Amended Taxes Templates

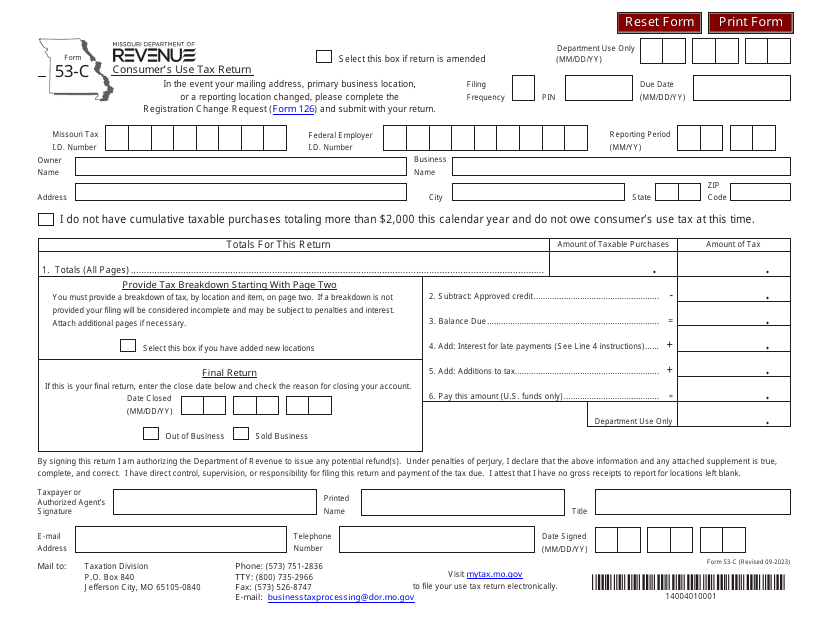

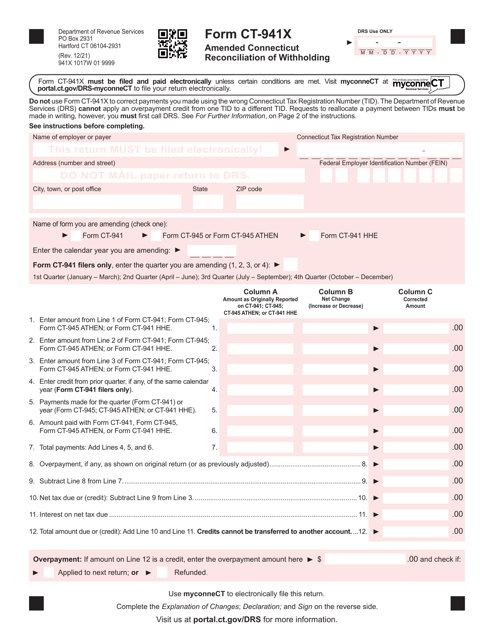

If you need to make changes to your previously filed tax return, you may need to file an amended tax return. This document group provides information and guidance on how to amend your tax forms in order to correct errors or update information. Whether you need to amend your individual income tax return, sales and use tax return, or business tax forms, this collection of documents will walk you through the process.

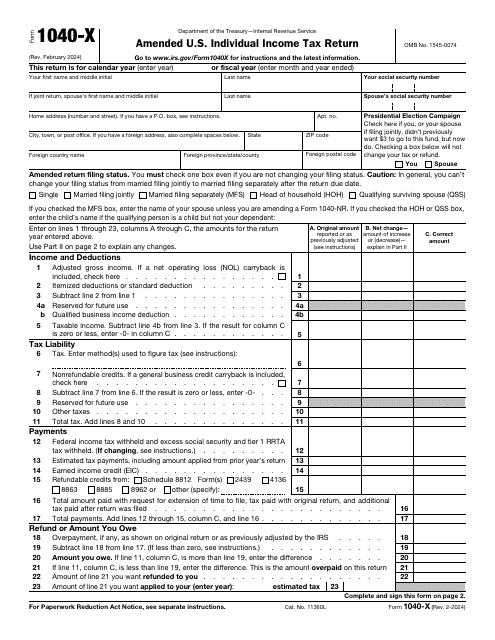

Amended taxes, also known as tax amendments or amended tax forms, allow you to make necessary changes to your tax filing. Whether you missed reporting income, claimed incorrect deductions, or need to update your filing status, filing an amended tax return can help you rectify any errors or omissions.

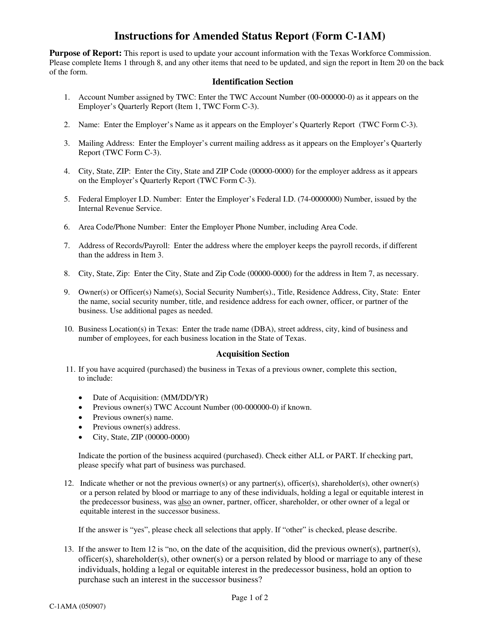

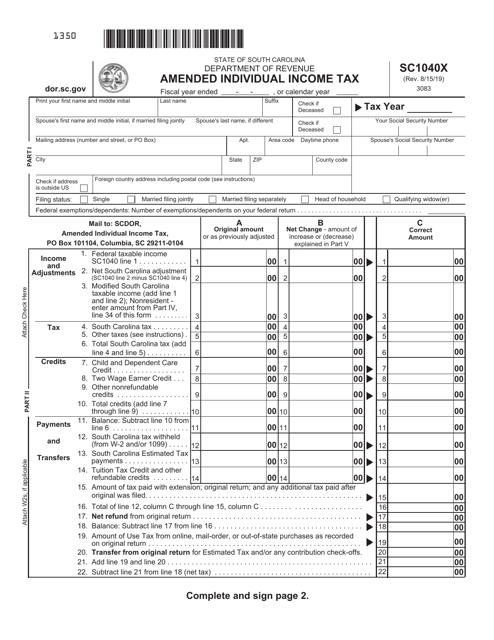

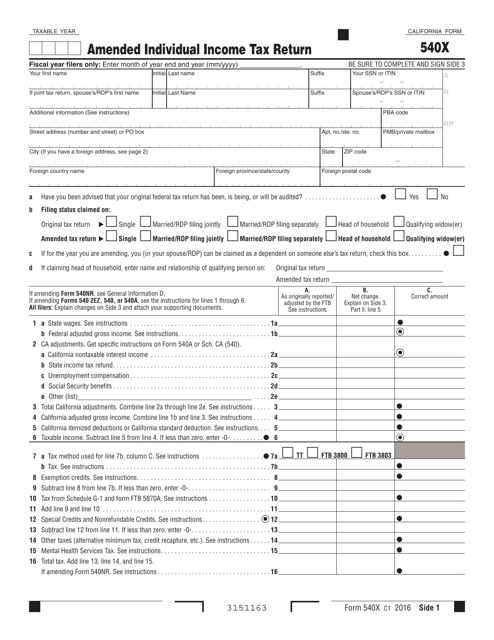

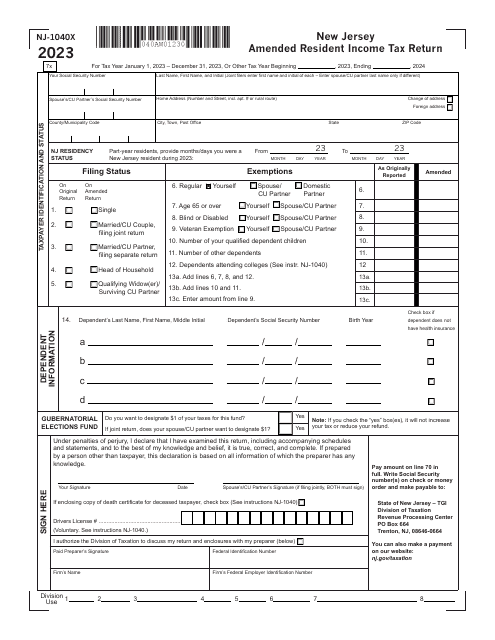

The documents in this collection, such as the Instructions for Form C-1AM Amended Status Report in Texas or the Form SC1040X Amended Individual Income Tax in South Carolina, provide step-by-step instructions on how to complete the necessary forms for amending your taxes. For example, the Form NJ-1040X Amended Resident Income Tax Return in New Jersey specifically caters to those who need to correct their resident income tax return.

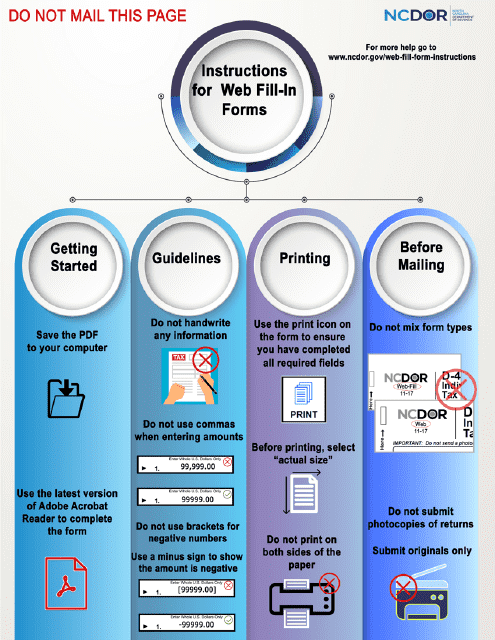

Understanding the process of amending your tax forms can be complex, but our collection of documents simplifies the process for you. From understanding the eligibility criteria for filing an amended tax return to providing detailed instructions on how to fill out the appropriate forms, this collection ensures that you have all the information you need to successfully amend your taxes.

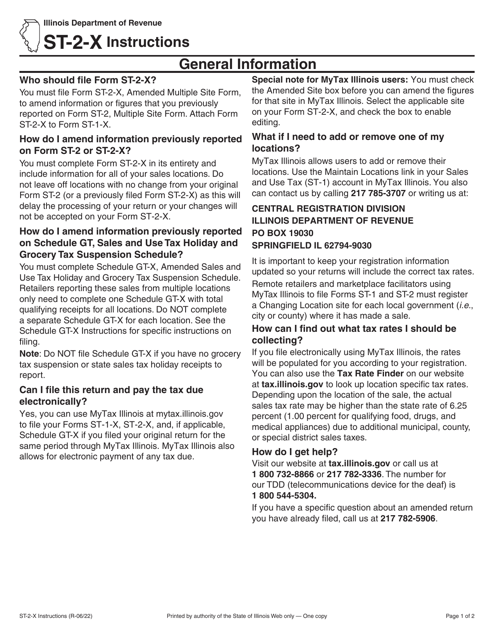

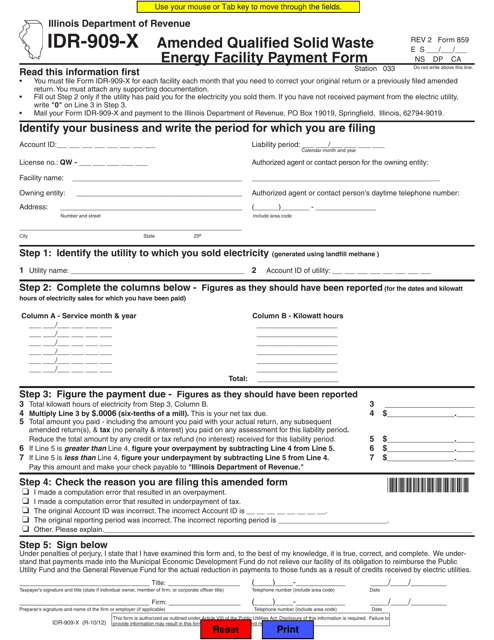

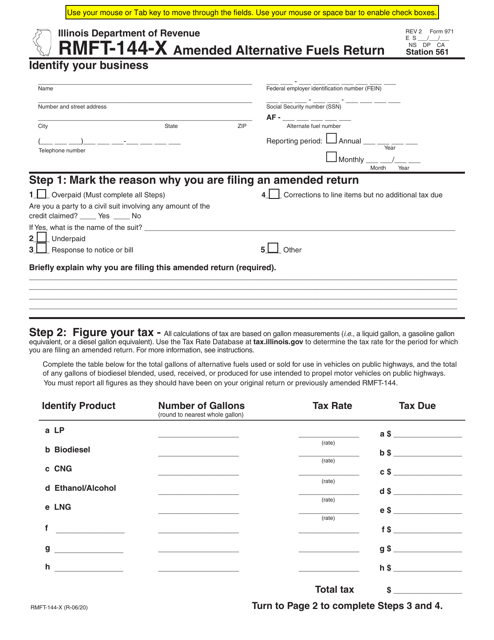

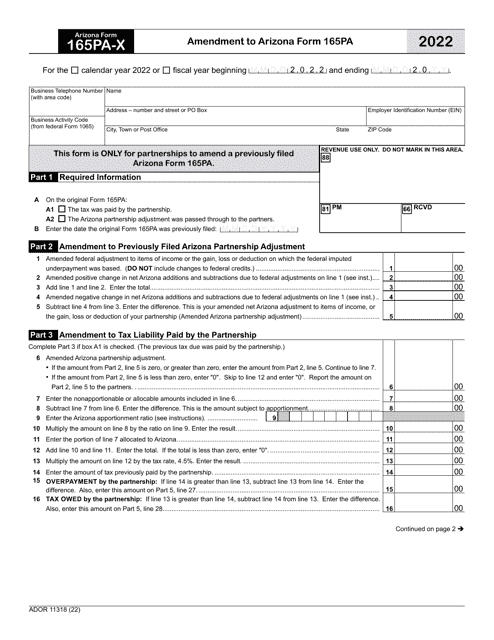

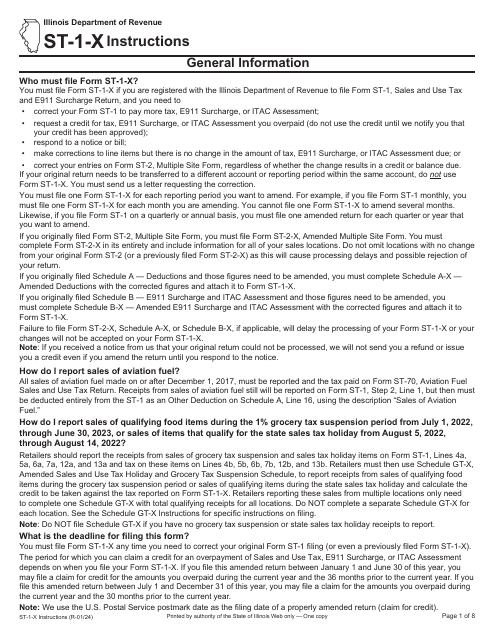

Whether it's the Form IDR-909-X (859) Amended Qualified Solid Waste Energy Facility Payment Form in Illinois or the Instructions for Form ST-1-X, 003 Amended Sales and Use Tax and E911 Surcharge Return, this collection covers a wide range of amended tax forms to cater to various tax needs.

Don't let mistakes on your initial tax filing cause unnecessary stress. With the help of these documents, filing your amended taxes becomes a simplified and straightforward process. Take advantage of our comprehensive collection of amended tax forms and guidance to ensure accuracy and compliance with tax laws.

Documents:

32

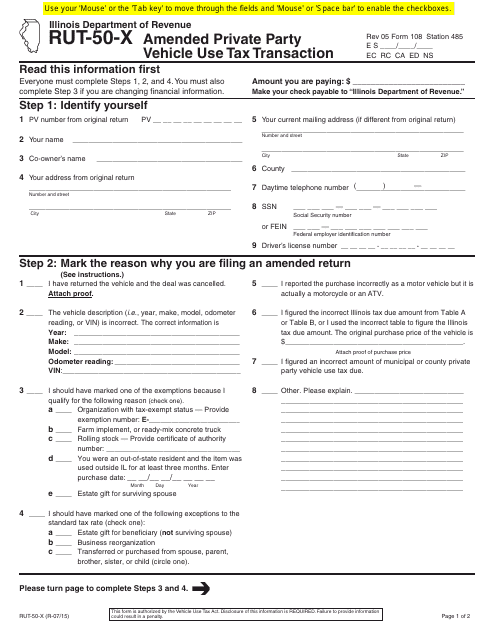

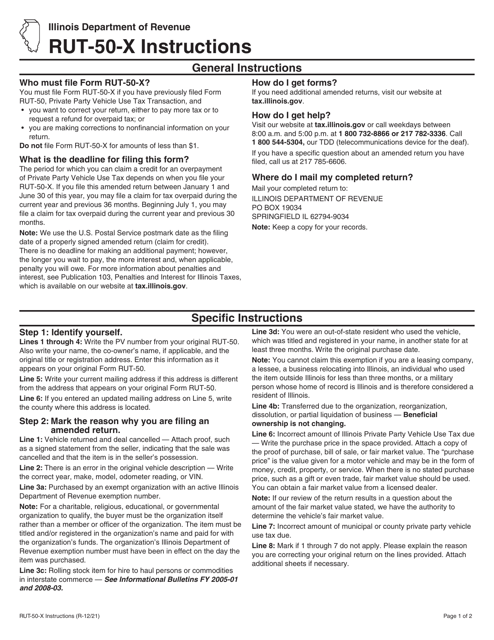

This form is used for reporting an amended private party vehicle use tax transaction in Illinois.

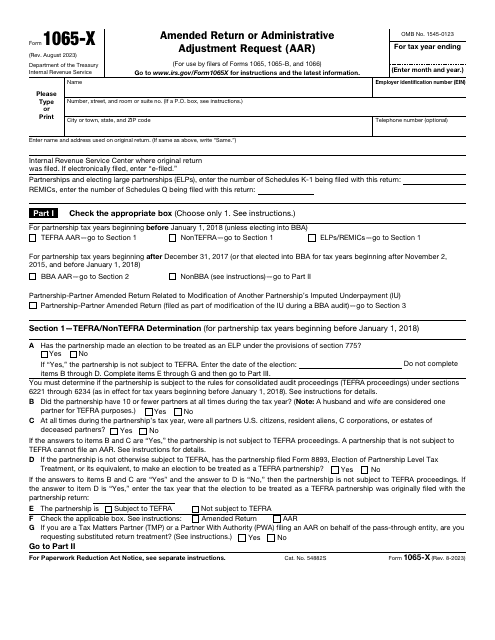

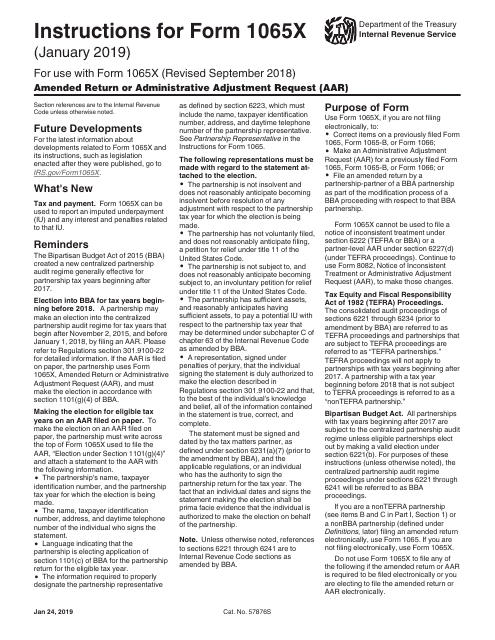

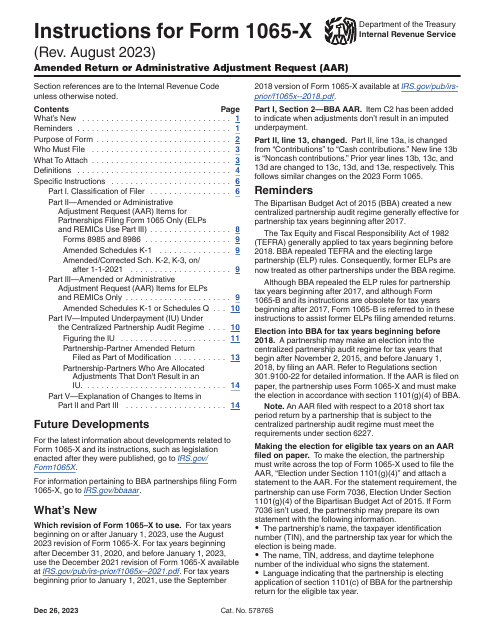

This is a fiscal statement used by partnerships and real estate mortgage investment conduits to fix the errors in previously filed IRS Form 1065, IRS Form 1065-B, IRS Form 1066.

This document is used for making changes or corrections to a previously filed IRS Form 1065 (Partnership Return). It can be used to amend the partnership return or to request administrative adjustments.

This Form is used for filing an amended status report in Texas. It provides instructions on how to update and correct information previously submitted.

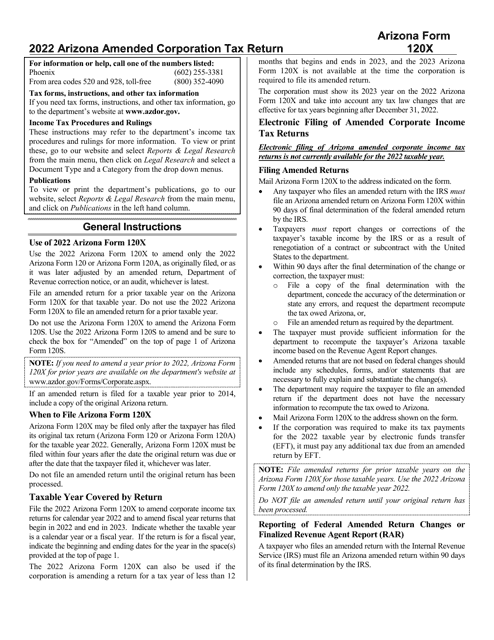

This form is used for making amendments to your individual income tax return in California.

This Form is used for making an amendment to the Qualified Solid Waste Energy Facility Payment Form in the state of Illinois.

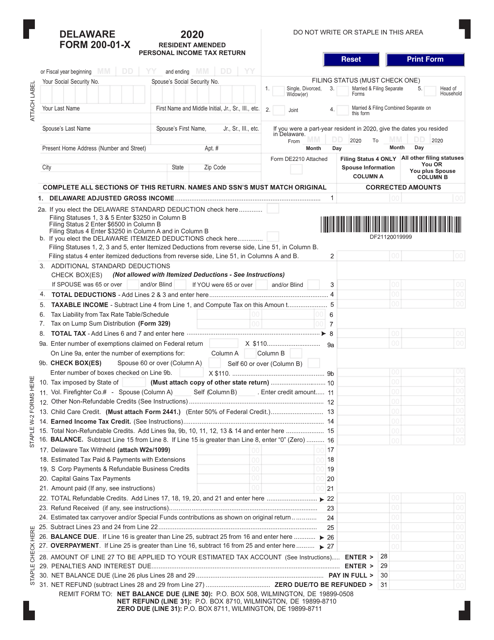

This document is used for correcting records on your tax return form. A separate form is used every year for which information is changed. Do not submit this document to request a refund of interest and penalties, or addition to the tax you have already paid.

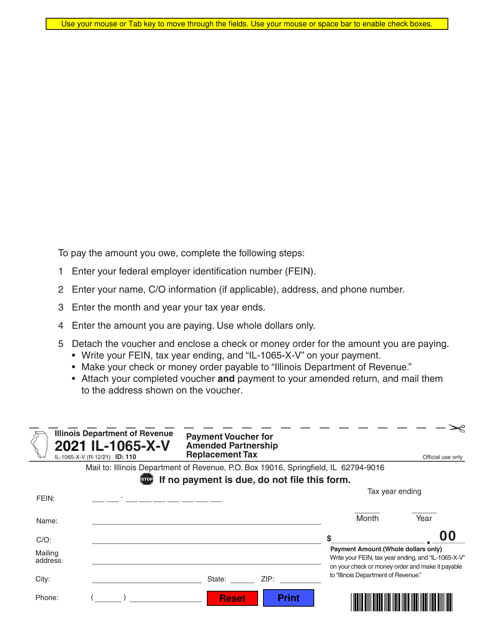

Form IL-1065-X-V Payment Voucher for Amended Corporation Income and Replacement Tax - Illinois, 2021

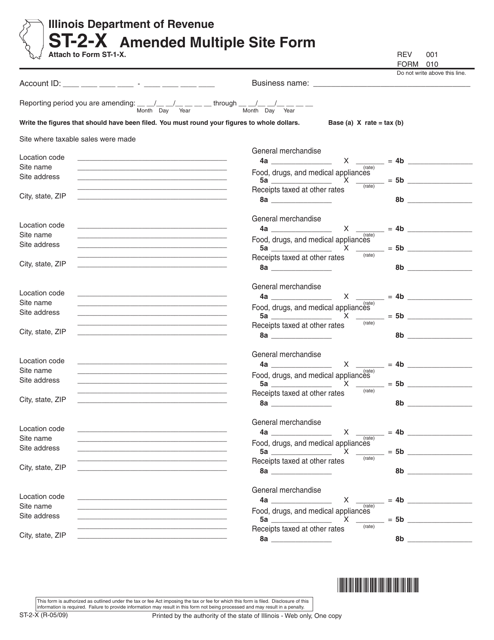

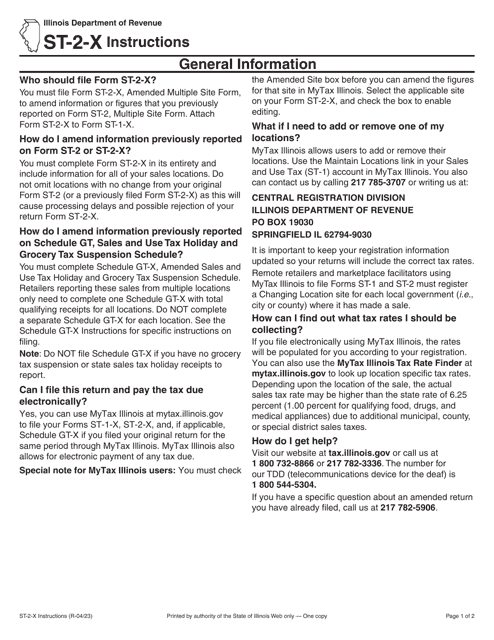

This Form is used for amending the multiple site information for businesses operating in Illinois.

This document provides instructions for filling out Form RUT-50-X, which is used to amend a private party vehicle use tax transaction in Illinois.