Vehicle Use Tax Templates

If you are purchasing, selling, or transferring a vehicle in the United States or Canada, you may be subject to a vehicle use tax. This tax, also known as the vehicle use fee or vehicle use surcharge, is a fee imposed on the use of motor vehicles.

The vehicle use tax is collected by the respective state or provincial tax authorities and is used to fund infrastructure projects, road maintenance, and other transportation-related initiatives. This tax is typically based on the value of the vehicle and is paid by the buyer or seller at the time of registration or transfer of ownership.

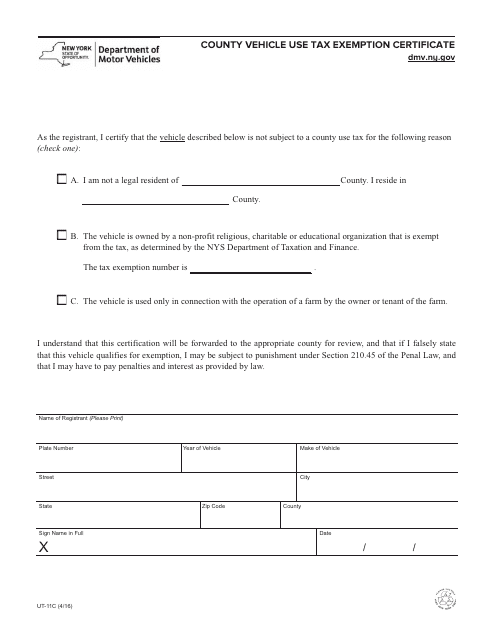

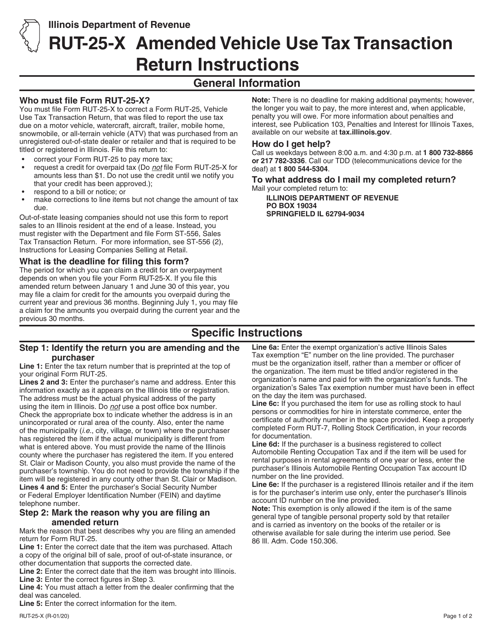

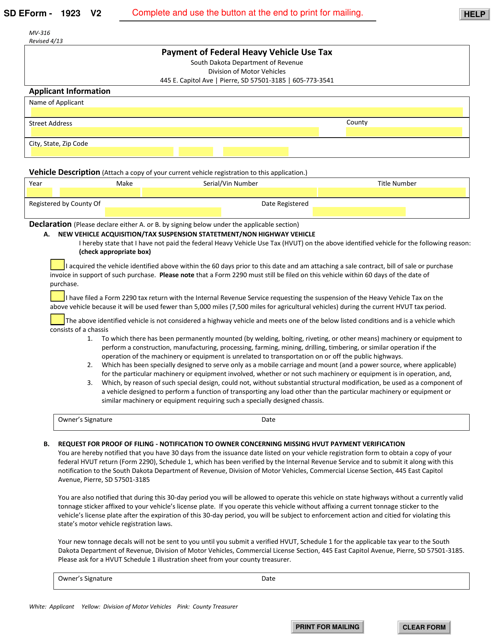

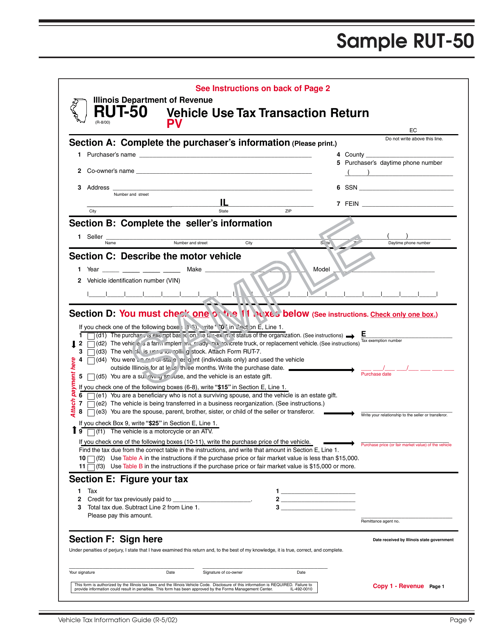

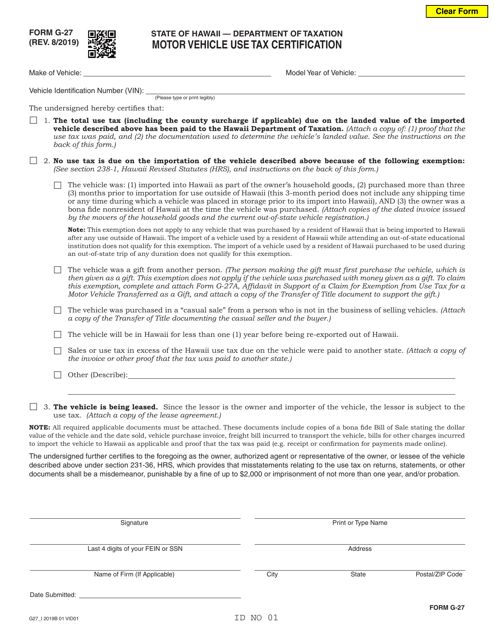

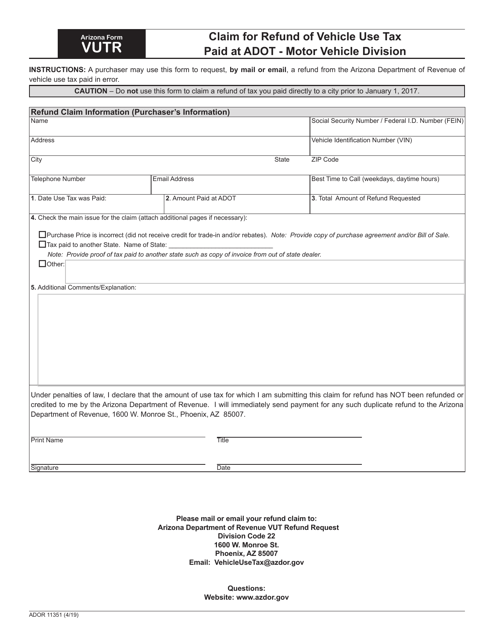

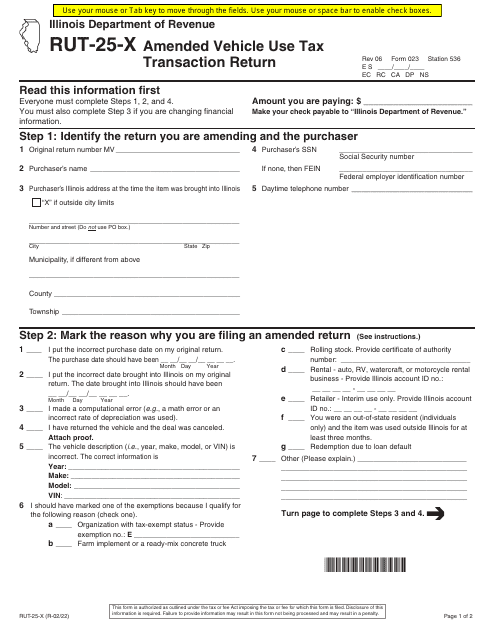

To comply with the vehicle use tax regulations, various documents and forms must be filed with the appropriate tax authority. These documents include the Form UT-11C County Vehicle Use Tax Exemption Certificate in New York, the Form CDTFA-106 Vehicle/Vessel Use Tax Clearance Request in California, the Arizona Form VUTR (ADOR11351) Claim for Refund of Vehicle Use Tax Paid at Adot - Motor Vehicle Division in Arizona, and the Form RUT-25-X (023) Amended Vehicle Use Tax Transaction Return in Illinois.

Filing these documents accurately and on time is crucial to avoid penalties or delays in vehicle registration or transfer of ownership. Whether you are claiming an exemption, requesting a refund, or amending a previous tax return, it is essential to understand the requirements and procedures involved in the vehicle use tax process.

If you are unsure about the specific requirements in your state or province, consult with a knowledgeable tax professional or visit the official website of your local tax authority for guidance. Compliance with the vehicle use tax regulations ensures that you contribute your fair share towards maintaining and improving the transportation infrastructure in your area.

Documents:

19

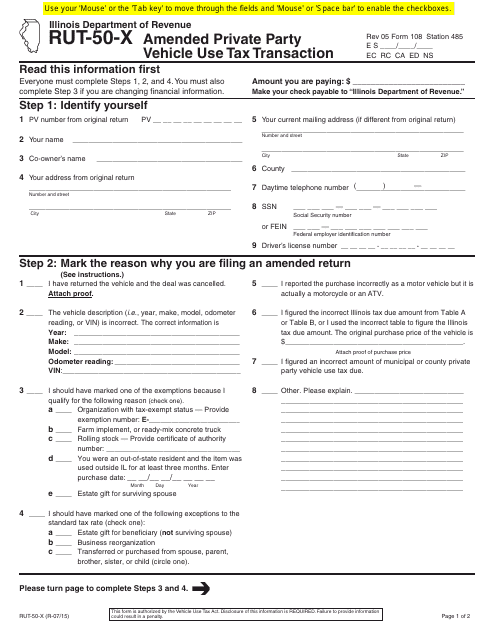

This form is used for reporting an amended private party vehicle use tax transaction in Illinois.

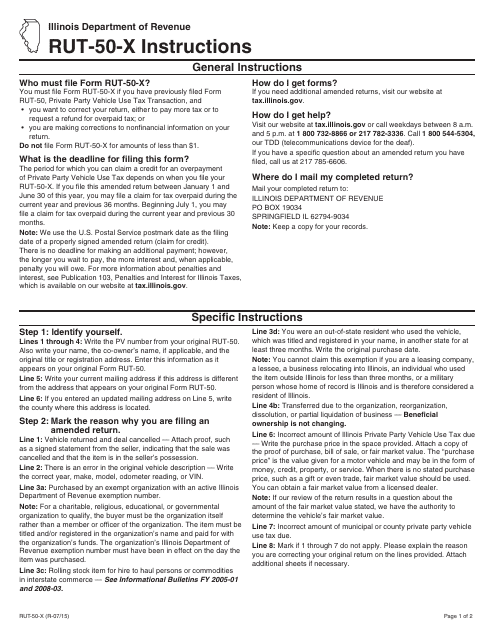

This form is used for amending a private party vehicle use tax transaction in Illinois. It provides instructions on how to properly complete the Form RUT-50-X.

This form is used for individuals or businesses in New York to claim an exemption from paying vehicle use tax for county vehicles.

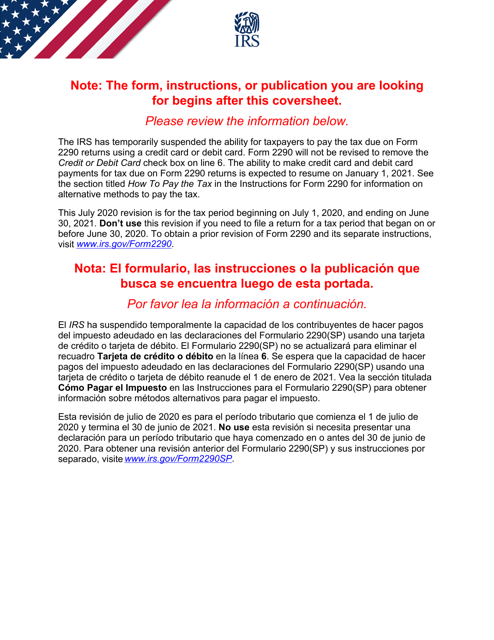

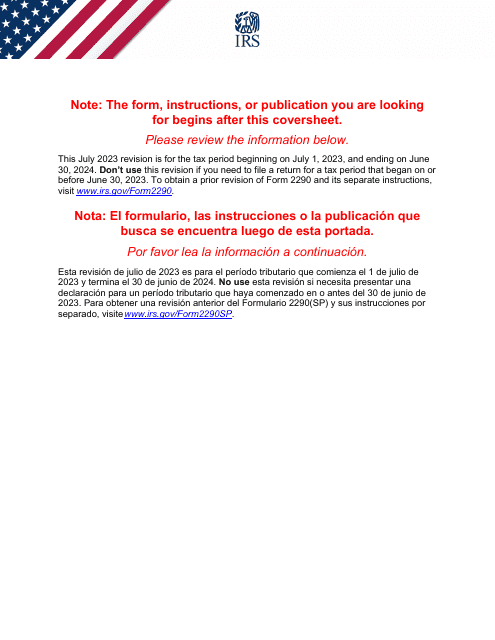

This form is used for paying the federal heavy vehicle use tax in South Dakota.

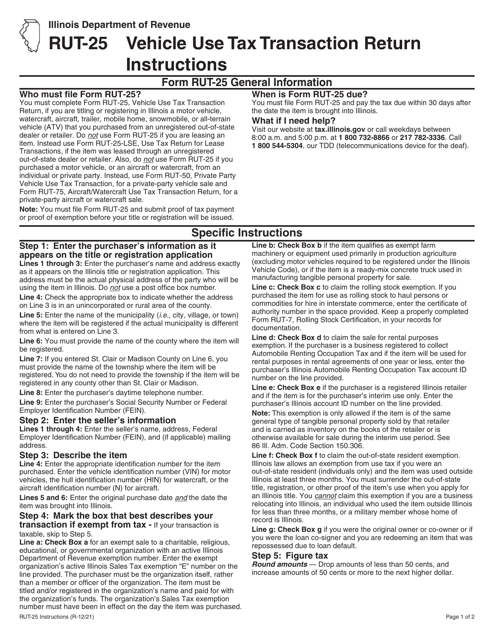

Use this form as a legal document completed by Illinois residents who purchased or acquired by transfer or gift a motor vehicle from a private party in the state of Illinois.

This Form is used for reporting and paying the heavy vehicle use tax in Spanish. It is specifically designed for Spanish-speaking individuals or businesses who operate heavy vehicles on US highways.

This Form is used for claiming a refund of vehicle use tax paid at the Arizona Department of Transportation's Motor Vehicle Division.

This Form is used for filing an amended vehicle use tax transaction return in the state of Illinois. It provides instructions for correctly completing and submitting Form RUT-25-X, which is used to report any changes or corrections to a previously filed vehicle use tax transaction return.

This form is used for reporting and amending vehicle use tax transactions in Illinois. It is specifically meant for taxpayers to correct any errors or changes in their previous vehicle use tax returns.