Jobs Tax Credit Templates

Are you a business owner looking to receive tax incentives? Look no further than the Jobs Tax Credit program. Also known as the job tax credit, this program offers financial benefits to companies that create jobs and stimulate economic growth in various regions.

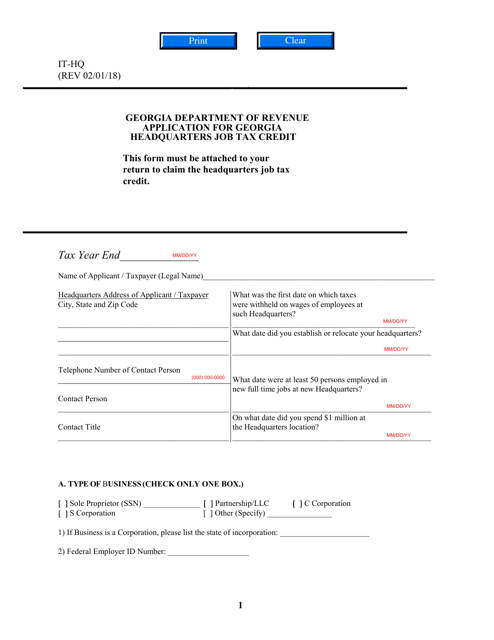

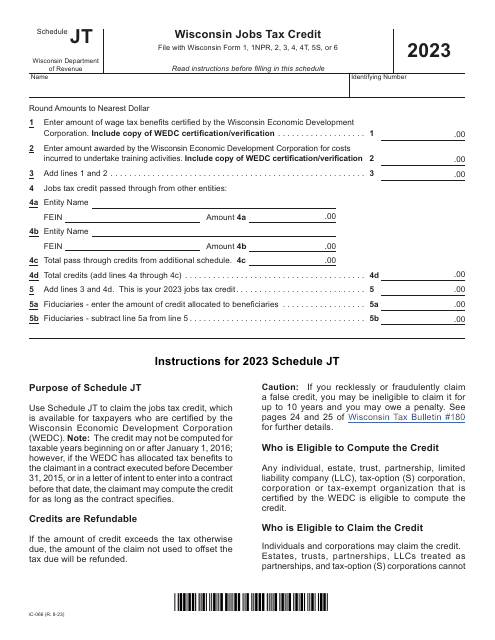

By taking advantage of the Jobs Tax Credit, businesses can receive substantial tax credits on their state income tax. These credits can be claimed by filling out specific application forms, such as the Form IT-HQ Application for Georgia Headquarters Job Tax Credit in Georgia, or the Form IC-066 Schedule JT Wisconsin Jobs Tax Credit in Wisconsin.

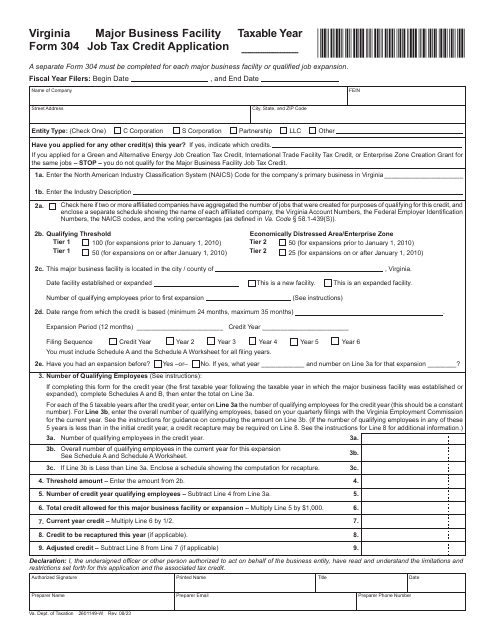

One of the key documents in the Jobs Tax Credit program is the Form 304 Major Business Facility Job Tax Credit Application in Virginia. This document allows businesses to apply for tax credits for major facility projects that result in job creation.

To ensure that the Jobs Tax Credit program is effective and transparent, certain states, like Georgia, require companies to submit a notice of intent, such as Appendix F Notice of Intent for Georgia Job Tax Credit, in addition to the application forms.

The Jobs Tax Credit program offers a valuable opportunity for businesses to receive significant tax benefits while contributing to job growth and economic development. Don't miss out on these incentives – start your journey towards receiving the jobs tax credit today!

Documents:

6

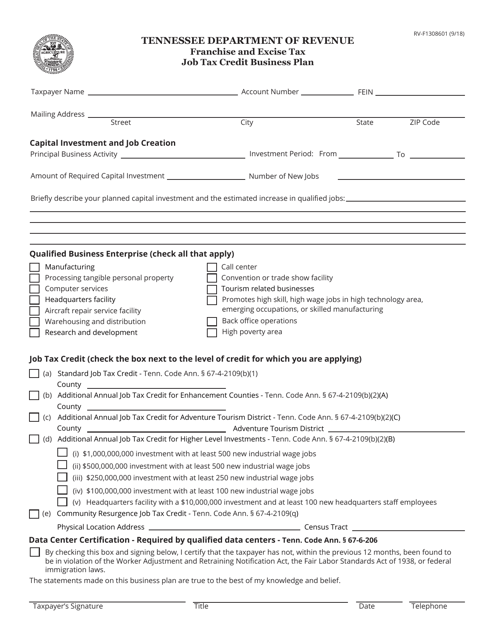

This form is used for submitting a business plan to apply for a job tax credit in Tennessee.

This form is used for applying for the Georgia Headquarters Job Tax Credit in the state of Georgia.