International Tax Compliance Templates

International Tax Compliance - Ensuring Global Tax Obligations

Welcome to our comprehensive resource on international tax compliance. We understand how complex and overwhelming it can be to navigate the intricate web of global tax regulations. That's why we have curated a collection of invaluable documents to assist individuals and businesses in meeting their international tax obligations.

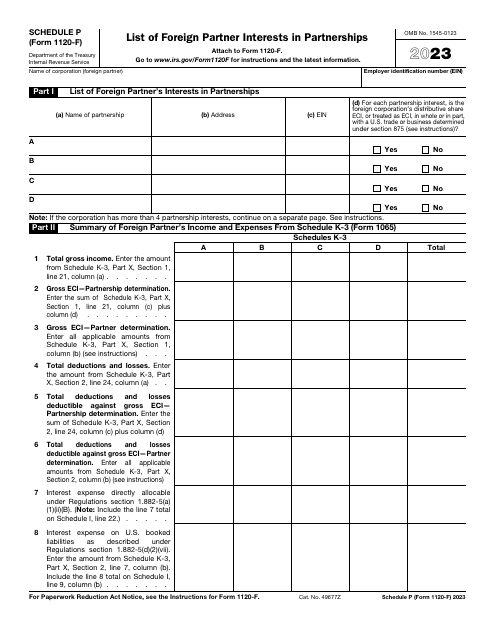

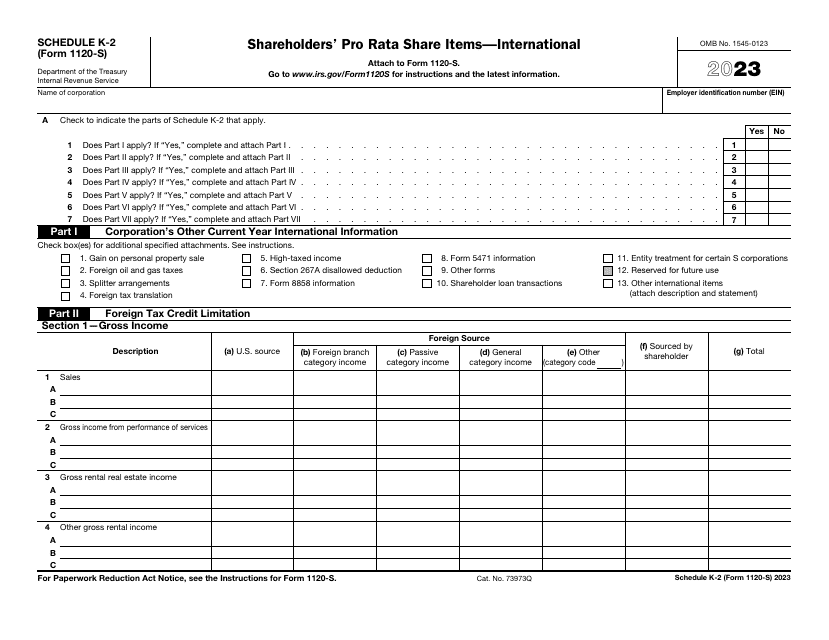

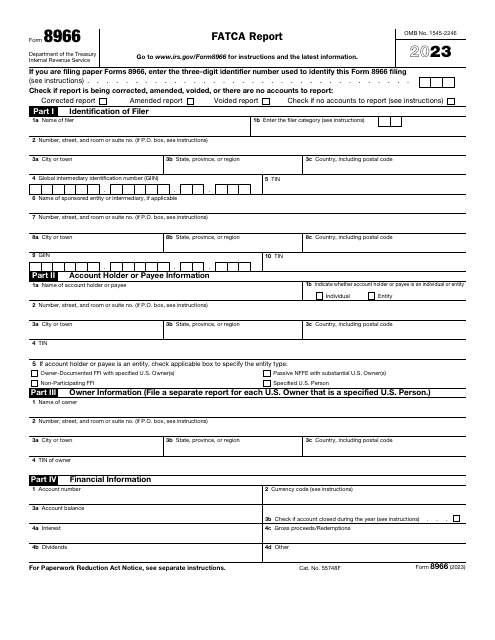

Our extensive document collection covers various aspects of international tax compliance, providing step-by-step instructions, guidelines, and important forms required for proper reporting and withholding. Whether you are a foreign intermediary, a flow-through entity, or a U.S. branch, our documents will help you understand your responsibilities and ensure compliance.

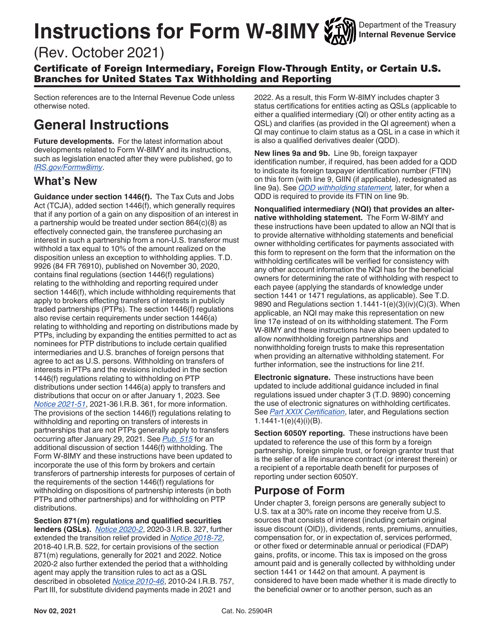

In our collection, you will find essential documents such as the Instructions for IRS Form W-8IMY Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting. This document serves as a guide to accurately fill out this crucial form and navigate the associated reporting requirements.

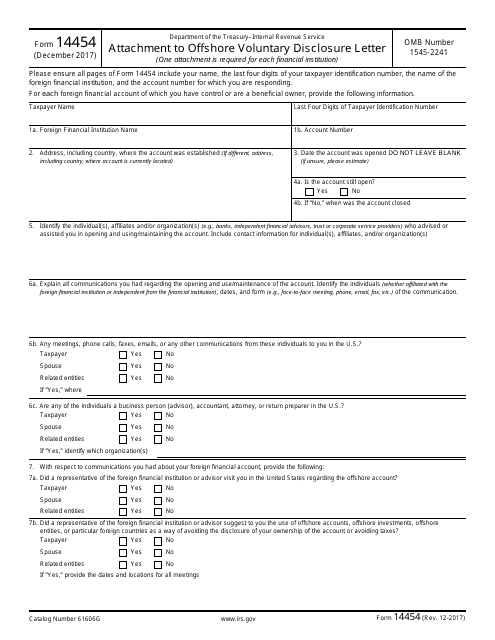

If you are considering participating in the Offshore Voluntary Disclosure Program, our Instructions for IRS Form 14454 Attachment to Offshore Voluntary Disclosure Letter will provide you with the necessary guidance. This document outlines the requirements and procedures involved in disclosing offshore accounts, ensuring you comply with the IRS regulations.

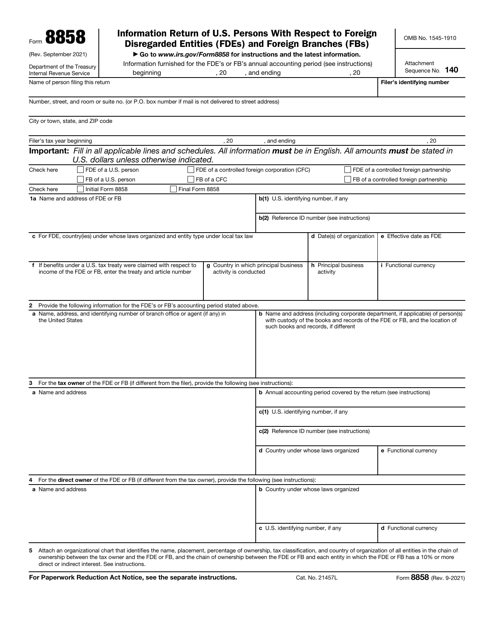

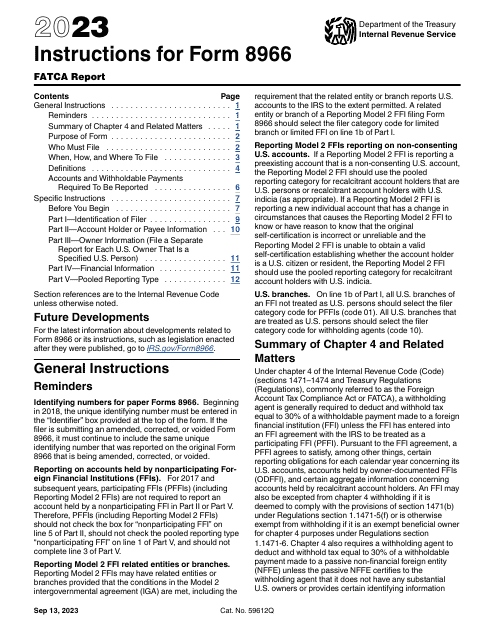

Additionally, our collection includes Instructions for IRS Form 8966 Fatca Report. This document guides foreign financial institutions in reporting their U.S. account holders to comply with the Foreign Account Tax Compliance Act (FATCA). By understanding the instructions provided, you can ensure accurate and timely reporting, avoiding potential penalties.

For shareholders of international corporations, our Instructions for IRS Form 1120-S Schedule K-3 and Schedule K-2 are invaluable resources. These documents help shareholders report and allocate their share of income, deductions, and credits, providing clarity on the intricate tax considerations related to international business operations.

We understand that international tax compliance can be a daunting task. However, with our collection of documents, you can rest assured that you have access to the guidance and information you need to fulfill your global tax obligations. Stay on the right side of the law, avoid penalties, and achieve peace of mind by leveraging our comprehensive resources.

Browse our collection of international tax compliance documents today and take the first step toward seamless global tax compliance. Trust us to provide you with the tools you need to navigate international tax regulations successfully.

Documents:

11

This form is used as an attachment to the Offshore Voluntary Disclosure Letter, which is submitted to the IRS. It provides additional information and documentation related to offshore accounts and income.

This document provides instructions for completing Schedule K-3 of IRS Form 1065, which calculates a partner's share of income, deductions, credits, etc. for international partnerships.