Tax Due Templates

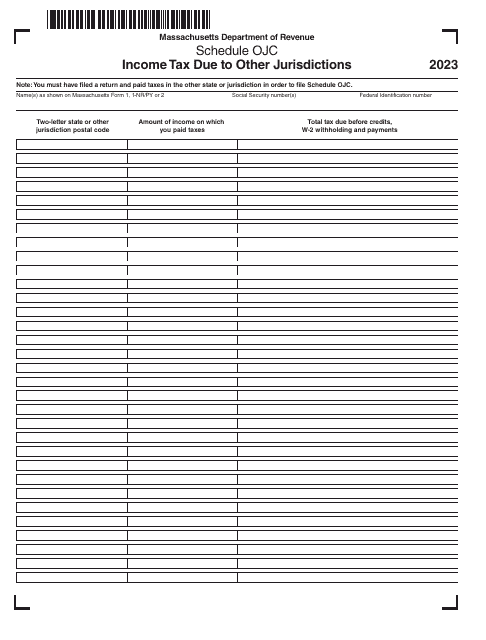

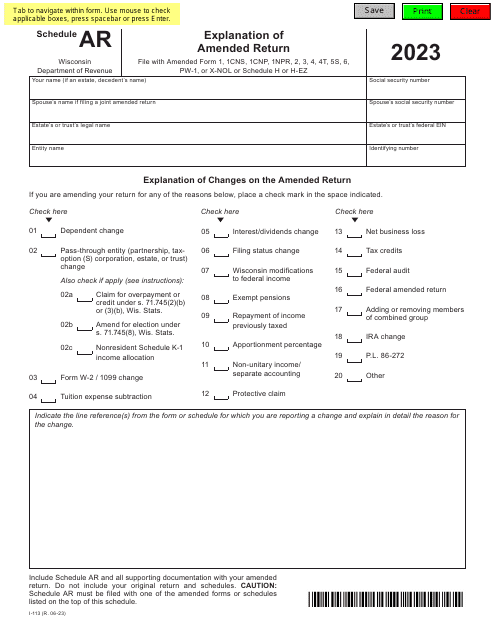

Are you wondering how to calculate and pay your taxes on time? Look no further! Our tax due knowledge system has got you covered. Whether you refer to it as tax due or dues tax, our comprehensive collection of documents will help you navigate through the complexities of tax obligations.

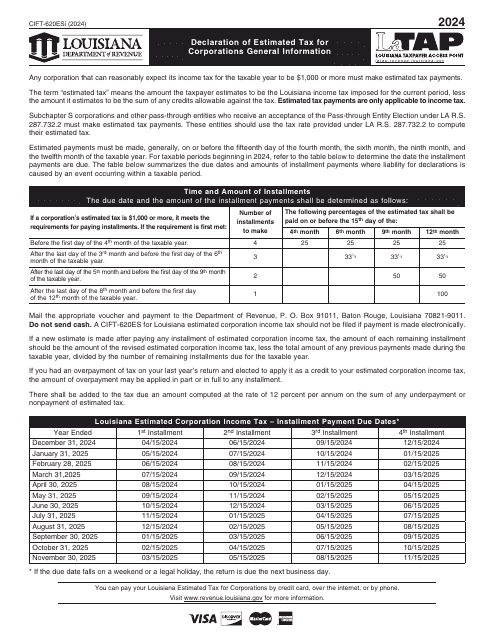

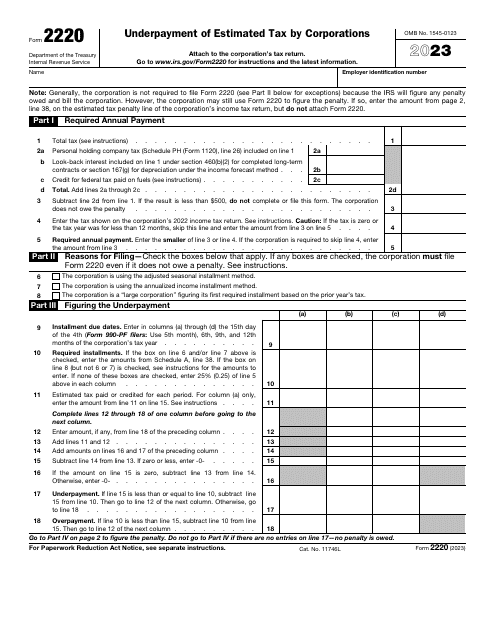

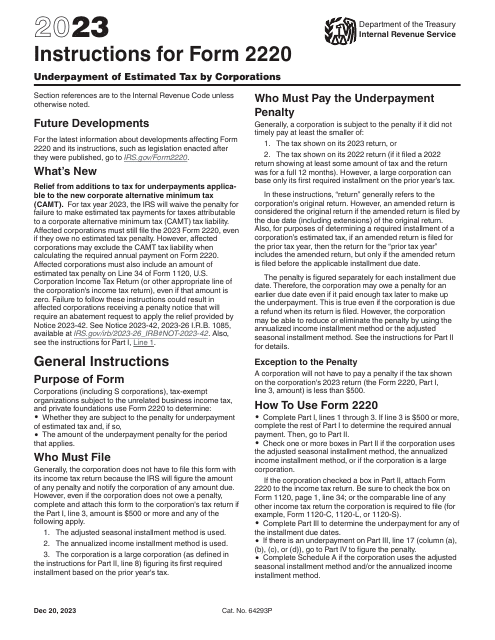

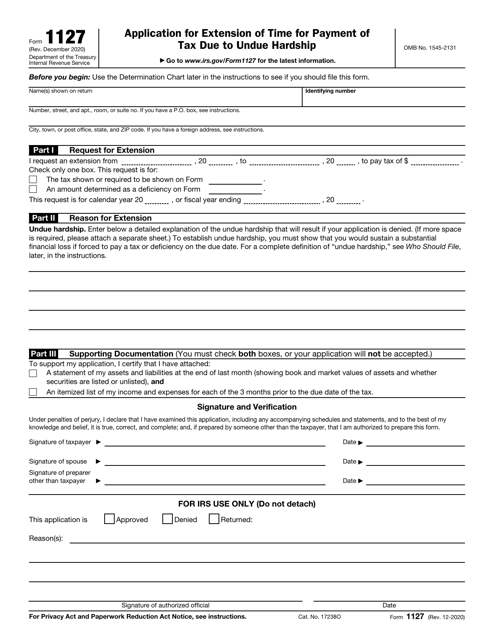

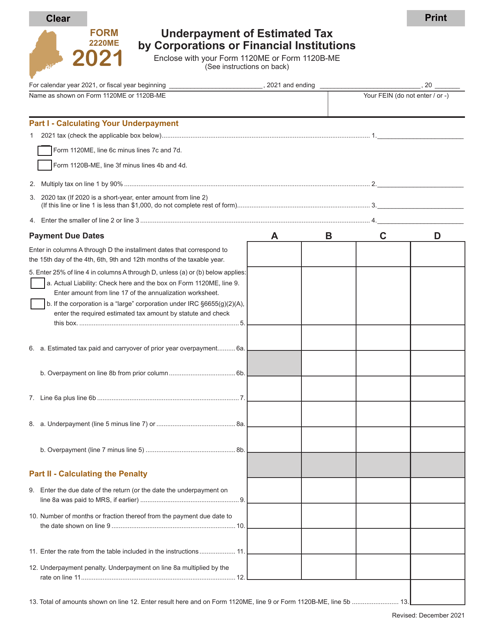

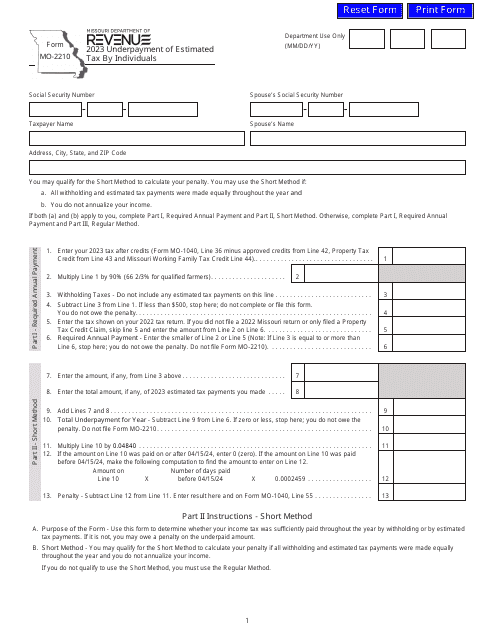

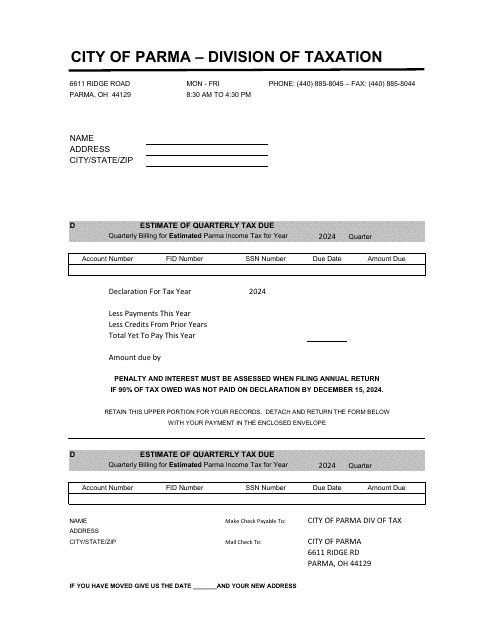

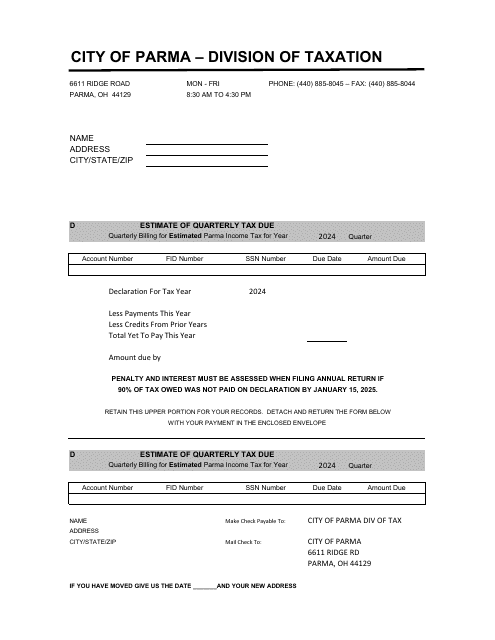

From IRS Form 2210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts to Form MO-2210 Underpayment of Estimated Tax by Individuals in Missouri, our database includes a wide range of resources to assist you in understanding and fulfilling your tax requirements. We also provide specific forms, such as the Business Estimate of Quarterly Tax Due for the City of Parma, Ohio, and the Individual Estimate of Quarterly Tax Due for the same location.

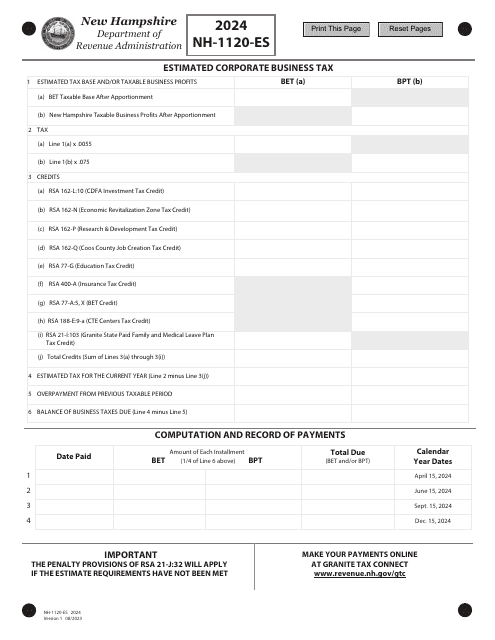

For corporate businesses in New Hampshire, we have Form NH-1120-ES Estimated Corporate Business Tax, ensuring that all entities, regardless of size or structure, have access to the information they need to accurately estimate and pay their taxes.

Don't let tax due dates and calculations overwhelm you - trust our tax due knowledge system to provide you with the necessary guidance and resources to stay on top of your tax obligations.

Documents:

19

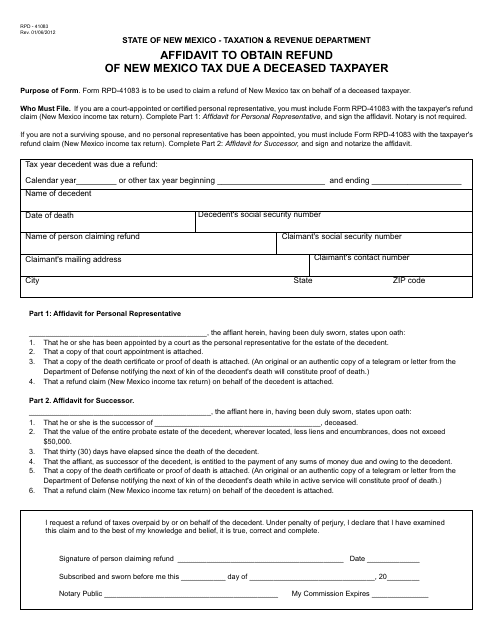

This form is used for obtaining a refund of New Mexico tax that is due to a deceased taxpayer in New Mexico.

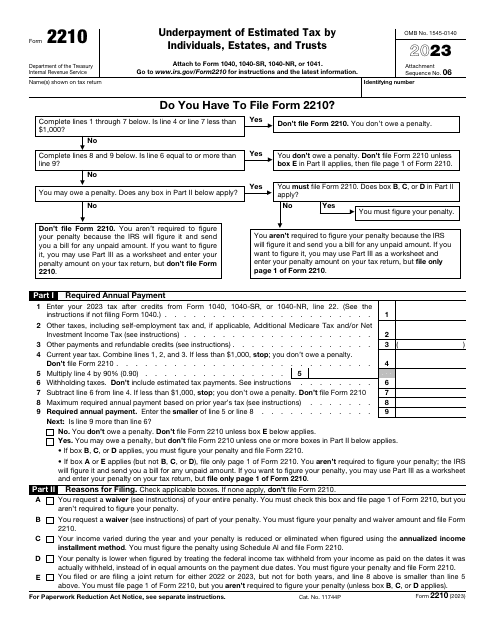

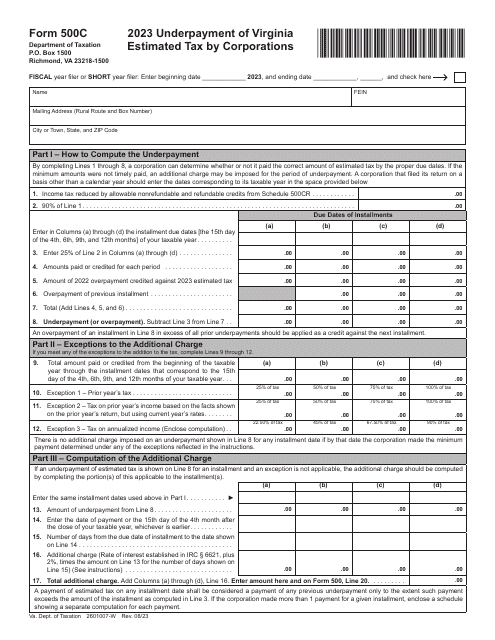

This is a fiscal instrument used by a taxpayer to find out whether they are liable for paying a penalty after underpaying their estimated tax.

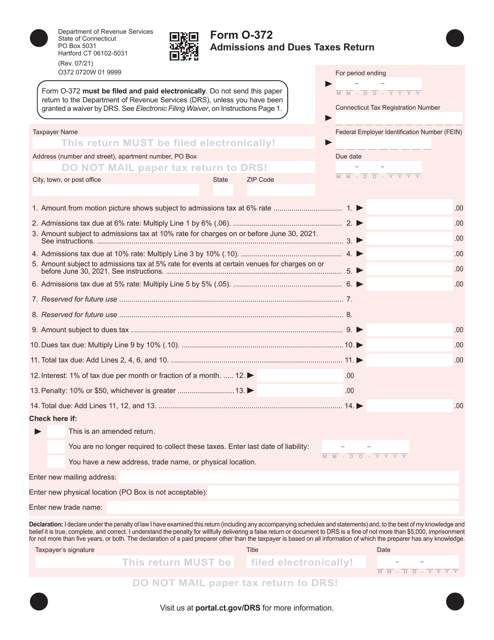

This Form is used for filing Admissions and Dues Taxes Return in the state of Connecticut.