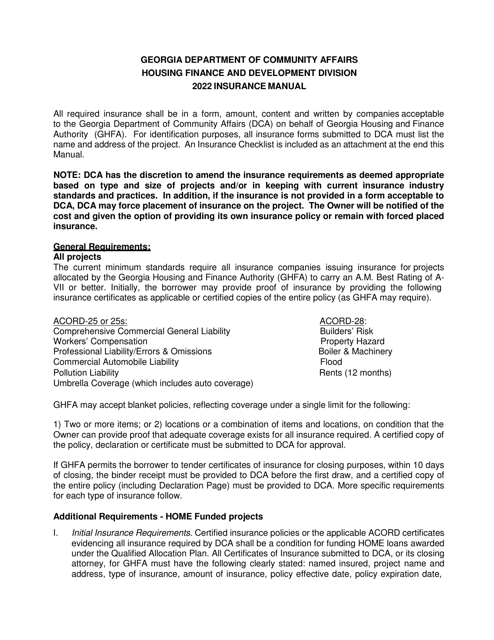

This checklist is used to guide residents in Georgia on the important factors to consider when getting insurance coverage. It covers various types of insurance such as auto, home, and medical.

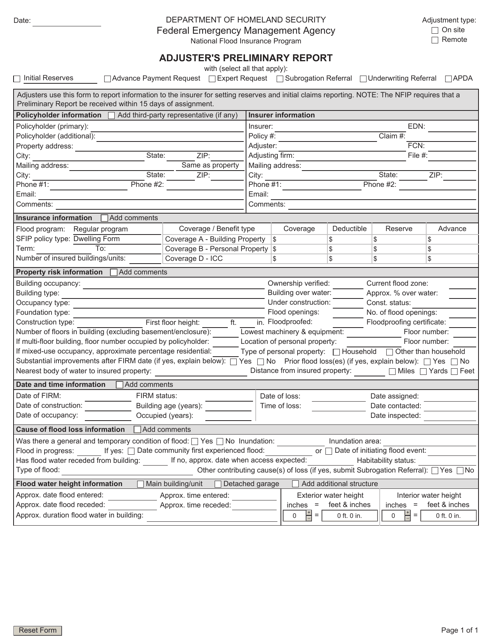

This document is used by insurance adjusters to provide an initial assessment and report on the damage and value of a claim. It helps determine the next steps for the claims process.

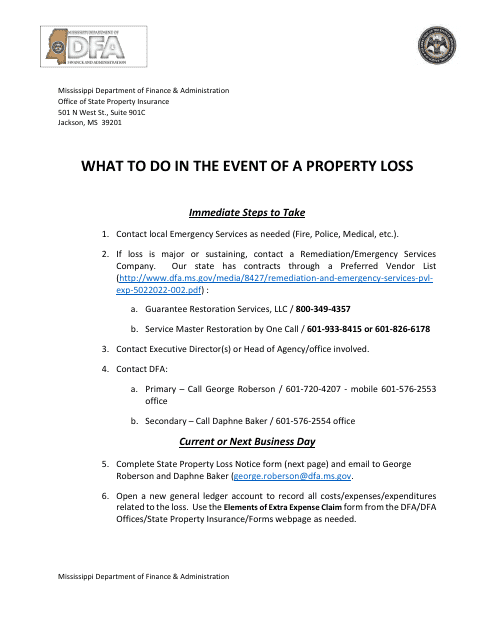

This form is used for reporting property losses to the state of Mississippi. It is an official document that helps individuals and businesses report any property damage or loss that they have experienced within the state.

This document outlines the insurance requirements that must be met when applying for Small Business Administration (SBA) loans. It details the types of insurance coverage that businesses must have in order to qualify for an SBA loan and protect their assets.