Environmental Tax Credits Templates

Are you looking to save money while helping the environment? Look no further than our comprehensive collection of documents on environmental tax credits. These credits are designed to incentivize businesses and individuals to make eco-friendly choices that benefit both our planet and their bottom line.

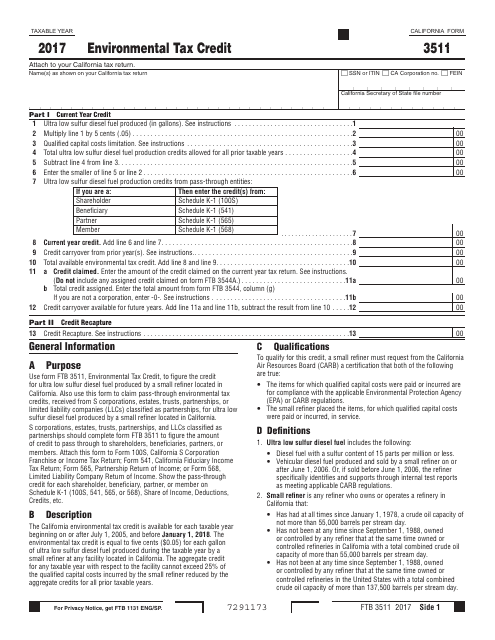

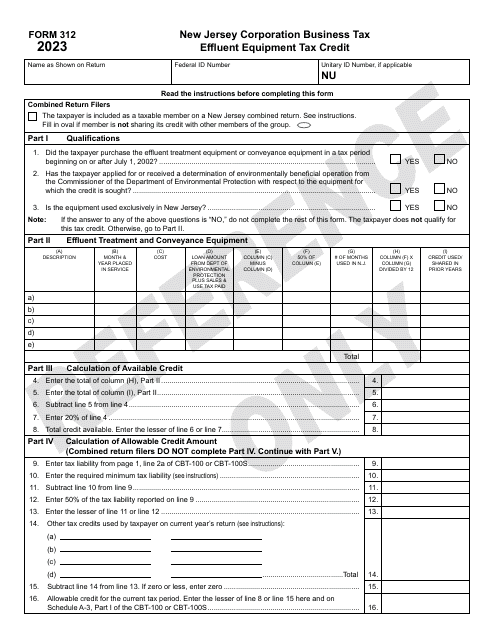

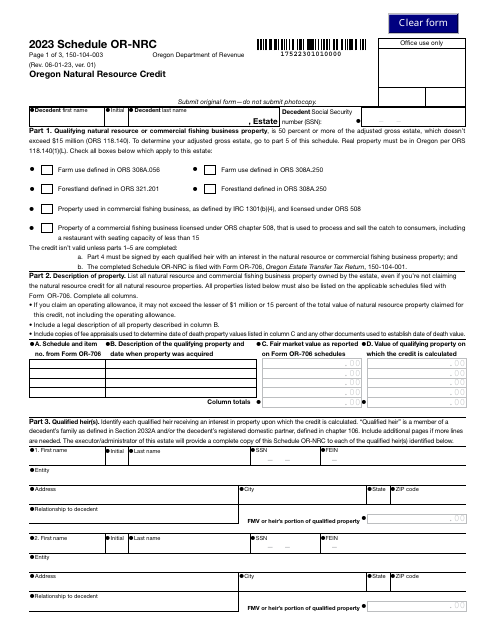

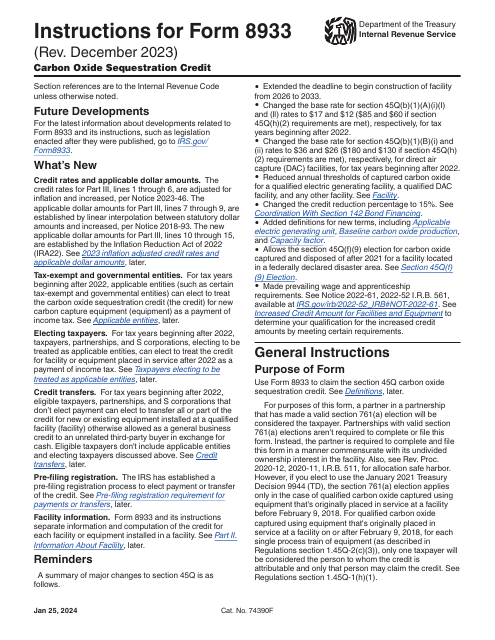

Whether you're a California resident seeking the Form FTB3511 Environmental Tax Credit or a New Jersey business owner interested in the Form 312 Effluent Equipment Tax Credit, our wide range of documents has got you covered. We even offer resources such as the Instructions for IRS Form 8933 Carbon Oxide Sequestration Credit, which can help you navigate the complex world of carbon offsetting.

Our environmental tax credits collection provides valuable information and guidance for those looking to take advantage of financial incentives for sustainable practices. These credits, also known as environmental tax credits or environmental tax credit, allow individuals and businesses to recoup a portion of their investments in environmentally friendly practices or equipment.

By claiming these credits, individuals and businesses can not only reduce their tax liability but also contribute to the overall well-being of our planet. So whether you're interested in the Oregon Natural Resource Credit or any other environmental tax credit, explore our collection of documents to learn how you can make a positive impact while enjoying potential financial benefits.

Documents:

5

This Form is used for claiming the Environmental Tax Credit in the state of California.