Taxpayer Relief Templates

Taxpayer Relief Assistance - Support and Solutions for Taxpayers

When facing the complexities of the tax system, individuals and businesses may find themselves burdened by penalties, interest, or unforeseen liabilities. In such situations, seeking taxpayer relief becomes a priority. Taxpayer relief offers a lifeline for individuals in need of assistance, providing avenues to address issues and alleviate their tax-related challenges.

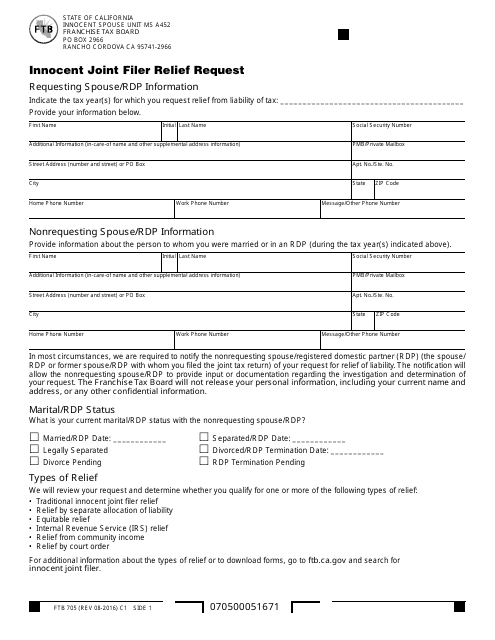

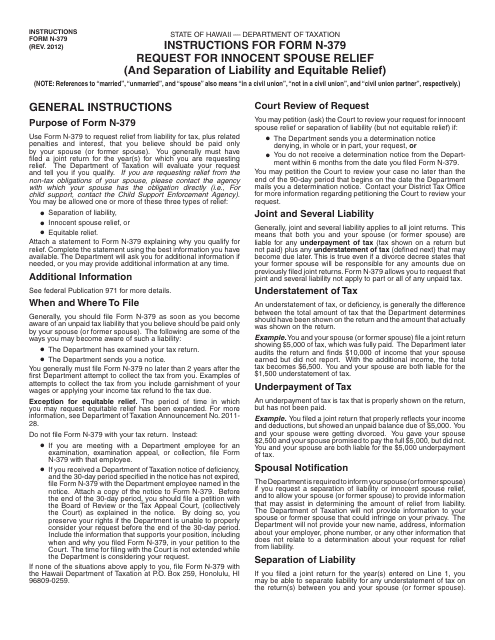

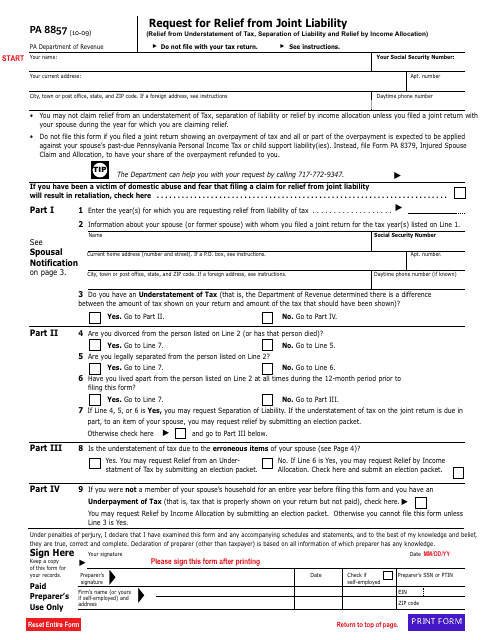

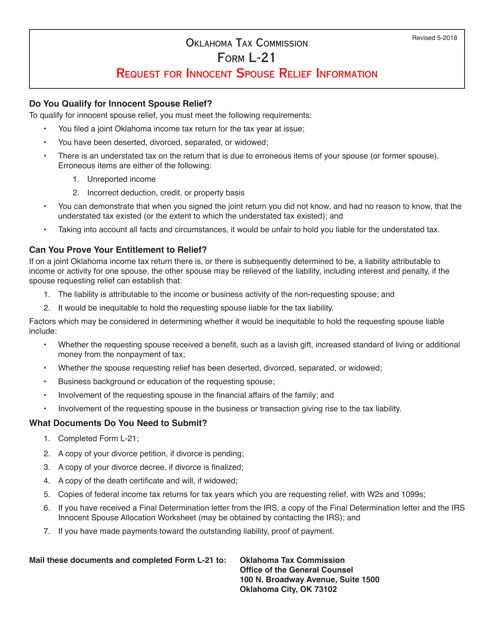

Our comprehensive taxpayer relief program offers a range of solutions for both American and Canadian taxpayers. Whether you are a California resident seeking Innocent Joint Filer Relief, an Oklahoma resident looking to apply for Innocent Spouse Relief, a Utah resident requiring assistance with Innocent Spouse Relief, or a Canadian individual wanting to request Taxpayer Relief to cancel or waive penalties or interest, our team is here to help.

Our dedicated professionals have extensive experience navigating the intricate tax codes and regulations to provide effective relief solutions. We understand the complexities and understand the stress that can accompany tax-related issues. By utilizing our expertise, we can guide you through the process, ensuring that you have the best chance of obtaining taxpayer relief.

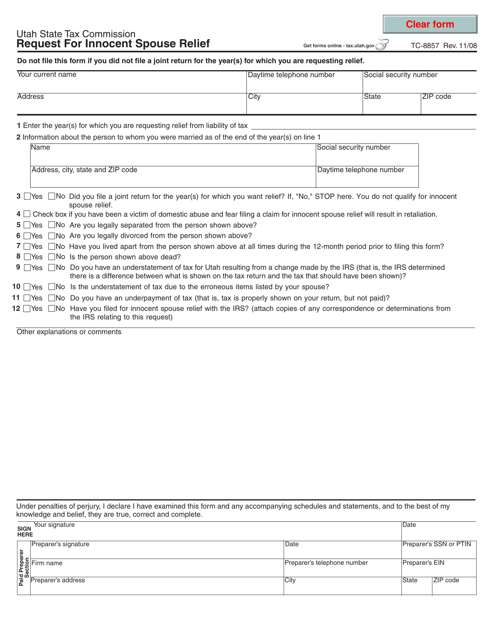

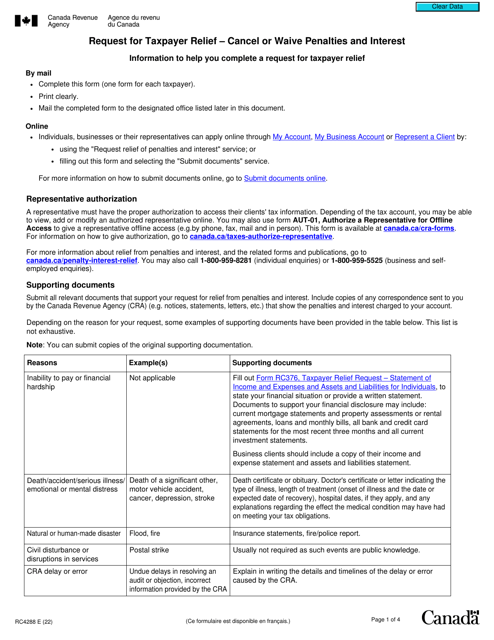

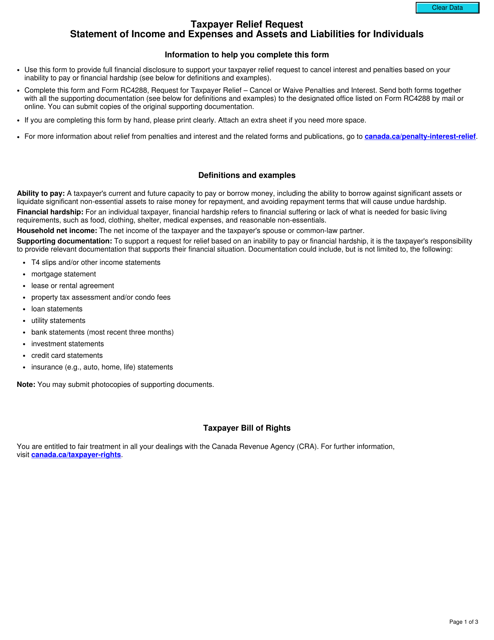

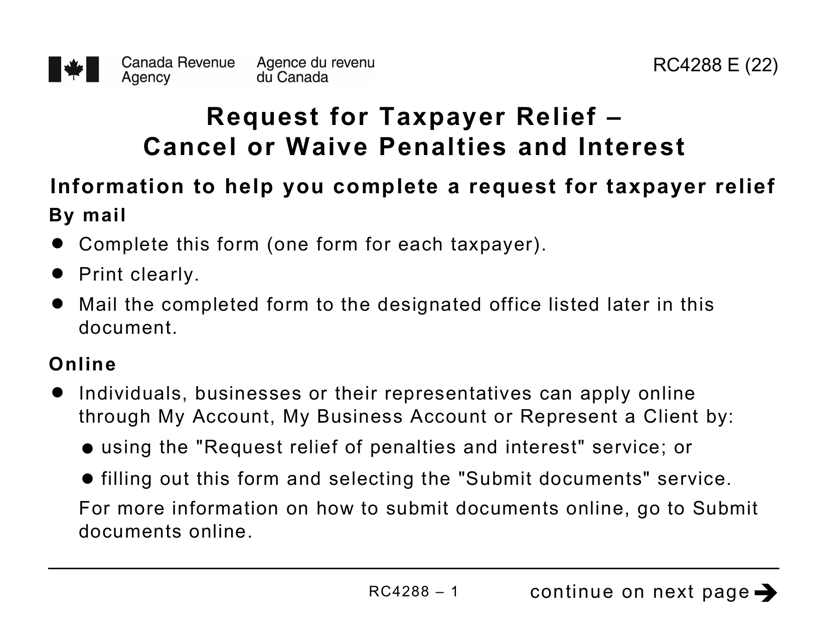

Our services include assisting you with the necessary forms, such as the Form FTB705 Innocent Joint Filer Relief Request in California, the OTC Form L-21 Request for Innocent Spouse Relief in Oklahoma, the Form TC-8857 Request for Innocent Spouse Relief in Utah, the Form RC4288 Request for Taxpayer Relief to Cancel or Waive Penalties or Interest in Canada, and the Form RC376 Taxpayer Relief Request - Statement of Income and Expenses and Assets and Liabilities for Individuals in Canada.

Whether you are an individual taxpayer or a business owner, our taxpayer relief program aims to alleviate the financial burden caused by penalties, interest, or unforeseen liabilities. Our goal is to help you navigate the system and provide the relief you need.

Don't let tax-related issues compromise your financial well-being. Contact our taxpayer relief experts today and let us guide you through the process of obtaining the relief you deserve.

Documents:

15

This form is used for requesting innocent joint filer relief in the state of California.

This Form is used for requesting innocent spouse relief in the state of Hawaii. It provides instructions on how to apply for relief from joint tax liability when a spouse or former spouse believes they should not be held responsible for the other spouse's tax obligations.

This form is used for requesting relief from joint liability for tax obligations in the state of Pennsylvania.

This form is used for requesting innocent spouse relief in the state of Oklahoma.

This form is used for requesting innocent spouse relief in the state of Utah. Innocent spouse relief is a provision that allows individuals to avoid being held responsible for taxes owed by their spouse or former spouse. Fill out this form to apply for relief from joint tax liability.

This form acts as the supporting documentation a Canadian person will need to submit when they are unable to pay their annual taxes due to extenuating circumstances.

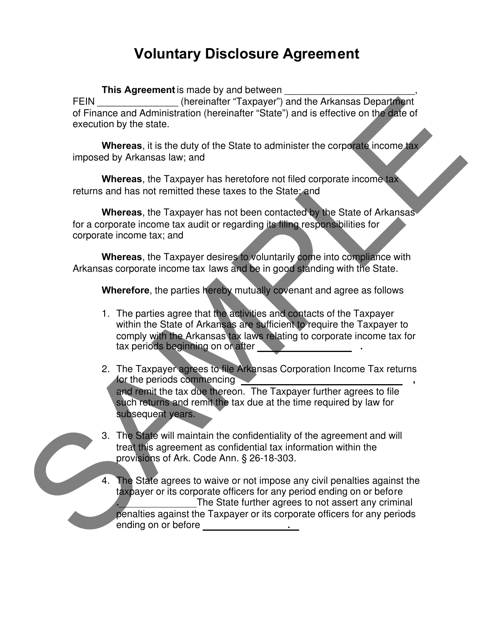

This form is used for corporate taxpayers in Arkansas to voluntarily disclose any errors or omissions in their previous corporate tax returns.

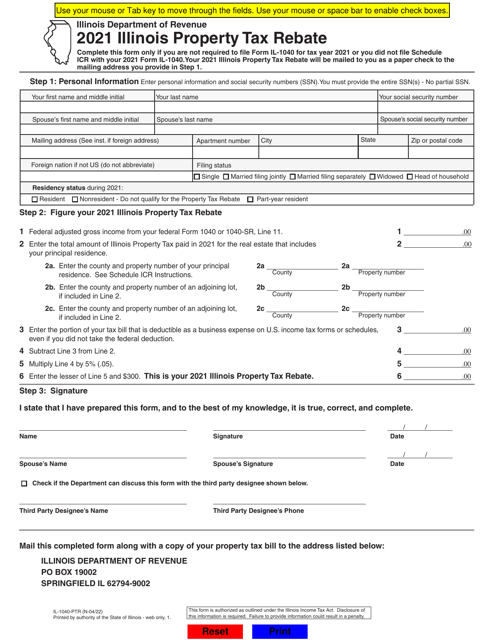

This form is used for applying for the Illinois Property Tax Rebate in the state of Illinois.

This document is a form for taxpayers in Canada to request relief from penalties and interest that may have been incurred. It is available in large print format.