Loan Default Templates

Are you struggling to repay your loans? Have you missed multiple payments and now facing the consequences of loan default? Our loan default assistance program is here to help you overcome this challenging situation.

Loan default, also known as defaulted loan or loan defaults, occurs when a borrower fails to make timely repayments on their loan. Defaulting on a loan can have serious repercussions on your credit score and financial stability. However, there are steps you can take to navigate through this difficult period and find a solution.

At our organization, we understand the stress and uncertainty that come with loan default. That's why we offer a range of resources and support to help you get back on track. Our dedicated team of experts will guide you through the process, providing personalized assistance tailored to your specific circumstances.

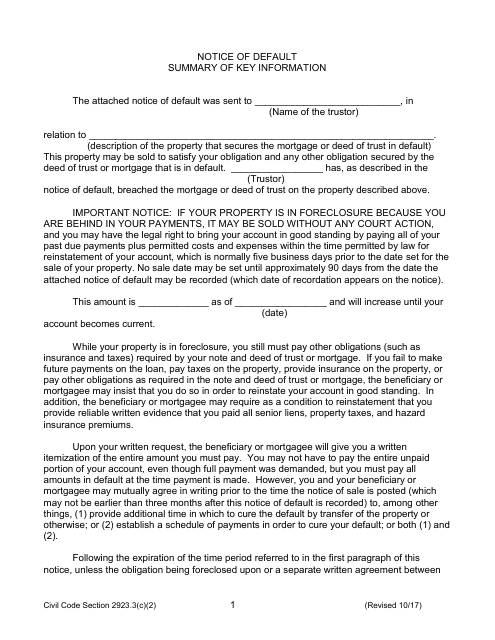

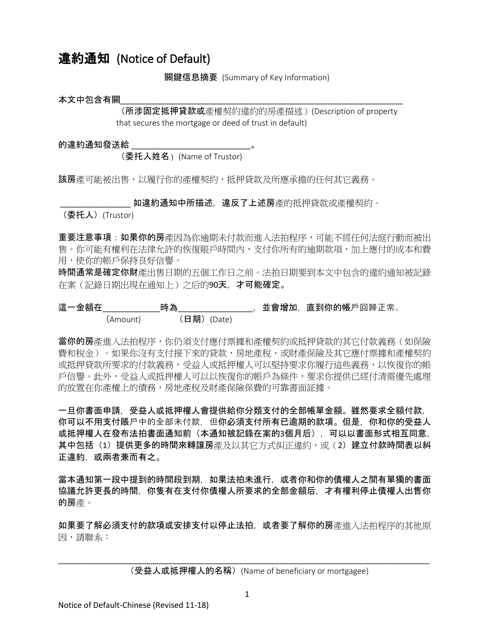

One of the essential documents related to loan default is the Notice of Default. This document is specific to California and serves as an official notice to the borrower regarding the default status of their loan. It outlines the legal actions that may be taken if the borrower fails to rectify the default.

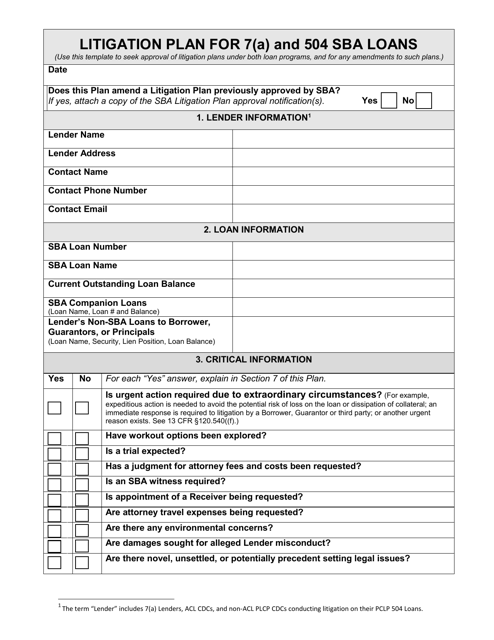

Another important document is the Litigation Plan for 7(A) and 504 SBA Loans. This plan provides borrowers with a comprehensive framework for addressing loan default issues through legal proceedings. It outlines the steps involved in the litigation process, including filing a lawsuit and presenting evidence.

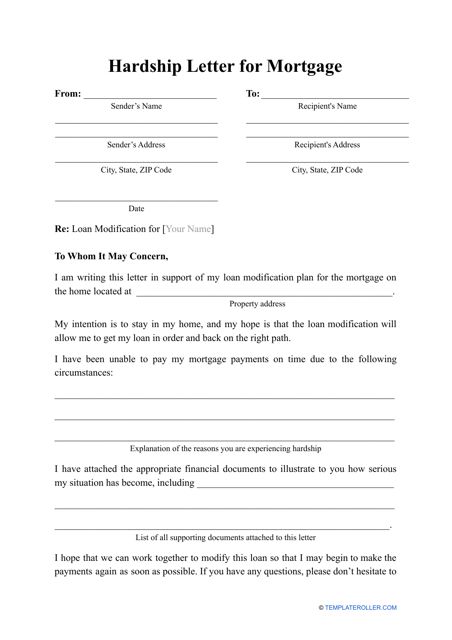

If you're having trouble paying your mortgage, a Hardship Letter for Mortgage Template can be a useful tool. This letter allows borrowers to explain their financial difficulties and request assistance from their lender. It can be a crucial document in negotiating loan modifications or alternative repayment plans.

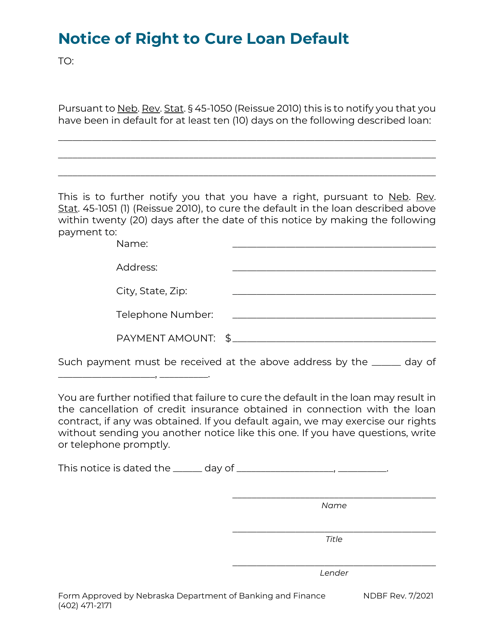

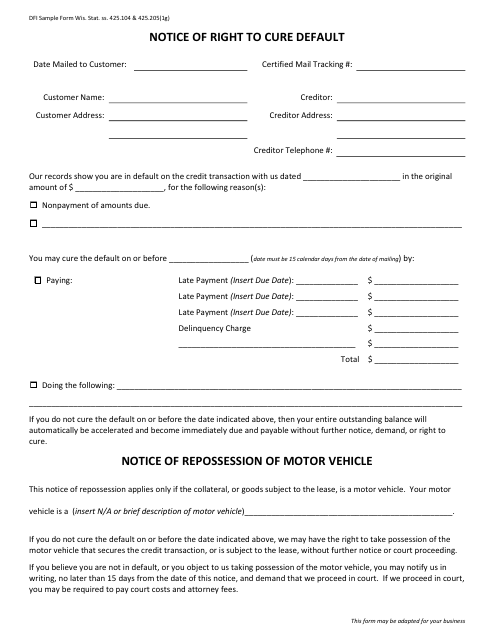

In some states, such as Nebraska, borrowers are entitled to a Notice of Right to Cure Loan Default. This document informs borrowers of their rights and options to cure their default before legal action is taken. It provides important information on the steps required to resolve the default and avoid further consequences.

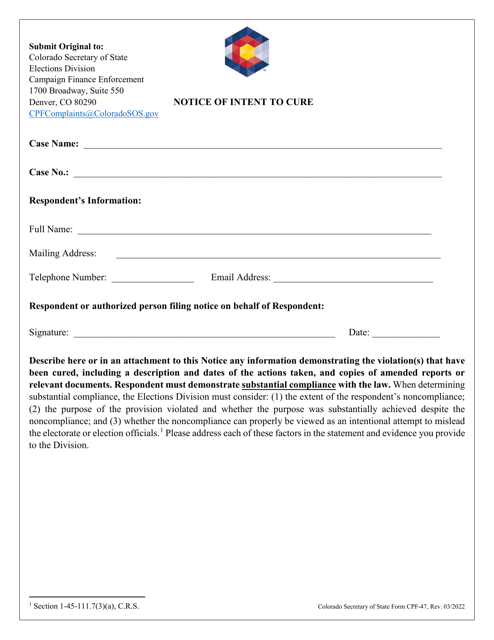

Colorado borrowers may be familiar with the Form CPF-47 Notice of Intent to Cure. This document allows borrowers to express their intention to cure the loan default and notifies the lender of their plan to rectify the situation within a specified period. It is a critical document in initiating the loan default resolution process.

If you're facing loan default, don't despair. Take advantage of our comprehensive loan default assistance program, designed to help you regain control of your financial situation. Our team is here to provide guidance, support, and the necessary resources to navigate through the complexities of loan default and find a sustainable solution.

Documents:

19

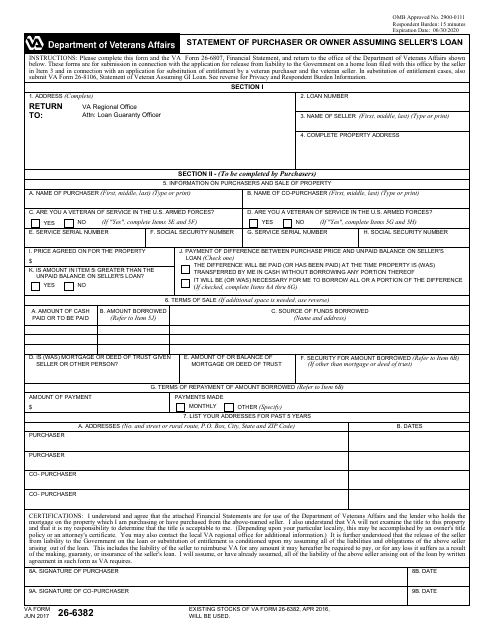

This Form is used for buyers or owners who are assuming the seller's loan.

This document is used to notify a borrower in California that they have defaulted on their loan or mortgage payments.

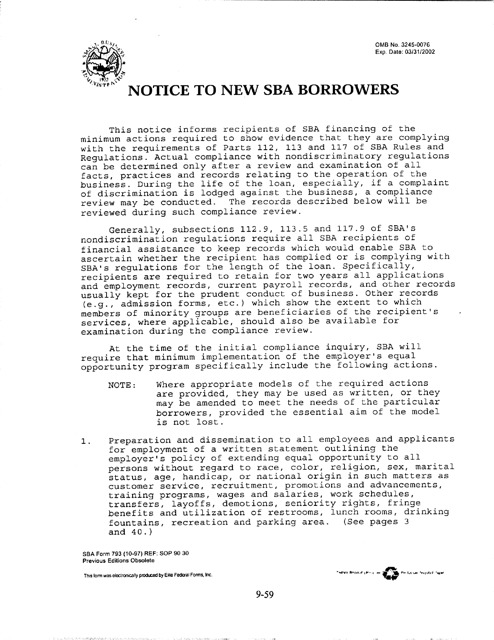

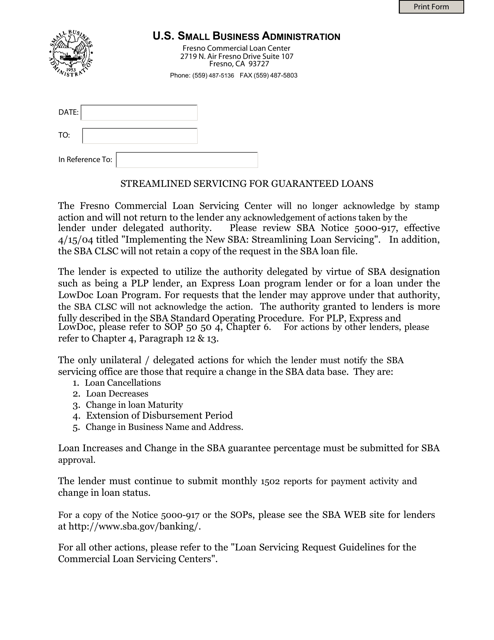

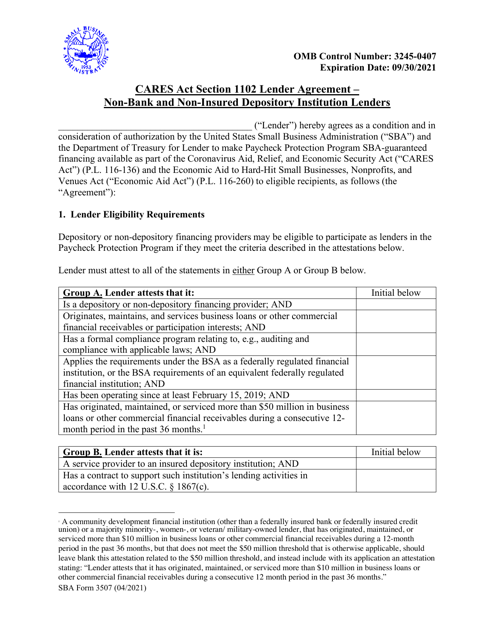

This form is used for notifying new borrowers about the Small Business Administration (SBA) requirements and terms for their loan.

This document outlines the plan for handling legal disputes related to 7(A) and 504 SBA loans. It covers strategies and steps to take in litigation proceedings.

This document provides information and guidelines for a simplified process of managing and servicing loans that are guaranteed by a certain entity. It outlines the steps and requirements for efficient loan administration.

This document is a Notice of Default specifically for properties in the state of California. It is written in Chinese.

Complete this ready-made template to explain to the bank why you're defaulting on your mortgage.

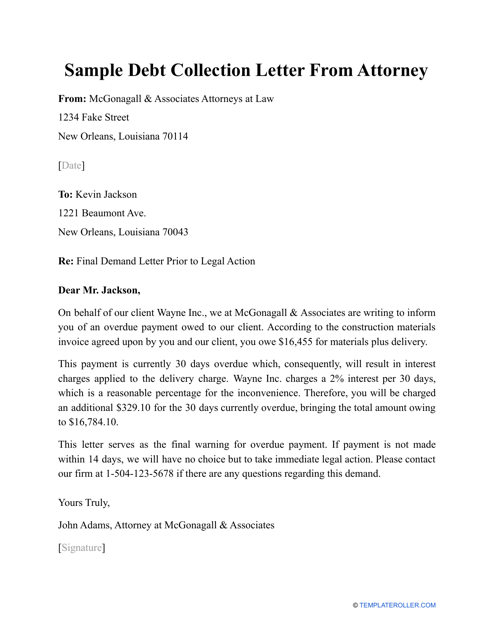

This letter is prepared by the attorney that represents the lender and has a purpose to convince the debtor to pay the money back or face a lawsuit.

This form is used for lenders to certify compliance with specific requirements for the OneHome Program.

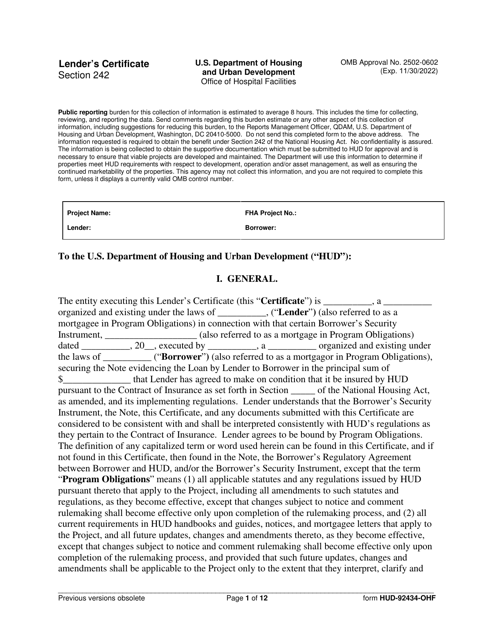

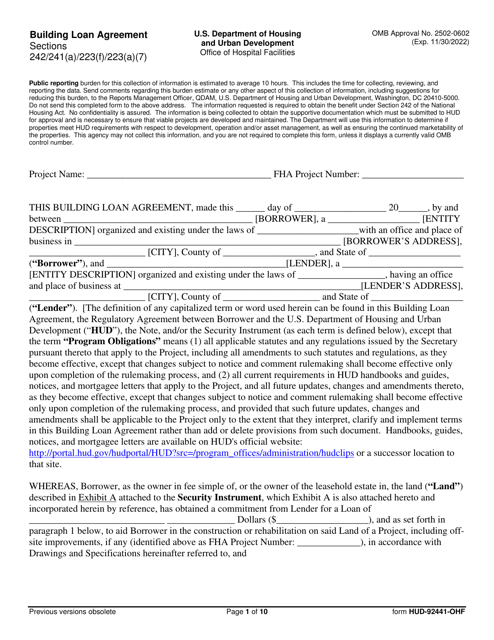

This document is a Building Loan Agreement form (Form HUD-92441-OHF) used by the U.S. Department of Housing and Urban Development (HUD) for financing the construction or rehabilitation of affordable housing projects.

This document provides guidance and important information for borrowers of federal student loans who are preparing to exit or finish their loan repayment. It helps borrowers understand their rights and responsibilities and provides tips for managing their student loan debt after graduation.

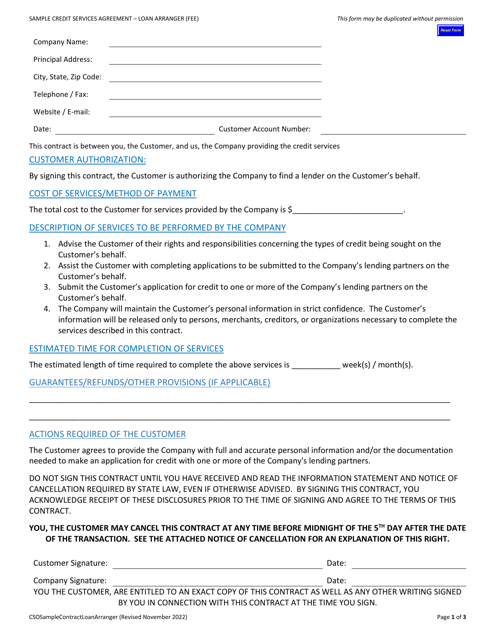

This agreement is used when loan arrangers in Wisconsin provide credit services for borrowers. It outlines the terms and conditions of the credit arrangement.

This form is used by mortgage lenders in Wisconsin to inform borrowers of their right to cure a default on their mortgage before foreclosure proceedings begin.