Base Year Value Transfer Templates

Base Year Value Transfer (also known as base year value transfers) is a crucial process that allows individuals and organizations to transfer the assessed value of a property from a previous base year to a new base year. This is particularly important when there is a change in property ownership or when a property is acquired by a public entity.

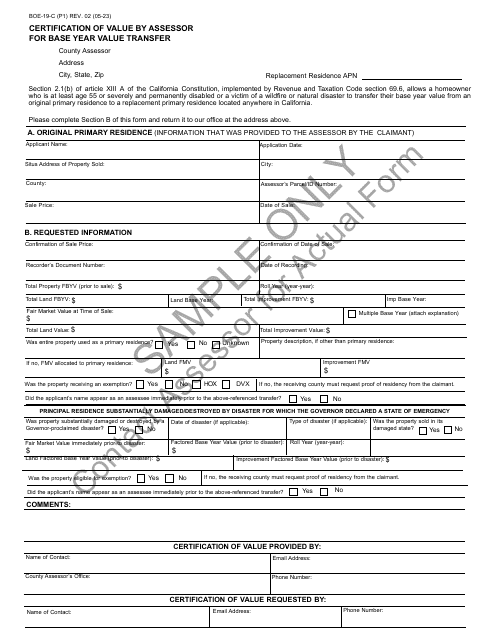

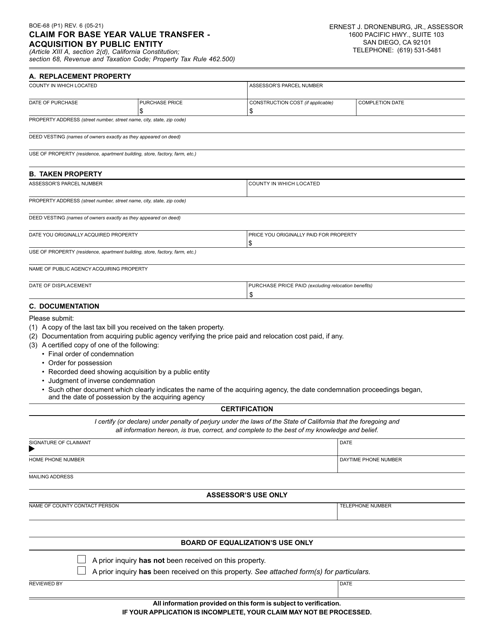

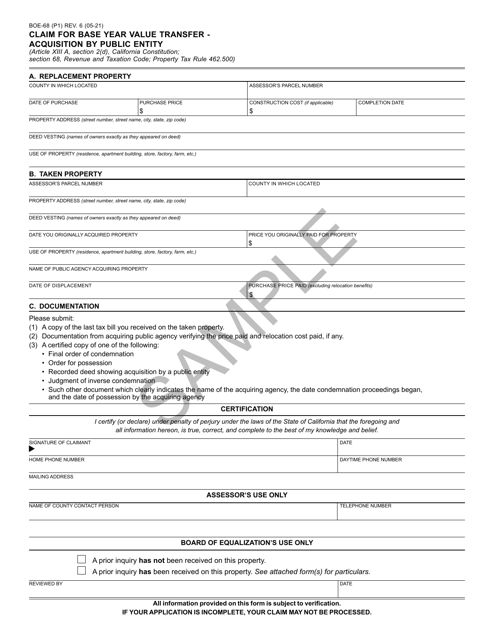

To facilitate this process, various forms are used, such as the Form BOE-19-C Certification of Value by Assessor for Base Year Value Transfer and the Form BOE-68 Claim for Base Year Value Transfer - Acquisition by Public Entity. These forms are utilized in different jurisdictions, including California.

Transferring the base year value of a property can have significant financial implications for property owners and public entities alike. It can help maintain consistency in property taxes, ensuring fair assessments and avoiding sudden increases in tax liabilities.

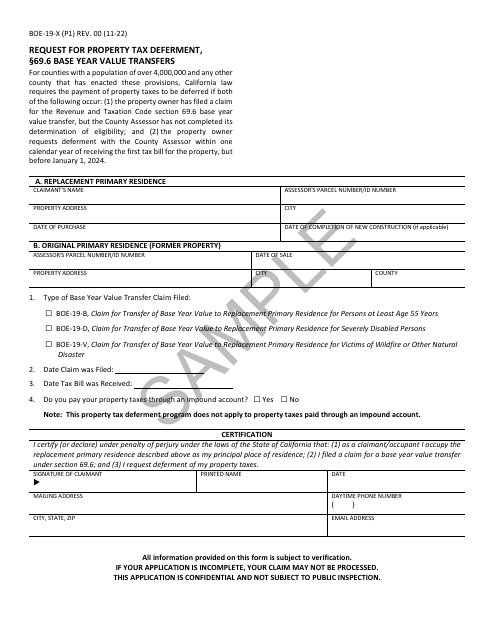

In addition, the Form BOE-19-X Request for Property Tax Deferment, 69.6 Base Year Value Transfers, is an essential document that enables property owners to defer property taxes under certain circumstances, further providing financial flexibility.

For individuals and organizations seeking guidance and assistance with base year value transfers, it is crucial to consult with experts in property taxation laws and regulations. Their expertise can ensure accurate completion of the necessary forms, compliance with relevant guidelines, and optimal outcomes in these transactions.

With the proper understanding and implementation of base year value transfers, property owners and public entities can navigate property tax assessments effectively and make informed financial decisions.

Documents:

5

This form is used for claiming a base year value transfer for a property acquisition by a public entity in the County of San Diego, California. It allows property owners to transfer their existing base year value to a new property acquired by a public entity.

This form is used for claiming base year value transfer when a property is acquired by a public entity in California. It is a sample form provided by the state.

This form is used for requesting property tax deferment and base year value transfers in California. It provides a sample of the BOE-19-X form.