Accidental Death and Dismemberment Templates

Accidental Death and Dismemberment (AD&D) Insurance is a crucial type of coverage that offers financial protection in the event of unexpected accidents that result in death or severe bodily injury. This insurance policy, also known as Accidental Death Insurance or AD&D, provides a lump-sum payment to the designated beneficiary or the policyholder themselves should they experience a covered accident that leads to death, dismemberment, or loss of sight, speech, or hearing.

AD&D insurance is designed to supplement traditional life insurance and disability coverage, providing an additional layer of financial security specifically for accidents. This type of insurance can be particularly valuable for individuals whose occupations or lifestyles place them at higher risk of accidents, such as construction workers, athletes, or frequent travelers. By adding AD&D coverage to your existing insurance portfolio, you can gain extra peace of mind knowing that you and your loved ones are protected in case the unexpected occurs.

The primary purpose of AD&D insurance is to provide a financial safety net, ensuring that your family and dependents are taken care of should you meet an untimely demise or suffer a devastating injury. The policy pays out a specified benefit amount in the event of accidental death or certain qualifying injuries, which can be used to cover funeral expenses, medical bills, mortgage payments, educational expenses, and other financial obligations that may arise after an accident.

In addition to the standard AD&D insurance policy, there may be supplemental benefits available that provide enhanced coverage, such as the option to designate multiple beneficiaries or increased benefit amounts. These optional benefits can be tailored to your specific needs and circumstances, offering an added layer of protection and flexibility.

If you are interested in obtaining Accidental Death and Dismemberment insurance, it is crucial to review the terms and conditions of the policy carefully. Additionally, it is advisable to consult with an insurance professional who can guide you through the process of selecting the right coverage and ensure that your policy aligns with your unique requirements and preferences.

With Accidental Death and Dismemberment insurance, you can have peace of mind knowing that you and your loved ones are protected in the face of unforeseen accidents. Don't leave your financial future to chance – explore the benefits of AD&D insurance today.

Documents:

5

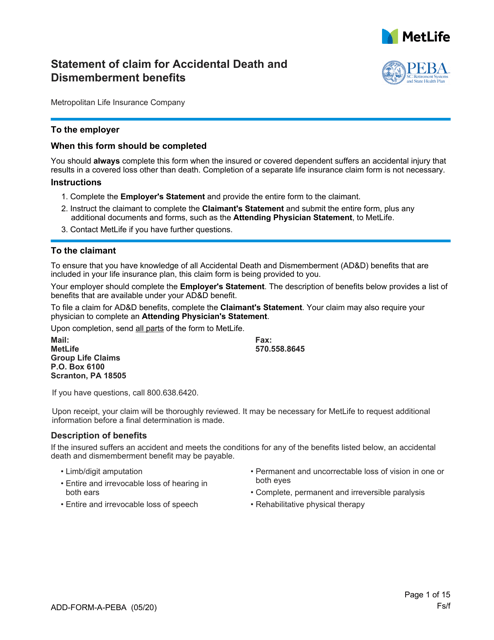

This Form is used for filing a claim for accidental death or dismemberment benefits in South Carolina. It includes details about the incident and the claimant's information.

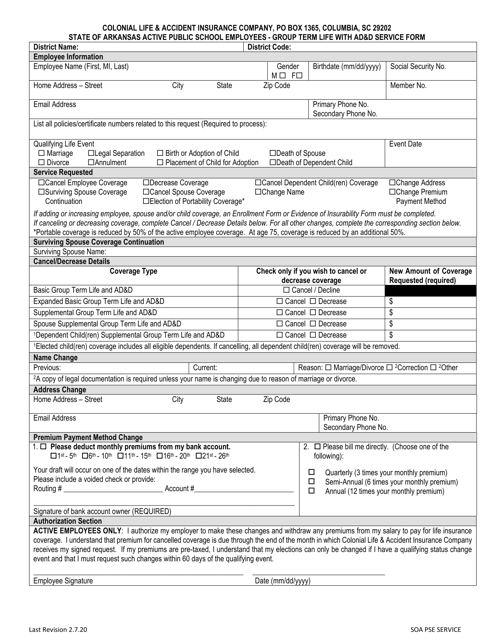

State of Arkansas Active Public School Employees - Group Term Life With Ad&d Service Form - Arkansas

This document is a form used by active public school employees in the state of Arkansas to enroll in a group term life insurance plan with accidental death and dismemberment (AD&D) coverage.