State Sales Tax Templates

Are you wondering about the state sales tax and how it may affect you or your business? Look no further! We have compiled a comprehensive collection of documents and resources related to state sales taxes to help you navigate this complex area.

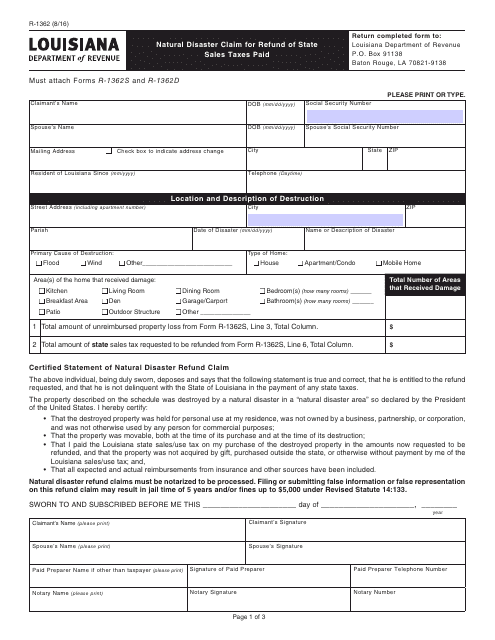

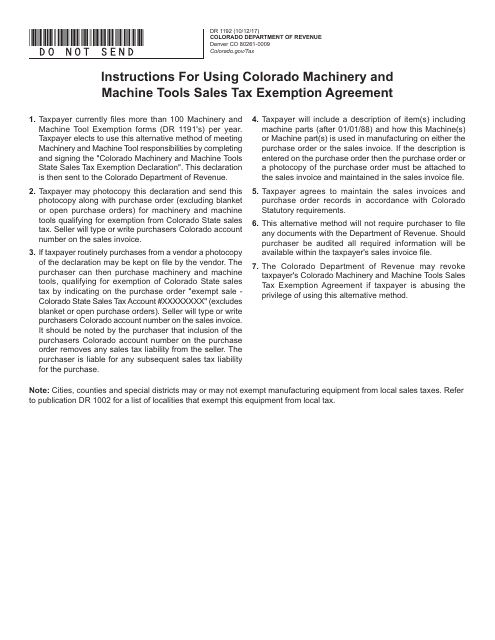

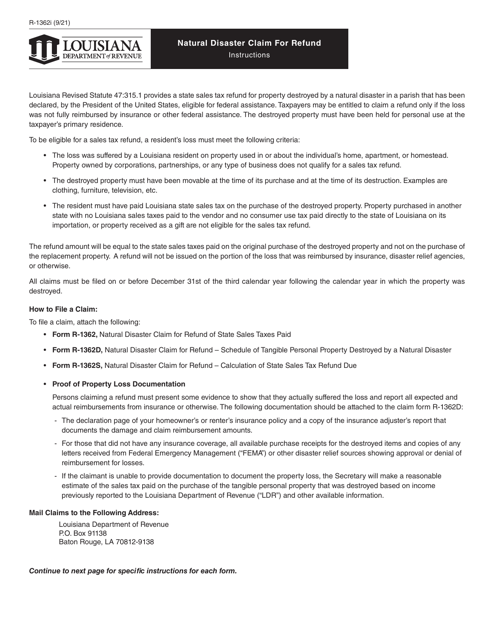

Explore our extensive database of documents, including the Form R-1362 Natural Disaster Claim for Refund of State Sales Taxes Paid in Louisiana and the Form DR1192 Colorado Machinery and Machine Tools State Sales Tax Exemption Declaration in Colorado. These documents provide valuable insights into the process of claiming refunds or exemptions for state sales taxes.

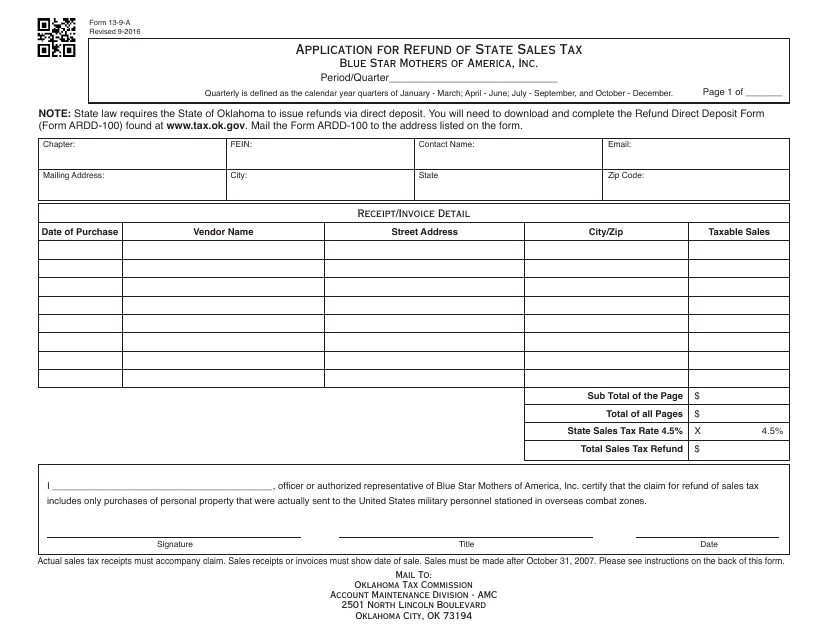

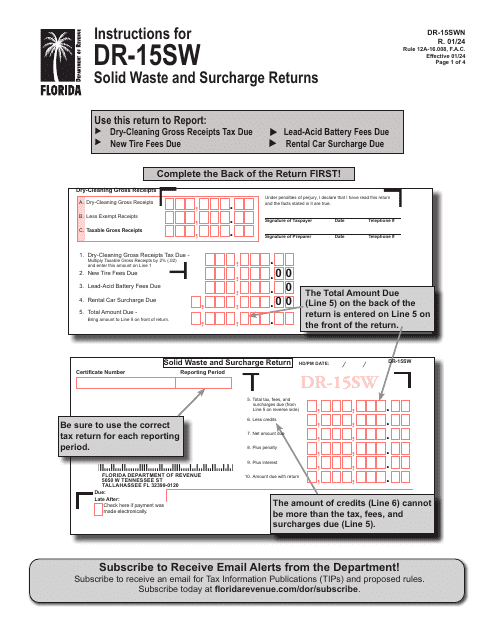

If you're looking for information on how to obtain a refund for state sales taxes paid in Oklahoma, you can find it in the OTC Form 13-9-A Application for Refund of State Sales Tax. Alternatively, if you're interested in learning about the state sales tax return process for solid waste and surcharges in Florida, our detailed Instructions for Form DR-15SW Solid Waste and Surcharge Return will guide you through the process.

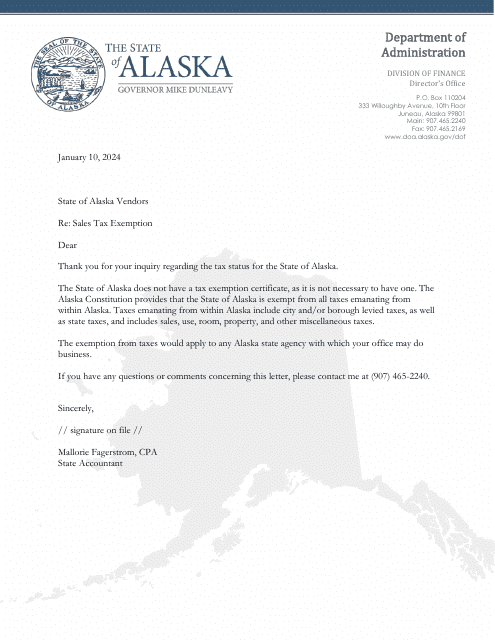

Our collection also includes a State Sales Tax Exemption - Response Letter from Alaska, which sheds light on the process for obtaining exemptions from state sales taxes.

Whether you're an individual or a business owner, understanding state sales taxes is crucial for your financial planning. Our documents cover a range of topics, from claiming refunds to navigating exemptions, to help you make informed decisions and stay compliant.

Don't let state sales taxes cause confusion or stress. Access our extensive collection of documents and resources to gain a better understanding of state sales taxes in your jurisdiction. With our comprehensive collection of documents, you'll have the knowledge you need to stay ahead of the game.

Documents:

16

This form is used for filing a claim to receive a refund on state sales taxes paid in Louisiana due to a natural disaster.

This form is used for declaring exemption from state sales tax in Colorado for machinery and machine tools. It is applicable to businesses engaged in manufacturing, research and development, or mining activities in the state.

This form is used for applying for a refund of state sales tax in Oklahoma.

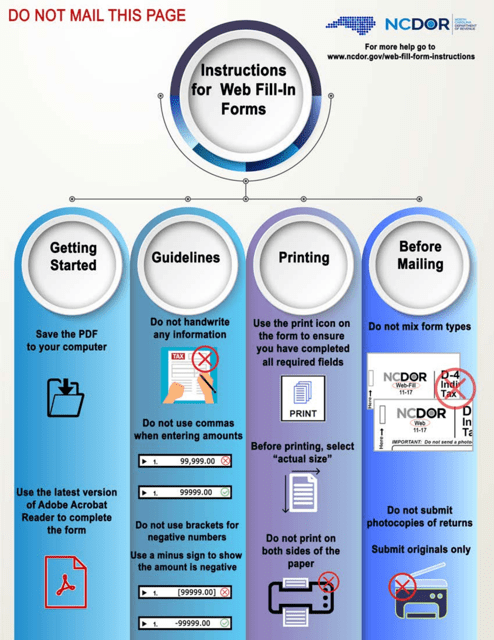

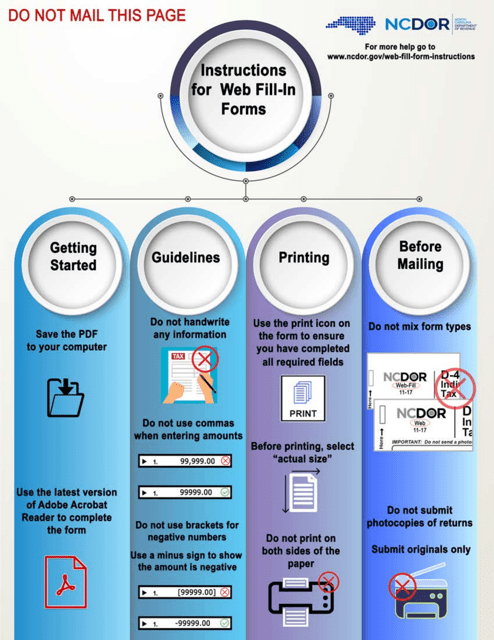

This form is used for claiming a refund on state, county, and transit sales and use taxes in North Carolina.

This is a North Carolina legal document used to request semiannual refunds of sales and use taxes paid on direct purchases and leases of tangible property and services from the Department of Revenue.

Instructions for Form R-1362 Natural Disaster Claim for Refund of State Sales Taxes Paid - Louisiana

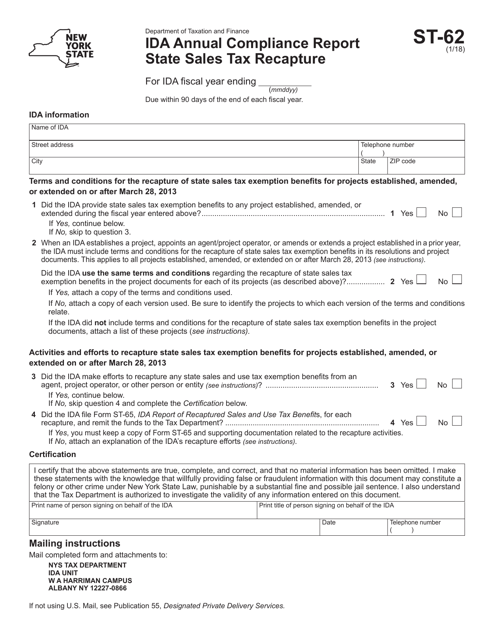

This form is used for reporting annual compliance with the State Sales Tax Recapture in New York.