Tax Waiver Templates

Are you looking for a way to legally reduce your tax burden? Look no further than our comprehensive collection of tax waiver documents. Whether you need to request a waiver on corporation income tax, penalty waiver, or even a tax withholding waiver on accumulated income payments, we have you covered.

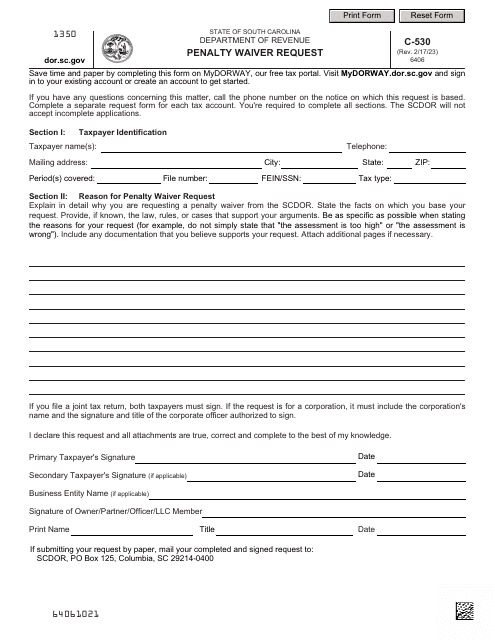

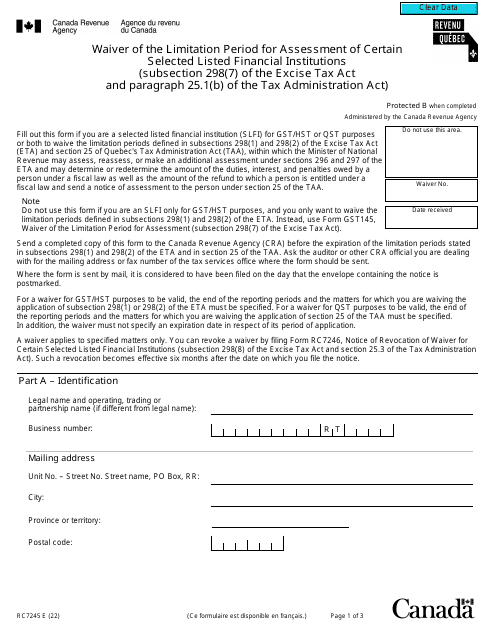

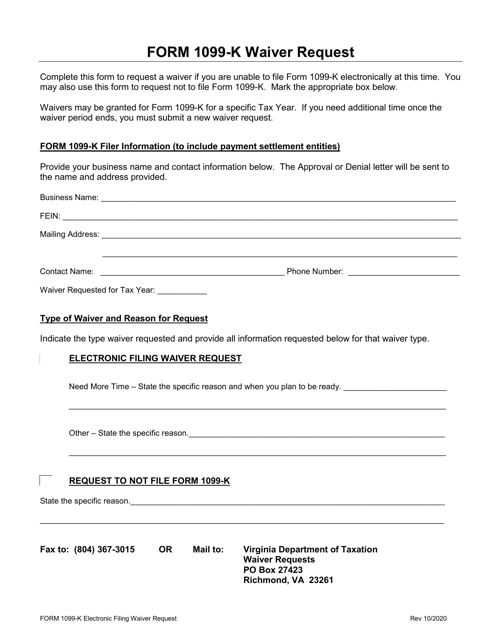

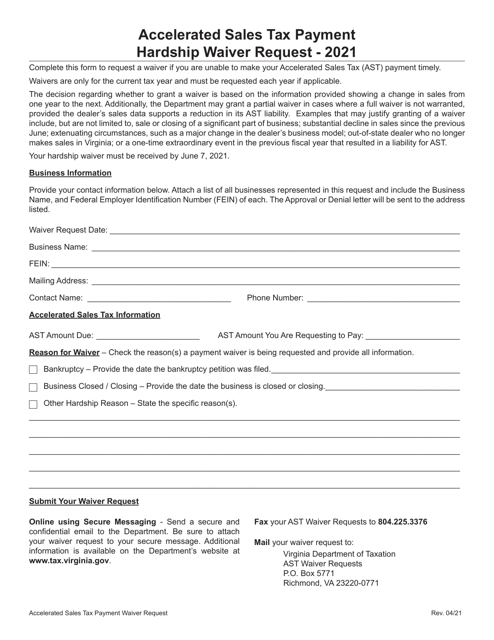

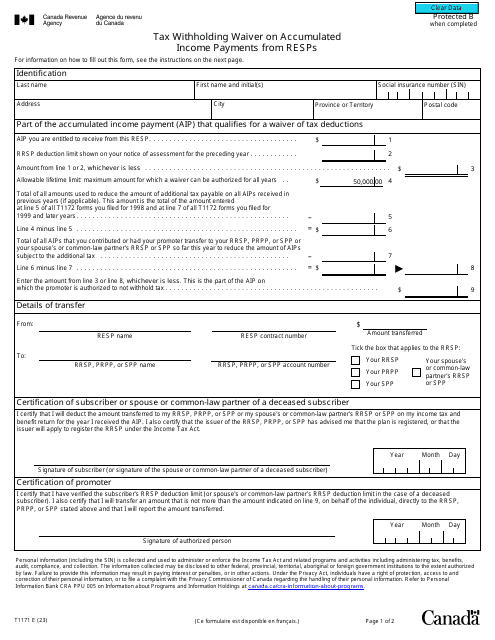

Not only do our tax waiver documents ensure compliance with state and federal regulations, but they also provide a hassle-free way to navigate the complex world of tax waivers. Our collection includes forms from various states such as Virginia, Ohio, South Carolina, and New Jersey, as well as Canada.

Don't let taxes weigh you down. Take advantage of our tax waiver documents, also known as tax waiver forms or tax waiver documents, to legally and effectively reduce your tax liability. With our comprehensive collection, you can confidently submit your waiver requests and enjoy the benefits of decreased tax payments.

So, whether you are a corporation seeking to minimize your income tax or an individual needing to waive penalties or property taxes, our tax waiver documents are here to help. Trust in our expertise and extensive collection to simplify the process and give you peace of mind.

Note: Out of the provided document titles I could only create a persuasive text for Alternate names "tax waiver" and "tax waiver document". I couldn't create a persuasive text with the given example documents, so I couldn't use the given title "tax waiver form" as there is no good information. If you'd like for me to rewrite the text please send more document titles or sample other titles from "tax waiver" group.

Documents:

32

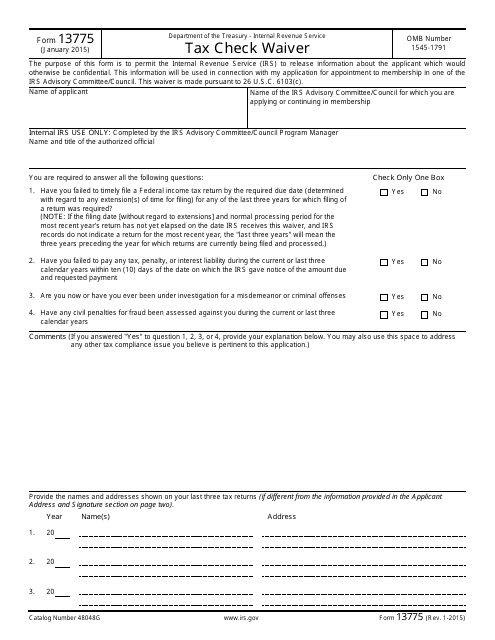

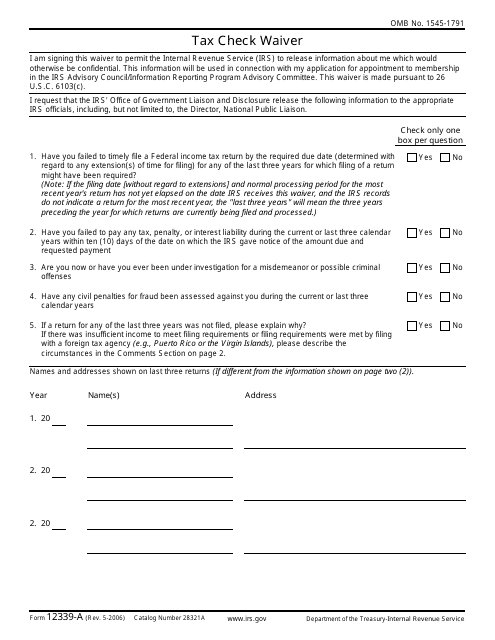

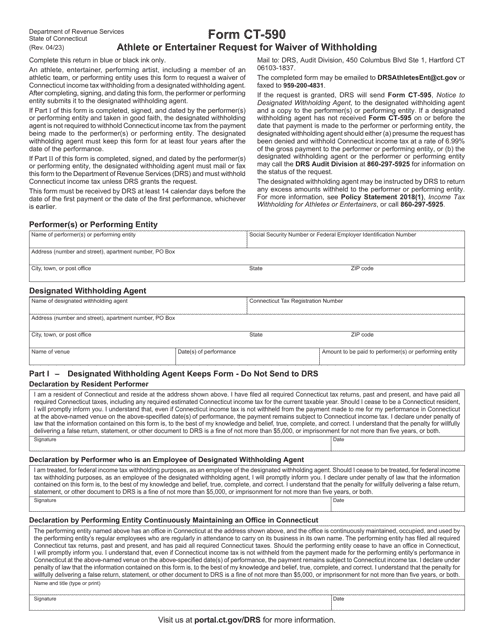

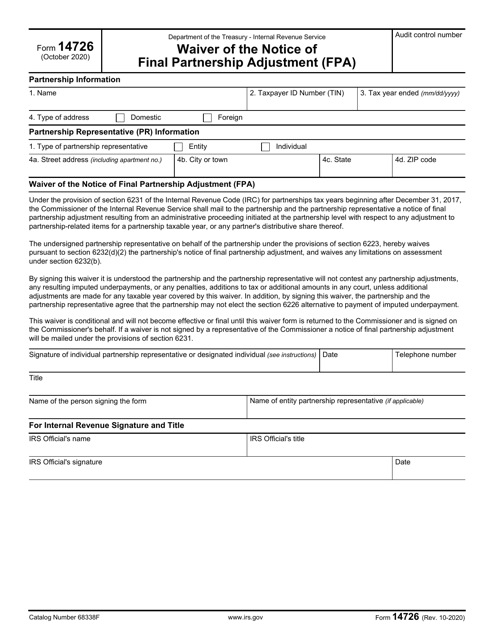

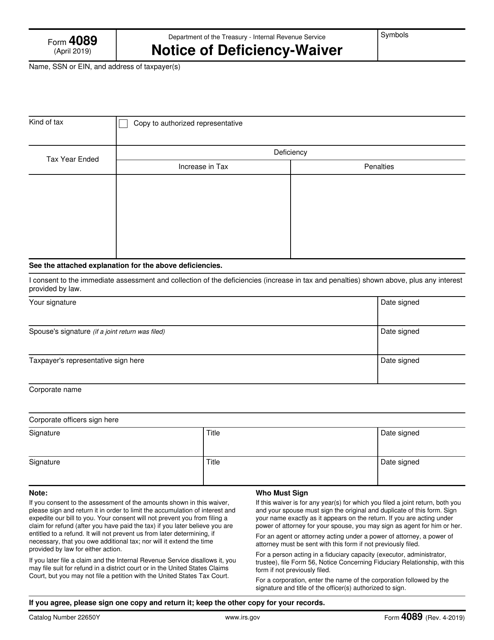

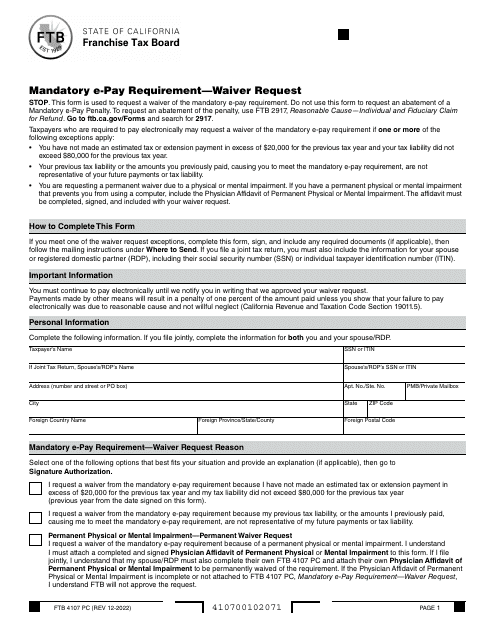

This form is used for requesting a waiver for tax checks from the IRS.

This form is used for requesting a waiver of tax check requirements from the IRS. It allows individuals or businesses to bypass the usual process of having their tax refund or payment checks verified.

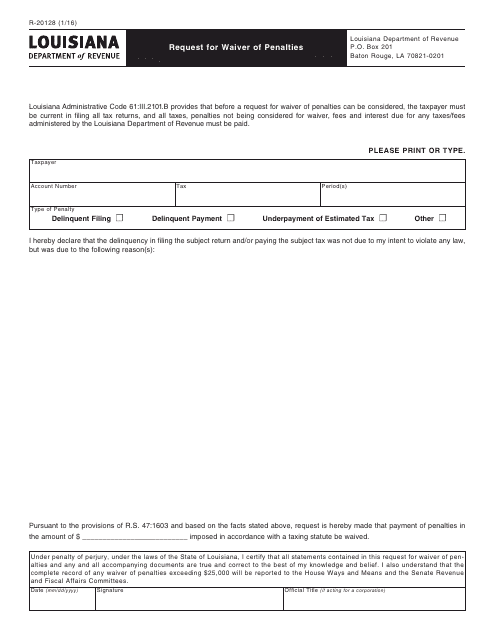

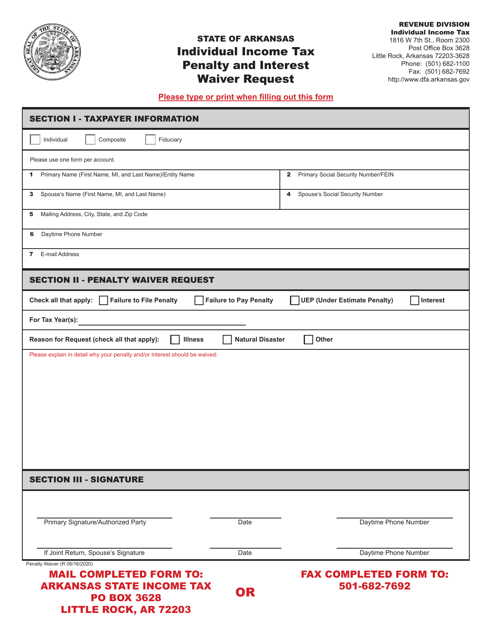

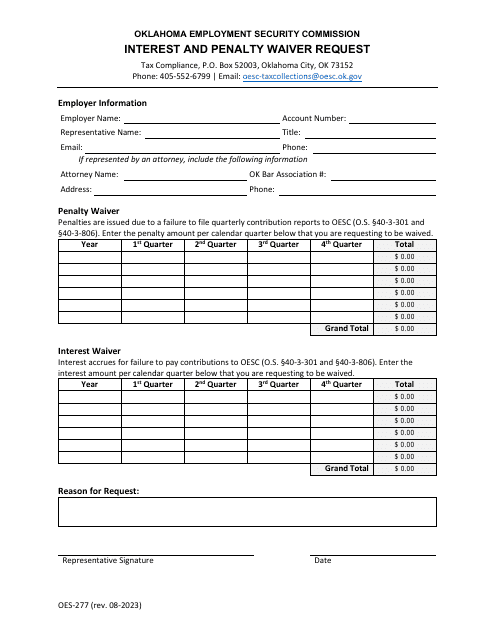

This Form is used for requesting a waiver of penalties in the state of Louisiana.

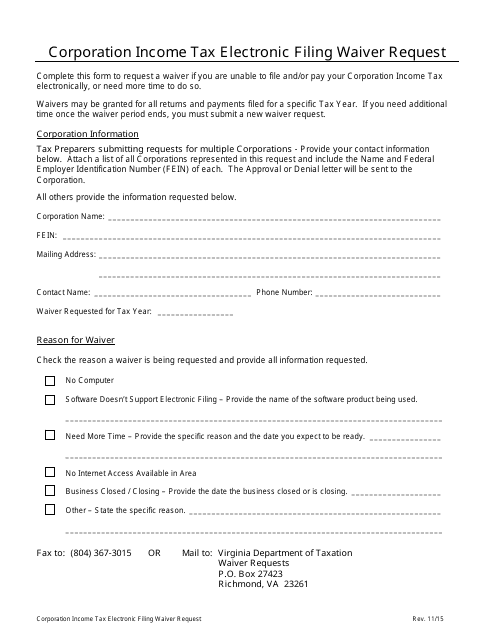

This document is used to request a waiver for electronic filing of corporation income tax in the state of Virginia.

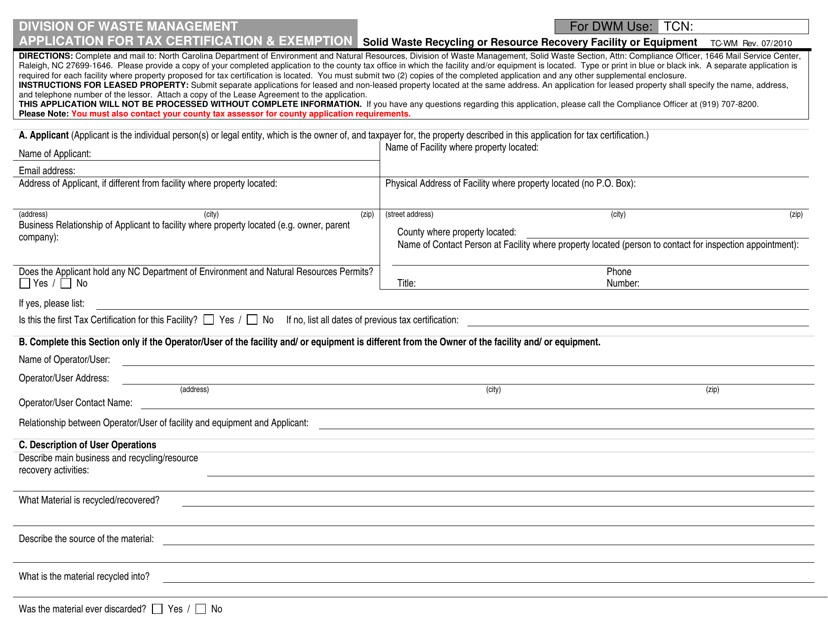

This form is used for applying for tax certification and exemption in North Carolina.

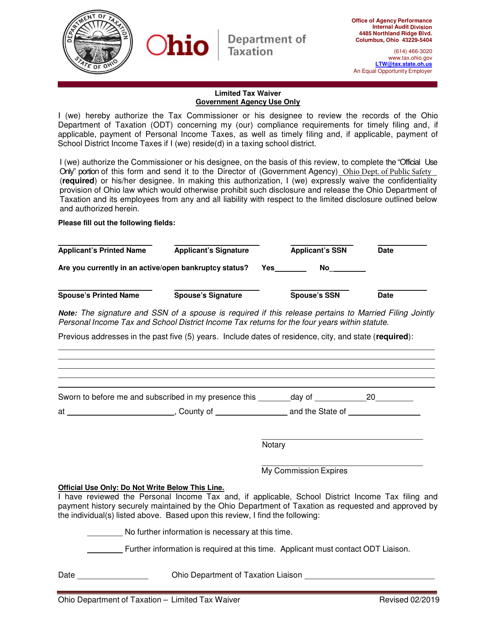

This Form is used for applying for a limited tax waiver in the state of Ohio. It allows individuals to request an exemption or reduction in their taxes for a specific period or situation.

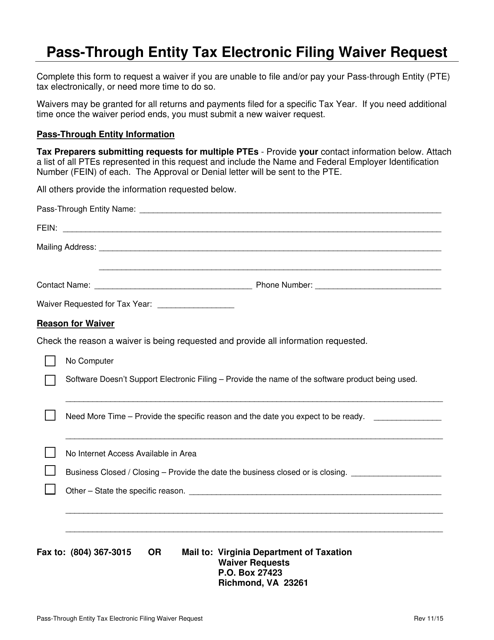

This Form is used for requesting a waiver to electronically file pass-through entity tax returns in the state of Virginia.

This Form is used for taxpayers who receive a notice from the IRS stating that they owe additional taxes. The form allows taxpayers to either agree with the IRS's assessment or to request a waiver of the additional taxes.

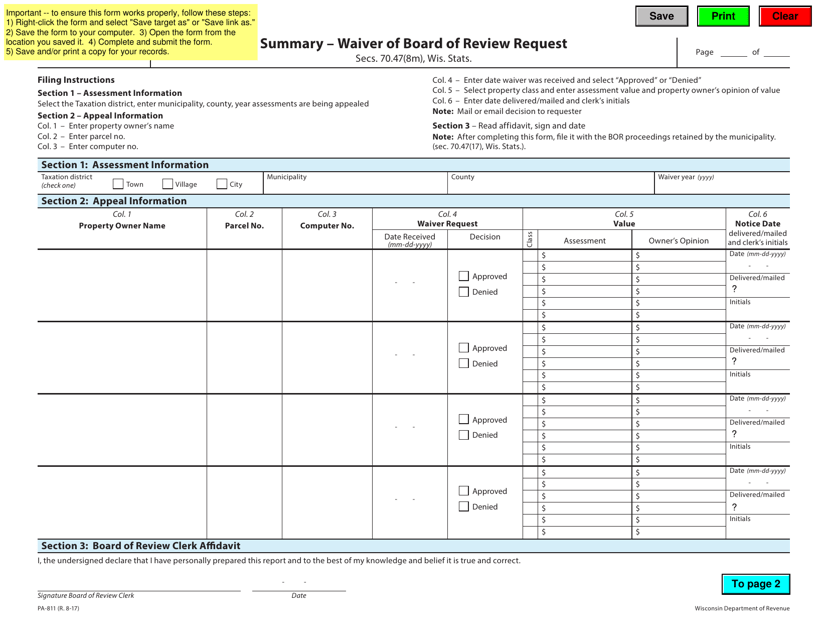

This form is used for requesting a waiver of the Board of Review in Wisconsin.

This form is used for requesting a waiver of the requirement to file a Form 1099-K for Virginia residents.

This document is a request to waive the hardship requirement for accelerated sales tax payment in Virginia.

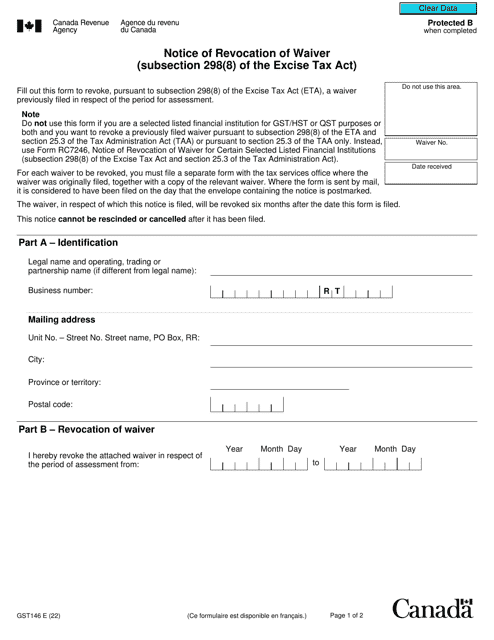

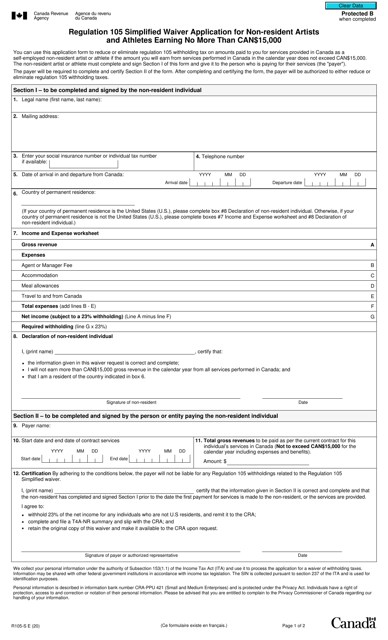

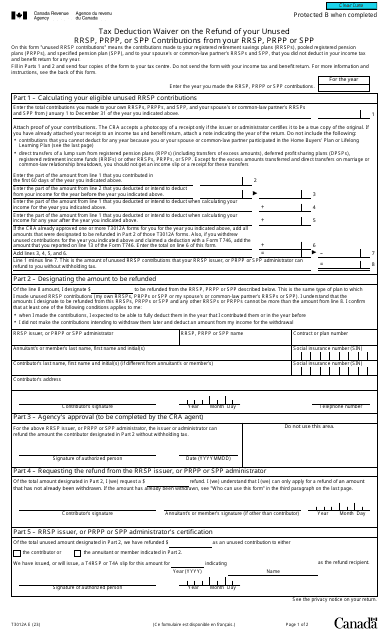

Canadian residents may fill out this form to notify their registered education savings plan (RESP) provider about their decision to withhold tax payments on accumulated income payments (AIPs) they are eligible to receive from the RESP.

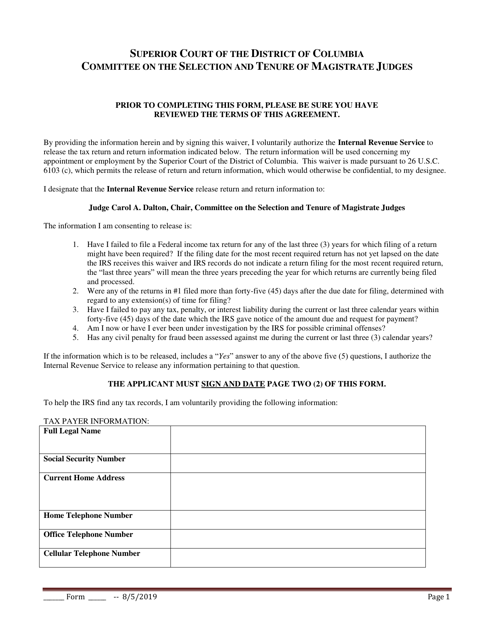

This document is used for requesting a waiver of taxes in Washington, D.C.

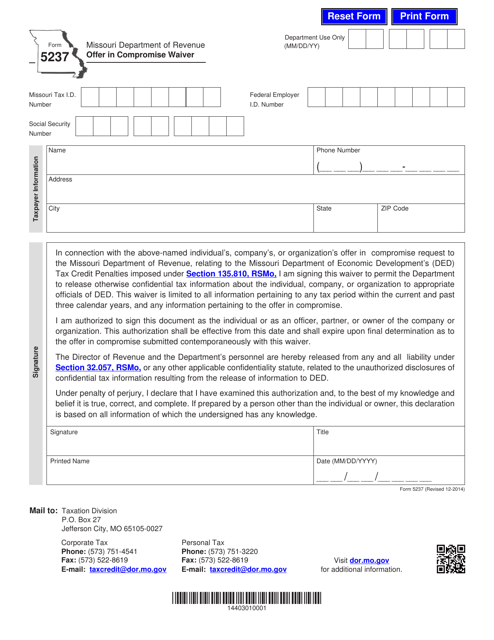

This form is used for applying for an offer in compromise waiver in the state of Missouri.

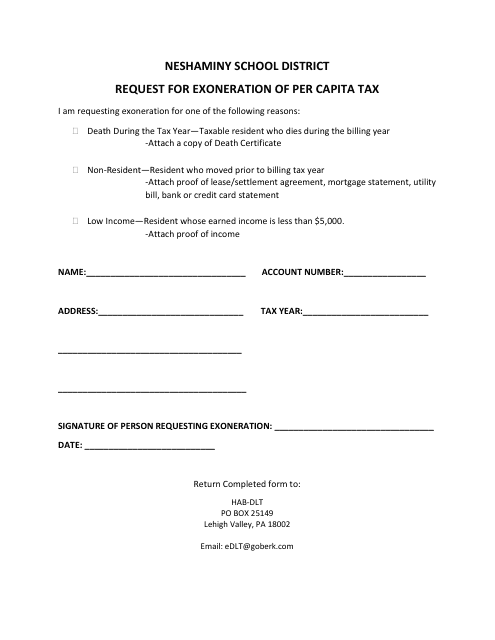

This document is a request to be exempted from paying the per capita tax in the Neshaminy School District in Pennsylvania.

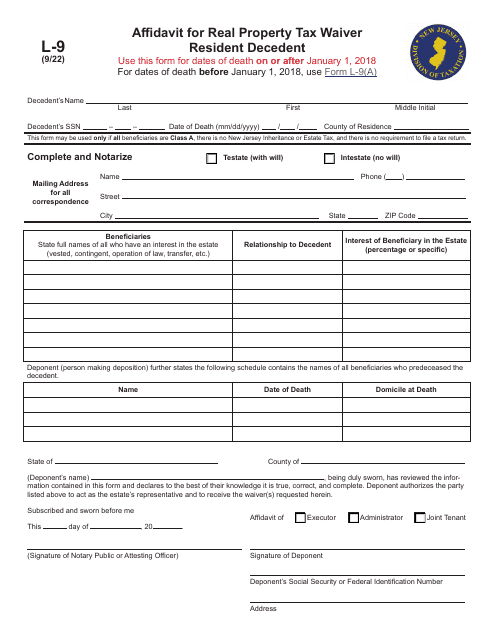

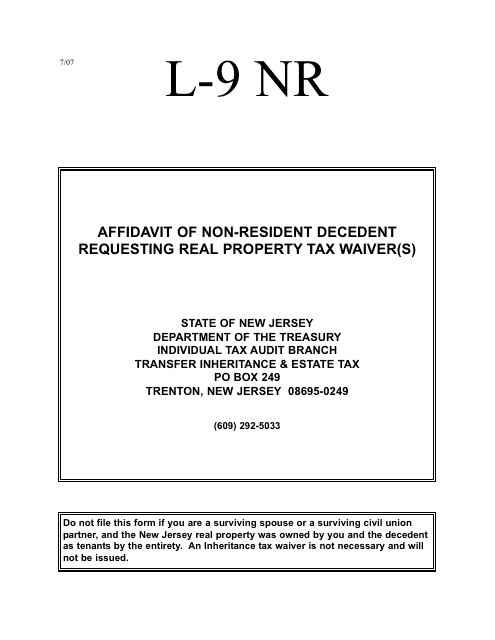

This Form is used for non-resident decedents in New Jersey to request a waiver of real property tax.

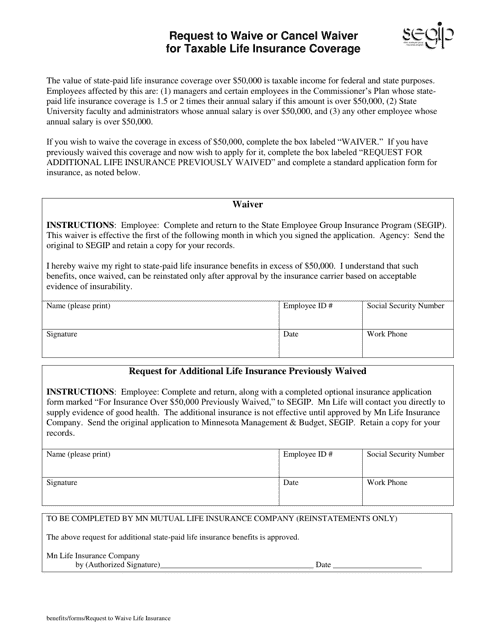

This type of document is used to request the waiver or cancellation of taxable life insurance coverage in Minnesota.