Tax Evasion Templates

Tax Evasion, also known as the alternate term tax fraud, refers to the illegal act of intentionally avoiding paying taxes owed to the government. This encompasses a wide range of activities, including underreporting income, inflating deductions, hiding assets or transactions, and using offshore accounts to evade taxes. Tax evasion can occur at both individual and business levels and is typically a criminal offense that carries severe penalties.

To combat tax evasion, governments have implemented various measures to ensure compliance, including the introduction of stringent reporting requirements, increased audit and investigation capabilities, and the promotion of tax amnesty programs. These efforts aim to identify and prosecute individuals and businesses involved in tax evasion, as well as to recover lost revenue.

Document Title Alternates

When it comes to tax evasion, various documents play a crucial role in detecting, reporting, and addressing these illicit activities. Some common examples of such documents include:

-

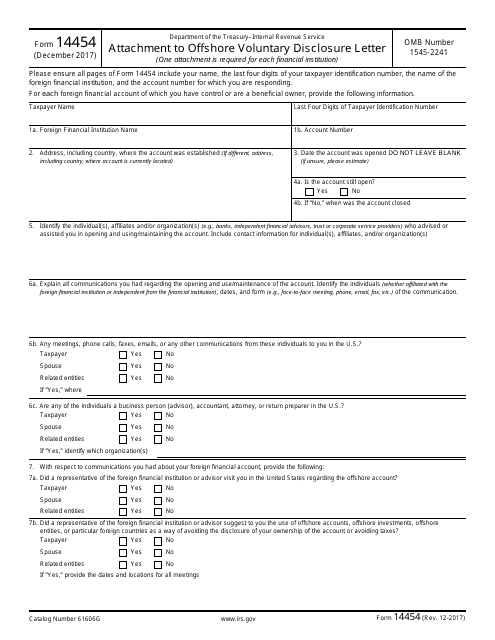

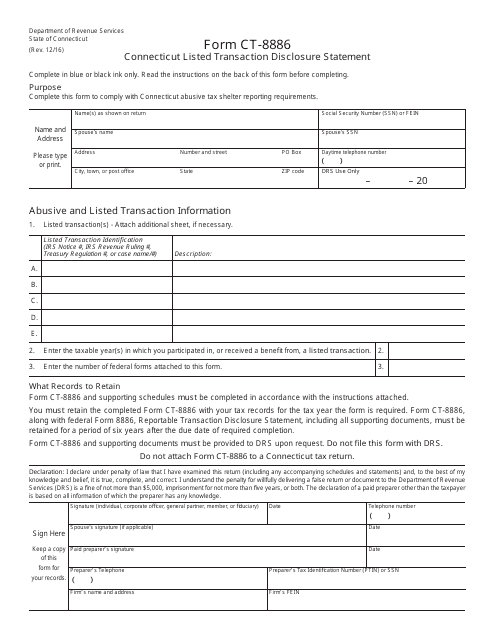

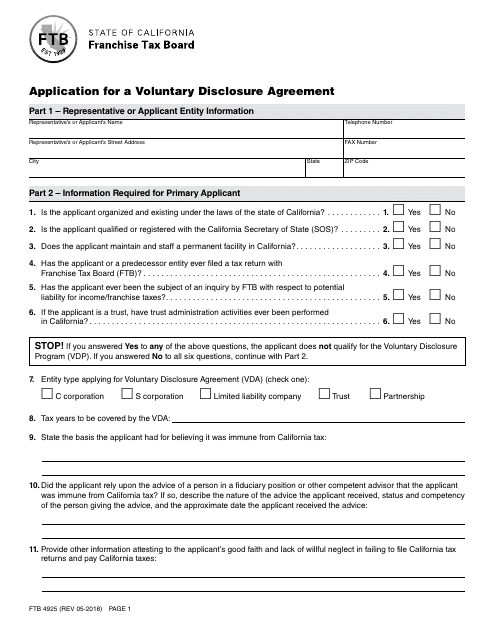

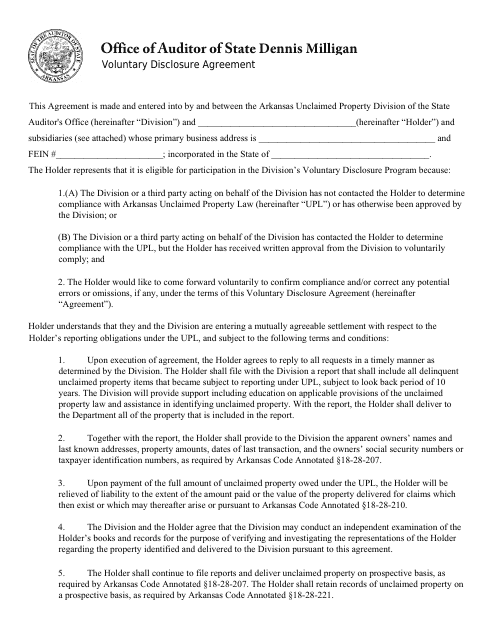

Disclosure Statements: These forms, such as the Form CT-8886 Connecticut Listed Transaction Disclosure Statement and Form FTB4925 Application for a Voluntary Disclosure Agreement, allow individuals or businesses to proactively report potential tax evasion activities to the respective tax authorities. These documents provide a means for taxpayers to come forward voluntarily and rectify any non-compliance issues without facing severe penalties.

-

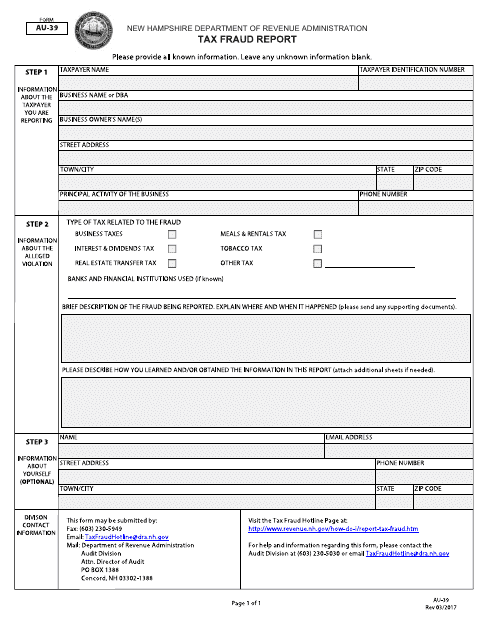

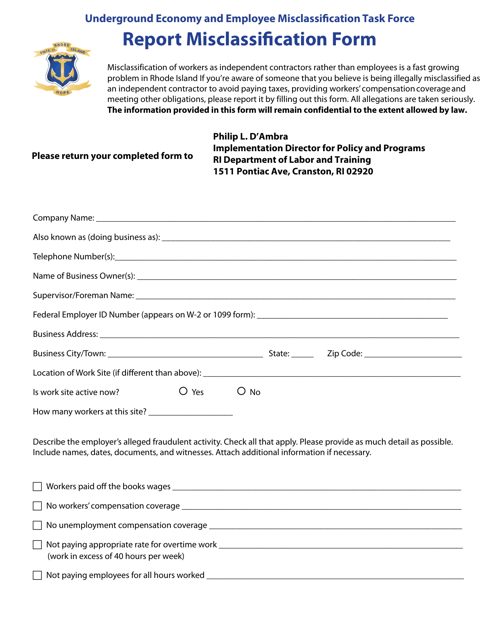

Fraud Reports: Documents like the Form AU-39 Tax Fraud Report are specifically designed for individuals or organizations to report suspected instances of tax fraud directly to the appropriate tax authorities. These reports serve as a vital tool in uncovering hidden tax evasion schemes and initiating investigations against the offenders.

-

Research and Analysis: Publications like "Illicit Financial Flows From Africa: Hidden Resource for Development" are essential resources that shed light on the magnitude and impact of tax evasion globally. These documents provide valuable insights into the methods and consequences of tax evasion, assisting governments and organizations in formulating effective strategies to tackle this complex issue.

-

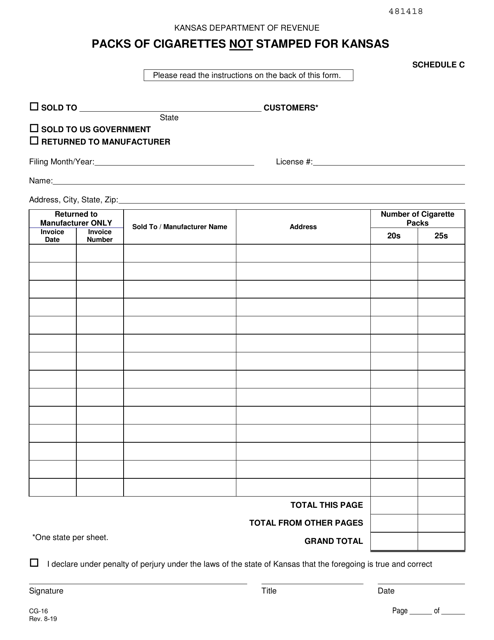

Compliance Forms: In some cases, documents like the Form CG-16 Schedule C Packs of Cigarettes Not Stamped for Kansas are used to ensure compliance with specific tax regulations. By requiring businesses to submit detailed information about taxable goods or services, authorities can monitor and detect potential instances of tax evasion in specific industries or sectors.

These documents collectively contribute to the fight against tax evasion by facilitating information sharing, enabling reporting, enhancing compliance, and raising awareness about the impact of tax fraud on society.

By employing a comprehensive approach that combines legal measures, enforcement actions, and public awareness campaigns, governments and organizations strive to combat tax evasion, protect revenue streams, and promote a fair and equitable tax system that benefits all citizens.

Documents:

11

This form is used as an attachment to the Offshore Voluntary Disclosure Letter, which is submitted to the IRS. It provides additional information and documentation related to offshore accounts and income.

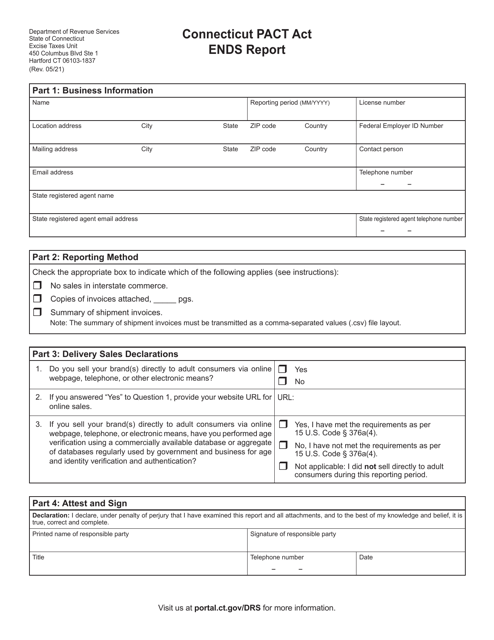

This Form is used for disclosing listed transactions in Connecticut.

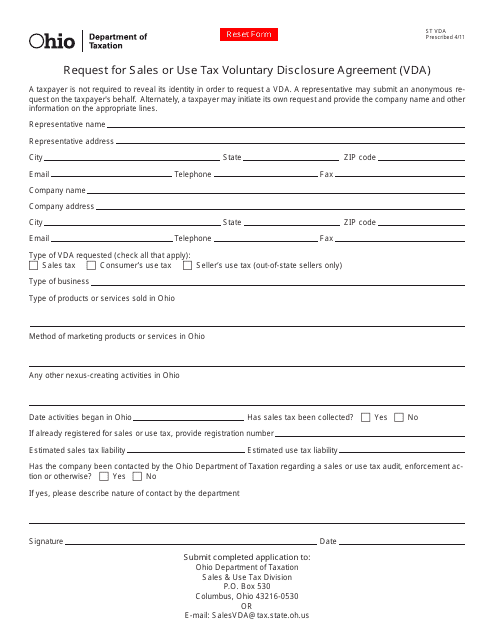

This form is used for requesting a Sales or Use Tax Voluntary Disclosure Agreement (VDA) in Ohio. It allows businesses to voluntarily disclose their unpaid taxes and enter into an agreement with the Ohio Department of Taxation to pay them.

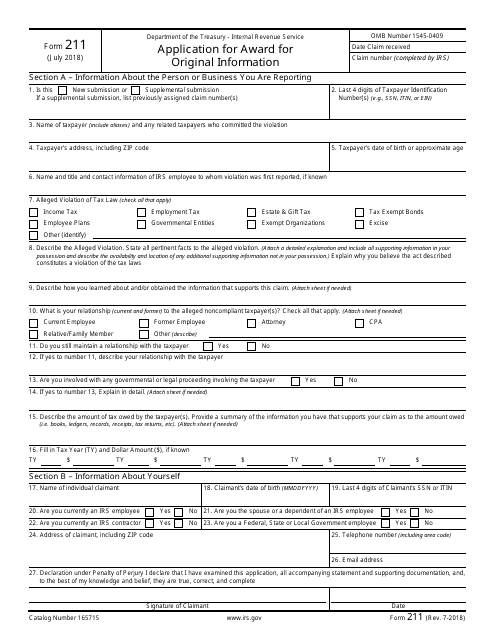

This Form is used for applying for a monetary award with the IRS by providing original information about possible tax fraud.

This Form is used for applying for a Voluntary Disclosure Agreement (VDA) in the state of California. A VDA allows taxpayers to voluntarily disclose and resolve past tax liabilities in exchange for potential penalty relief.

This form is used for reporting tax fraud in the state of New Hampshire.

This document explores the issue of illicit financial flows from Africa, and how they represent a hidden resource for development. It discusses the significant amount of money that is illegally transferred out of Africa each year, the negative impact this has on the continent's development, and potential solutions to address this problem.

This form is used for reporting packs of cigarettes that are not stamped for the state of Kansas. It is specifically for the state of Kansas.

This Form is used for reporting misclassification of workers in Rhode Island.

This document is for the State of Connecticut. It announces the end of the Connecticut Pact Act report.