Education Credit Templates

Are you a student or a parent looking for financial assistance to help cover the cost of education? Look no further than the Education Credit program, also known as education credits or education tax credits. These credits offer eligible individuals the opportunity to reduce their tax liability by claiming expenses related to qualifying educational expenses.

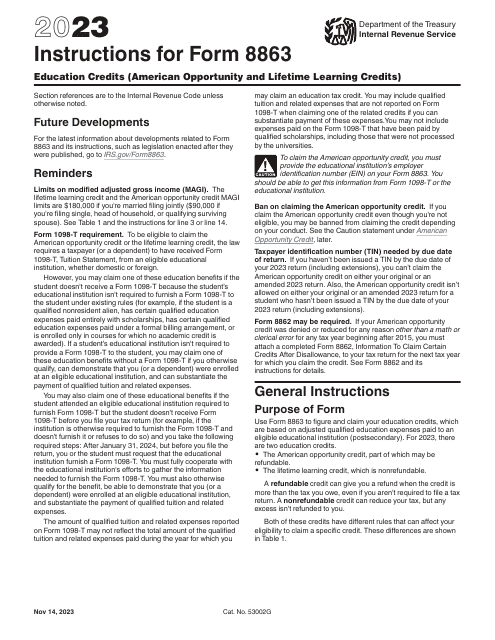

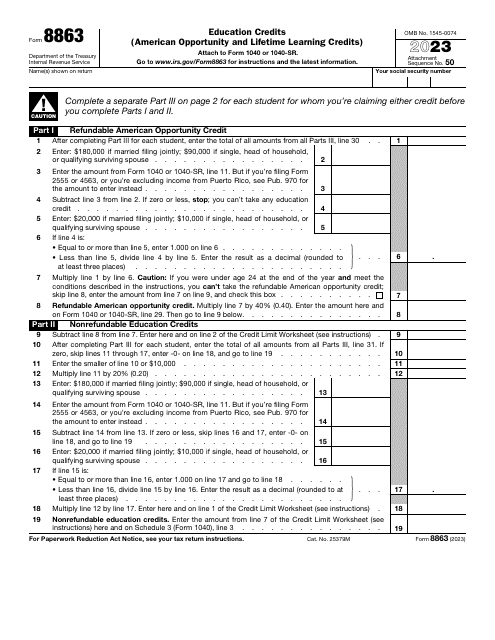

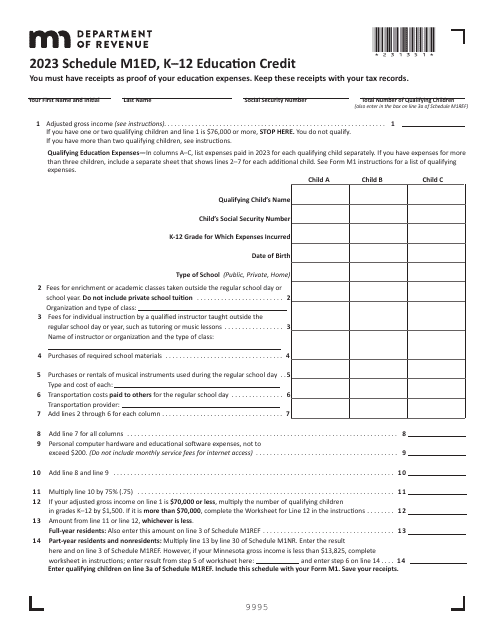

Whether you're a resident of the United States or Canada, the Education Credit program is designed to provide financial relief to individuals pursuing higher education. In the United States, you can take advantage of the IRS forms such as Form 8863, which allows you to claim either the American Opportunity Credit or the Lifetime Learning Credit, depending on your eligibility. These credits can help offset the cost of tuition, textbooks, and other educational fees.

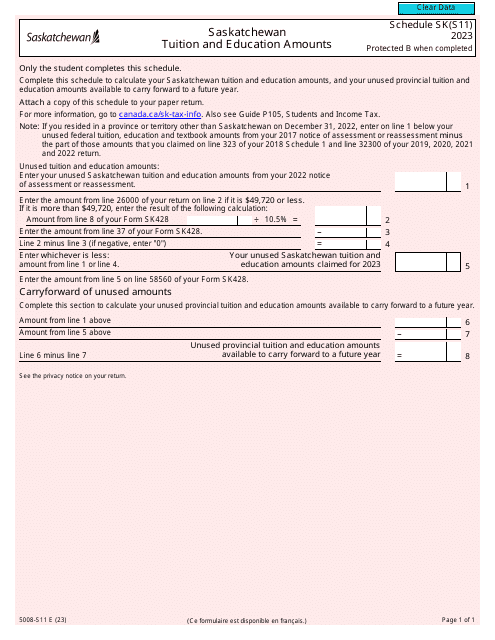

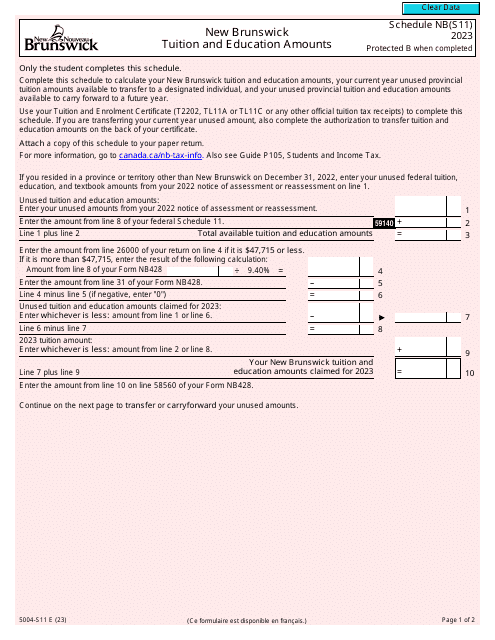

If you're a Canadian resident, the Education Credit program also offers benefits through forms like Form 5008-S11 in Saskatchewan. This form enables students to claim tuition and education amounts, reducing their tax burden and making education more accessible.

To make the process easier, detailed instructions for completing these forms are readily available, such as the Instructions for IRS Form 8863 Education Credits in the United States. These instructions provide step-by-step guidance on how to accurately complete the forms and maximize your eligible credits.

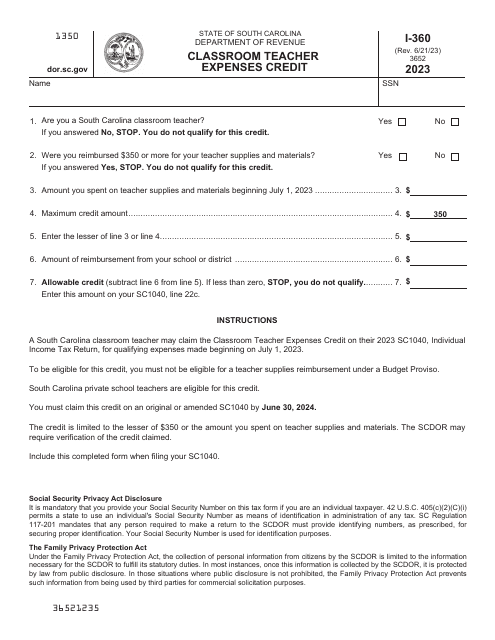

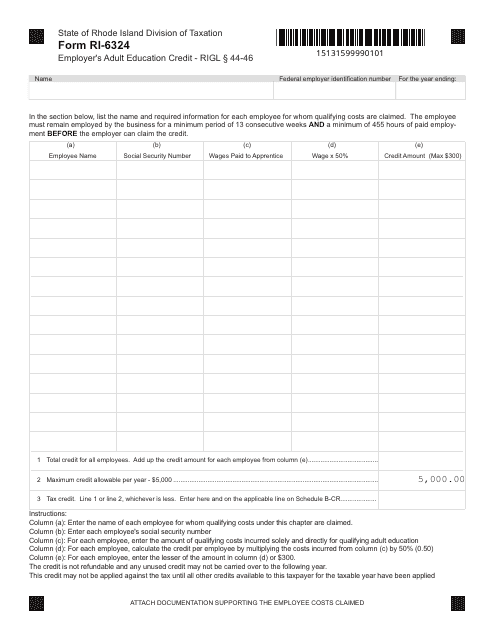

Additionally, some states in the United States offer their own education credit programs, such as the Employer's Adult Education Credit in Rhode Island, which can provide further financial relief for individuals pursuing adult education opportunities.

Education credit programs are a valuable resource for students and parents alike, helping to alleviate the financial strain of educational expenses. So, if you're looking to offset the cost of education and reduce your tax liability, make sure to explore the Education Credit program, education credits, or education tax credits available to you.

Documents:

17

These instructions for IRS Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits), explain how to utilize this form when claiming costs for post-secondary schooling.

Fill in this form to claim one of the Internal Revenue Service (IRS) educational tax credits. It will provide a dollar-for-dollar reduction in the amount of tax owed at the end of the reporting year for the expenses incurred to attend educational institutions that participate in the student aid programs.

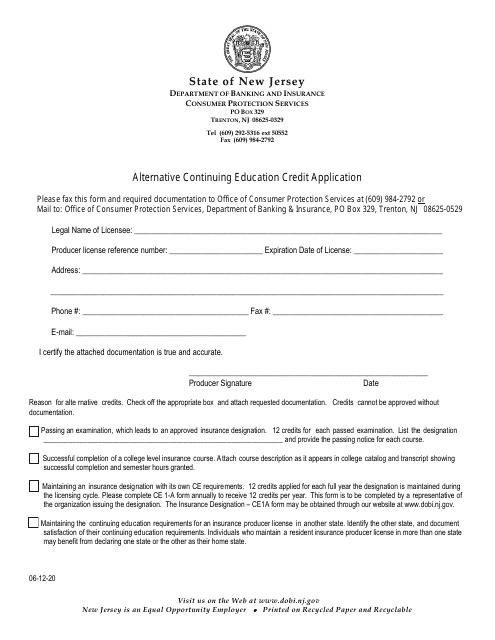

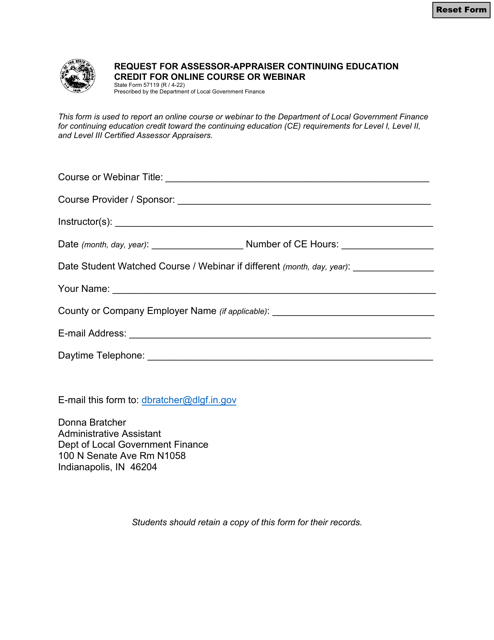

This Form is used for applying for alternative continuing education credit in New Jersey.