Loan Interest Rates Templates

Looking for the best loan interest rates? Look no further! Our comprehensive collection of loan interest rate documents will help you make informed decisions about your financial future. Whether you're a homebuyer, a student looking for loan options, or a business owner seeking funding, we've got you covered. Our documents cover a wide range of topics, including VA loans, clean water fund loans, and streamlined loan servicing. Whether you're in Alabama, North Carolina, or anywhere else in the US or Canada, our documents will provide you with the guidance you need to navigate the world of loan interest rates. Don't miss out on the opportunity to find the best loan interest rates for your needs. Start exploring our collection today!

Documents:

12

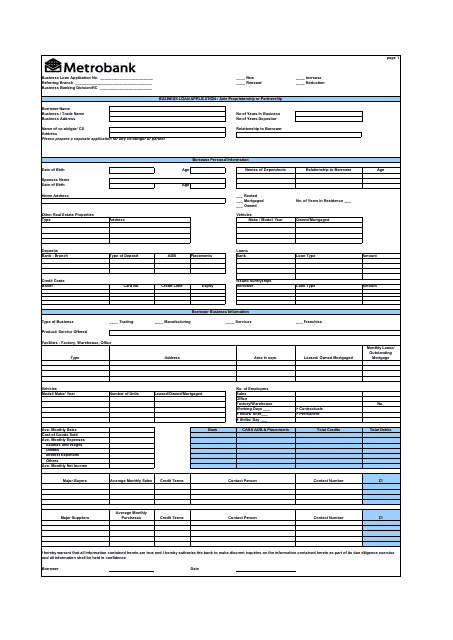

This document is used for applying for a business loan with Metrobank.

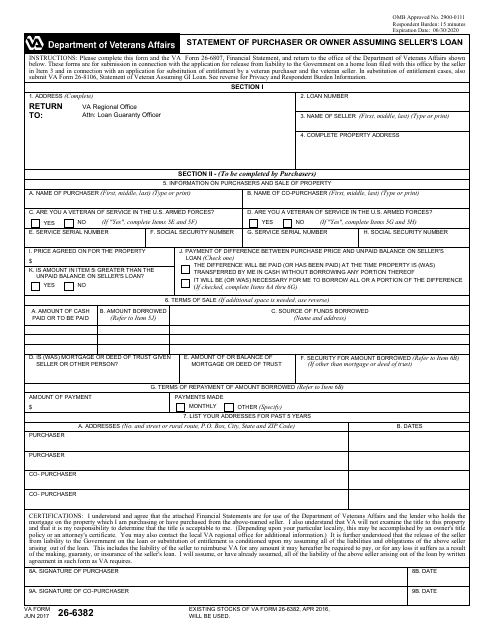

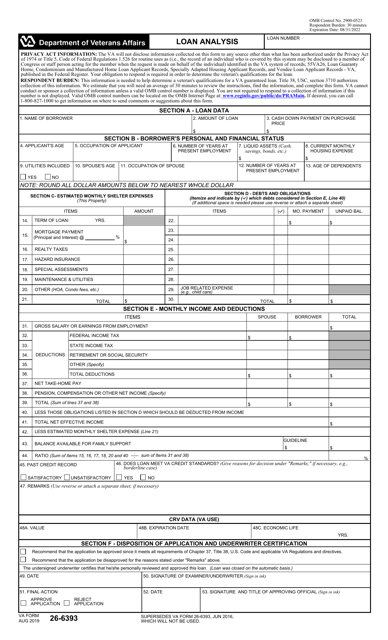

This Form is used for buyers or owners who are assuming the seller's loan.

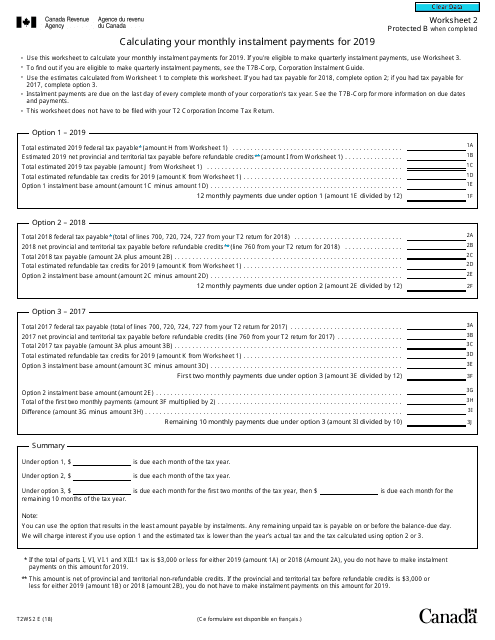

This form is used for calculating your monthly installment payments in Canada. It helps you determine how much you need to pay each month for various types of loans or financing arrangements.

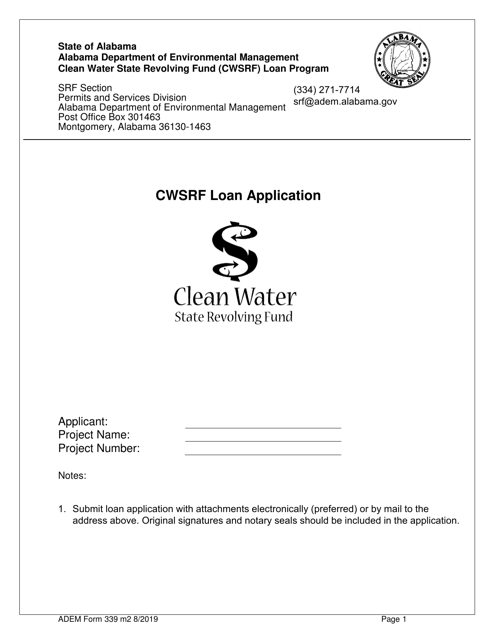

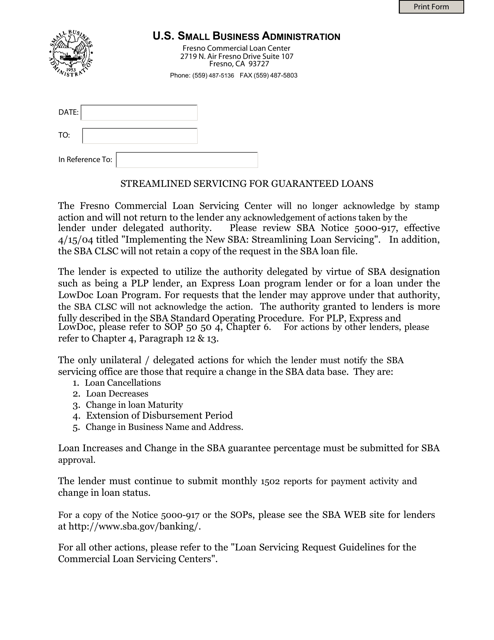

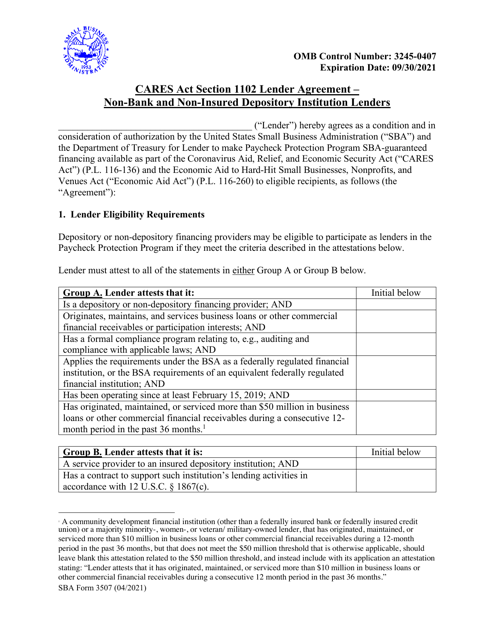

This document provides information and guidelines for a simplified process of managing and servicing loans that are guaranteed by a certain entity. It outlines the steps and requirements for efficient loan administration.

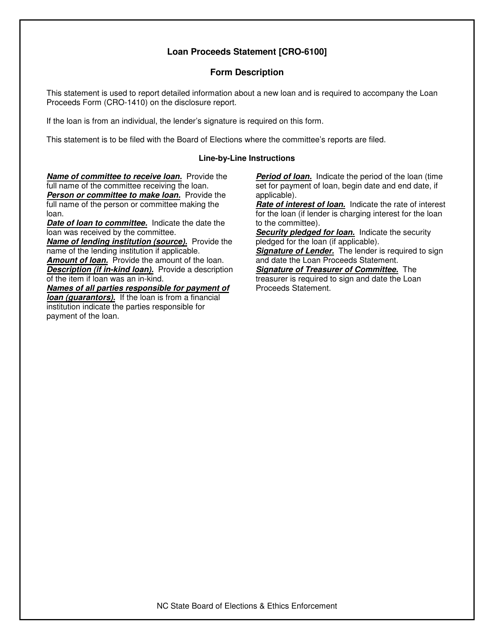

This form is used to provide instructions for completing Form CRO-6100 Loan Proceeds Statement in North Carolina. It provides guidance on how to accurately report loan proceeds for various purposes.

This document is for first-time homebuyers participating in the CalHome Program in California. It is a promissory note that outlines the terms of the loan, repayment schedule, and other details related to the home purchase.

This document is used for submitting an affidavit related to the Servicemembers Civil Relief Act in Pennsylvania. The form is available in both English and Chinese Simplified languages.

This form is used for lenders to certify compliance with specific requirements for the OneHome Program.

This document provides guidance and important information for borrowers of federal student loans who are preparing to exit or finish their loan repayment. It helps borrowers understand their rights and responsibilities and provides tips for managing their student loan debt after graduation.