Electric Cooperatives Templates

Electric cooperatives, also known as electric cooperative or rural electric cooperatives, play a vital role in providing electricity to rural and underserved areas. These member-owned organizations are distinct from traditional utility companies, prioritizing the needs of their members rather than generating profits. Electric cooperatives ensure that everyone has access to reliable and affordable electricity.

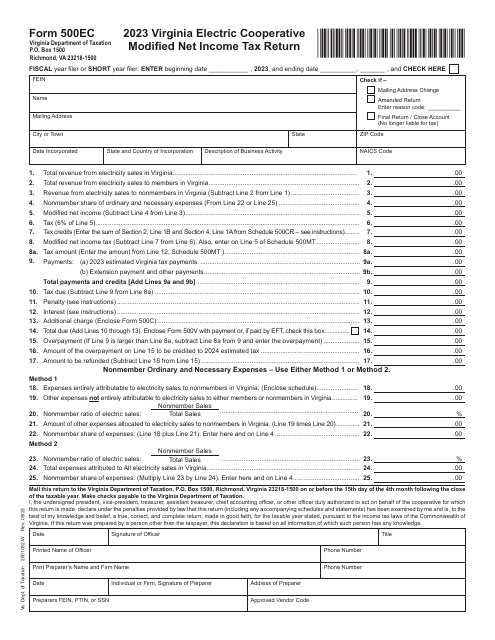

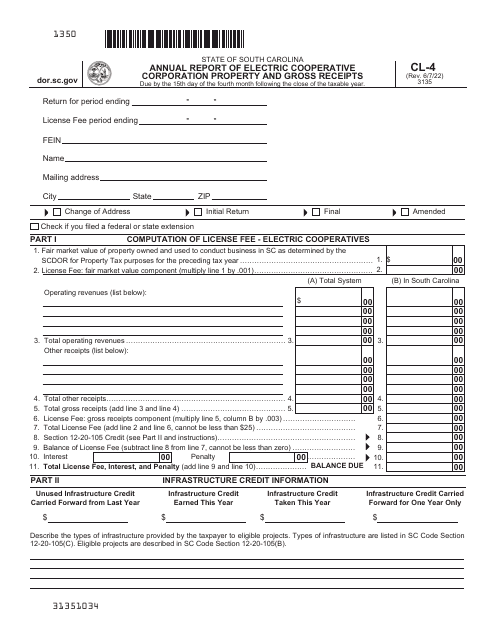

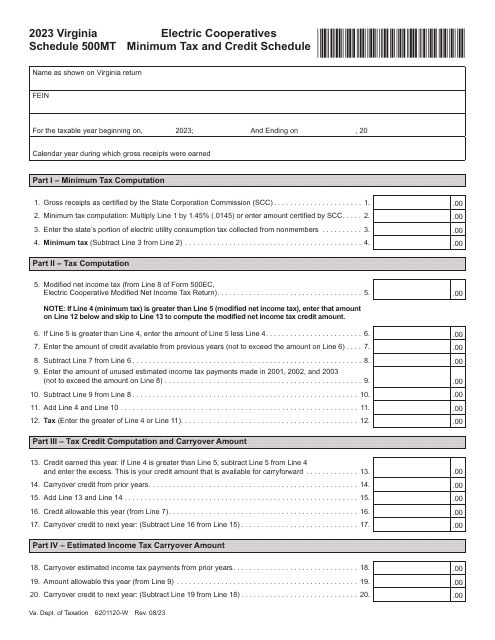

Form 500EC Electric Cooperative Modified Net Income Tax Return - Virginia and other similar documents are an important part of the financial and regulatory obligations of electric cooperatives. These forms help co-ops report their net income for tax purposes and comply with the state's requirements. By fulfilling these obligations, electric cooperatives demonstrate transparency and accountability as they serve their communities.

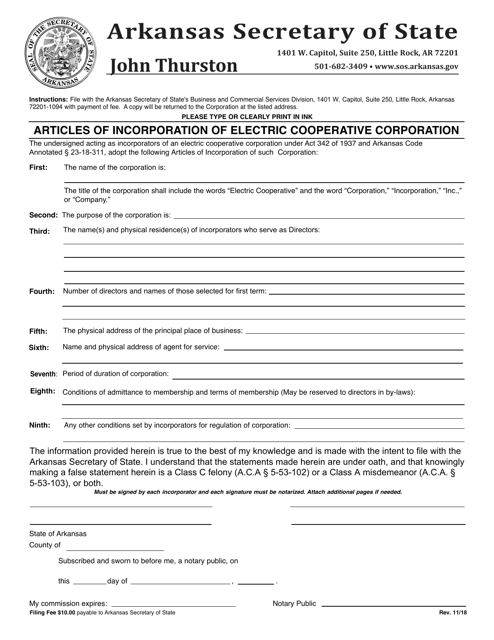

Another essential document is the Articles of Incorporation of Electric Cooperative Corporation - Arkansas. This document formalizes the creation of the electric cooperative corporation, outlining its purpose, structure, and governance. It establishes the cooperative as a legal entity and sets the framework for its operations.

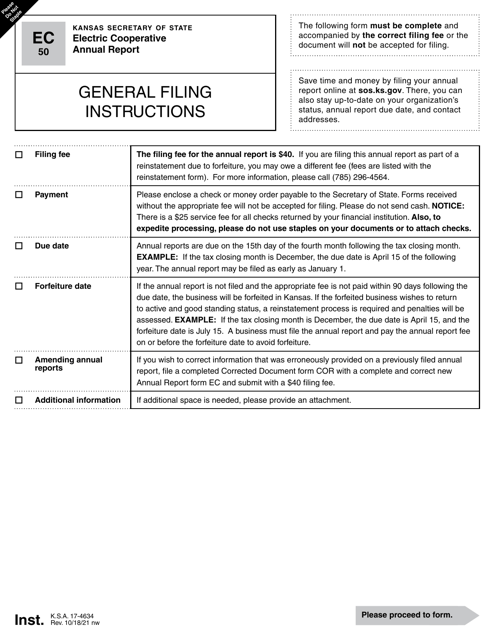

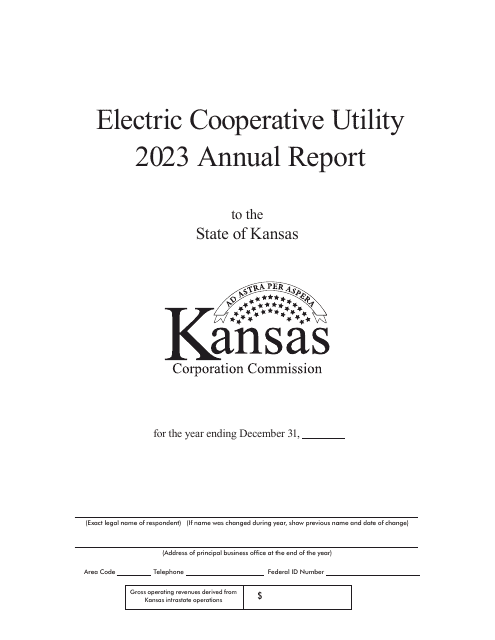

Form EC50 Electric Cooperative Annual Report - Kansas is an annual report that electric cooperatives in Kansas submit to provide an overview of their activities and financial performance. This document helps regulators, members, and other stakeholders understand the cooperative's impact on the community and its commitment to delivering essential electric services.

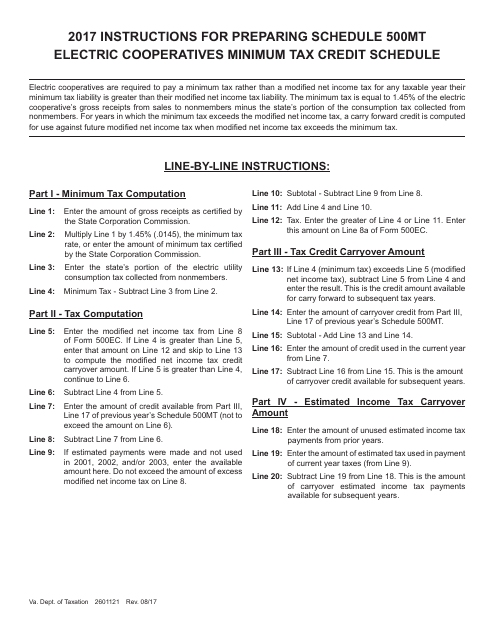

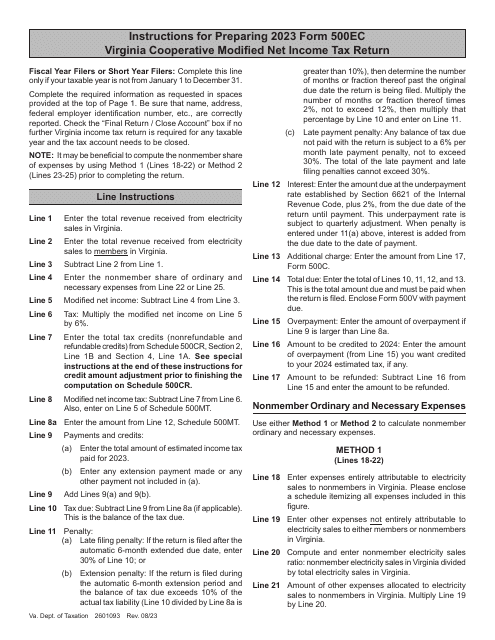

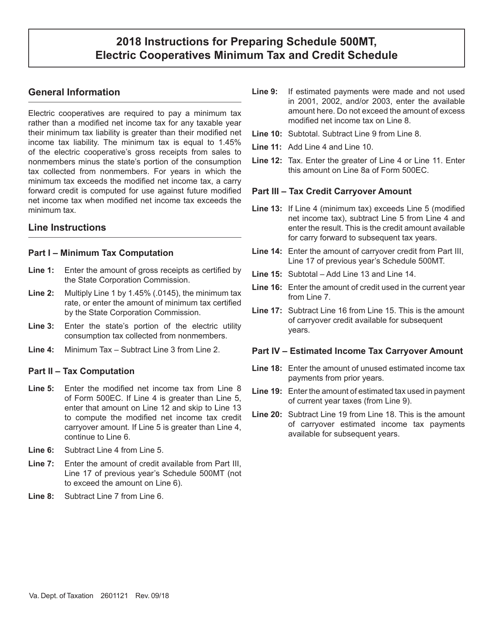

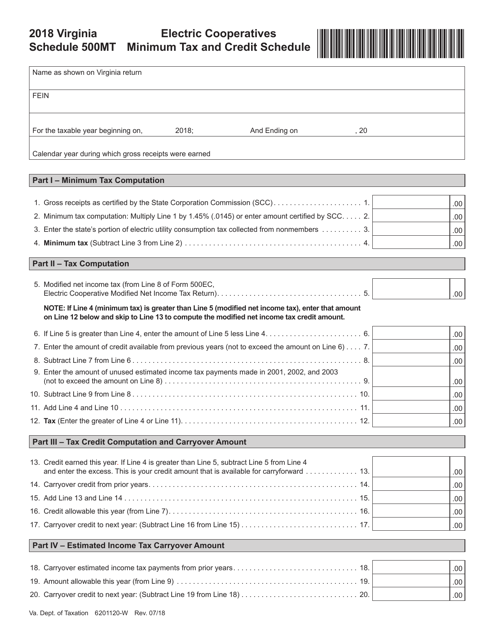

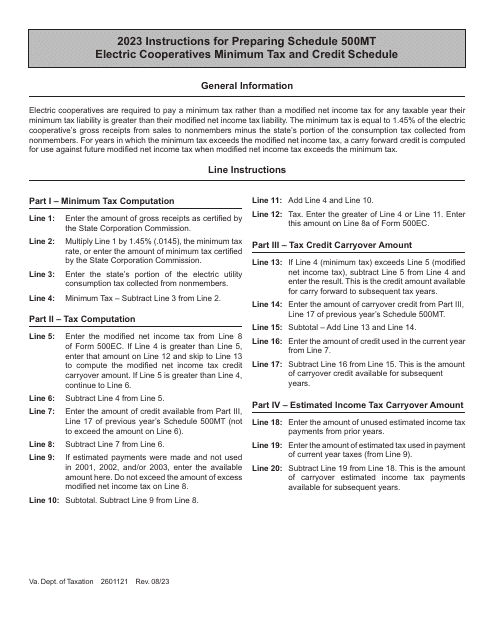

Instructions for Form 500EC Virginia Electric Cooperative Modified Net Income Tax Return - Virginia offer detailed guidance on completing the tax return form correctly. These instructions ensure that electric cooperatives accurately report their net income, deductions, and credits. Following these instructions is crucial to comply with tax regulations and maintain the integrity of the cooperative's financial records.

Whether it's tax returns, articles of incorporation, or annual reports, these documents are essential for the proper functioning and governance of electric cooperatives. They demonstrate the cooperatives' commitment to transparency, accountability, and serving the best interests of their members and communities.

Documents:

26

This Form is used for reporting the Minimum Tax Credit Schedule for Electric Cooperatives in Virginia.

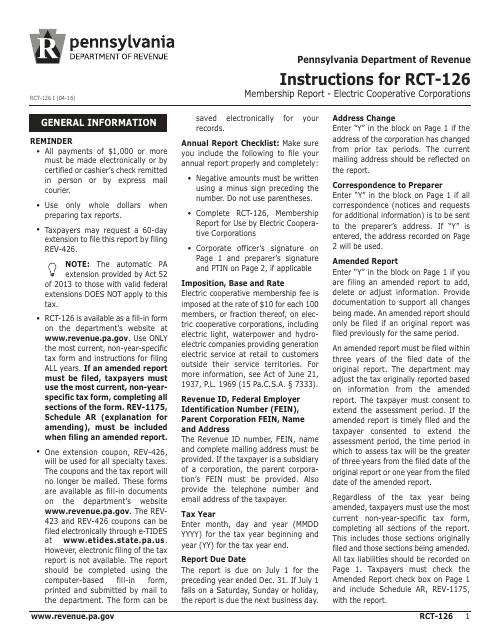

This Form is used for reporting membership information for electric cooperative corporations in Pennsylvania. It provides instructions on how to complete and submit the Form RCT-126 Membership Report.

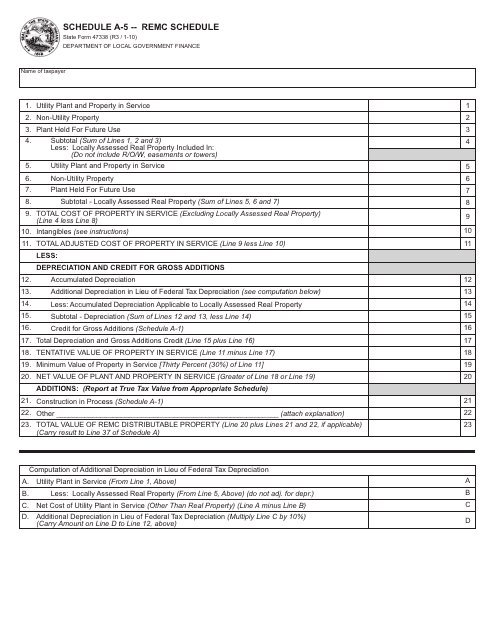

This Form is used for reporting and tracking remc schedules for the state of Indiana.

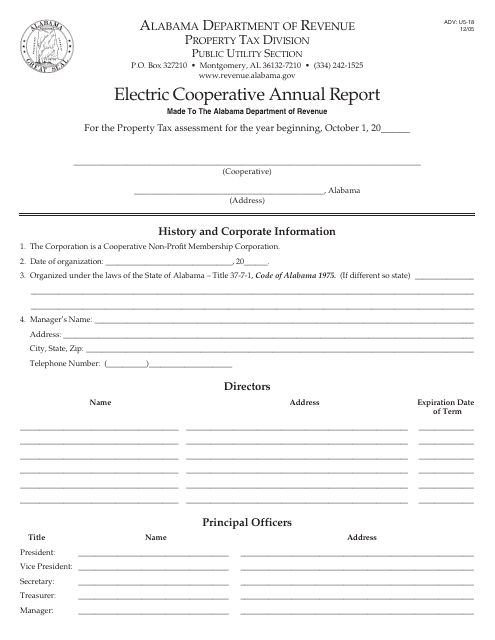

This document is the Form ADV: U5-18 Electric Cooperative Annual Report for Alabama.

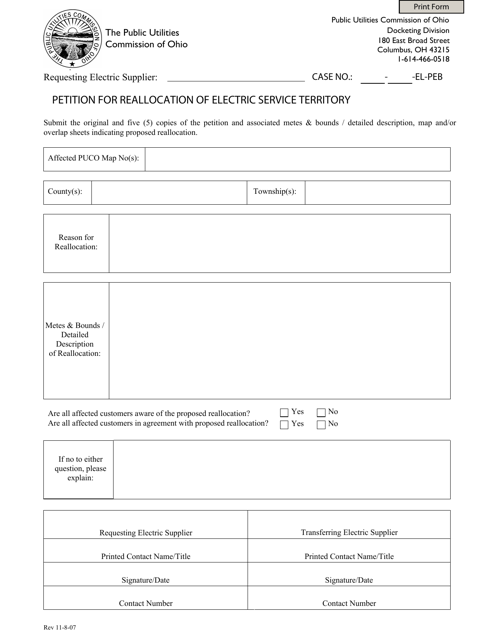

This document is used for petitioning the reallocation of electric service territory in Ohio.

Form 6201120-W Schedule 500MT Electric Cooperatives Minimum Tax and Credit Schedule - Virginia, 2018

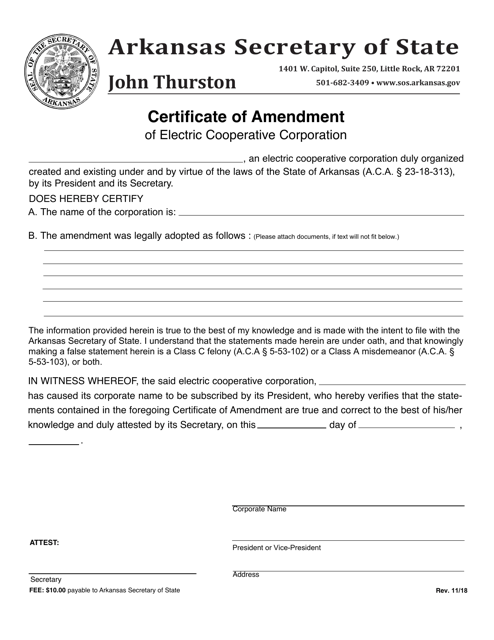

This document is used for making changes or amendments to the articles of incorporation of an electric cooperative corporation in the state of Arkansas.

This document is the Articles of Incorporation for an Electric Cooperative Corporation in Arkansas. This form is used to legally establish the corporation and outlines its purpose and structure.